The Power Of Simplicity: A Proven Dividend Investing Strategy

Table of Contents

Understanding the Fundamentals of Dividend Investing

Dividend investing is a strategy centered around acquiring stocks of companies that regularly distribute a portion of their profits to shareholders as dividends. These payments represent a share of the company's success and provide a steady stream of income. Understanding key terms is crucial for success in this simple dividend investing approach:

- Dividend Yield: The annual dividend per share, expressed as a percentage of the stock's price. A higher yield generally indicates a larger dividend payment relative to the stock's cost.

- Dividend Payout Ratio: The percentage of a company's earnings paid out as dividends. A sustainable payout ratio typically falls below 70%, indicating the company retains enough earnings for reinvestment and growth.

- Dividend Growth Rate: The rate at which a company increases its dividend payments over time. Consistent dividend growth signifies a healthy and expanding business.

The long-term benefits of dividend reinvestment (DRIP) are significant. DRIP plans allow you to automatically reinvest your dividend payments to purchase more shares, accelerating your investment growth through the power of compounding.

- Diversification: Spread your investments across various dividend-paying stocks in different sectors to reduce risk.

- Company Research: Thoroughly research the financial health and future prospects of companies before investing.

- Tax Implications: Understand the tax implications of dividend income to effectively manage your tax liability.

Building a Simple, Diversified Dividend Portfolio

Simplicity is key to a successful dividend investing strategy. Rather than trying to manage dozens of stocks, focus on building a manageable portfolio of 10-20 carefully selected companies. This simple dividend investing approach prioritizes diversification across different sectors (technology, healthcare, consumer goods, etc.) to mitigate risk. A single sector downturn won't cripple your entire portfolio.

Index funds offer a simple way to achieve broad diversification. These funds track a specific market index, providing instant exposure to a large basket of stocks.

- Low-Cost ETFs: Explore low-cost exchange-traded funds (ETFs) that focus on dividend-paying stocks, offering diversified exposure with minimal expense ratios. Examples include the Vanguard High Dividend Yield ETF (VYM) or the Schwab US Dividend Equity ETF (SCHD).

- Individual Stock Selection: If you prefer individual stock picking, choose companies with a history of consistent dividend payments, strong financial performance, and a sustainable business model.

- Regular Review and Rebalancing: Periodically review and rebalance your portfolio to ensure it aligns with your investment goals and risk tolerance. Rebalancing involves selling some of your higher-performing assets and buying more of your underperforming ones to maintain your desired asset allocation.

Identifying High-Quality Dividend Stocks for Long-Term Growth

Not all dividend-paying companies are created equal. To identify high-quality stocks suitable for a long-term simple dividend investing strategy, evaluate their dividend sustainability and long-term growth potential.

Key financial metrics to analyze include:

-

Dividend Payout Ratio: As mentioned, a sustainable payout ratio (typically below 70%) indicates the company can comfortably maintain its dividend payments.

-

Debt-to-Equity Ratio: A low debt-to-equity ratio suggests the company is financially sound and less susceptible to economic downturns.

-

Return on Equity (ROE): Measures how effectively a company uses shareholder investments to generate profits. A consistently high ROE indicates strong profitability.

-

Financial Ratio Analysis: Understand what key financial ratios indicate about a company's financial health and performance.

-

Business Model Understanding: Evaluate the company's business model, competitive advantages, and long-term prospects to ensure its sustainability.

-

Research Resources: Utilize resources like SEC filings (EDGAR database), financial news websites (Yahoo Finance, Google Finance), and company investor relations pages for in-depth research.

The Power of Patience and Long-Term Holding in Dividend Investing

Successful dividend investing requires patience and a long-term perspective. Aim for a minimum holding period of 5 years or more to allow your investments to grow and benefit from compounding.

Dollar-cost averaging (DCA) is a valuable strategy. DCA involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This mitigates the risk of investing a lump sum at a market peak.

- Compounding Returns: The magic of compounding allows your dividend income to grow exponentially over time. Reinvesting dividends further accelerates this growth.

