The GOP Tax Plan And The National Deficit: Fact Vs. Fiction

Table of Contents

Projected Revenue Impacts of the GOP Tax Plan

Initial Projections vs. Actual Revenue

The official projections of the GOP tax plan, primarily from the Congressional Budget Office (CBO), predicted a significant decrease in federal revenue. These projections anticipated that lower tax rates would stimulate economic growth, partially offsetting the revenue loss. However, comparing these initial projections to the actual revenue collected paints a more complex picture.

- CBO projections: Forecasted a substantial reduction in tax revenue over the following decade.

- Actual revenue: While revenue did decline initially, the decrease was not as drastic as initially projected in some areas. This discrepancy can be attributed to several factors.

The reasons for the discrepancies are multifaceted:

- Economic growth: While the tax cuts did stimulate some economic growth, it wasn't as robust as initially predicted by proponents of the plan.

- Changes in tax behavior: Taxpayers adjusted their behavior in response to the lower rates, influencing the total revenue collected.

- Unforeseen economic events: Global economic shifts and unforeseen events, such as the COVID-19 pandemic, significantly impacted revenue collection.

Analyzing data from the Treasury Department and comparing it to CBO projections reveals a nuanced reality – one where simple narratives about immediate revenue loss are insufficient to fully grasp the complex interplay of economic factors.

Impact on Different Income Brackets

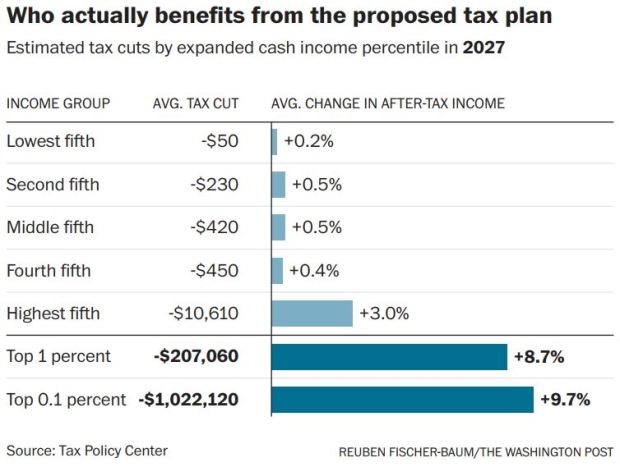

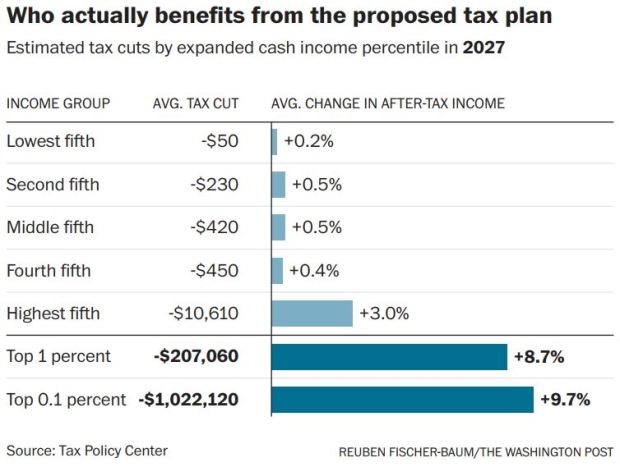

A crucial aspect of the GOP Tax Plan and National Deficit debate centers on the distribution of tax benefits. While the plan lowered tax rates across the board, the impact varied significantly depending on income brackets.

- Data on tax benefit distribution: Studies show that a disproportionate share of the tax cuts benefited high-income earners. This finding fuels the criticism that the plan worsened income inequality.

- Arguments regarding the wealthy: Critics argue that the tax cuts primarily benefited corporations and the wealthy, widening the gap between the rich and the poor. Conversely, proponents contend that the resulting economic growth benefited all income brackets.

Visualizing this data through charts and graphs allows for a clearer understanding of the distributional effects of the tax cuts, highlighting the debate's core complexities.

The GOP Tax Plan and Increased Government Spending

Mandatory Spending vs. Discretionary Spending

Understanding the impact of the GOP Tax Plan on the national deficit necessitates distinguishing between mandatory and discretionary spending.

- Mandatory spending: This includes entitlement programs like Social Security and Medicare, which are legally obligated expenditures.

- Discretionary spending: This includes areas like defense, education, and infrastructure, which are subject to annual appropriations.

The tax cuts led to increased pressure on both types of spending. Reduced tax revenue created a fiscal gap, potentially squeezing discretionary spending and creating challenges for managing mandatory spending growth over the long term.

