The Trump Presidency And Economic Performance: A Data-Driven Analysis

Table of Contents

GDP Growth Under the Trump Administration

Analyzing the economic performance of any presidency requires a thorough examination of GDP growth. This key indicator reflects the overall health and output of the economy.

Analyzing Annual GDP Growth Rates

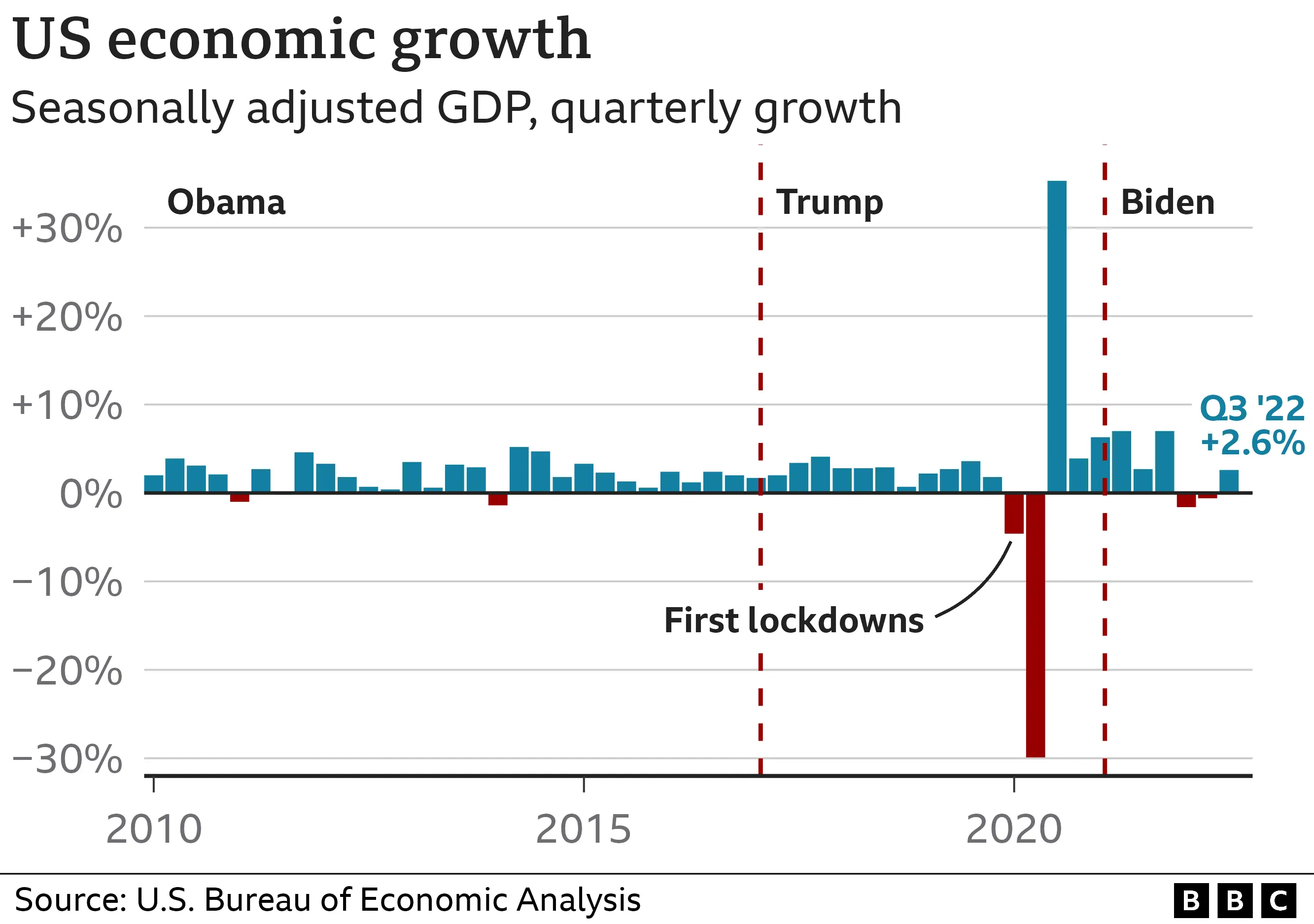

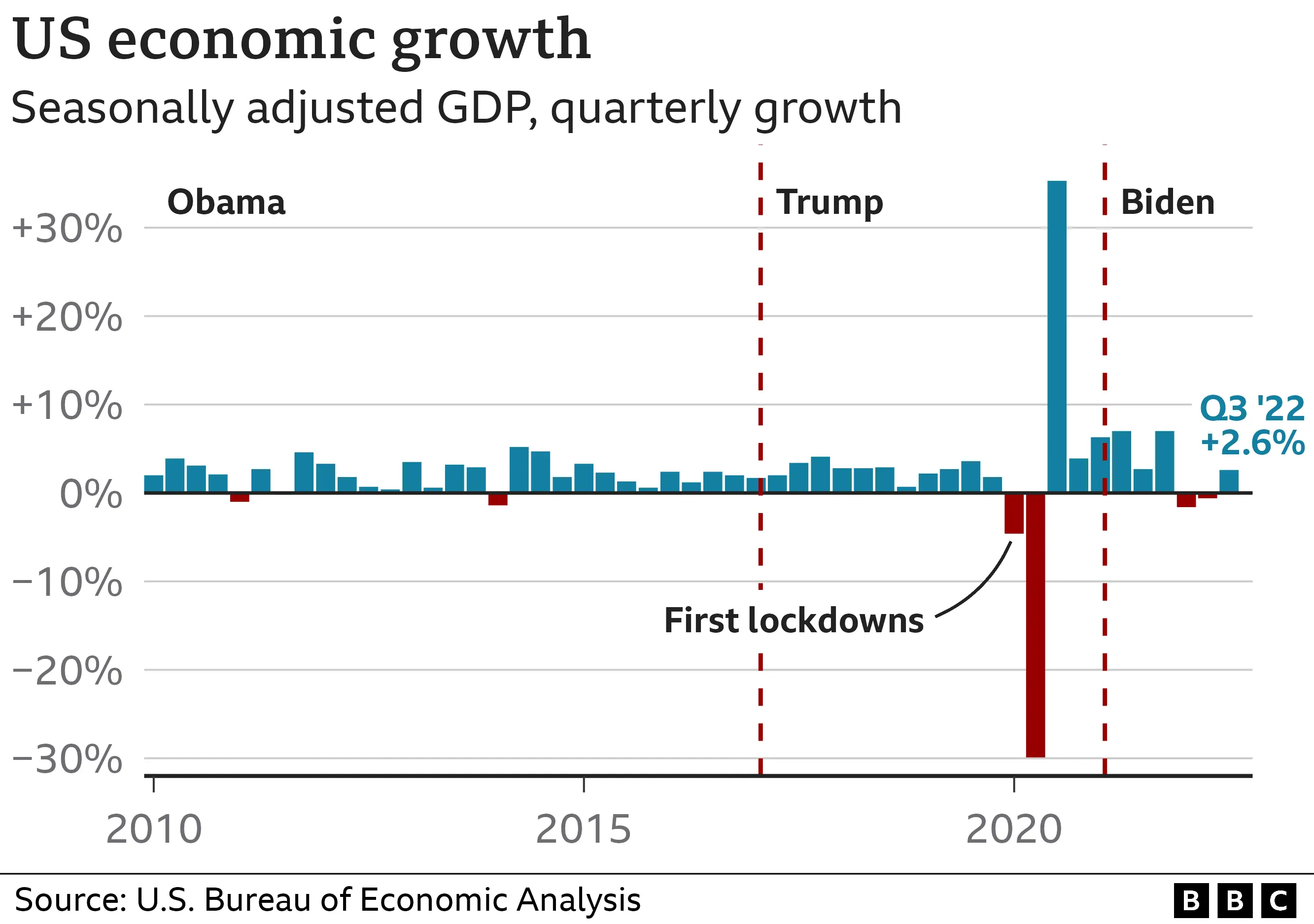

Comparing annual GDP growth rates under the Trump presidency to previous and subsequent administrations reveals important trends. While the Trump administration boasted periods of strong growth, it's crucial to contextualize these figures.

- Peak and Trough Years: The economy experienced periods of robust growth, particularly in the early years of the Trump presidency, followed by a decline. Analyzing these peak and trough years provides a more complete picture than simply averaging the growth rates.

- Comparison to Obama Administration: Comparing average GDP growth rates under Trump to the Obama administration provides a benchmark for evaluating relative performance. Factors beyond any single administration's control, such as global economic conditions, must be considered.

- External Factors: Global economic conditions, technological advancements, and unforeseen events (like the COVID-19 pandemic) significantly influence GDP growth. Isolating the direct impact of specific policies requires careful consideration of these external factors. For example, the late stages of the Trump presidency saw a sharp economic downturn largely attributed to the COVID-19 pandemic.

The Impact of Tax Cuts on GDP Growth

The 2017 Tax Cuts and Jobs Act, a cornerstone of Trump's economic policy, aimed to stimulate investment and consumption through significant corporate and individual tax reductions. However, the impact of these tax cuts on GDP growth remains a subject of ongoing debate among economists.

