The Looming Bond Crisis: Understanding The Scale And Impact

Table of Contents

H2: The Scale of the Problem: Assessing the Global Bond Market's Vulnerability

The vulnerability of the global bond market stems from a confluence of factors, each exacerbating the risk of a full-blown crisis. Understanding these interconnected elements is critical to grasping the sheer scale of the potential problem.

H3: Rising Interest Rates and Their Impact

Rising interest rates are a primary driver of the looming bond crisis. This is because of the inverse relationship between interest rates and bond prices: as interest rates rise, the value of existing bonds with lower fixed interest rates falls.

- Inverse Relationship: When interest rates increase, newly issued bonds offer higher yields, making older bonds less attractive. This forces down the prices of existing bonds to match the higher yields available in the market.

- Impact on Bond Types: Government bonds, generally considered safer, are not immune. Corporate bonds, already facing tighter credit conditions, are particularly vulnerable to rising rates, potentially leading to increased defaults.

- Vulnerable Sectors: Highly indebted sectors, such as real estate and certain emerging markets with significant dollar-denominated debt, face severe challenges. Countries with high levels of government debt are especially susceptible to a bond crisis. For example, certain Eurozone countries are already experiencing significant pressure.

H3: Inflation's Role in Exacerbating the Crisis

Persistent inflation is another key factor fueling the instability. Central banks, in their efforts to combat inflation, are aggressively raising interest rates, which directly impacts bond prices, as discussed above.

- Inflation and Bond Yields: High inflation erodes the purchasing power of fixed-income payments from bonds, reducing their attractiveness to investors and pushing yields higher to compensate for the risk.

- Impact on Investor Confidence: Inflation uncertainty undermines investor confidence, leading to capital flight from bond markets and increased demand for assets that can better hedge against inflation.

- Central Bank Actions: While central bank actions aim to curb inflation, the aggressive rate hikes needed can inadvertently trigger a bond market crisis by causing significant losses for bondholders.

H3: Geopolitical Uncertainty and its Influence

Global geopolitical uncertainty further amplifies the risks. Unpredictable events can trigger sudden shifts in investor sentiment, causing large-scale selling of bonds.

- Geopolitical Risks: The ongoing war in Ukraine, trade tensions between major economies, and rising political instability in several regions create significant uncertainty for investors.

- Investor Sentiment: Geopolitical risks lead to "risk-off" sentiment, where investors move away from riskier assets, including bonds, to safer havens like gold or US Treasuries. This increased demand for safe-haven assets can lead to a further decline in bond prices.

- Capital Flows: Geopolitical events can disrupt global capital flows, leading to reduced liquidity in bond markets and amplifying price swings. Past crises, such as the 1997-98 Asian financial crisis, demonstrated how geopolitical factors can trigger a domino effect in bond markets globally.

H2: Potential Impacts of a Bond Market Crisis

The potential consequences of a major bond market crisis are far-reaching and could have devastating economic and social repercussions.

H3: Economic Recession and Market Volatility

A bond crisis can significantly increase market volatility and potentially trigger or worsen an economic recession.

- Interconnectedness: Bond markets are deeply intertwined with other financial markets. A crisis in the bond market can easily spill over into the equity market, causing a broader market downturn.

- Contagion Effects: The collapse of even one major bond issuer can trigger a chain reaction, with investors losing confidence and selling off bonds across the board.

- Investor and Consumer Confidence: A bond crisis erodes investor and consumer confidence, leading to decreased spending and investment, further exacerbating economic slowdowns.

H3: Impact on Government Spending and Debt Sustainability

Governments face substantial challenges during a bond crisis. Increased borrowing costs make it more expensive for them to finance their debts.

- Increased Borrowing Costs: Rising interest rates make it significantly more costly for governments to service their existing debts and issue new bonds.

- Debt Defaults: Countries with high levels of debt may face the risk of defaulting on their obligations, leading to further economic instability.

- Austerity Measures: Governments may be forced to implement harsh austerity measures to reduce spending and restore confidence, often leading to social unrest.

H3: Consequences for Businesses and Investors

Businesses and investors will bear the brunt of a significant bond crisis. Businesses may struggle to access credit, potentially leading to bankruptcies and job losses.

- Corporate Borrowing Costs: Higher interest rates make it more expensive for businesses to borrow money, hindering investment and economic growth.

- Bankruptcies and Defaults: Companies with high levels of debt may be unable to repay their obligations, leading to bankruptcies and defaults.

- Investor Losses: Investors holding bonds, particularly those in less liquid markets, will suffer significant losses. Pension funds and other institutional investors with large bond holdings face substantial risks.

3. Conclusion:

The looming bond crisis presents significant risks to the global economy. Rising interest rates, persistent inflation, and geopolitical uncertainty are creating a perfect storm that threatens to destabilize bond markets worldwide. The potential consequences include economic recession, increased market volatility, government debt defaults, and widespread investor losses. Understanding this looming bond crisis is paramount. Stay informed and make informed decisions to navigate these challenging market conditions. Don't underestimate the looming bond crisis; proactively manage your financial portfolio for resilience.

