The One Percent Budget: A Retrospective On Clinton's Presidential Actions

Table of Contents

The Economic Context of the 1990s

The Deficit Reduction Goal

The Clinton administration inherited a substantial national debt, a legacy of the Reagan and Bush presidencies. The urgency to reduce this deficit was paramount.

- Deficit Figures: The national debt stood at approximately $4 trillion in 1993, representing a significant burden on the American economy.

- Economic Challenges: The economy faced sluggish growth, high unemployment in some sectors, and concerns about long-term fiscal sustainability.

- Political Climate: The political climate was highly partisan, with Republicans largely opposing tax increases and Democrats advocating for government intervention to address economic inequality.

Tax Increases on the Wealthy

A cornerstone of Clinton's economic plan was to increase taxes on higher earners. This involved raising the top income tax rate and adjusting capital gains taxes and estate taxes. These changes aimed to increase revenue and address concerns about income inequality.

- Specific Tax Rate Changes: The top marginal income tax rate was increased from 31% to 39.6%, impacting the wealthiest Americans. Capital gains taxes and estate taxes were also adjusted upwards.

- Projected Revenue Increases: The administration projected significant revenue increases from these tax hikes, contributing to the overall deficit reduction strategy.

- Arguments For and Against: Proponents argued that the wealthy could afford to contribute more to reduce the deficit and address inequality. Opponents countered that higher taxes would stifle economic growth and investment.

Spending Cuts and Government Efficiency

Alongside tax increases, the Clinton administration implemented spending cuts and sought to improve government efficiency. These measures were crucial for achieving deficit reduction goals.

- Examples of Spending Cuts: Cuts were made across various government programs, though some were controversial and faced significant opposition.

- Government Reorganization Efforts: The administration attempted to streamline government operations and reduce bureaucratic inefficiencies.

- Debates Surrounding These Measures: The cuts sparked intense political debates, with accusations of targeting essential social programs and undermining public services.

The Impact of "The One Percent Budget" on the Economy

Economic Growth and Job Creation

The 1990s witnessed a period of significant economic growth under Clinton. The relationship between the tax policies and this prosperity remains a subject of ongoing debate.

- GDP Growth Statistics: The US experienced substantial GDP growth during the Clinton years, exceeding expectations.

- Employment Figures: The job market expanded significantly, creating millions of new jobs.

- Inflation Rates: Inflation remained relatively low, contributing to overall economic stability.

Income Inequality and its Evolution

Whether "The One Percent Budget" reduced or exacerbated income inequality is a complex question. Analyzing data on wealth distribution during this period provides some insight.

- Income Inequality Statistics: While economic growth benefited many, income inequality remained a concern, with the gap between the rich and poor continuing to widen in certain respects, though at a potentially slower rate than might have been the case without the tax increases.

- Different Perspectives on These Statistics: Economists offer differing interpretations of the data, with some emphasizing the positive impact of the policies on overall economic prosperity and others focusing on the continued growth of income inequality.

- Wealth Distribution: The concentration of wealth at the top remained significant throughout the decade, raising questions about the long-term effects of the policies on wealth distribution.

Long-Term Effects on the National Debt

The Clinton administration's deficit reduction efforts had a significant, though arguably short-term, impact on the national debt.

- National Debt Figures: The national debt was reduced considerably by the end of Clinton's presidency.

- Long-Term Trends in National Debt: However, the long-term trend of increasing national debt continued after the Clinton era, highlighting the challenges of long-term fiscal sustainability.

- Fiscal Responsibility: The success of the Clinton-era policies in reducing the national debt is often cited as an example of fiscal responsibility, yet critics point to the subsequent growth as evidence of the policy's limitations.

Political and Social Reactions to "The One Percent Budget"

Political Opposition and Debate

Clinton's economic policies faced significant political opposition, primarily from Republicans who argued against tax increases and government intervention.

- Key Political Figures: Prominent Republicans strongly opposed the tax increases, arguing they would harm the economy.

