The Implications Of Taiwan's Nuclear Phase-out On LNG Markets

Table of Contents

Increased LNG Demand and Price Volatility

Rising LNG Imports for Taiwan

Taiwan's nuclear power plants currently contribute a substantial portion of its electricity generation. Their decommissioning necessitates a massive increase in LNG imports to bridge the energy gap. Projections indicate a potential doubling or tripling of LNG imports within the next decade, depending on the pace of renewable energy development. This rapid escalation presents significant infrastructure challenges.

- Infrastructure Bottlenecks: Taiwan's existing LNG import terminals may struggle to handle the drastically increased volume, requiring substantial investment in new infrastructure, including regasification terminals, pipelines, and storage facilities. Delays in these projects could lead to supply shortages and price spikes.

- Financial Strain: The massive increase in LNG imports will place a considerable strain on Taiwan's energy budget, potentially impacting other crucial sectors of the economy. Securing long-term, cost-effective LNG supply contracts will be paramount.

- Projected Increase: Estimates suggest an increase in LNG imports ranging from 15 to 30 million tonnes per annum (mtpa) to compensate for the lost nuclear capacity, representing a substantial shift in Taiwan's energy mix.

Global Competition for LNG Supply

The increased demand from Taiwan intensifies the already fierce competition for LNG resources on the global stage. Countries worldwide are increasingly turning to LNG to enhance their energy security, creating a scenario of constrained supply and surging prices.

- Price Volatility: The limited global supply of LNG, coupled with increased demand from both developed and developing nations, is likely to lead to significant price volatility in the coming years, potentially impacting Taiwan's economic stability.

- Geopolitical Factors: Geopolitical events, such as conflicts or sanctions, can severely disrupt LNG supply chains, further exacerbating price instability and highlighting the vulnerability of countries heavily reliant on LNG imports.

- Supply Chain Disruptions: The complex and geographically dispersed nature of LNG supply chains makes them susceptible to disruptions caused by natural disasters, political instability in producing regions, or logistical bottlenecks.

Geopolitical Implications and Energy Security

Diversification of LNG Suppliers

To mitigate the risks associated with reliance on a limited number of LNG suppliers, Taiwan needs a proactive strategy for diversification. This means securing supply from multiple sources, reducing dependence on any single nation or region.

- Supplier Analysis: Careful assessment of potential supplier countries is crucial, considering not only their LNG production capacity but also their political stability and reliability. Diversification helps mitigate risks related to geopolitical instability or supply disruptions in a specific region.

- Long-Term Contracts: Securing long-term supply contracts with diverse suppliers is essential to ensure a stable and predictable LNG supply at competitive prices. These contracts help to reduce price volatility and ensure energy security.

- International Partnerships: Collaborating with other countries to secure joint LNG procurement or develop regional infrastructure projects can enhance Taiwan's bargaining power and energy security.

Strengthening Energy Infrastructure

Investing in and upgrading Taiwan's LNG import infrastructure is absolutely critical for managing the increased demand. This requires significant capital expenditure and efficient project management.

- Infrastructure Investment: Building new LNG import terminals, expanding pipeline networks, and increasing storage capacity are vital to ensure a smooth transition and avoid supply disruptions. This requires a significant influx of both public and private investment.

- Private Sector Involvement: Encouraging private sector participation in infrastructure development can help leverage expertise and capital, while also promoting competition and efficiency.

- Environmental Considerations: Increased LNG use brings environmental concerns, necessitating investments in carbon capture technologies and a focus on renewable energy integration to mitigate greenhouse gas emissions. Sustainable practices are crucial for a responsible energy transition.

Impact on Regional LNG Markets and Global Trade

Regional Price Fluctuations

Taiwan's dramatically increased LNG demand will exert significant upward pressure on prices in the Asia-Pacific region, impacting neighboring countries that also rely on LNG imports.

- Regional Competition: This heightened competition for LNG resources will exacerbate price fluctuations and potentially lead to trade tensions between Taiwan and its neighbors. Strategic planning to manage regional relationships is essential.

