The Trump Legacy And Nvidia's Future: Navigating Geopolitical Uncertainty

Table of Contents

The Trump Administration's Impact on the Semiconductor Industry

The Trump administration's approach to trade and technology fundamentally altered the operating environment for semiconductor companies like Nvidia. Two key areas stand out: the trade war with China and the increased emphasis on national security.

Trade Wars and Tariffs

The Trump administration's imposition of tariffs on goods from China, including components used in semiconductor manufacturing, created significant ripples throughout the supply chain.

- Increased costs: Tariffs directly increased the cost of raw materials and components, squeezing profit margins for Nvidia and other semiconductor companies.

- Supply chain disruptions: The uncertainty surrounding tariffs led to disruptions in the supply chain, making it more challenging to procure necessary components on time and at predictable prices.

- Relocation of manufacturing considerations: Companies, including Nvidia, began evaluating the feasibility of relocating or diversifying their manufacturing operations to mitigate the risks associated with trade tensions.

The 25% tariffs on certain Chinese imports, for example, directly impacted the cost of manufacturing Nvidia's GPUs, forcing the company to adjust pricing strategies and potentially impacting its competitiveness. This underscored the vulnerability of global supply chains to protectionist policies.

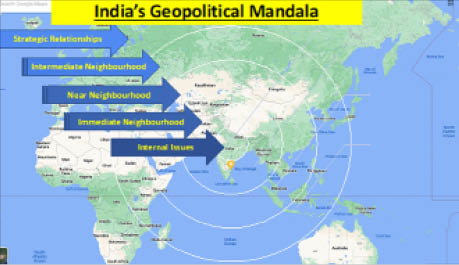

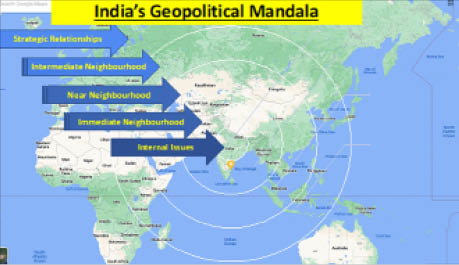

Focus on National Security and Technology Rivalry

The Trump administration's focus on national security elevated semiconductors to a strategic level, viewing them as critical for military applications and technological dominance. This led to several significant policy shifts:

- Increased scrutiny of technology exports to China: The addition of Chinese companies to the Entity List restricted the export of certain US technologies, including advanced semiconductors, to China, impacting Nvidia's sales in this key market.

- Investment in domestic chip manufacturing initiatives: The administration pushed for increased domestic semiconductor manufacturing capabilities through incentives and funding programs, aiming to reduce dependence on foreign sources. This created both opportunities and challenges for Nvidia, requiring adaptation to changing manufacturing landscapes.

- Implications for Nvidia's sales in China: The restrictions on technology exports to China presented a significant challenge to Nvidia's sales growth in this important market, forcing the company to adjust its strategies and explore alternative markets.

The Entity List and similar export control measures placed significant constraints on Nvidia's ability to supply certain products to the Chinese market, highlighting the growing influence of national security considerations on global technology trade.

Nvidia's Strategic Response to Geopolitical Uncertainty

Nvidia's response to the geopolitical uncertainties created by the Trump legacy has been characterized by strategic diversification, regulatory compliance, and continued investment in R&D.

Diversification of Supply Chains

Nvidia has actively pursued strategies to diversify its manufacturing and supply chains to mitigate risks associated with geopolitical tensions:

- Partnerships with foundries in different regions: Nvidia has expanded its partnerships with foundries located in different regions, reducing its reliance on any single geographic location for manufacturing. This includes working with foundries in Taiwan, South Korea, and potentially other regions.

- Investments in research and development for alternative technologies: Nvidia has invested heavily in R&D to explore alternative technologies and architectures, reducing its dependence on specific components or manufacturing processes that might be vulnerable to geopolitical disruption.

- Localization strategies: The company has explored strategies for localizing certain aspects of its manufacturing and supply chain to better comply with regulatory requirements and reduce vulnerability to trade disruptions.

These diversification efforts are crucial for ensuring a resilient and robust supply chain in the face of geopolitical uncertainty.

