The Next Fed Chair: Inheriting Trump's Economic Challenges

Table of Contents

Inflation and Monetary Policy Tightrope

The next Fed Chair will need to grapple with potentially persistent inflation. The Trump administration's fiscal policies, including significant tax cuts and increased government spending, contributed to inflationary pressures. Successfully navigating this requires a delicate balance between controlling inflation and maintaining economic growth – a classic monetary policy tightrope walk. This delicate balancing act will require a nuanced understanding of the interplay between various economic indicators.

- Balancing the need to curb inflation without triggering a recession: Aggressive interest rate hikes, while effective in combating inflation, risk slowing economic growth too sharply, potentially leading to a recession. The Fed Chair must carefully calibrate monetary policy to avoid this outcome.

- Determining the appropriate pace of interest rate hikes: The speed and magnitude of interest rate increases will be crucial. Too slow a response risks allowing inflation to become entrenched, while too rapid an increase risks triggering a recession. Data-driven decision-making will be paramount.

- Managing the unwinding of quantitative easing programs: The previous administration's quantitative easing (QE) programs injected vast sums of money into the economy. The next Fed Chair will need to manage the gradual unwinding of these programs without causing market disruptions.

- Assessing the impact of global factors on US inflation: Global supply chain disruptions, geopolitical instability, and energy prices all contribute to inflationary pressures. The Fed Chair must account for these external factors when formulating monetary policy.

Trade Wars and Global Uncertainty

The Trump administration's trade policies, including tariffs and trade disputes, created significant uncertainty in global markets and disrupted supply chains. These actions had a ripple effect across the global economy, impacting businesses and consumers alike. The next Fed Chair must understand these disruptions and their lingering impacts on the US economy, adapting monetary policy accordingly. The complexities of international trade and their impact on domestic economic stability will be a major focus.

- Assessing the long-term effects of trade disputes on US businesses and consumers: The tariffs imposed during the trade wars increased costs for businesses and consumers, impacting profitability and purchasing power. The lasting effects of these trade actions need careful assessment.

- Addressing the vulnerabilities exposed in global supply chains: The pandemic exposed the fragility of global supply chains. The next Fed Chair must work to ensure greater resilience and diversification of these chains to mitigate future shocks.

- Considering the implications of geopolitical instability on US economic growth: Global geopolitical events, including the war in Ukraine, have significant economic ramifications. The Fed Chair needs to incorporate these geopolitical risks into their economic forecasts and policy decisions.

- Evaluating the effectiveness of existing trade policies and their impact on monetary policy: The Fed Chair must consider the long-term effects of existing trade policies on inflation, growth, and employment, and how these factors influence the appropriate monetary policy response.

Debt Accumulation and Fiscal Sustainability

The national debt increased significantly under the Trump administration. This poses a substantial challenge for the next Fed Chair, requiring careful consideration of the potential long-term consequences. High national debt can impact interest rates, economic growth, and the overall stability of the financial system. The next Fed Chair will need to navigate this complex issue in close collaboration with the government.

- Analyzing the impact of high national debt on interest rates and economic growth: High national debt can lead to higher interest rates, potentially crowding out private investment and slowing economic growth.

- Assessing the sustainability of current fiscal policies: The next Fed Chair must evaluate the long-term sustainability of government spending and revenue projections, and identify potential risks to fiscal stability.

- Coordinating with the government on fiscal policy to ensure economic stability: Effective communication and coordination between the Fed and the government are crucial for achieving macroeconomic stability.

Technological Disruption and Labor Market Dynamics

Rapid technological advancements continue to reshape the labor market. The next Fed Chair will need to consider the implications of automation and the need for workforce adaptation. The increasing role of technology requires a forward-looking approach to managing the economy and its impact on employment.

- Addressing the challenges of job displacement due to automation: Automation is transforming industries, leading to job displacement in some sectors. The Fed Chair needs to consider policies to support workers affected by these changes.

- Promoting policies that support workforce retraining and development: Investing in workforce retraining and development programs is crucial to equip workers with the skills needed for the jobs of the future.

- Monitoring the impact of technological change on wage growth and income inequality: Technological change can exacerbate income inequality if not managed properly. The Fed Chair must monitor these trends and consider policies to mitigate negative consequences.

Conclusion

The next Fed Chair faces a formidable set of economic challenges, the legacy of the Trump administration's policies playing a significant role. Successfully navigating inflation, addressing global uncertainty, managing the national debt, and adapting to technological disruption will require exceptional skill and judgment. The decisions made by the next Fed Chair will have profound implications for the US economy for years to come. Understanding the complexities of the economic landscape inherited from the Trump era is crucial for the next Fed Chair’s success in maintaining stable economic growth. The appointment of the next Fed Chair is therefore a matter of vital national importance. Choosing a candidate equipped to handle these economic challenges will be essential for navigating the future of the US economy.