- Examples of affected spending programs: Reduced funding for certain social programs and increased pressure on the debt ceiling.

Long-Term Fiscal Sustainability

The long-term implications of the GOP tax cuts on the national debt are a major concern.

- Impact on future generations: The increased national debt resulting from the tax cuts will burden future generations with higher interest payments and reduced government resources.

- Economic models and predictions: Various economic models predict significantly different outcomes regarding the long-term fiscal impact of the plan. Some suggest a manageable increase in the debt-to-GDP ratio, while others forecast a more dire situation.

Key concerns regarding the national debt and fiscal responsibility include the potential for a debt crisis, increased interest rates, and reduced government capacity to address future economic challenges.

Analyzing the Economic Impacts Beyond the Deficit

Economic Growth and Job Creation

Proponents of the GOP tax plan argued that it would stimulate significant economic growth and job creation.

- Claims regarding economic growth: While the economy did experience a period of growth following the tax cuts, it's challenging to definitively attribute this solely to the plan. Other factors, such as global economic conditions, played a significant role.

- Data on job creation and economic output: Analyzing economic data, including GDP growth and job creation figures, is necessary to assess the actual impact of the tax cuts.

Counterarguments exist, suggesting that the tax cuts had a limited impact on economic growth and job creation compared to the cost to the national deficit.

Inflationary Pressures

The GOP tax cuts' potential to fuel inflation is another important consideration.

- Relationship between tax cuts, increased demand, and price increases: Lower taxes can lead to increased consumer spending and business investment, potentially driving up demand and prices.

- Relevant economic indicators: Analyzing inflation rates, wage growth, and other economic indicators helps assess the inflationary pressures created by the tax cuts.

Conclusion

The relationship between the GOP Tax Plan and National Deficit is complex, defying simplistic narratives. While the plan did lower tax revenue in the short term, the magnitude of the effect and its long-term consequences are subjects of ongoing debate. Separating fact from fiction requires a careful examination of the economic data, considering various economic models, and recognizing the interplay of numerous factors beyond the tax cuts themselves. The impact on different income brackets and the long-term fiscal sustainability are critical aspects of the analysis. We urge readers to critically evaluate information regarding the GOP Tax Plan and National Deficit and to seek out reputable sources for accurate data. Informed discussion and further research are vital for understanding this complex issue and for shaping responsible fiscal policy.

Featured Posts

-

Chinas Next Giant Leap A Supercomputer In Orbit

May 20, 2025

Chinas Next Giant Leap A Supercomputer In Orbit

May 20, 2025 -

Regional Stability At Risk Chinas Call For Philippines To Remove Typhon Missiles

May 20, 2025

Regional Stability At Risk Chinas Call For Philippines To Remove Typhon Missiles

May 20, 2025 -

Urgence Securite A La Gaite Lyrique Intervention De La Mairie Demandee Par Les Salaries

May 20, 2025

Urgence Securite A La Gaite Lyrique Intervention De La Mairie Demandee Par Les Salaries

