The Tesla-Dogecoin Connection: Analyzing The Recent Market Volatility

Table of Contents

Elon Musk's Influence: The Driving Force Behind the Volatility

Elon Musk's pronouncements, particularly on social media, have significantly impacted both Tesla's stock price and Dogecoin's value. This section delves into the specifics of this influence.

Musk's Tweets and Social Media Impact:

-

Specific Examples: Musk's tweets frequently mention Dogecoin, sometimes praising it, other times seemingly criticizing it. These tweets often trigger immediate and dramatic price swings in Dogecoin. Similarly, news regarding Tesla, often originating from Musk himself, affects Tesla's stock price. For instance, announcements about new product launches or Tesla's foray into new markets cause significant stock price fluctuations.

-

Investor Sentiment: Musk's pronouncements significantly influence investor sentiment. Positive comments generate FOMO (fear of missing out), leading to buying frenzies and price surges. Conversely, negative comments can spark selling pressure and price drops. The speed and magnitude of these reactions are remarkable, highlighting the power of Musk's social media influence on market psychology.

-

Market Manipulation Concerns: The dramatic price swings triggered by Musk's tweets raise concerns about potential market manipulation. While Musk denies manipulating the market, the sheer impact of his actions necessitates careful consideration of these ethical and regulatory implications. The SEC has also shown interest in Musk's actions and the influence of his tweets on the market, adding further complexity to the situation.

Tesla's Acceptance of Dogecoin:

-

Impact on Dogecoin Adoption: Tesla's decision to accept Dogecoin as payment for certain goods and services marked a significant step toward mainstream cryptocurrency adoption. This action increased Dogecoin's visibility and legitimacy, attracting new investors and driving up its price.

-

Market Capitalization: The increased demand for Dogecoin, fueled by Tesla's acceptance, directly impacted its market capitalization. This event showed the potential for real-world utility of cryptocurrencies to influence their market value. However, the impact is not solely tied to this acceptance and many other factors need to be considered when analyzing Dogecoin's price.

-

Long-Term Effects: The long-term effects of Tesla's acceptance of Dogecoin remain to be seen. It could lead to increased cryptocurrency adoption by other major corporations, further solidifying Dogecoin's position in the market. However, it also highlights the risks associated with relying on a single entity for validation and price support.

Correlation vs. Causation: Understanding the Relationship

While a strong correlation exists between Tesla's stock price and Dogecoin's value, it's crucial to differentiate correlation from causation.

Analyzing the Correlation Between Tesla and Dogecoin Prices:

