The Increasing Importance Of Succession Planning Among High-Net-Worth Individuals

Table of Contents

Protecting and Growing Your Wealth Through Strategic Succession Planning

Strategic succession planning is vital for preserving and growing your wealth across generations. A well-structured plan minimizes tax liabilities, ensures the smooth transfer of assets, and safeguards your family's financial security.

Minimizing Estate Taxes and Maximizing Wealth Transfer

Effective wealth transfer requires minimizing estate taxes and maximizing the amount passed on to heirs. This involves exploring various tax-efficient strategies, each with its own implications:

-

Utilizing Trusts: Trusts offer sophisticated ways to manage and distribute assets while minimizing estate taxes. Different types of trusts, such as irrevocable life insurance trusts (ILITs) and dynasty trusts, cater to specific needs and tax situations. A qualified estate planning attorney can help you determine the most suitable trust structure for your circumstances.

-

Gifting Strategies: Gifting assets during your lifetime can reduce the size of your taxable estate. Annual gift tax exclusions allow for a certain amount to be gifted tax-free each year. Careful planning is essential to optimize these exclusions and minimize tax implications.

-

Charitable Remainder Trusts (CRTs): These trusts allow you to make charitable donations while receiving income for life, reducing your taxable estate and providing significant tax benefits. CRTs offer a powerful combination of philanthropy and tax optimization.

-

Implications of Different Tax Laws Across Jurisdictions: Wealth transfer laws vary significantly across jurisdictions. International tax planning is crucial for HNWIs with assets in multiple countries. Seeking advice from tax professionals experienced in international estate planning is highly recommended.

-

The Role of Professionals: Engaging experienced estate planning attorneys and financial advisors is paramount. They provide expert guidance on navigating complex tax laws and developing a customized tax optimization strategy tailored to your individual situation.

Ensuring Seamless Business Succession for Family-Owned Enterprises

Transferring a family business to the next generation presents unique challenges. A robust succession plan is crucial to ensure its continued success and prevent family conflict:

-

Developing a Detailed Business Succession Plan: This plan should include a clear valuation of the business, a timeline for the transfer of ownership, and strategies for managing the transition.

-

Mentoring the Next Generation of Leadership: Preparing the next generation to take over requires providing them with the necessary skills and experience through mentorship and training programs. This ensures a smooth transition and reduces the risk of disruption.

-

Establishing Clear Roles and Responsibilities: Defining roles and responsibilities within the business, both for family members and key personnel, prevents confusion and potential conflict. A clear organizational structure is key for effective management.

-

Succession Planning for Key Personnel: It's vital to plan for the succession of key non-family employees who are critical to the business's success. Their expertise and institutional knowledge are invaluable assets.

Preserving Family Harmony and Legacy Through Clear Communication and Governance

Open communication and a well-defined governance structure are essential for maintaining family harmony and preserving your legacy.

Open Communication and Family Meetings

Transparent communication about financial matters is crucial for preventing misunderstandings and conflicts.

-

Regular Family Meetings: Establish regular family meetings to discuss financial plans, goals, values, and expectations. This fosters open dialogue and ensures everyone is informed and involved.

-

Openly Communicating Estate Plans to Heirs: Sharing estate plans with heirs well in advance minimizes misunderstandings and allows for open discussion and clarification.

-

Mediation to Address Family Conflicts: Engaging a professional mediator can be invaluable for resolving family conflicts related to wealth and inheritance. Mediation provides a neutral platform for productive communication.

Establishing a Family Governance Structure

A formal governance structure provides a framework for managing family wealth and resolving conflicts.

-

Establishing a Family Constitution: A family constitution outlines the family's values, principles, and guidelines for managing wealth and resolving disputes. It acts as a roadmap for future generations.

-

Creating a Family Office: A family office can handle the complex administrative tasks associated with managing significant wealth. This frees family members to focus on other priorities.

-

Implementing a System for Conflict Resolution: Developing a clear process for resolving conflicts before they escalate is crucial for maintaining family harmony. This might include mediation or arbitration clauses.

Integrating Philanthropic Goals into Your Succession Plan

Integrating philanthropic goals into your succession plan allows you to leave a lasting legacy beyond financial assets.

