The Importance Of Reviewing Proxy Statements (Form DEF 14A)

Table of Contents

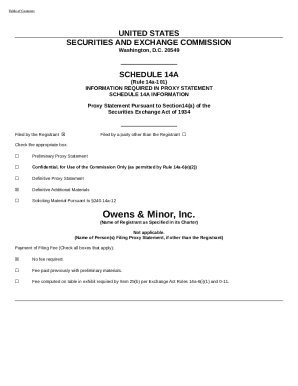

What is a Proxy Statement (Form DEF 14A)?

Definition and Purpose

A proxy statement, officially known as Form DEF 14A, is a document that publicly traded companies are required by the Securities and Exchange Commission (SEC) to send to their shareholders before an annual meeting or other significant corporate vote. Its primary purpose is to allow shareholders to cast their votes on important matters, even if they cannot attend the meeting in person. Essentially, it's your formal invitation to participate in the governance of the companies you own.

Key Information Contained Within

Proxy statements are packed with vital information that sheds light on a company's inner workings. A thorough review can significantly enhance your understanding of the company's direction and its management. Key information typically includes:

- Executive compensation packages and analysis: This section details the salaries, bonuses, stock options, and other benefits received by top executives. Analyzing this data allows you to assess whether executive compensation is aligned with company performance.

- Information about board of directors nominations and their backgrounds: Learn about the experience, expertise, and potential conflicts of interest of the individuals nominated to serve on the board. This is crucial for evaluating the quality of corporate governance.

- Details of any shareholder proposals to be voted upon: Shareholder proposals often address critical issues such as environmental sustainability, executive pay, or social responsibility. Understanding these proposals is essential to making informed voting decisions.

- Information about significant corporate transactions like mergers or acquisitions: Proxy statements disclose details of proposed mergers, acquisitions, or other substantial transactions, providing you with crucial information to evaluate the potential impact on your investment.

- Details regarding audit committee reports: The audit committee's oversight of the company's financial reporting is critical. Reviewing this section ensures transparency and accountability.

Why Reviewing Proxy Statements is Crucial for Informed Investment Decisions

Understanding Corporate Governance

Proxy statements offer invaluable insights into a company's corporate governance practices. By examining the composition and independence of the board of directors, you can assess the effectiveness of their oversight and the company's commitment to good governance.

Evaluating Executive Compensation

Analyzing executive compensation helps determine whether executive pay is appropriately linked to performance. Excessive or poorly justified compensation can be a red flag, indicating potential mismanagement or misalignment of interests.

Identifying Potential Risks and Opportunities

A careful review of a proxy statement can reveal potential risks and opportunities. This might include emerging challenges, strategic shifts, or new initiatives that could impact the company's future performance and your investment.

- Assess the independence and effectiveness of the board of directors. Are board members truly independent, or do they have conflicts of interest?

- Evaluate the fairness and competitiveness of executive compensation. Is executive pay justified by company performance, or does it seem excessive?

- Identify potential conflicts of interest among directors and executives. Are there any relationships or transactions that could compromise the objectivity of decision-making?

- Gain insight into the company’s long-term strategic plans. What are the company's goals, and how does it plan to achieve them?

- Discover potential upcoming changes or significant events affecting the company. Are there any mergers, acquisitions, or other major developments on the horizon?

How to Effectively Review a Proxy Statement (Form DEF 14A)

Key Sections to Focus On

While the entire proxy statement is important, certain sections warrant closer attention: the executive summary, the compensation discussion and analysis (CD&A), shareholder proposals, and the risk factors section.

Utilizing Online Resources

The SEC's EDGAR database (Electronic Data Gathering, Analysis, and Retrieval system) provides free access to all company filings, including proxy statements. Many financial websites also offer tools to help you analyze and compare proxy data.

Seeking Professional Advice

For complex situations or if you lack the expertise to fully interpret a proxy statement, consulting a financial advisor is advisable.

- Begin with the executive summary for an overview. This provides a concise summary of the key issues to be voted on.