- Major Arguments Used by Both Sides: The debate centered on the impact of tax policies on economic growth, investment, and job creation.

Social Impact and Public Perception

Public perception of "The One Percent Budget" was varied, reflecting diverse socioeconomic experiences.

- Public Opinion on Tax Increases: Public opinion on the tax increases was divided, with some supporting them as fair and necessary and others opposing them as unfair and economically damaging.

- Impact on Different Socioeconomic Groups: The impact of the policies varied across socioeconomic groups, benefiting some while potentially leaving others behind.

- Lasting Social Consequences: The long-term social consequences of these policies continue to be debated, with ongoing discussion about their impact on social mobility and economic opportunity.

Conclusion

"The One Percent Budget," while achieving notable deficit reduction and fostering economic growth, left a complex legacy. Its impact on income inequality and long-term fiscal stability remains a subject of ongoing discussion and interpretation. The policies highlight the intricate balance between addressing immediate economic challenges and achieving long-term economic and social goals. The effectiveness of the policies and their lasting impact on the economy continue to be debated. We encourage you to continue researching the impact of "The One Percent Budget" and to explore alternative perspectives and data to form your own informed opinion about the effectiveness of similar policies, examining their impact on both the wealthy and the broader American population. Understanding "The One Percent Budget" offers crucial lessons for navigating contemporary economic policy debates and addressing income inequality.

