The Private Credit Job Market: 5 Actions To Maximize Your Chances

Table of Contents

Tailor Your Resume and Cover Letter for Private Credit Roles

Your resume and cover letter are your first impression – make it count! Tailoring them specifically to each private credit role is crucial.

Highlight Relevant Skills and Experience

- Quantify your accomplishments: Instead of simply stating your responsibilities, quantify your achievements. For example, "Increased portfolio yield by 15%" is far more impactful than "Managed portfolio investments."

- Emphasize key skills: Focus on skills highly sought after in private credit, such as financial modeling (including LBO and DCF modeling), credit analysis, due diligence, portfolio management, and risk assessment.

- Incorporate industry keywords: Scan job descriptions for common keywords like "leveraged loans," "distressed debt," "private equity," "senior secured loans," "subordinated debt," "unitranche financing," and "mezzanine financing," and weave them naturally into your resume and cover letter.

Showcase Understanding of Private Credit Strategies

Demonstrate your understanding of various private credit strategies and the broader private credit industry landscape.

- Mention specific strategies: Show familiarity with direct lending, mezzanine financing, distressed debt investing, and other relevant strategies.

- Highlight market knowledge: Demonstrate your awareness of current market trends, regulatory changes (like LIBOR transition), and the competitive landscape. This shows you’re more than just technically proficient.

- Showcase relevant experience: If you have experience with specific types of credit instruments, be sure to highlight that experience. For example, mention experience with CLOs, BDCs, or other relevant vehicles.

Target Your Application to Specific Firms

Generic applications rarely succeed. Research each firm thoroughly before submitting your application.

- Understand their investment strategy: Research the firm's investment focus (e.g., specific industries, deal sizes, investment stages).

- Demonstrate genuine interest: Show you understand their investment philosophy and recent activities. Mention specific deals or portfolio companies that resonate with your skills and interests.

- Tailor your language: Adjust the tone and content of your resume and cover letter to align with the firm's culture and values.

Network Strategically Within the Private Credit Industry

Networking is paramount in the Private Credit Job Market. Building relationships can unlock opportunities you won't find advertised.

Attend Industry Events and Conferences

- Identify relevant events: Research and attend industry conferences and events like those hosted by associations like the Loan Syndications and Trading Association (LSTA) or industry-specific events focused on private debt.

- Engage actively: Don't just attend – actively participate in discussions, exchange business cards, and follow up with meaningful connections.

- Build relationships: Networking is about building long-term relationships, not just collecting business cards.

Leverage LinkedIn and Other Professional Platforms

LinkedIn is an invaluable tool for connecting with professionals in the private credit industry.

- Optimize your profile: Ensure your LinkedIn profile is professional, accurate, and keyword-rich.

- Join relevant groups: Engage in discussions and participate in groups related to private credit, finance, and investment management.

- Connect strategically: Connect with professionals in your target firms and engage with their content to build rapport.

Informational Interviews

Informational interviews are a powerful way to uncover hidden opportunities and gain valuable insights.

- Reach out strategically: Identify professionals you admire and request informational interviews, explaining your interest in their experience and the private credit industry.

- Prepare thoughtful questions: Prepare insightful questions to demonstrate your interest and understanding.

- Follow up: Always send a thank-you note after the interview.

Master the Private Credit Interview Process

The interview process for private credit roles is rigorous. Preparation is key.

Prepare for Technical Questions

Expect challenging technical questions assessing your financial modeling, valuation, and credit analysis skills.

- Practice common questions: Practice answering common questions related to DCF modeling, LBO modeling, credit ratios (like leverage ratios, coverage ratios, and interest coverage ratios), and valuation methodologies.

- Utilize resources: Use online courses, books, and practice problems to sharpen your skills.

- Master your technical skills: Confidence and proficiency in these areas will significantly boost your interview performance.

Showcase Your Behavioral Skills

Behavioral questions assess your soft skills, crucial in collaborative environments.

- Use the STAR method: Structure your answers using the STAR method (Situation, Task, Action, Result) to showcase your skills effectively.

- Highlight teamwork and problem-solving: Demonstrate your ability to work effectively in teams and solve complex problems.

- Show your personality and cultural fit: Let your personality shine through to demonstrate a good cultural fit.

Ask Thoughtful Questions

Asking insightful questions demonstrates your genuine interest and understanding.

- Prepare insightful questions: Develop questions that show you've researched the firm and the role.

- Go beyond the surface: Avoid generic questions; focus on questions that show your critical thinking abilities.

- Demonstrate your interest in the firm's specific activities: Show that you understand their investment strategy and have a genuine interest in their work.

Develop In-Demand Skills for the Private Credit Job Market

Continuous learning is essential in this dynamic field. Develop and enhance skills that are highly valued.

Financial Modeling and Valuation

Proficiency in financial modeling is non-negotiable.

- Master key techniques: Develop strong skills in DCF modeling, LBO modeling, comparable company analysis, and precedent transaction analysis.

- Use relevant software: Become proficient in Excel and potentially specialized financial modeling software.