Strategic Charitable Giving

Charitable giving can be strategically integrated into wealth transfer strategies.

-

Establishing a Family Foundation: A family foundation provides a formal structure for managing charitable giving and pursuing philanthropic objectives across generations.

-

Making Charitable Bequests in Your Will: Leaving charitable bequests in your will ensures that your philanthropic goals continue after your passing.

-

Donating Appreciated Assets: Donating appreciated assets reduces your capital gains tax liability while supporting your favorite charities.

Creating a Lasting Legacy

A lasting legacy encompasses more than just financial assets.

-

Creating a Family Archive: Preserve family history and values by creating a family archive of photos, documents, and stories.

-

Establishing Educational Scholarships: Supporting education through scholarships creates a lasting impact on future generations.

-

Supporting Causes Aligned with Family Values: Supporting causes that align with your family's values ensures that your legacy reflects your commitment to making a positive difference.

Conclusion

Succession planning for high-net-worth individuals is a multifaceted process requiring proactive and strategic planning. By addressing wealth transfer, business continuity, family harmony, and philanthropic aspirations, HNWIs can secure their financial future and create a lasting legacy. Don't delay – developing a comprehensive succession plan is a vital step in protecting your assets and ensuring your family's well-being. Contact a qualified financial advisor or estate planning attorney today to begin creating your personalized high-net-worth succession plan.