- Ripple Effects: Price increases in one region can have knock-on effects globally, impacting LNG markets worldwide and potentially influencing energy policies in other nations.

Shifting Global LNG Trade Dynamics

Taiwan's shift towards LNG will fundamentally alter global LNG trade patterns, impacting pricing and supply dynamics across the world.

- Long-Term Price Impacts: The increased demand from Taiwan and other nations transitioning away from fossil fuels will significantly shape the long-term price trajectory of LNG.

- Role of Trading Companies: International LNG trading companies will play a crucial role in navigating the complexities of this transition, brokering deals and optimizing supply chains.

Conclusion: Navigating the Challenges of Taiwan's LNG Transition

Taiwan's nuclear phase-out presents a formidable challenge, dramatically increasing its reliance on LNG and significantly impacting regional and global LNG markets. The implications are far-reaching, necessitating strategic planning, significant investment in infrastructure, and a focus on diversifying LNG suppliers to ensure energy security. Failure to proactively address these issues could lead to price volatility, supply disruptions, and significant economic consequences. Further research and open dialogue are essential to fully comprehend the long-term implications of Taiwan's Nuclear Phase-out on LNG Markets and to develop effective mitigation strategies. Stakeholders must actively participate in forging a sustainable and secure energy future for Taiwan.

Featured Posts

-

Taming The Love Monster Strategies For Building Strong Relationships

May 21, 2025

Taming The Love Monster Strategies For Building Strong Relationships

May 21, 2025 -

Decouverte Du Theatre Tivoli A Clisson Photos Interieures Et Loto Du Patrimoine 2025

May 21, 2025

Decouverte Du Theatre Tivoli A Clisson Photos Interieures Et Loto Du Patrimoine 2025