Adapting to Regulatory Changes

Nvidia has proactively adapted its business strategies to comply with evolving regulations and trade policies:

- Compliance with export control regulations: The company has invested in robust compliance programs to ensure adherence to export control regulations in various countries.

- Lobbying efforts: Nvidia actively engages with regulatory bodies in different countries to advocate for policies that support the semiconductor industry and address concerns about geopolitical uncertainty.

- Adaptation of product offerings to different market needs: Nvidia tailors its product offerings to meet the specific requirements and regulations of different markets, ensuring compliance while maintaining its competitive edge.

This proactive approach to regulatory compliance has been crucial in maintaining Nvidia's ability to operate effectively in a complex and ever-changing geopolitical environment.

Investment in R&D and Technological Leadership

Continued investment in R&D remains a core element of Nvidia’s strategy for navigating geopolitical challenges:

- Advancements in AI chip technology: Nvidia’s continuous innovation in AI chip technology ensures it maintains a technological edge, making its products less susceptible to competition and geopolitical disruptions.

- Development of new architectures: Developing new architectures and technologies provides flexibility and resilience against potential disruptions in specific manufacturing processes or supply chains.

- Focus on software and platform development: Investing in software and platform development strengthens Nvidia's ecosystem and reduces its dependence on hardware-specific solutions, enhancing its adaptability.

This commitment to R&D helps ensure Nvidia's long-term competitiveness and ability to adapt to evolving geopolitical realities.

The Future of Nvidia in a Geopolitically Uncertain World

The future of Nvidia remains intertwined with the ongoing geopolitical uncertainty stemming from the Trump legacy and its lasting impact on US-China relations and technology regulation.

Opportunities and Challenges

Nvidia faces both significant opportunities and challenges in the coming years:

- Growth in AI adoption: The rapidly expanding adoption of artificial intelligence presents substantial growth opportunities for Nvidia, as its GPUs are central to many AI applications.

- Increasing demand for high-performance computing: The increasing demand for high-performance computing across various sectors—from gaming to scientific research—creates further opportunities for Nvidia's products.

- Competition from other chipmakers: Intense competition from other chipmakers, including AMD and Intel, presents a significant challenge for maintaining market share.

- Potential for further regulatory changes: Future regulatory changes, including further tightening of export controls or shifts in trade policy, could significantly impact Nvidia's business.

Nvidia's success will depend on its ability to navigate this complex landscape effectively.

The Role of Government Policy

Future government policies will play a crucial role in shaping Nvidia's future and the wider semiconductor industry:

- Potential for further investment in domestic chip manufacturing: Continued government investment in domestic chip manufacturing could create new opportunities for Nvidia, but also increased regulatory burdens.

- Evolving export control regulations: Changes in export control regulations could further restrict Nvidia's access to certain markets or technologies.

- Impact of trade agreements: New trade agreements or shifts in existing agreements could significantly affect Nvidia's supply chains and global competitiveness.

Monitoring these evolving policy landscapes is critical for Nvidia’s strategic planning and future success.

Conclusion

The Trump legacy continues to shape the geopolitical landscape for the semiconductor industry, profoundly impacting companies like Nvidia. Navigating this uncertainty requires strategic adaptability, diversification, and continued investment in technological leadership. While challenges remain, Nvidia’s commitment to innovation and its proactive response to regulatory changes position it for continued growth. Understanding the complex interplay between the Trump legacy, geopolitical uncertainty, and Nvidia’s future is crucial for investors and industry stakeholders alike. Staying informed about the evolving dynamics of the global semiconductor landscape and the impact of geopolitical shifts on companies like Nvidia is key to making informed decisions. Therefore, continue to monitor the developments concerning the Trump legacy and its influence on Nvidia’s future in this ever-changing geopolitical climate.