Featured Posts

-

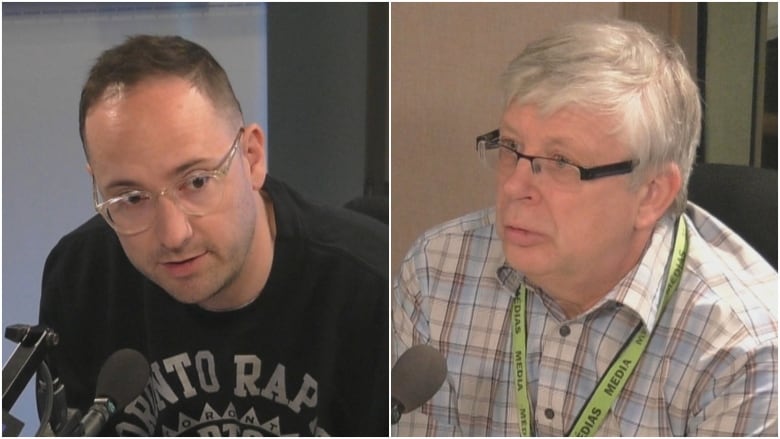

Costco Campaign In Saskatchewan A Political Panel Perspective

May 22, 2025

Costco Campaign In Saskatchewan A Political Panel Perspective

May 22, 2025 -

A Britons Grueling Australian Run Overcoming Pain Insects And Accusations

May 22, 2025

A Britons Grueling Australian Run Overcoming Pain Insects And Accusations

May 22, 2025 -

Could A New Record Be Set In The Trans Australia Run

May 22, 2025

Could A New Record Be Set In The Trans Australia Run

May 22, 2025 -

From Young Louth Chef To Business Leader A Success Story

May 22, 2025

From Young Louth Chef To Business Leader A Success Story

May 22, 2025 -

Analysis Of Trumps Plan For A National Missile Defense System

May 22, 2025

Analysis Of Trumps Plan For A National Missile Defense System

May 22, 2025

Latest Posts

-

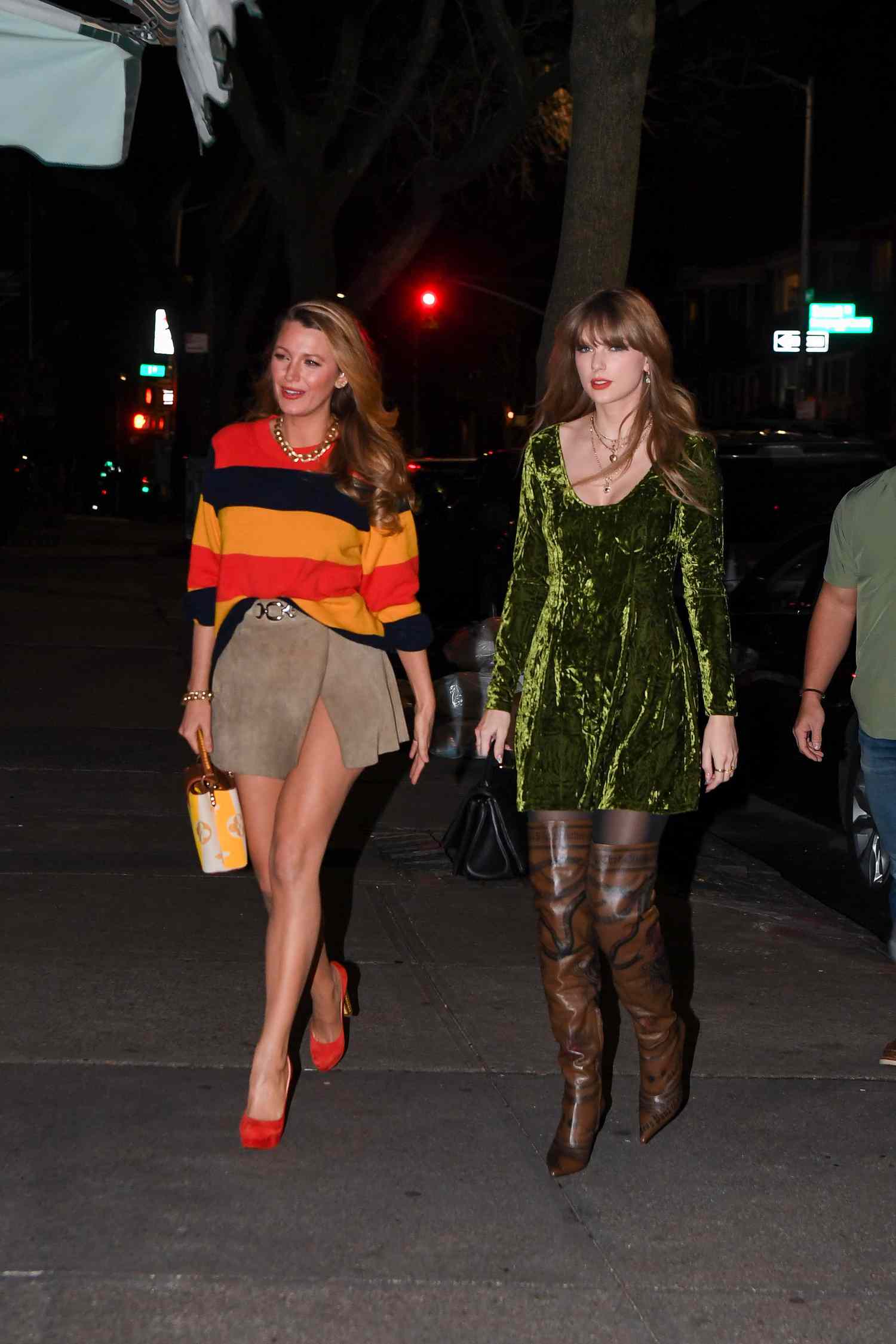

The Rift Between Taylor Swift And Blake Lively A Legal Battles Fallout

May 22, 2025

The Rift Between Taylor Swift And Blake Lively A Legal Battles Fallout

May 22, 2025 -

Subpoena Report Casts Shadow On Blake Lively And Taylor Swifts Friendship

May 22, 2025

Subpoena Report Casts Shadow On Blake Lively And Taylor Swifts Friendship

May 22, 2025 -

Exclusive Report Taylor Swifts Response To The Blake Lively And Justin Baldoni Legal Battle

May 22, 2025

Exclusive Report Taylor Swifts Response To The Blake Lively And Justin Baldoni Legal Battle

May 22, 2025 -

Is Blake Lively And Taylor Swifts Friendship On The Rocks After Subpoena Reports

May 22, 2025

Is Blake Lively And Taylor Swifts Friendship On The Rocks After Subpoena Reports

May 22, 2025 -

Blake Lively And Taylor Swift Friendship Fracture Over Subpoena

May 22, 2025

Blake Lively And Taylor Swift Friendship Fracture Over Subpoena

May 22, 2025