- Carefully review the compensation discussion and analysis (CD&A). This section provides detailed information about executive compensation.

- Pay close attention to any shareholder proposals. These proposals can highlight important issues and offer you a chance to influence company direction.

- Review the risk factors section for potential red flags. This section discloses potential risks that could affect the company's performance.

- Utilize online tools and resources for additional analysis. Many websites offer tools to help you compare executive compensation and other key metrics across companies.

Consequences of Ignoring Proxy Statements

Missed Voting Opportunities

Ignoring proxy statements means forfeiting your right to vote on significant matters affecting the company and your investment. This includes votes on executive compensation, board nominations, and major strategic decisions.

Potential Financial Losses

Uninformed investment decisions, stemming from a lack of understanding of company governance and strategy, can lead to significant financial losses.

- Inability to vote on significant issues affecting shareholder value. Your vote matters, and neglecting to cast it means missing an opportunity to influence the company's direction.

- Lack of influence over executive compensation and corporate governance. By not reviewing proxy statements, you lose the ability to hold management accountable.

- Increased vulnerability to poor management decisions. Understanding the company’s strategy and risks through the proxy statement allows you to better assess potential threats.

- Missed opportunities to challenge detrimental corporate strategies. Shareholder proposals often bring forth critical issues that may otherwise be ignored.

Conclusion

Reviewing proxy statements (Form DEF 14A) is not optional; it’s a critical component of responsible investing. These documents provide invaluable insights into corporate governance, executive compensation, and potential risks and opportunities. Ignoring them risks missed voting opportunities and potentially significant financial losses. Don't miss out – actively review your next proxy statement (Form DEF 14A)! Take control of your investments and participate in the governance of the companies you own by mastering the art of reviewing proxy statements (Form DEF 14A)!

Featured Posts

-

Angel Reeses Emotional Mothers Day Dedication During Brothers Ncaa Triumph

May 17, 2025

Angel Reeses Emotional Mothers Day Dedication During Brothers Ncaa Triumph

May 17, 2025 -

R1 45 Lakh Ultraviolette Tesseract Electric Scooter Specs And Features

May 17, 2025

R1 45 Lakh Ultraviolette Tesseract Electric Scooter Specs And Features

May 17, 2025 -

Review Of 7 Bit Casino And Other Top Canadian Online Casinos For 2025

May 17, 2025

Review Of 7 Bit Casino And Other Top Canadian Online Casinos For 2025

May 17, 2025 -

Understanding The Market Dynamics Behind Ubers April Double Digit Rally

May 17, 2025

Understanding The Market Dynamics Behind Ubers April Double Digit Rally

May 17, 2025 -

Doctor Who Season 2 Fifteenth Doctors New Companion Battles Killer Cartoons

May 17, 2025

Doctor Who Season 2 Fifteenth Doctors New Companion Battles Killer Cartoons

May 17, 2025

Latest Posts

-

6 1 Billion Celtics Sale Impact On The Team And Its Fans

May 17, 2025

6 1 Billion Celtics Sale Impact On The Team And Its Fans

May 17, 2025 -

Celtics Sale To Private Equity A 6 1 Billion Deal And Fan Concerns

May 17, 2025

Celtics Sale To Private Equity A 6 1 Billion Deal And Fan Concerns

May 17, 2025 -

6 1 Billion Celtics Sale Impact On The Team And Its Future

May 17, 2025

6 1 Billion Celtics Sale Impact On The Team And Its Future

May 17, 2025 -

Boston Celtics Future Uncertain After 6 1 Billion Sale To Private Equity Firm

May 17, 2025

Boston Celtics Future Uncertain After 6 1 Billion Sale To Private Equity Firm

May 17, 2025 -

Boston Celtics Sold For 6 1 Billion Fans React To Private Equity Buyout

May 17, 2025

Boston Celtics Sold For 6 1 Billion Fans React To Private Equity Buyout

May 17, 2025