Featured Posts

-

French Film Week Award Winning Films In Seoul And Busan

May 23, 2025

French Film Week Award Winning Films In Seoul And Busan

May 23, 2025 -

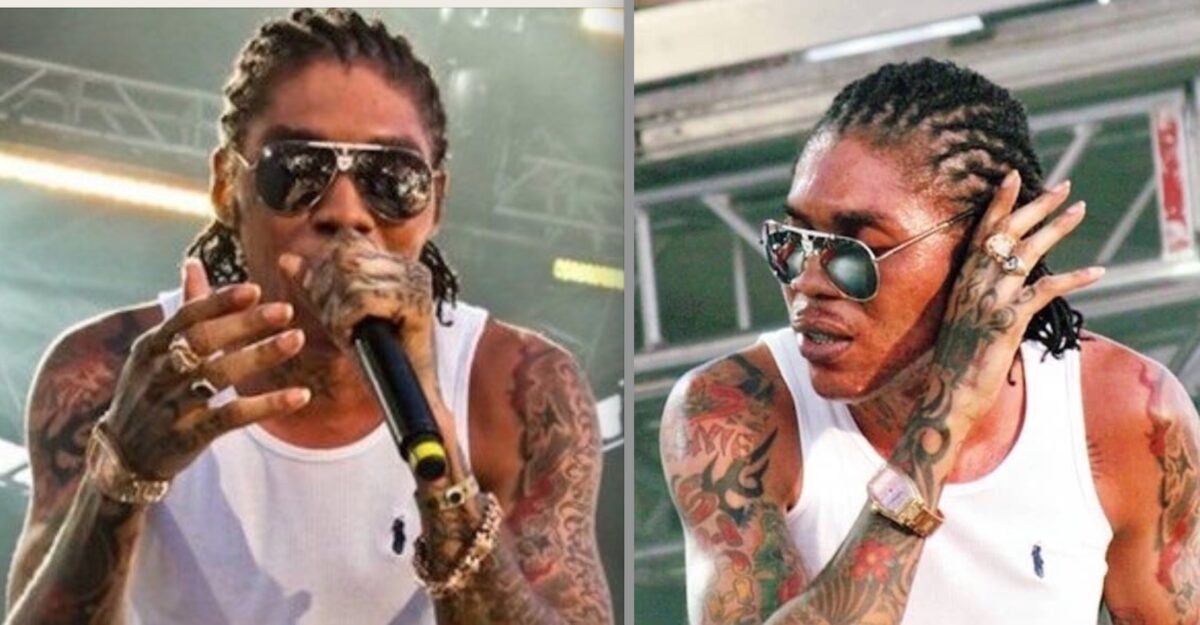

Vybz Kartels Barclay Center Concert Nyc April Show Announced

May 23, 2025

Vybz Kartels Barclay Center Concert Nyc April Show Announced

May 23, 2025 -

Access To Birth Control Examining The Impact Of Otc Availability Post Roe

May 23, 2025

Access To Birth Control Examining The Impact Of Otc Availability Post Roe

May 23, 2025 -

Medical Research Paper Details Egan Bernals Recovery From Critical Injuries

May 23, 2025

Medical Research Paper Details Egan Bernals Recovery From Critical Injuries

May 23, 2025 -

Understanding The Connection Between Kartel And Rum Culture In Guyana Stabroek News Analysis

May 23, 2025

Understanding The Connection Between Kartel And Rum Culture In Guyana Stabroek News Analysis

May 23, 2025

Latest Posts

-

Burclar Ve Zeka Hangi Burclar Daha Akilli

May 23, 2025

Burclar Ve Zeka Hangi Burclar Daha Akilli

May 23, 2025 -

En Zeki Burclar Siralamasi Akil Yetenek Ve Basari

May 23, 2025

En Zeki Burclar Siralamasi Akil Yetenek Ve Basari

May 23, 2025 -

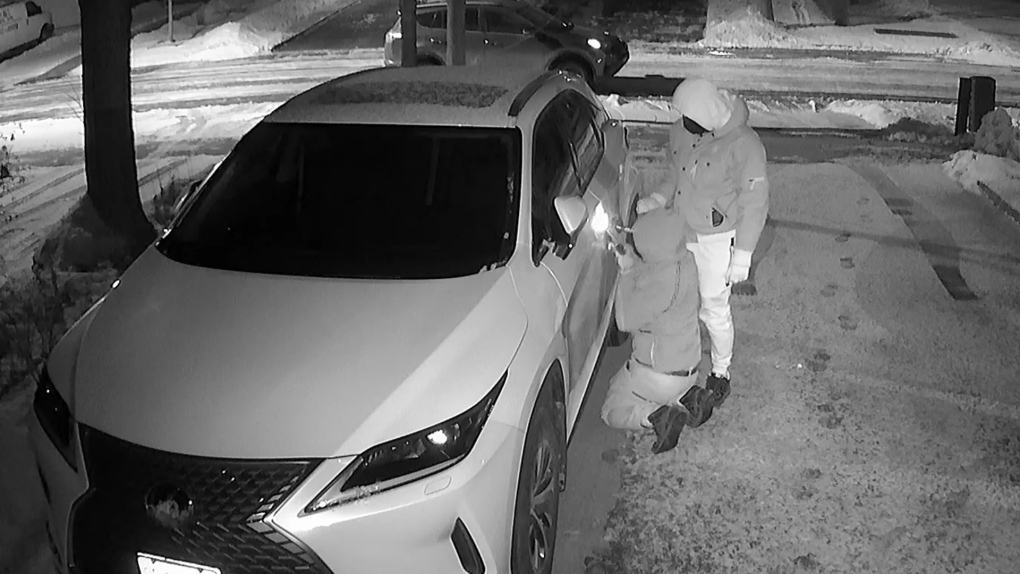

Economic Hardship And The Rise In Canadian Auto Thefts

May 23, 2025

Economic Hardship And The Rise In Canadian Auto Thefts

May 23, 2025 -

March 20 2025 Horoscope Predictions For 5 Lucky Zodiac Signs

May 23, 2025

March 20 2025 Horoscope Predictions For 5 Lucky Zodiac Signs

May 23, 2025 -

En Zeki Burclar Dahilik Genleri Ve Akil Uestuenluegue

May 23, 2025

En Zeki Burclar Dahilik Genleri Ve Akil Uestuenluegue

May 23, 2025