The Posthaste Report: Predicting A Correction In Canadian Home Prices

Table of Contents

Rising Interest Rates & Their Impact

The Bank of Canada's aggressive monetary policy is a primary driver of potential market shifts. Higher interest rates directly impact the affordability and accessibility of homeownership for many Canadians.

The Bank of Canada's Aggressive Monetary Policy:

The Bank of Canada's recent interest rate hikes are significantly increasing borrowing costs, making mortgages more expensive and reducing affordability for potential buyers. This has ripple effects throughout the housing market.

- Increased mortgage payments strain household budgets. Higher rates mean significantly larger monthly payments, leaving less disposable income for other expenses.

- Reduced purchasing power leads to lower demand. As mortgages become more expensive, potential buyers are forced to reduce their budgets, leading to decreased demand for homes.

- Impact on both new construction and resale markets. The slowdown affects both the construction of new homes and the sales of existing properties, impacting developers and existing homeowners alike.

The Impact on the Mortgage Stress Test:

The stricter mortgage stress test, designed to ensure borrowers can handle higher interest rates, further restricts borrowing capacity, limiting the number of qualified buyers.

- Fewer buyers enter the market. The stress test acts as a significant barrier to entry for many potential homebuyers, reducing overall market competition.

- Increased competition for available properties at lower price points. Buyers with approved mortgages will compete more fiercely for properties within their reduced budget.

- Potential for decreased bidding wars. While still possible, the frequency and intensity of bidding wars are likely to decrease as demand softens.

Cooling Demand & Inventory Levels

Alongside rising interest rates, a cooling demand and shifting inventory levels are significant indicators pointing towards a potential correction in Canadian home prices.

Decreased Buyer Activity:

Sales activity across major Canadian cities has shown a noticeable decline, suggesting weakening demand. This is supported by data from various sources.

- Data from the Canadian Real Estate Association (CREA). CREA's monthly reports provide valuable insights into market trends across the country.

- Regional variations in market slowdown. While some areas are experiencing sharper declines than others, the overall trend indicates a broader market slowdown.

- Impact of inflation and economic uncertainty. Inflation and economic uncertainty contribute to buyer hesitancy and reduced spending.

Shifting Inventory Levels:

While inventory remains relatively low in many areas, there are signs of a gradual increase, which could put downward pressure on prices. This shift in supply affects market dynamics considerably.

- Increased supply leads to less competition among buyers. A rise in available properties gives buyers more choices and less pressure to make immediate offers.

- Potential for longer listing times. Properties may stay on the market longer as buyers are less eager to engage in competitive bidding.

- Impact on seller negotiation power. Sellers may need to be more flexible with pricing to attract buyers in a less competitive market.

Economic Headwinds & Affordability Concerns

Beyond interest rates and market dynamics, broader economic factors and affordability issues significantly influence the outlook for Canadian home prices.

Inflation's Impact on Purchasing Power:

High inflation erodes the purchasing power of consumers, impacting their ability to afford homes, even with lower interest rates. This is a major hurdle for many potential buyers.

- The impact on disposable income. Rising prices for everyday goods and services reduce disposable income, leaving less available for housing expenses.

- Rising costs of living beyond housing. Inflation impacts all areas of personal finance, not only housing, thus limiting affordability overall.

- Consumer confidence and its effect on market sentiment. Decreased consumer confidence contributes to a more cautious approach to major purchases like homes.

Affordability Crisis in Major Cities:

The unaffordability of housing in major Canadian cities is pushing many potential buyers out of the market. This crisis requires detailed analysis.

- Analysis of affordability indices in key cities. Indices track the relationship between home prices and household incomes, highlighting affordability challenges.

- Comparison with historical affordability levels. Comparing current affordability levels with historical data reveals the extent of the current crisis.

- The role of government policies in affordability. Government policies, including taxes and regulations, play a significant role in shaping housing affordability.

Conclusion

The convergence of rising interest rates, cooling demand, economic uncertainty, and affordability concerns strongly suggests a potential correction in Canadian home prices is on the horizon. While the extent and timing of this correction remain uncertain, understanding these factors is crucial for both homeowners and prospective buyers. Stay informed about the evolving market dynamics and consider consulting with financial professionals to navigate this period of potential change in the Canadian home prices landscape. For further analysis on potential corrections in Canadian home prices, continue following our regular reports.

