The Goldman Sachs CEO And The Suppression Of Internal Voices

Table of Contents

Allegations of a Stifled Culture at Goldman Sachs

Reports suggest a growing concern regarding the suppression of dissenting opinions within Goldman Sachs under David Solomon's leadership. This perceived stifling of internal voices raises serious questions about the firm's internal culture and its potential impact on its long-term success.

Evidence of Suppressed Dissent

Several accounts and reports point towards a culture that discourages open disagreement. These include:

- Reduced employee feedback mechanisms: Anonymous sources claim a decline in the effectiveness of internal feedback channels, making it difficult for employees to express concerns without fear of reprisal. (Source needed – replace with actual reputable source link)

- Increased emphasis on conformity: Anecdotal evidence suggests a greater focus on aligning with the CEO's vision, potentially discouraging independent thought and alternative strategies. (Source needed – replace with actual reputable source link)

- Instances of whistleblowers facing repercussions: Allegations of retaliatory actions against employees who voiced concerns internally have fueled concerns about a lack of genuine transparency and accountability. (Source needed – replace with actual reputable source link)

The impact of these actions on employee morale and creativity is substantial. Fear of retribution can lead to self-censorship, hindering the free flow of ideas and ultimately impacting the quality of decision-making.

The Impact on Innovation and Performance

A culture that discourages internal challenge inevitably hampers innovation and effective risk assessment. The pressure to conform can lead to groupthink, where dissenting viewpoints are ignored or suppressed, resulting in potentially disastrous consequences.

Reduced Creativity and Risk Management

- Missed opportunities: A lack of diverse perspectives can lead to the overlooking of crucial market trends and innovative solutions.

- Poor risk assessment: The suppression of critical voices can result in inadequate identification and mitigation of potential risks, leading to financial losses or reputational damage.

- Stagnation of ideas: Without the challenge of different viewpoints, existing strategies and processes may become outdated and ineffective.

Goldman Sachs' recent performance, while subject to various market factors, could be partially attributed to a lack of internal critique and the stifling of innovative ideas. A thorough investigation into this potential correlation is warranted.

The Role of Leadership in Fostering Open Communication

David Solomon's leadership style has been a subject of considerable discussion. His approach, while lauded by some, has also been criticized for potentially contributing to the perceived suppression of internal voices.

David Solomon's Leadership Style and its Critics

- Communication style: Critics suggest his communication style may not be conducive to open dialogue and the free exchange of ideas. (Source needed – replace with actual reputable source link)

- Management decisions: Certain management decisions might be interpreted as prioritizing conformity over independent thought. (Source needed – replace with actual reputable source link)

- Public statements: Public statements by Solomon could be analyzed to determine whether they reflect a commitment to open communication and dissent. (Source needed – replace with actual reputable source link)

Creating a culture that encourages open dialogue requires transparent and inclusive leadership. Leaders must actively solicit diverse perspectives, create safe spaces for dissent, and demonstrate a genuine commitment to acting upon constructive criticism.

Comparisons with Other Financial Institutions

Benchmarking Goldman Sachs against its competitors reveals contrasting approaches to internal communication and dissent.

Benchmarking Against Competitors

- JPMorgan Chase: Often cited for its more open and collaborative culture, JPMorgan Chase provides a stark contrast. (Specific examples needed – replace with details and source links)

- Bank of America: Examples of successful initiatives promoting internal feedback and dissent at Bank of America can offer valuable insights. (Specific examples needed – replace with details and source links)

Goldman Sachs could learn from these examples by implementing more robust feedback mechanisms, fostering a more inclusive leadership style, and promoting a culture that values diverse perspectives and constructive criticism.

The Long-Term Consequences of Suppressing Internal Voices

The long-term implications of stifling internal voices are far-reaching and potentially devastating for Goldman Sachs.

Reputational Damage and Employee Turnover

- Reputational damage: A culture perceived as suppressing dissent can damage the firm's reputation, making it harder to attract and retain top talent.

- Employee attrition: Employees may seek opportunities in more open and inclusive environments, leading to a loss of valuable skills and expertise.

- Difficulty attracting top talent: Top professionals are increasingly seeking out organizations with cultures that value diversity of thought and open communication.

These issues can significantly affect Goldman Sachs' long-term sustainability and competitive advantage in the highly competitive financial services industry. The financial implications of losing talented employees and sustaining reputational damage are substantial.

Conclusion

The allegations of suppressed internal voices at Goldman Sachs under David Solomon's leadership raise serious concerns about the firm's internal culture and its potential long-term impact. Stifling dissent undermines innovation, weakens risk management, and ultimately jeopardizes the firm's future success. Fostering a culture of open communication and constructive criticism is vital for any organization, but especially within the high-stakes world of finance. To learn more about Goldman Sachs CEO internal dissent, explore the impact of stifled voices, and examine the consequences of suppressing internal viewpoints within Goldman Sachs, further research is encouraged. This includes investigating the specific sources cited in the above points and exploring additional resources on leadership styles and organizational culture within the financial services industry.

Featured Posts

-

Batterie Longue Duree Top 5 Des Smartphones Les Plus Endurants

May 28, 2025

Batterie Longue Duree Top 5 Des Smartphones Les Plus Endurants

May 28, 2025 -

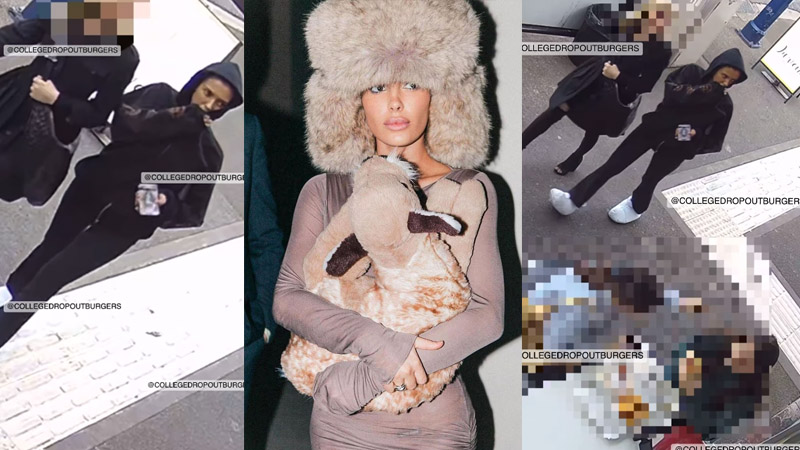

Recent Photos Of Bianca Censori Spark Online Debate

May 28, 2025

Recent Photos Of Bianca Censori Spark Online Debate

May 28, 2025 -

40 Yasindaki Ronaldo Hala Zirvede

May 28, 2025

40 Yasindaki Ronaldo Hala Zirvede

May 28, 2025 -

Cuaca Bandung Besok 23 April 2024 Peringatan Hujan Hingga Sore

May 28, 2025

Cuaca Bandung Besok 23 April 2024 Peringatan Hujan Hingga Sore

May 28, 2025 -

Us Envoy Offers Gaza Ceasefire Hamas Urged To Accept Deal

May 28, 2025

Us Envoy Offers Gaza Ceasefire Hamas Urged To Accept Deal

May 28, 2025