-

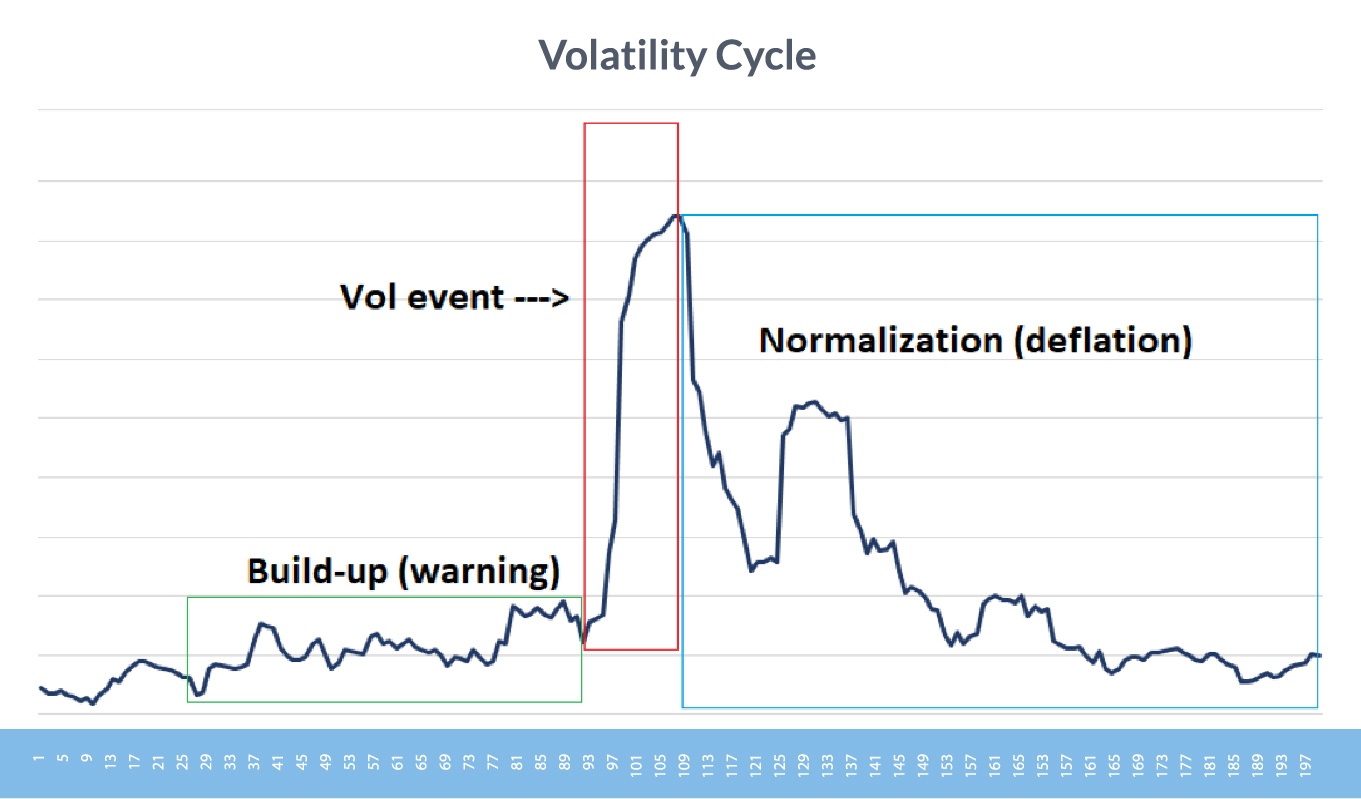

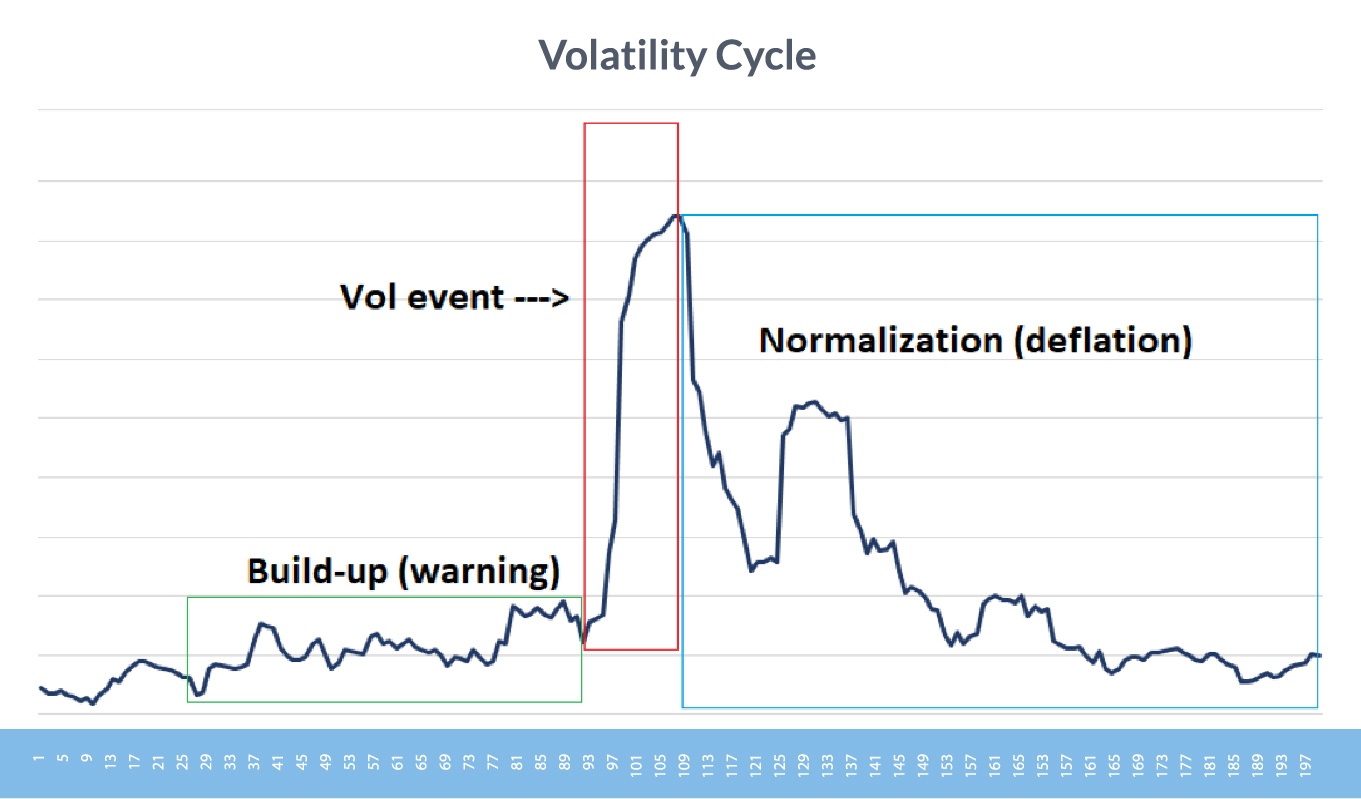

Data and Charts: Analyzing historical price data clearly shows a positive correlation between Tesla's stock price and Dogecoin's price. Charts illustrating these price movements over time visually confirm this relationship. The correlation coefficient can be calculated to quantify the strength of this relationship.