Featured Posts

-

Celebrating The Premier League 2024 25 Champions Picture Gallery

May 22, 2025

Celebrating The Premier League 2024 25 Champions Picture Gallery

May 22, 2025 -

Provence Walking Tour Mountains To Mediterranean Coast

May 22, 2025

Provence Walking Tour Mountains To Mediterranean Coast

May 22, 2025 -

Wtt Chennai Arunas Tournament Ends Prematurely

May 22, 2025

Wtt Chennai Arunas Tournament Ends Prematurely

May 22, 2025 -

Love Monster A Guide To Understanding And Managing This Personality Type

May 22, 2025

Love Monster A Guide To Understanding And Managing This Personality Type

May 22, 2025 -

Blake Lively Film Controversy The Justin Baldoni Lawsuit Explained

May 22, 2025

Blake Lively Film Controversy The Justin Baldoni Lawsuit Explained

May 22, 2025

Latest Posts

-

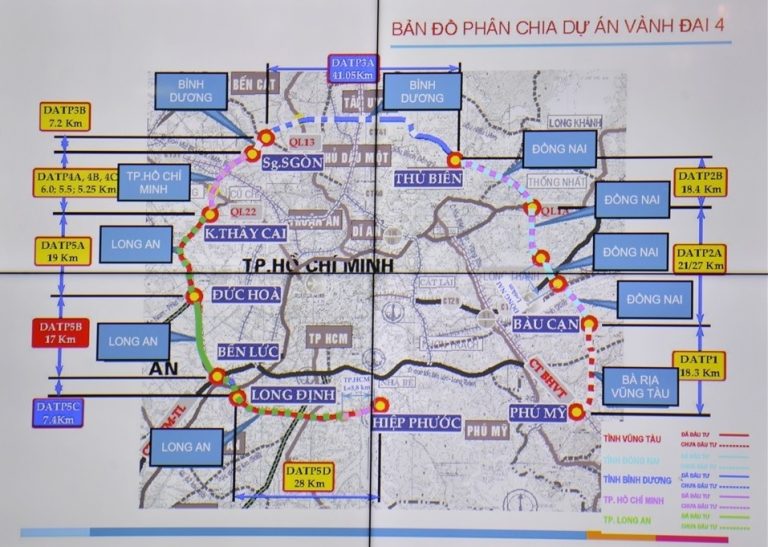

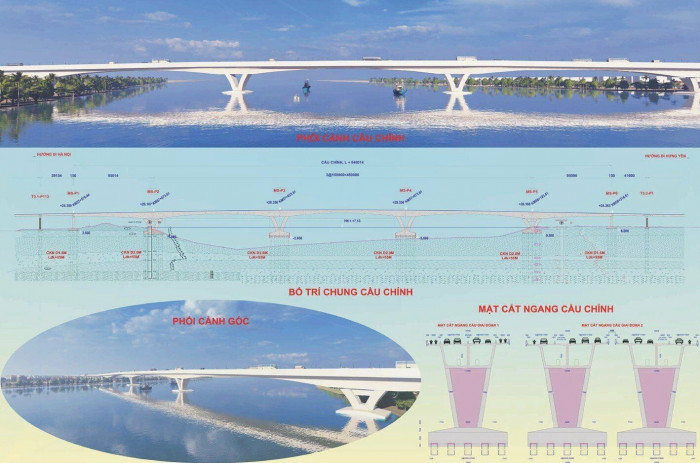

Xay Dung Cau Ma Da Ket Noi Giao Thong Hai Tinh Dong Nai

May 22, 2025

Xay Dung Cau Ma Da Ket Noi Giao Thong Hai Tinh Dong Nai

May 22, 2025 -

Kien Nghi Xay Dung Tuyen Duong 4 Lan Xe Tu Dong Nai Den Binh Phuoc Qua Rung Ma Da

May 22, 2025

Kien Nghi Xay Dung Tuyen Duong 4 Lan Xe Tu Dong Nai Den Binh Phuoc Qua Rung Ma Da

May 22, 2025 -

Du An Duong 4 Lan Xe Xuyen Rung Ma Da Dong Nai Kien Nghi Voi Binh Phuoc

May 22, 2025

Du An Duong 4 Lan Xe Xuyen Rung Ma Da Dong Nai Kien Nghi Voi Binh Phuoc

May 22, 2025 -

Dong Nai Kien Nghi Duong Cao Toc 4 Lan Xe Xuyen Rung Ma Da Den Binh Phuoc

May 22, 2025

Dong Nai Kien Nghi Duong Cao Toc 4 Lan Xe Xuyen Rung Ma Da Den Binh Phuoc

May 22, 2025 -

De Xuat Xay Dung Duong 4 Lan Xe Xuyen Rung Ma Da Ket Noi Dong Nai Va Binh Phuoc

May 22, 2025

De Xuat Xay Dung Duong 4 Lan Xe Xuyen Rung Ma Da Ket Noi Dong Nai Va Binh Phuoc

May 22, 2025