May 21, 2025 -

Investing In Ai Quantum Computing One Compelling Reason To Buy The Dip

May 21, 2025

Investing In Ai Quantum Computing One Compelling Reason To Buy The Dip

May 21, 2025 -

Private Credit Jobs 5 Tips For A Successful Application

May 21, 2025

Private Credit Jobs 5 Tips For A Successful Application

May 21, 2025 -

Huizenmarkt Voorspelling Abn Amro Ziet Hogere Prijzen Ondanks Rente

May 21, 2025

Huizenmarkt Voorspelling Abn Amro Ziet Hogere Prijzen Ondanks Rente

May 21, 2025

Latest Posts

-

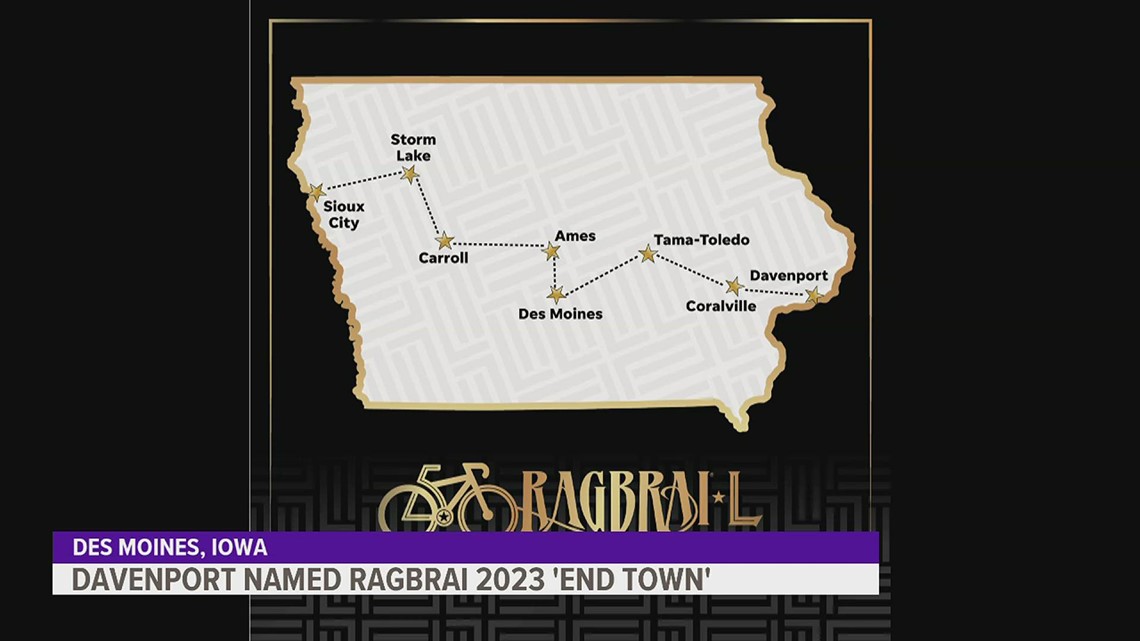

Ragbrai And Beyond Exploring Scott Savilles Cycling Life

May 21, 2025

Ragbrai And Beyond Exploring Scott Savilles Cycling Life

May 21, 2025 -

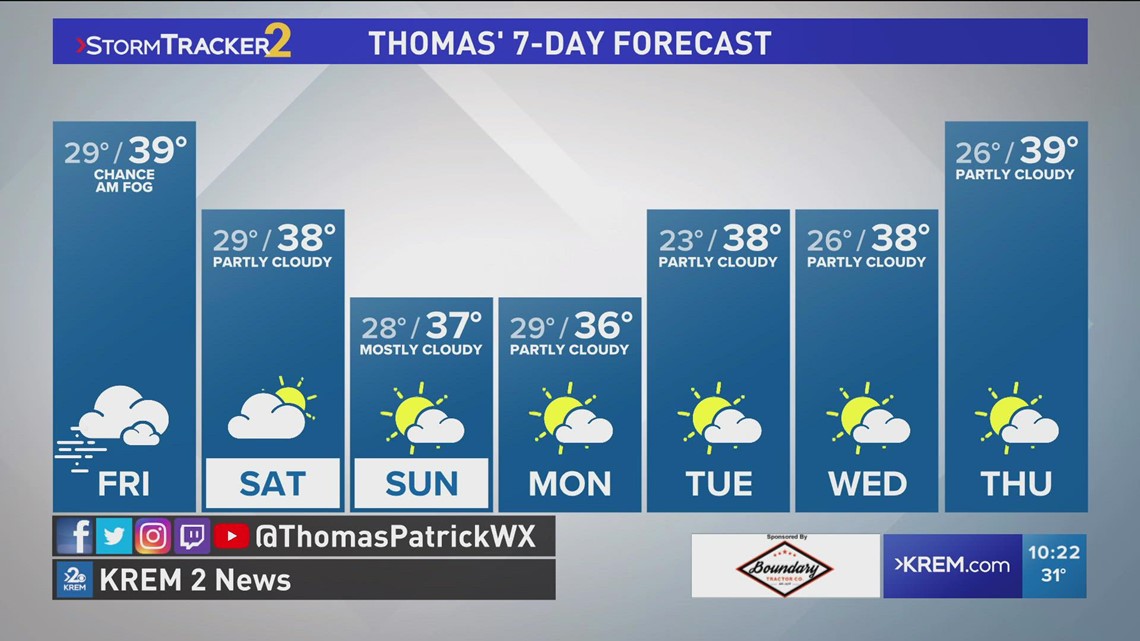

Prepare For Mild Temperatures And Dry Conditions

May 21, 2025

Prepare For Mild Temperatures And Dry Conditions

May 21, 2025 -

From Ragbrai To Daily Rides Scott Savilles Passion For Cycling

May 21, 2025

From Ragbrai To Daily Rides Scott Savilles Passion For Cycling

May 21, 2025 -

How To Predict Breezy And Mild Weather For Your Next Trip

May 21, 2025

How To Predict Breezy And Mild Weather For Your Next Trip

May 21, 2025 -

Expecting Mild Temperatures Low Rain Probability This Week

May 21, 2025

Expecting Mild Temperatures Low Rain Probability This Week

May 21, 2025