Featured Posts

-

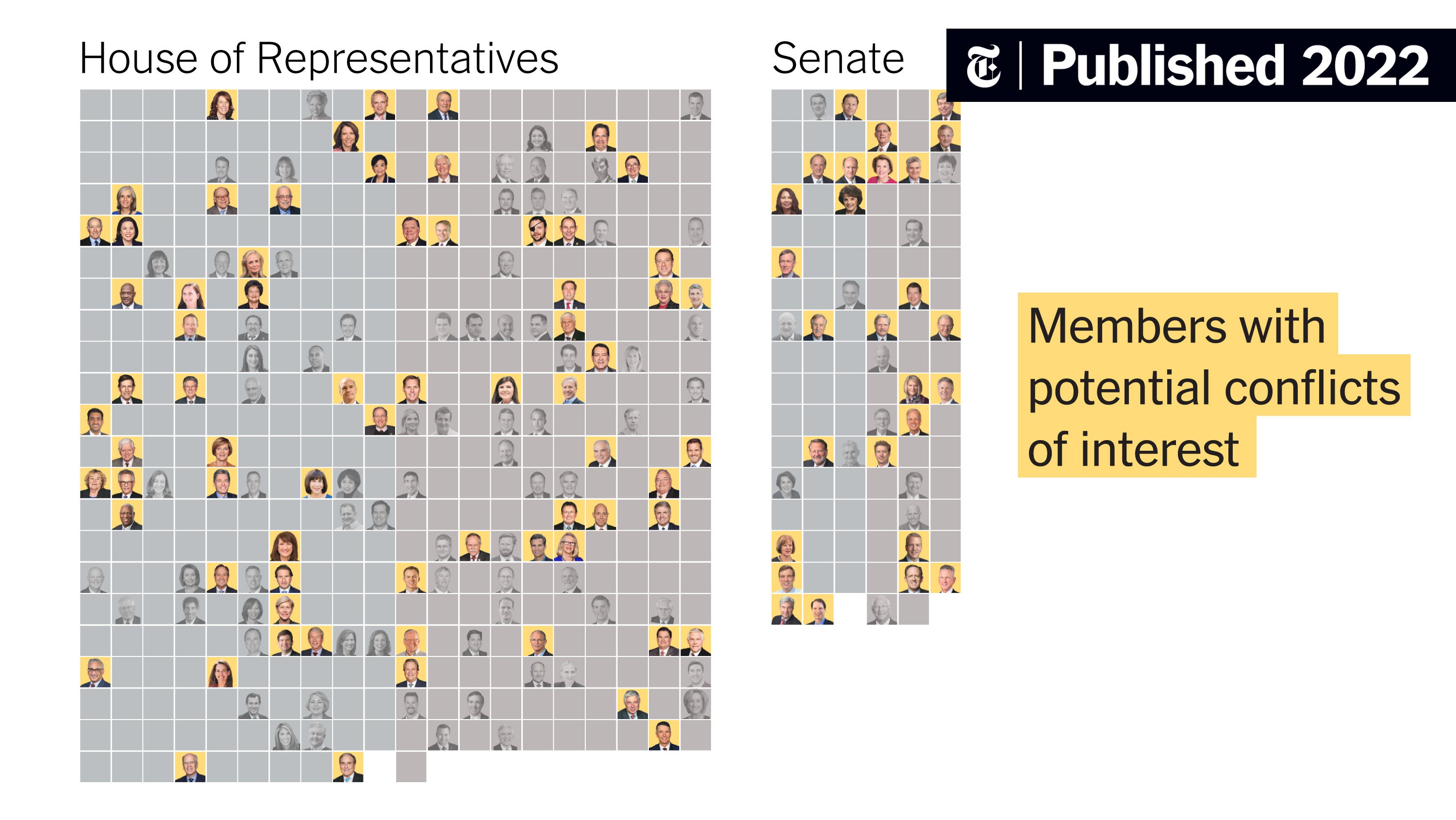

Time Interview Reveals Trumps Position On Banning Congressional Stock Trades

Apr 26, 2025

Time Interview Reveals Trumps Position On Banning Congressional Stock Trades

Apr 26, 2025 -

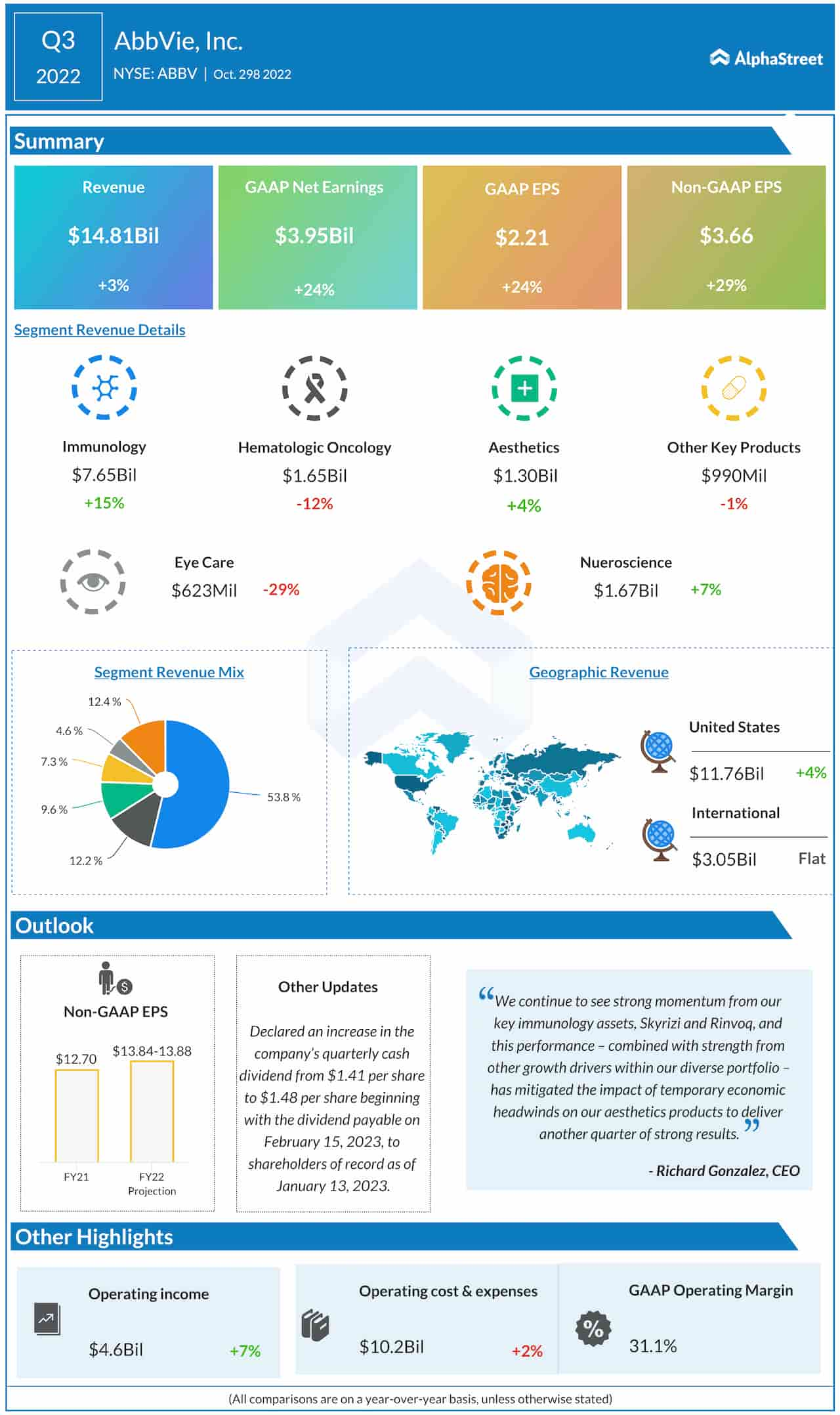

Abb Vies Q Quarter Earnings Higher Profits Driven By New Drug Performance

Apr 26, 2025

Abb Vies Q Quarter Earnings Higher Profits Driven By New Drug Performance

Apr 26, 2025 -

Ai And Human Creativity Insights From Microsofts Head Of Design

Apr 26, 2025

Ai And Human Creativity Insights From Microsofts Head Of Design

Apr 26, 2025 -

Open Ai Unveils Streamlined Voice Assistant Creation At 2024 Event

Apr 26, 2025

Open Ai Unveils Streamlined Voice Assistant Creation At 2024 Event

Apr 26, 2025 -

After A Decade Construction Resumes On Worlds Tallest Abandoned Skyscraper

Apr 26, 2025

After A Decade Construction Resumes On Worlds Tallest Abandoned Skyscraper

Apr 26, 2025

Latest Posts

-

Binoche To Head Cannes Film Festival Jury

Apr 27, 2025

Binoche To Head Cannes Film Festival Jury

Apr 27, 2025 -

Juliette Binoche Appointed President Of The Cannes Jury

Apr 27, 2025

Juliette Binoche Appointed President Of The Cannes Jury

Apr 27, 2025 -

Juliette Binoche To Lead Cannes Film Festival Jury

Apr 27, 2025

Juliette Binoche To Lead Cannes Film Festival Jury

Apr 27, 2025 -

The Perfect Couple Season 2 A Look At The New Cast And Its Source Material

Apr 27, 2025

The Perfect Couple Season 2 A Look At The New Cast And Its Source Material

Apr 27, 2025 -

New Cast And Source Material Confirmed For The Perfect Couple Season 2

Apr 27, 2025

New Cast And Source Material Confirmed For The Perfect Couple Season 2

Apr 27, 2025