- Stay updated: Keep your skills sharp by consistently practicing and learning new techniques.

Credit Analysis and Due Diligence

Understanding credit risk is crucial.

- Learn credit analysis techniques: Become proficient in analyzing financial statements, calculating key credit ratios, and assessing credit risk.

- Understand different credit structures: Familiarize yourself with various debt instruments, including senior secured loans, subordinated debt, and mezzanine financing.

- Develop due diligence skills: Practice conducting thorough due diligence on potential investments.

Industry Knowledge and Market Trends

Staying informed is critical.

- Read industry publications: Follow leading publications in the finance and private credit sectors.

- Attend industry events: Networking and staying updated on market trends go hand in hand.

- Understand macroeconomic factors: Develop a strong understanding of the macroeconomic environment and its influence on the private credit market.

Utilize Job Boards and Recruiters Effectively

Use all available resources to maximize your job search efforts.

Target Specific Job Boards

Use specialized job boards to target your search effectively.

- Utilize niche job boards: Search finance-specific job boards and those focusing on private equity and credit roles.

- Optimize your search terms: Use relevant keywords to refine your search and increase the likelihood of finding relevant opportunities.

- Regularly check for new postings: Job postings in the private credit market can be dynamic, so regular monitoring is crucial.

Work with Recruiters

Recruiters specializing in the private credit industry can provide valuable insights and opportunities.

- Network with recruiters: Build relationships with recruiters who focus on private credit placements.

- Provide accurate information: Ensure your resume and profile are up-to-date and accurate.

- Maintain communication: Stay in regular contact with your chosen recruiters to update them on your job search progress.

Network through your existing network

Don't underestimate the power of your existing contacts.

- Inform your network: Let your contacts know you're actively looking for a role in private credit.

- Leverage referrals: Referrals can significantly boost your chances of getting an interview.

Securing Your Dream Role in the Private Credit Job Market

Securing a position in the competitive Private Credit Job Market requires a multifaceted approach. By tailoring your applications, networking strategically, mastering the interview process, developing in-demand skills, and utilizing job boards and recruiters effectively, you significantly increase your chances of landing your dream role. Remember the high demand and lucrative compensation associated with these roles make the effort well worthwhile. Start maximizing your chances today! Begin your journey in the lucrative Private Credit Job Market now!