May 20, 2025 -

A New Bbc Venture Brings Agatha Christie Back To Life

May 20, 2025

A New Bbc Venture Brings Agatha Christie Back To Life

May 20, 2025 -

Michael Schumacher Gina Schumacher A Devenit Mama O Fetita S A Nascut

May 20, 2025

Michael Schumacher Gina Schumacher A Devenit Mama O Fetita S A Nascut

May 20, 2025

Latest Posts

-

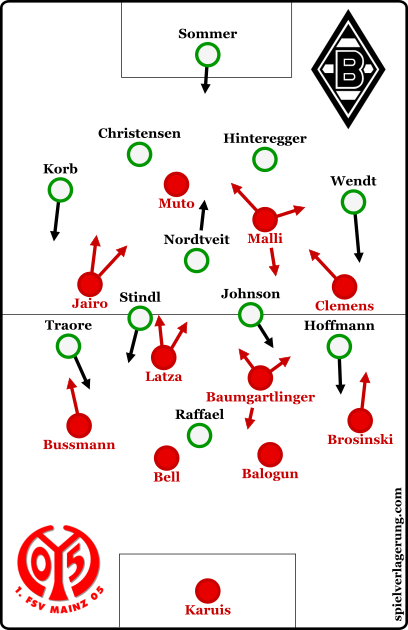

Gladbach Defeat Boosts Mainzs Top Four Chances

May 20, 2025

Gladbach Defeat Boosts Mainzs Top Four Chances

May 20, 2025 -

Mainz Extends Top Four Hopes Following Gladbach Win

May 20, 2025

Mainz Extends Top Four Hopes Following Gladbach Win

May 20, 2025 -

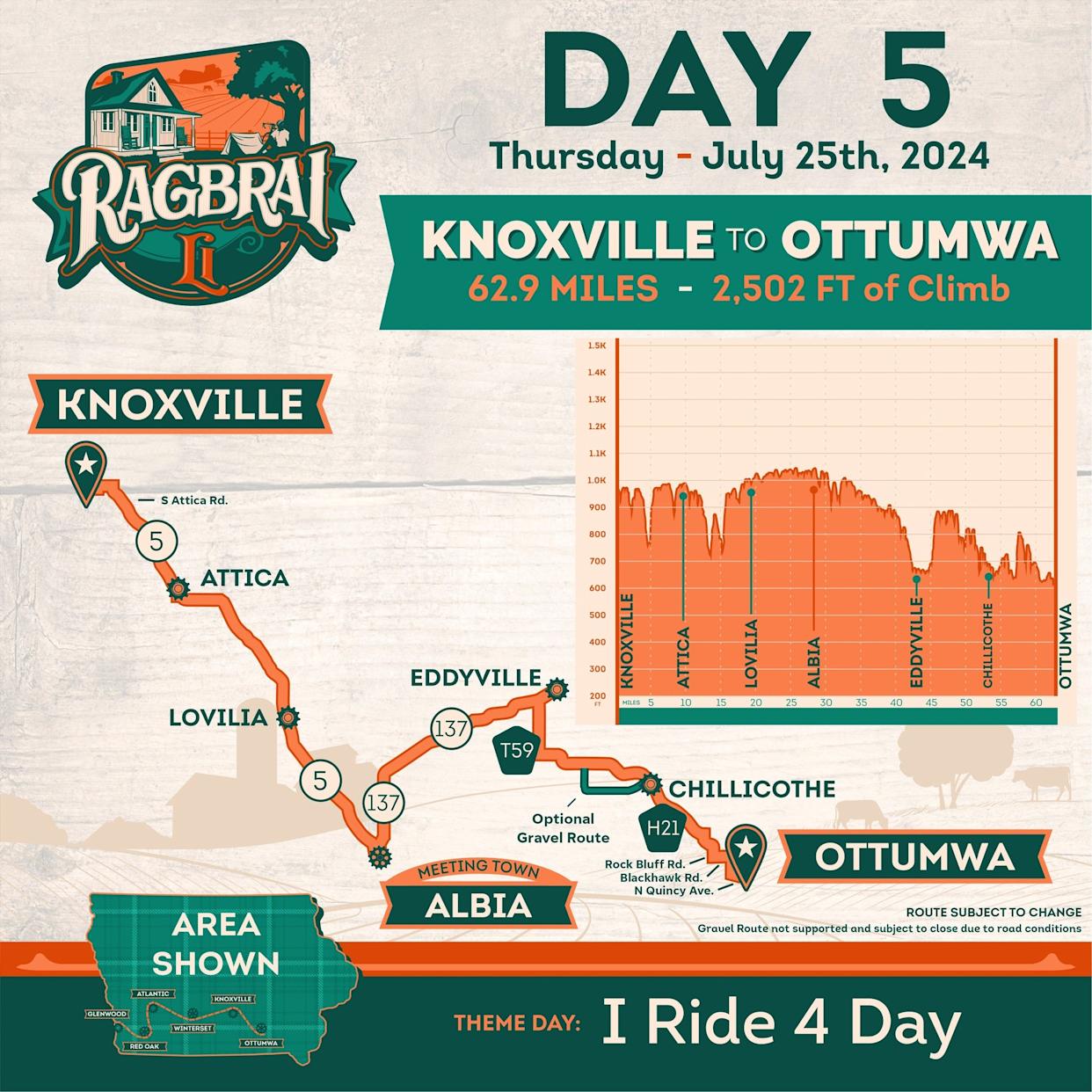

From Ragbrai To Daily Rides Scott Savilles Passion For Biking

May 20, 2025

From Ragbrai To Daily Rides Scott Savilles Passion For Biking

May 20, 2025 -

Scott Savilles Cycling Journey From Ragbrai To Daily Commutes

May 20, 2025

Scott Savilles Cycling Journey From Ragbrai To Daily Commutes

May 20, 2025 -

Mild Temperatures And Little Rain Chance Perfect For Outdoor Activities

May 20, 2025

Mild Temperatures And Little Rain Chance Perfect For Outdoor Activities

May 20, 2025