- Stimulus and Investment: Proponents argue that the tax cuts fueled investment and boosted economic activity, leading to higher GDP growth.

- Criticisms and Alternative Explanations: Critics point to alternative explanations for the observed growth, such as pre-existing economic momentum or increased government spending. Furthermore, concerns were raised about the long-term effects of increased national debt resulting from the tax cuts.

- Economic Studies and Reports: Numerous economic studies have analyzed the effects of the 2017 tax cuts, offering varying conclusions depending on the methodologies used and assumptions made. A thorough review of these studies is necessary for a comprehensive understanding.

Job Creation and Unemployment During the Trump Presidency

Examining job creation and unemployment rates provides another critical lens through which to analyze economic performance under the Trump administration.

Unemployment Rate Trends

Analyzing monthly and annual unemployment rates offers insights into the labor market's health.

- Comparison to Previous Administrations: Comparing unemployment rates under Trump to previous administrations provides a basis for comparison. However, it's important to consider factors such as the overall global economic climate and technological advancements.

- Impact of Automation and Technology: The effects of automation and technological advancements on employment trends need consideration. These factors can displace workers in some sectors while creating jobs in others.

- Types of Jobs Created: The types of jobs created are crucial. Analyzing whether job growth was concentrated in high-paying or low-paying sectors helps determine the overall impact on income distribution.

Wage Growth and Income Inequality

Wage growth and income inequality are closely linked to economic well-being. Examining these factors provides a nuanced understanding of the impact of the Trump administration's policies on different segments of the population.

- Impact of Tax Cuts on Income Inequality: The 2017 tax cuts disproportionately benefited high-income earners, raising concerns about their impact on income inequality.

- Wage Growth Across Sectors and Demographics: Comparing wage growth across different sectors and demographic groups highlights whether the benefits of economic growth were shared broadly or concentrated among certain segments of the population.

- Limitations of Wage Data: Wage data can be subject to biases and limitations, requiring careful interpretation. Factors such as inflation and changes in the composition of the workforce need consideration.

Inflation and Monetary Policy

Inflation and monetary policy are intertwined aspects of macroeconomic management. Examining these elements under the Trump administration provides further insight into its economic performance.

Inflation Rates and Federal Reserve Actions

Analyzing inflation rates and the Federal Reserve's response reveals how monetary policy influenced the economy.

- Relationship Between Inflation, Interest Rates, and Economic Growth: Understanding the interplay between inflation, interest rates, and economic growth is crucial. The Federal Reserve typically raises interest rates to combat inflation.

- Effectiveness of Monetary Policy: Assessing the effectiveness of the Federal Reserve's monetary policy during the Trump administration requires careful evaluation of its impact on inflation and economic growth.

- External Factors Influencing Inflation: External factors, such as fluctuations in oil prices and global supply chains, can significantly impact inflation rates. Separating the effects of these external factors from the impact of domestic policies is challenging but essential for accurate analysis.

The Impact of Trade Wars on Inflation

Trump's trade policies, particularly the imposition of tariffs, generated considerable debate regarding their effect on inflation and consumer prices.

- Effects on Specific Sectors: Tariffs primarily affect industries directly involved in international trade. Analyzing the impact on specific sectors helps assess the overall impact on inflation.

- Protectionism vs. Inflation: Protectionist trade policies can lead to higher prices for consumers due to reduced competition and increased import costs, resulting in increased inflation.

- Economic Models and Studies: Economic models and studies analyzing the effects of tariffs on inflation offer valuable perspectives, though their conclusions may vary depending on their underlying assumptions and methodologies.

Government Spending and Fiscal Policy

Government spending and fiscal policy significantly influence the economy. Analyzing these elements provides further context for evaluating the Trump administration's economic performance.

Analysis of Fiscal Policy Decisions

Examining fiscal policy decisions, such as changes in government spending and taxation, offers insights into the administration's economic priorities.

- Budget Deficit and National Debt: The budget deficit and national debt increased significantly during the Trump administration. Analyzing the reasons for these increases and their long-term implications is crucial.

- Comparison to Previous Administrations: Comparing the fiscal policy choices of the Trump administration to those of previous administrations allows for a broader historical perspective.

- Long-Term Consequences of Fiscal Policy Choices: The long-term consequences of fiscal policy decisions, such as increased national debt, can have significant impacts on future economic growth and stability.

Conclusion

This data-driven analysis provided a comprehensive overview of the economic performance during the Trump presidency, examining GDP growth, job creation, inflation, and fiscal policy. The findings reveal a complex picture with both positive and negative aspects, highlighting the need for nuanced interpretation when assessing the impact of any administration's economic policies. The interplay of domestic policies and external factors like global economic conditions and unforeseen events (e.g., the COVID-19 pandemic) significantly shapes economic outcomes. Further research is needed to fully understand the long-term effects of the policies implemented during this period.