Featured Posts

-

Ipswich Towns Victory Over Bournemouth Broadheads Impact

May 28, 2025

Ipswich Towns Victory Over Bournemouth Broadheads Impact

May 28, 2025 -

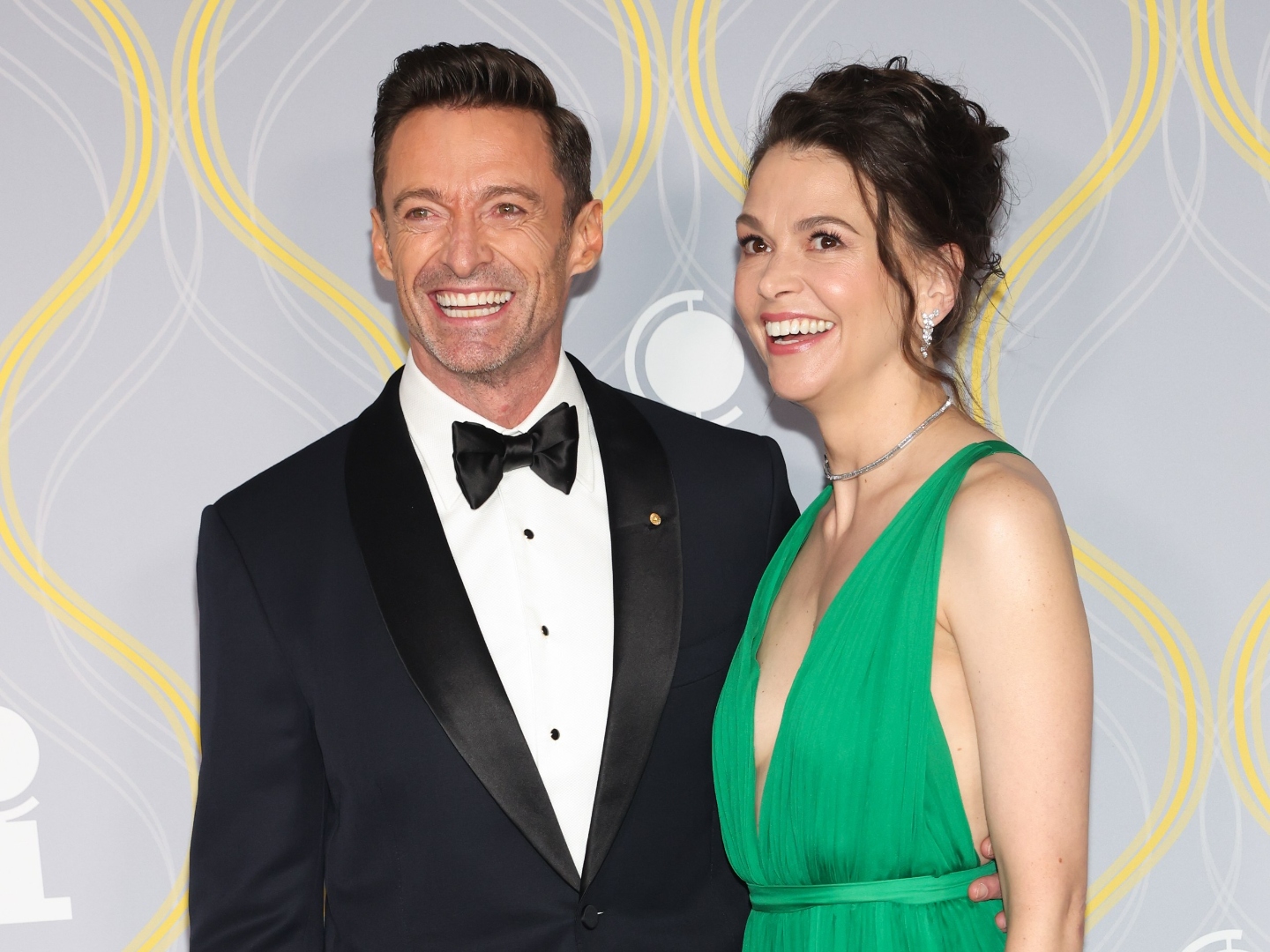

Hugh Jackman And Sutton Fosters Relationship A Look At The Reported Cooling

May 28, 2025

Hugh Jackman And Sutton Fosters Relationship A Look At The Reported Cooling

May 28, 2025 -

Arsenal Beats Real Madrid And Man Utd To Key Signing

May 28, 2025

Arsenal Beats Real Madrid And Man Utd To Key Signing

May 28, 2025 -

Jawa Timur Dilanda Hujan Petir Peringatan Cuaca 29 Maret 2024

May 28, 2025

Jawa Timur Dilanda Hujan Petir Peringatan Cuaca 29 Maret 2024

May 28, 2025 -

Real Madrid Star Rodrygo Arsenals Transfer Interest Intensifies

May 28, 2025

Real Madrid Star Rodrygo Arsenals Transfer Interest Intensifies

May 28, 2025