The Impact Of US Solar Import Duties On Hanwha And OCI's Market Position

Table of Contents

Hanwha Q CELLS' Response to US Solar Import Duties

Hanwha Q CELLS, a leading solar panel manufacturer, has faced significant headwinds due to US solar import duties. Understanding how the company has navigated these challenges is crucial to understanding the impact of this trade policy.

Navigating Tariff Challenges

Hanwha Q CELLS has implemented several strategies to mitigate the negative effects of US solar import duties. These actions demonstrate the company's adaptability and commitment to maintaining its competitive edge in the face of trade barriers.

- Investment in US-based manufacturing plants: By establishing manufacturing facilities within the US, Hanwha Q CELLS can bypass the tariffs imposed on imported solar panels. This strategy represents a substantial investment, but it offers long-term benefits by securing access to the lucrative US market.

- Focus on diversification of markets: Reducing reliance on any single market, especially one subject to unpredictable trade policies, is vital. Hanwha Q CELLS has actively pursued opportunities in other regions, lessening the impact of US tariff fluctuations on its overall revenue and profitability.

- Price adjustments and cost-cutting measures: The company has implemented various cost-cutting measures and adjusted pricing strategies to remain competitive despite the increased costs associated with tariffs. This necessitates careful balancing to maintain profitability while remaining attractive to buyers.

- Lobbying efforts to influence US trade policy: Hanwha Q CELLS, along with other industry players, has engaged in lobbying efforts to influence US trade policy and advocate for more favorable trade conditions for solar products.

Impact on Market Share and Profitability

The US solar import duties have undeniably impacted Hanwha Q CELLS' market share and profitability. While precise figures can fluctuate, it's evident that the tariffs have presented challenges.

- Changes in US Market Share: While Hanwha Q CELLS maintains a significant presence in the US market, the tariffs have likely resulted in a reduction in their market share compared to pre-tariff levels. This reduction is partly due to increased competition from domestic manufacturers and those circumventing the tariffs through other strategies.

- Effects on Profitability and Financial Performance: The tariffs have undoubtedly affected Hanwha Q CELLS' profitability. The need for increased investment in US-based manufacturing and the adjustments to pricing strategies have likely impacted profit margins. Detailed financial reports would provide a comprehensive assessment of the quantitative effect. A comparison of pre- and post-tariff financial performance would be particularly insightful.

OCI's Position and Adaptation Strategies

OCI's position differs from Hanwha Q CELLS, as it primarily focuses on polysilicon production, a crucial raw material for solar panel manufacturing. Understanding OCI's role in the solar supply chain is key to assessing the indirect impact of the US solar import duties.

OCI's Reliance on Polysilicon Exports

OCI's business is significantly influenced by global demand for polysilicon. The US solar import duties indirectly affect OCI by impacting the demand for solar panels and, consequently, the demand for polysilicon.

- Connection between polysilicon prices and solar panel tariffs: When US solar panel demand decreases due to tariffs, so does the demand for polysilicon. This results in lower polysilicon prices and potentially reduced profits for OCI.

- Impact of reduced demand on OCI's production and sales: Reduced demand from US solar manufacturers has forced OCI to adjust its production levels and explore other market opportunities to maintain profitability.

Diversification and Long-Term Outlook

OCI is actively pursuing diversification strategies to mitigate risks associated with the volatile nature of the solar industry and the unpredictability of trade policies.

- Diversification into other sectors or markets: To reduce dependence on the solar industry, OCI is investing in other areas, ensuring business stability even if solar panel demand remains subdued.

- Long-term prospects: OCI's long-term prospects depend heavily on the continued growth of the global solar energy market and its ability to adapt to changing global trade policies. Expert analysis and industry forecasts offer valuable insights into this aspect.

The Broader Implications of US Solar Import Duties

The US solar import duties have had significant consequences for the US solar industry and the global solar market.

Impact on the US Solar Industry

The tariffs have had a mixed impact on the US solar energy sector:

- Positive consequences: The tariffs have provided a boost to domestic solar manufacturers, encouraging investment and job creation within the US.

- Negative consequences: The higher prices resulting from tariffs have slowed the overall growth of the US solar energy sector and hindered the expansion of renewable energy adoption.

Global Market Dynamics and Competition

The tariffs have altered the global landscape of solar panel manufacturing and trade:

- Shifting Global Production: The increased cost of US-bound imports has prompted some manufacturers to relocate production to other regions or adjust their supply chains.

- Impact on Competition: The tariffs have led to a more complex and competitive landscape, with some manufacturers gaining an advantage while others face challenges.

Conclusion

The US solar import duties have had a significant, albeit complex, impact on Hanwha Q CELLS and OCI. Hanwha Q CELLS has responded by investing in US manufacturing and diversifying its markets, while OCI has had to adapt to fluctuations in polysilicon demand. The tariffs have broader consequences for the US and global solar industries, impacting growth, investment, and competition. Staying informed about the evolving landscape of US solar import duties and their impact on key players like Hanwha and OCI is crucial for understanding the future of the solar energy sector. Further research into the effects of US solar import duties is vital for navigating this dynamic market.