To gain a deeper understanding of the complexities of the Trump presidency and its economic legacy, further research into specific policy areas and their long-term consequences is crucial. Continue exploring the impact of the Trump presidency's economic policies for a more complete picture of this critical period in US economic history.

Featured Posts

-

Guemueshane De Okullar Yarin Tatil Mi Valilik Aciklamasi

Apr 23, 2025

Guemueshane De Okullar Yarin Tatil Mi Valilik Aciklamasi

Apr 23, 2025 -

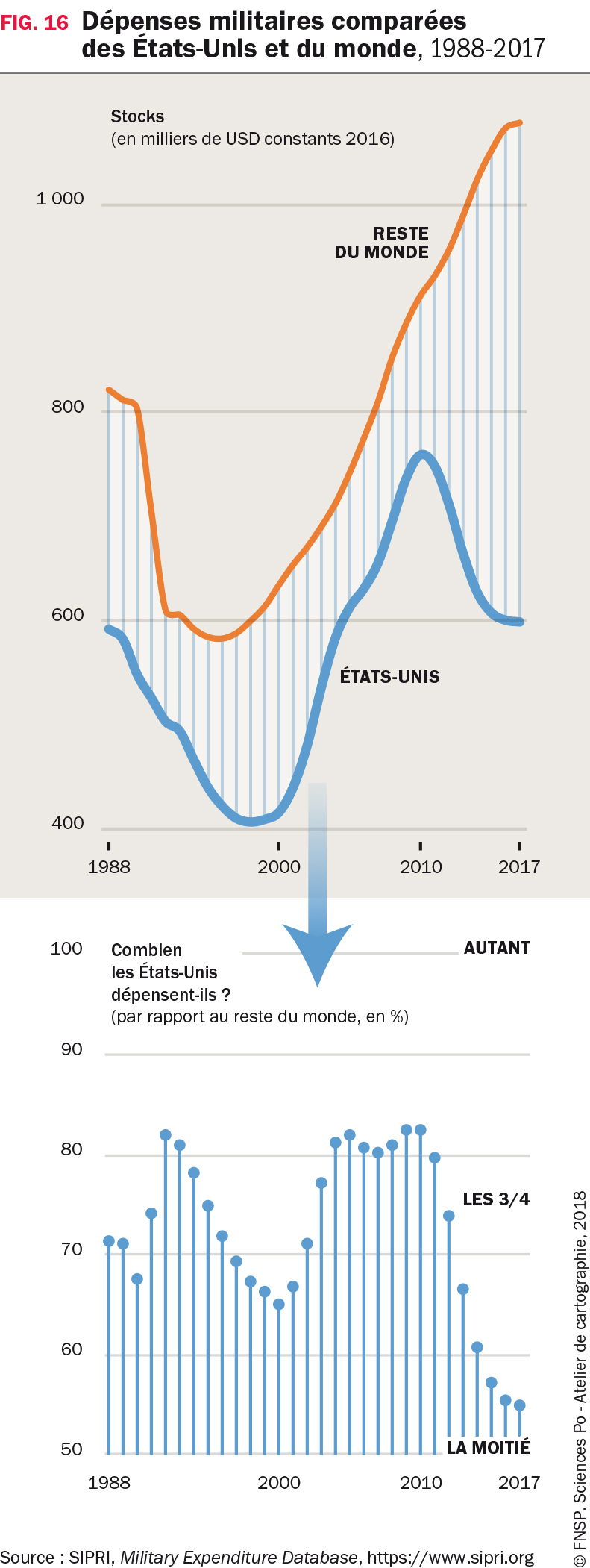

Tensions Geopolitiques L Augmentation Des Depenses Militaires Americaines Et Russes

Apr 23, 2025

Tensions Geopolitiques L Augmentation Des Depenses Militaires Americaines Et Russes

Apr 23, 2025 -

Covid 19 Pandemic Lab Owner Admits To Faking Test Results

Apr 23, 2025

Covid 19 Pandemic Lab Owner Admits To Faking Test Results

Apr 23, 2025 -

Planirajte Svoju Uskrsnu Kupovinu Radno Vrijeme Trgovina

Apr 23, 2025

Planirajte Svoju Uskrsnu Kupovinu Radno Vrijeme Trgovina

Apr 23, 2025 -

A Comprehensive Guide To Removing Your Digital Information Online

Apr 23, 2025

A Comprehensive Guide To Removing Your Digital Information Online

Apr 23, 2025