Featured Posts

-

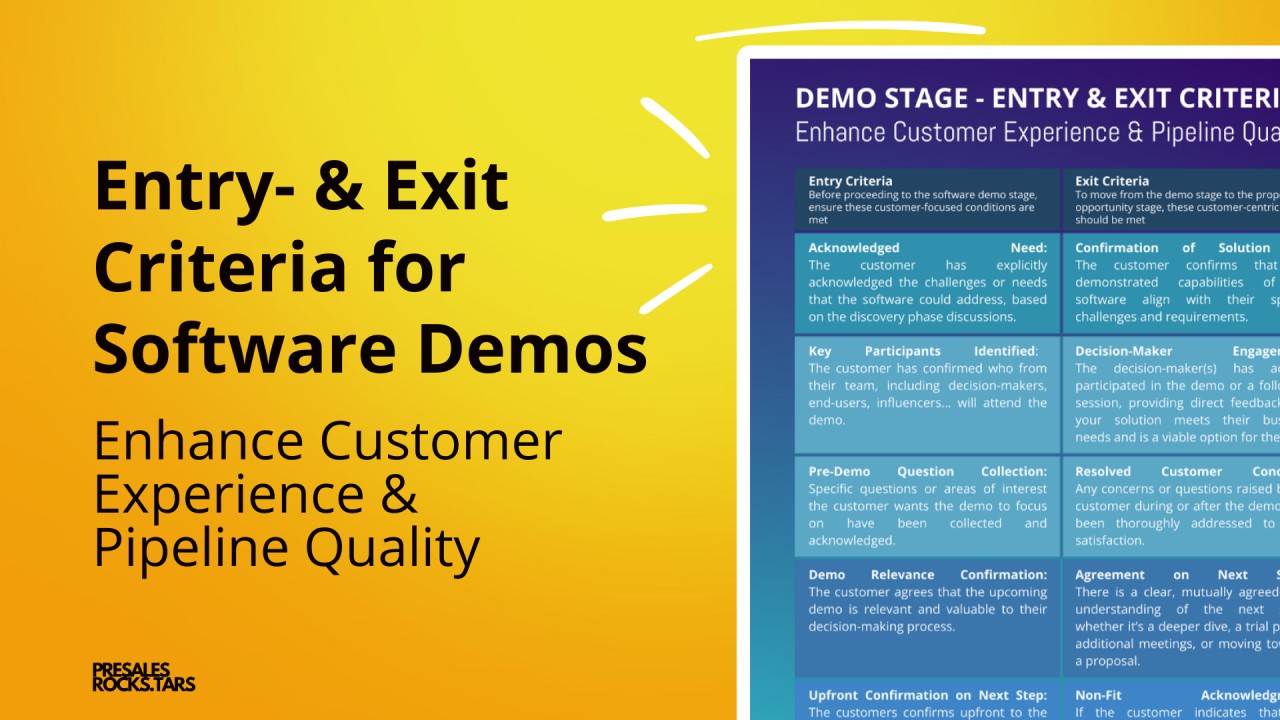

New York Mets A Deep Dive Into Their Recent Offensive Slump

May 19, 2025

New York Mets A Deep Dive Into Their Recent Offensive Slump

May 19, 2025 -

Bare Beating On Public Transport A Commuters Nightmare

May 19, 2025

Bare Beating On Public Transport A Commuters Nightmare

May 19, 2025 -

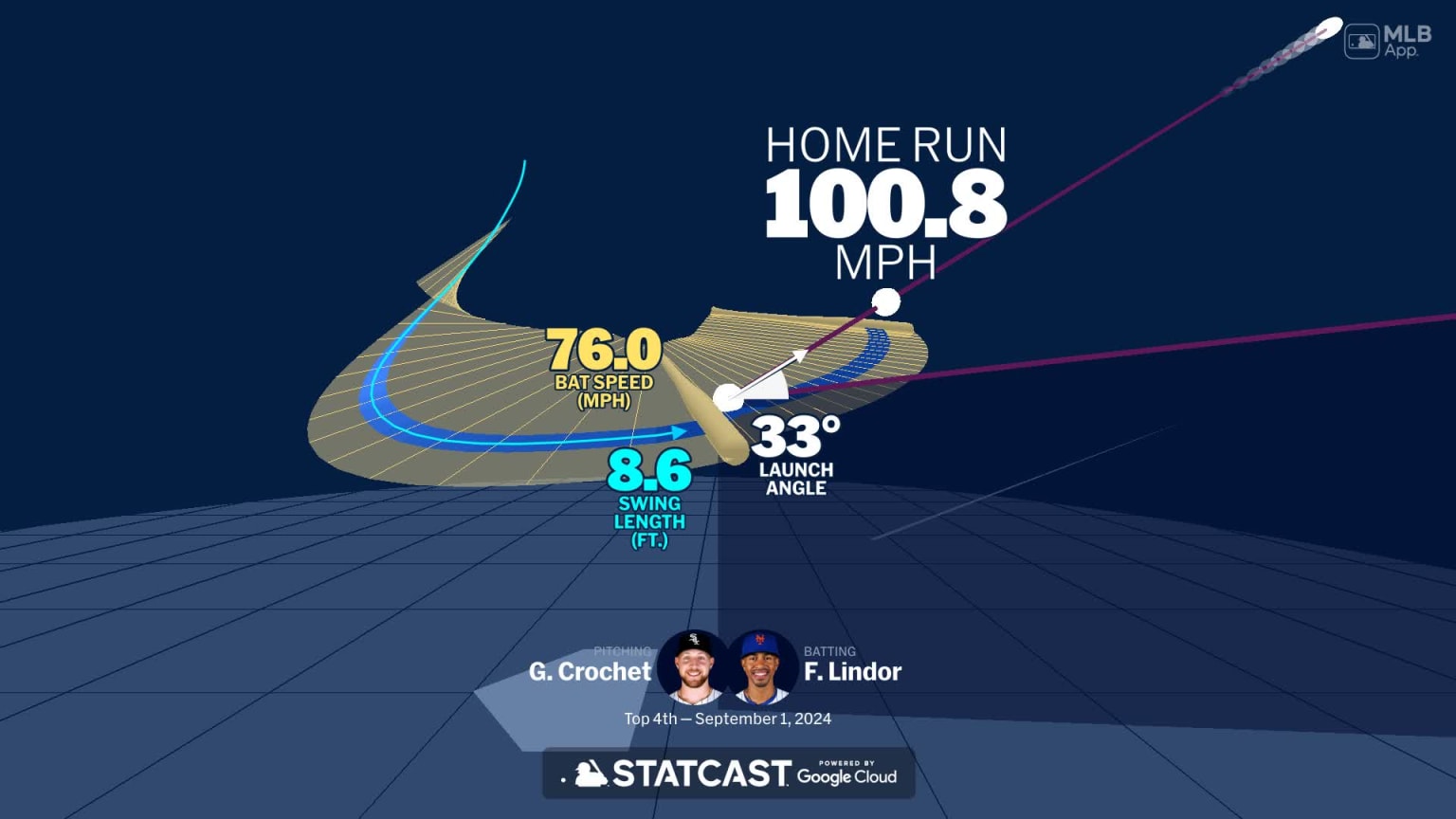

Haalands Hat Trick Powers Norway To Dominant World Cup Qualifying Win

May 19, 2025

Haalands Hat Trick Powers Norway To Dominant World Cup Qualifying Win

May 19, 2025 -

Exploring The Balmain Fall Winter 2025 2026 Collection

May 19, 2025

Exploring The Balmain Fall Winter 2025 2026 Collection

May 19, 2025 -

Fastest To 100 Haalands Epl Goal Involvement Record

May 19, 2025

Fastest To 100 Haalands Epl Goal Involvement Record

May 19, 2025