The Treasury Market On April 8th: A Recap And Analysis

Table of Contents

Yield Curve Movements on April 8th

The yield curve, a graphical representation of the yields of Treasury bonds across different maturities, offers crucial insights into market sentiment and economic expectations. On April 8th, the yield curve showed a [insert actual shape: e.g., slight steepening/flattening/inversion]. This shape signifies [insert interpretation based on the actual shape, e.g., growing confidence in future economic growth/concerns about slowing economic growth/increased recessionary fears].

- Specific Yield Changes: The 2-year Treasury yield [increased/decreased] by [percentage], while the 10-year yield [increased/decreased] by [percentage], and the 30-year yield [increased/decreased] by [percentage]. These changes reflect [explain the reasoning behind the observed changes].

- Comparison to Previous Day and Averages: Compared to the previous day's closing yields, we observed [describe the differences]. Relative to long-term averages, the yields were [describe the relationship to long-term averages].

- Unusual Movements: [Mention any significant unusual movements or anomalies observed in the yield curve on April 8th and their potential causes].

Impact of Economic Data Releases on April 8th

Several significant economic data releases on April 8th played a pivotal role in shaping Treasury market movements. [Insert specific data release, e.g., The Consumer Price Index (CPI) report] revealed [state the key findings of the data release]. This data [exceeded/fell short of] market expectations, leading to [describe the market reaction; e.g., a sell-off in Treasury bonds/increased demand for safe-haven assets].

- Data Points and Values: [List the specific data points and their values. For example: CPI increased by 0.4%, exceeding expectations of 0.3%].

- Expectations vs. Results: Market expectations were [describe the market consensus before the data release], whereas the actual results showed [describe the actual results].

- Market Response: The market responded with [describe the specific market reaction, e.g., an immediate sell-off in longer-term Treasuries, reflecting concerns about inflation and future interest rate hikes/a buying spree in short-term Treasuries as investors sought safety].

Influence of Federal Reserve Policy on April 8th

The Federal Reserve's stance on monetary policy significantly influences the Treasury market. On April 8th, [mention any relevant statements, speeches, or actions from the Fed, e.g., a Fed official hinted at a potential pause in interest rate hikes/the Fed released minutes from its previous meeting suggesting a more hawkish approach]. This [action/statement] was interpreted by the market as [describe the market's interpretation, e.g., dovish, signaling a potential easing of monetary policy/hawkish, implying continued aggressive rate hikes].

- Fed Announcements/Speeches: [Summarize any key announcements or speeches made by the Fed on or around April 8th].

- Market Interpretation: The market interpreted the Fed's stance as [explain the market's interpretation and the reasons behind it].

- Potential Future Adjustments: [Discuss potential future policy adjustments and their anticipated impact on Treasury yields. For example: Future rate hikes could further increase Treasury yields, while a pause might lead to a yield decline.].

Trading Volume and Volatility on April 8th

Trading volume in the Treasury market on April 8th was [high/low/average] compared to recent averages. This suggests [interpret the implications of the trading volume, e.g., increased market uncertainty/relative market stability]. Price volatility was [high/low/average], potentially driven by [mention the potential causes of volatility, e.g., the unexpected inflation data/uncertainty surrounding Fed policy].

- Volume Comparison: Trading volume on April 8th was [quantify the volume relative to previous days and historical averages].

- Measures of Volatility: [Mention specific measures of volatility and their values. E.g., The VIX index (volatility index) was at X].

- Major Trading Events: [Identify any major trading events or periods of high volatility on April 8th].

Conclusion: Key Takeaways and Future Outlook for the Treasury Market

The April 8th Treasury market was characterized by [summarize the key trends observed, e.g., increased volatility driven by unexpected economic data and ongoing uncertainty surrounding Federal Reserve policy]. Yield curve movements, influenced by economic data releases and Fed policy expectations, shaped investor sentiment. Trading volume and volatility reflected the overall market uncertainty.

Looking ahead, the Treasury market's trajectory will depend on upcoming economic data releases, the Federal Reserve's policy decisions, and global economic developments. Understanding these intertwined factors is crucial for navigating the complexities of the government bond market. Stay updated on future Treasury market analyses to make informed investment decisions. Learn more about Treasury market dynamics and follow our blog for continuous Treasury market insights.

Featured Posts

-

Country Legend Willie Nelson Releases Oh What A Beautiful World

Apr 29, 2025

Country Legend Willie Nelson Releases Oh What A Beautiful World

Apr 29, 2025 -

Elite Universities Form Private Group To Counter Trump Administration Policies

Apr 29, 2025

Elite Universities Form Private Group To Counter Trump Administration Policies

Apr 29, 2025 -

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Ban And Its Implications

Apr 29, 2025

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Ban And Its Implications

Apr 29, 2025 -

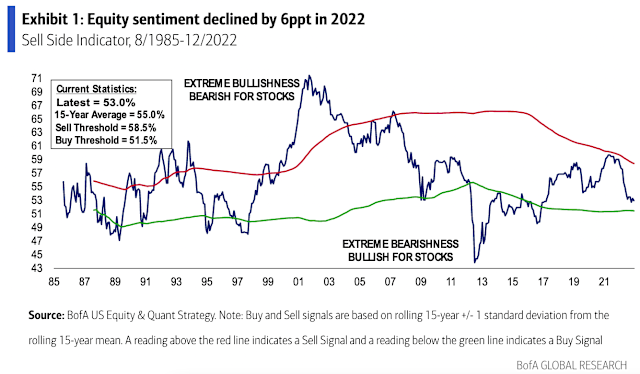

Should Investors Worry About Current Stock Market Valuations Bof As Insight

Apr 29, 2025

Should Investors Worry About Current Stock Market Valuations Bof As Insight

Apr 29, 2025 -

Wrestle Mania Missing Brit Paralympian Found Safe After Four Day Search

Apr 29, 2025

Wrestle Mania Missing Brit Paralympian Found Safe After Four Day Search

Apr 29, 2025

Latest Posts

-

Kitzbuehel Tgi Ag Feiert Erfolge Und Neue Strategien

Apr 29, 2025

Kitzbuehel Tgi Ag Feiert Erfolge Und Neue Strategien

Apr 29, 2025 -

Fussball Austria Wien Jancker Ist Der Neue Trainer

Apr 29, 2025

Fussball Austria Wien Jancker Ist Der Neue Trainer

Apr 29, 2025 -

Zukunftsorientierte Feier Der Tgi Ag In Kitzbuehel

Apr 29, 2025

Zukunftsorientierte Feier Der Tgi Ag In Kitzbuehel

Apr 29, 2025 -

Neuer Klagenfurt Coach Jancker Ersetzt Pacult

Apr 29, 2025

Neuer Klagenfurt Coach Jancker Ersetzt Pacult

Apr 29, 2025 -

Pacult Geht Jancker Kommt Trainerwechsel Bei Austria Wien

Apr 29, 2025

Pacult Geht Jancker Kommt Trainerwechsel Bei Austria Wien

Apr 29, 2025