Featured Posts

-

Shock For Glastonbury Attendees Huge Act Pulled From Festival Lineup

May 30, 2025

Shock For Glastonbury Attendees Huge Act Pulled From Festival Lineup

May 30, 2025 -

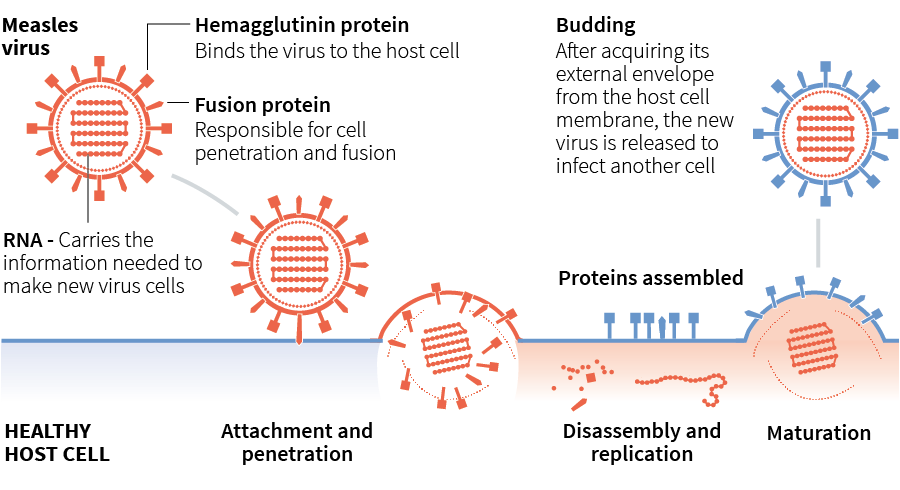

Understanding The Spread Of Measles Updated U S Case Locations

May 30, 2025

Understanding The Spread Of Measles Updated U S Case Locations

May 30, 2025 -

Bruno Fernandes Transfer Speculation Al Hilals Pursuit

May 30, 2025

Bruno Fernandes Transfer Speculation Al Hilals Pursuit

May 30, 2025 -

Preduprezhdenie Mada Anomalnaya Zhara Pokholodanie I Silniy Shtorm V Izraile

May 30, 2025

Preduprezhdenie Mada Anomalnaya Zhara Pokholodanie I Silniy Shtorm V Izraile

May 30, 2025 -

Ruuds Knee Injury Derrails French Open 2025 Campaign

May 30, 2025

Ruuds Knee Injury Derrails French Open 2025 Campaign

May 30, 2025

Latest Posts

-

The Good Life Finding Purpose And Meaning

May 31, 2025

The Good Life Finding Purpose And Meaning

May 31, 2025 -

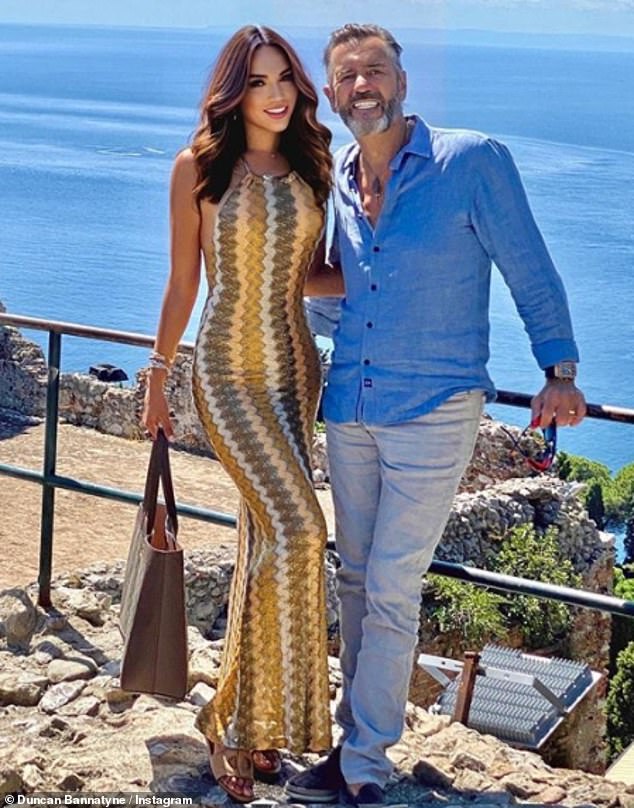

Moroccan Childrens Charity Receives Support From Duncan Bannatyne

May 31, 2025

Moroccan Childrens Charity Receives Support From Duncan Bannatyne

May 31, 2025 -

Bannatynes Philanthropy Supporting Children In Morocco

May 31, 2025

Bannatynes Philanthropy Supporting Children In Morocco

May 31, 2025 -

Nigora Bannatynes Abs And Sparkling Outfit

May 31, 2025

Nigora Bannatynes Abs And Sparkling Outfit

May 31, 2025 -

Rosemary And Thyme Essential Oils Applications And Precautions

May 31, 2025

Rosemary And Thyme Essential Oils Applications And Precautions

May 31, 2025