- Managing Market Downturns: Market volatility is inevitable. Develop strategies to manage your emotions and avoid panic selling during downturns. Stick to your investment plan and remember that market fluctuations are temporary.

- Investment Plan Adherence: The most crucial aspect is consistently following your chosen simple dividend investing strategy. Discipline is essential for long-term success.

Harness the Power of a Simple Dividend Investing Strategy

A simple dividend investing strategy offers ease of management, effectiveness in generating income and wealth, and the potential for strong long-term growth. By focusing on a diversified portfolio of high-quality dividend-paying stocks and employing a long-term perspective, you can build a financially secure future. Remember to consistently reinvest your dividends to maximize the power of compounding.

Start building your own powerful and simple dividend investing strategy today! Learn more about [link to relevant resource] and begin your journey towards financial freedom.

Featured Posts

-

Ataque De Avestruz A Boris Johnson En Texas La Reaccion Del Ex Primer Ministro

May 11, 2025

Ataque De Avestruz A Boris Johnson En Texas La Reaccion Del Ex Primer Ministro

May 11, 2025 -

Victoria De Knicks Sobre Sixers Anunoby Brilla Con 27 Puntos Novena Derrota De Filadelfia

May 11, 2025

Victoria De Knicks Sobre Sixers Anunoby Brilla Con 27 Puntos Novena Derrota De Filadelfia

May 11, 2025 -

Bayern Legend Thomas Mueller Bids Farewell To The Allianz Arena After 25 Years

May 11, 2025

Bayern Legend Thomas Mueller Bids Farewell To The Allianz Arena After 25 Years

May 11, 2025 -

Chantal Ladesou Filmographie Et Roles Emblematiques

May 11, 2025

Chantal Ladesou Filmographie Et Roles Emblematiques

May 11, 2025 -

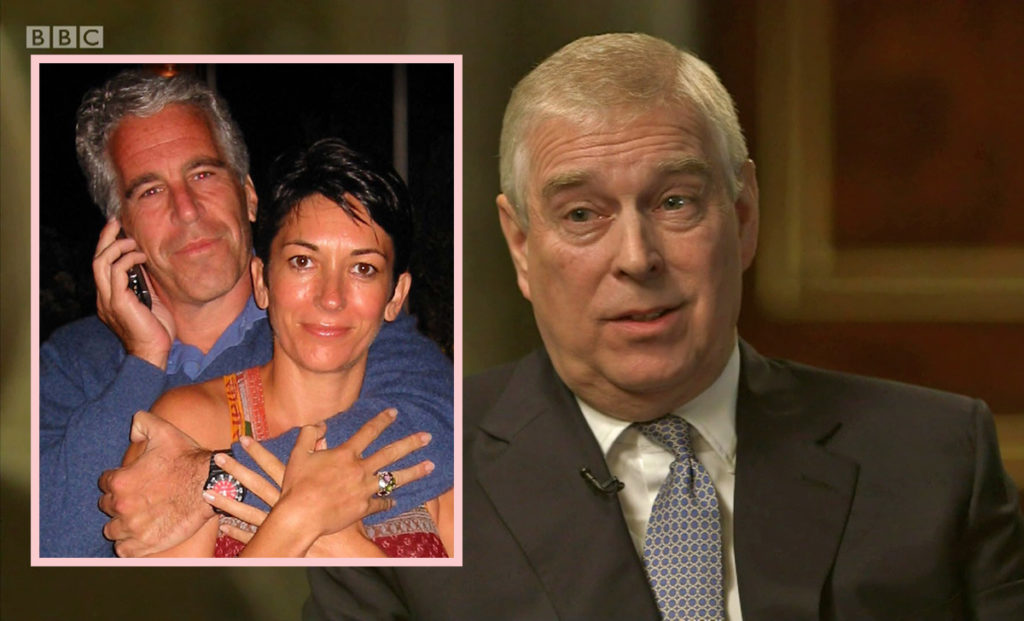

Undercover Investigation Explosive Allegations Against Prince Andrew Regarding Underage Girl

May 11, 2025

Undercover Investigation Explosive Allegations Against Prince Andrew Regarding Underage Girl

May 11, 2025