Featured Posts

-

Tanner Bibees First Pitch Homer Guardians Comeback Victory Over Yankees

Apr 30, 2025

Tanner Bibees First Pitch Homer Guardians Comeback Victory Over Yankees

Apr 30, 2025 -

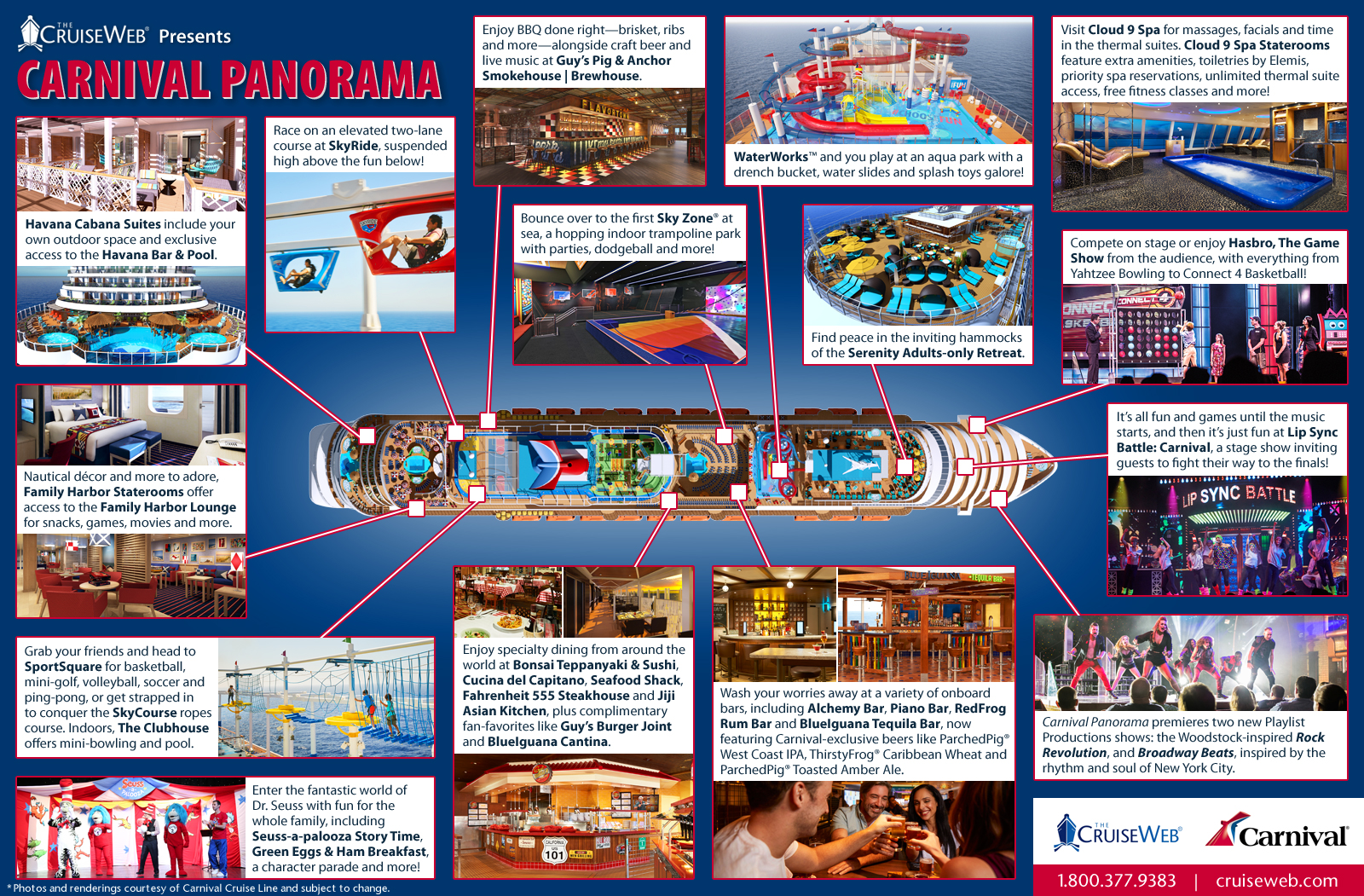

Carnival Cruise Line 7 Big Announcements For Next Month

Apr 30, 2025

Carnival Cruise Line 7 Big Announcements For Next Month

Apr 30, 2025 -

10 Tran Dau Hap Dan Nhat Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025

Apr 30, 2025

10 Tran Dau Hap Dan Nhat Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025

Apr 30, 2025 -

Your March Roster Roundup Dancers And Directors On The Move

Apr 30, 2025

Your March Roster Roundup Dancers And Directors On The Move

Apr 30, 2025 -

Condanna Per Becciu 40 000 Euro Di Risarcimento Per Gli Accusatori

Apr 30, 2025

Condanna Per Becciu 40 000 Euro Di Risarcimento Per Gli Accusatori

Apr 30, 2025