-

Statistical Significance: Statistical analysis can determine the statistical significance of this correlation, helping to confirm whether the observed relationship is likely due to chance or a real underlying connection. However, statistical significance alone does not prove causation.

-

Periods of Divergence: It is important to note that periods of divergence exist where Tesla's stock price and Dogecoin's price move independently. These instances highlight the influence of other factors on each asset's price. Understanding these periods is critical to avoid oversimplifying the relationship.

Identifying Other Influencing Factors:

-

Broader Market Trends: Both Tesla and Dogecoin are subject to broader market trends. A bullish overall market environment tends to benefit both, while a bearish market can negatively impact both assets. Macroeconomic factors like inflation and interest rates also play a role.

-

Regulatory Changes: Regulatory changes affecting either the cryptocurrency market or the automotive industry can independently influence the prices of Dogecoin and Tesla stock, respectively. Government regulations and policies often introduce uncertainty and volatility.

-

News Events: Positive or negative news regarding either Tesla or Dogecoin (independent of Musk's actions) can also impact their respective prices. For example, news about technological advancements or partnerships can boost investor confidence and drive prices up.

Investment Implications and Risk Assessment

Investing in assets heavily influenced by a single individual's actions carries significant risks.

The Risks of Investing in Tesla and Dogecoin Based on Musk's Actions:

-

Volatility and Uncertainty: The inherent volatility associated with both Tesla stock and Dogecoin, largely due to Musk's influence, presents substantial investment risks. Investors should be prepared for significant price swings.

-

Diversification and Risk Management: Diversifying one's investment portfolio is crucial to mitigate the risk associated with these assets. A well-diversified portfolio can help to cushion losses from sudden price drops.

-

Speculative Investments: Both Tesla and Dogecoin are considered speculative investments, meaning their prices are not always driven by fundamentals. Investors should only allocate capital they can afford to lose.

Potential Future Scenarios and Long-Term Outlook:

-

Regulatory Scrutiny: Increased regulatory scrutiny of both Tesla and the cryptocurrency market could impact their future performance. Changes in regulations can introduce uncertainty and affect investor sentiment.

-

Technological Advancements: Technological advancements in electric vehicles and blockchain technology could positively influence both Tesla and Dogecoin's long-term prospects. Innovation is key in these rapidly evolving industries.

-

Market Adoption: Widespread adoption of electric vehicles and cryptocurrencies is crucial for the long-term success of both Tesla and Dogecoin. Increased adoption would likely lead to greater price stability and investor confidence. However, widespread adoption is never guaranteed.

Conclusion

This analysis reveals a strong correlation between Tesla's stock price and Dogecoin's value, primarily driven by Elon Musk's actions. The volatility inherent in both assets, stemming from this influence and other market factors, highlights the importance of understanding and managing investment risk. Investing in either requires careful consideration of potential downside.

Call to Action: Continue your research on the Tesla-Dogecoin connection. Stay informed about market developments and make informed investment decisions based on a thorough understanding of the inherent risks involved in this volatile relationship. Remember to diversify your portfolio and conduct thorough due diligence before investing in either Tesla or Dogecoin. Understanding the Tesla-Dogecoin connection is key to navigating the complexities of this dynamic market relationship.

Featured Posts

-

Find Out When Does The Next High Potential Episode Air On Abc

May 10, 2025

Find Out When Does The Next High Potential Episode Air On Abc

May 10, 2025 -

Harry Styles 70s Inspired Mustache A London Appearance

May 10, 2025

Harry Styles 70s Inspired Mustache A London Appearance

May 10, 2025 -

Ve Day Speech Taiwans Lai Addresses Rising Totalitarian Threat

May 10, 2025

Ve Day Speech Taiwans Lai Addresses Rising Totalitarian Threat

May 10, 2025 -

Adin Hill Leads Golden Knights To 4 0 Victory Over Blue Jackets

May 10, 2025

Adin Hill Leads Golden Knights To 4 0 Victory Over Blue Jackets

May 10, 2025 -

Vegas Golden Knights Potential Hertl Absence Looms Large After Lightning Game

May 10, 2025

Vegas Golden Knights Potential Hertl Absence Looms Large After Lightning Game

May 10, 2025