The Future Of XRP: Navigating The SEC Landscape And The Promise Of ETFs

Table of Contents

The Ongoing SEC Lawsuit Against Ripple and its Implications for XRP

The SEC's lawsuit against Ripple Labs, the creator of XRP, casts a long shadow over the cryptocurrency's future. Understanding the intricacies of this legal battle is crucial for anyone considering XRP investment.

Understanding the Core Allegations

The SEC's core allegation is that Ripple engaged in an unregistered securities offering by selling XRP. They argue that XRP functions as a security, subject to SEC regulations, because investors purchased it with the expectation of profit based on Ripple's efforts. This classification is central to the case and determines whether Ripple violated securities laws. The SEC’s argument hinges on the Howey Test, a legal framework used to determine whether an investment contract constitutes a security.

Ripple's Defense Strategy and Recent Developments

Ripple vehemently denies the SEC's claims, arguing that XRP is a decentralized digital asset, not a security. Their defense strategy focuses on demonstrating XRP's operational independence from Ripple and its widespread use in decentralized exchanges.

- Partial summary judgement ruling and its interpretation: The court's partial summary judgement ruling in July 2023 significantly impacted the XRP price, offering a mixed bag of wins and losses for both sides. The ruling clarified that programmatic sales of XRP did not constitute securities offerings, while leaving the question of institutional sales open for trial.

- Expert witness testimonies and their significance: Expert testimonies from both sides have played a crucial role, offering contrasting interpretations of XRP's functionality and market dynamics. The credibility and weight given to these testimonies will be instrumental in the final judgement.

- Potential future legal proceedings: Regardless of the outcome, further appeals are likely, extending the uncertainty surrounding XRP's regulatory status and potentially impacting XRP price prediction models for years to come.

Potential Outcomes and Their Impact on XRP's Price

Several potential outcomes exist: a complete victory for Ripple, a complete victory for the SEC, or a negotiated settlement.

- Ripple Victory: A favorable ruling would likely lead to a significant surge in XRP's price, boosting investor confidence and potentially paving the way for XRP ETF approval.

- SEC Victory: An SEC victory could severely impact XRP's price, potentially leading to delisting from exchanges and further regulatory uncertainty.

- Settlement: A settlement could bring some clarity but might still negatively impact XRP's price depending on the terms.

The Potential for XRP ETFs and Their Market Impact

The possibility of XRP ETFs holds immense potential for transforming the cryptocurrency's market landscape.

What are XRP ETFs and Why are They Important?

Exchange-Traded Funds (ETFs) are investment funds traded on stock exchanges, offering investors easy access to diversified portfolios. An XRP ETF would provide a regulated and convenient way for investors to gain exposure to XRP, potentially attracting institutional investors and increasing liquidity.

Regulatory Hurdles for XRP ETF Approval

Securing SEC approval for an XRP ETF faces significant hurdles, primarily due to the ongoing lawsuit and the uncertainty surrounding XRP's regulatory classification. The SEC's stance on cryptocurrencies, particularly regarding their classification as securities, remains a major obstacle. The SEC's approach to Bitcoin and Ethereum ETF applications also provides valuable insights into their regulatory thinking and the challenges facing XRP.

The Potential Benefits of XRP ETF Approval

The approval of an XRP ETF would have several positive effects:

- Increased trading volume and market capitalization: Increased accessibility would lead to higher trading volumes and a potentially larger market cap.

- Attraction of institutional investors: ETFs appeal to institutional investors who prefer regulated investment vehicles.

- Improved price stability due to increased regulation: The regulated nature of ETFs could contribute to greater price stability.

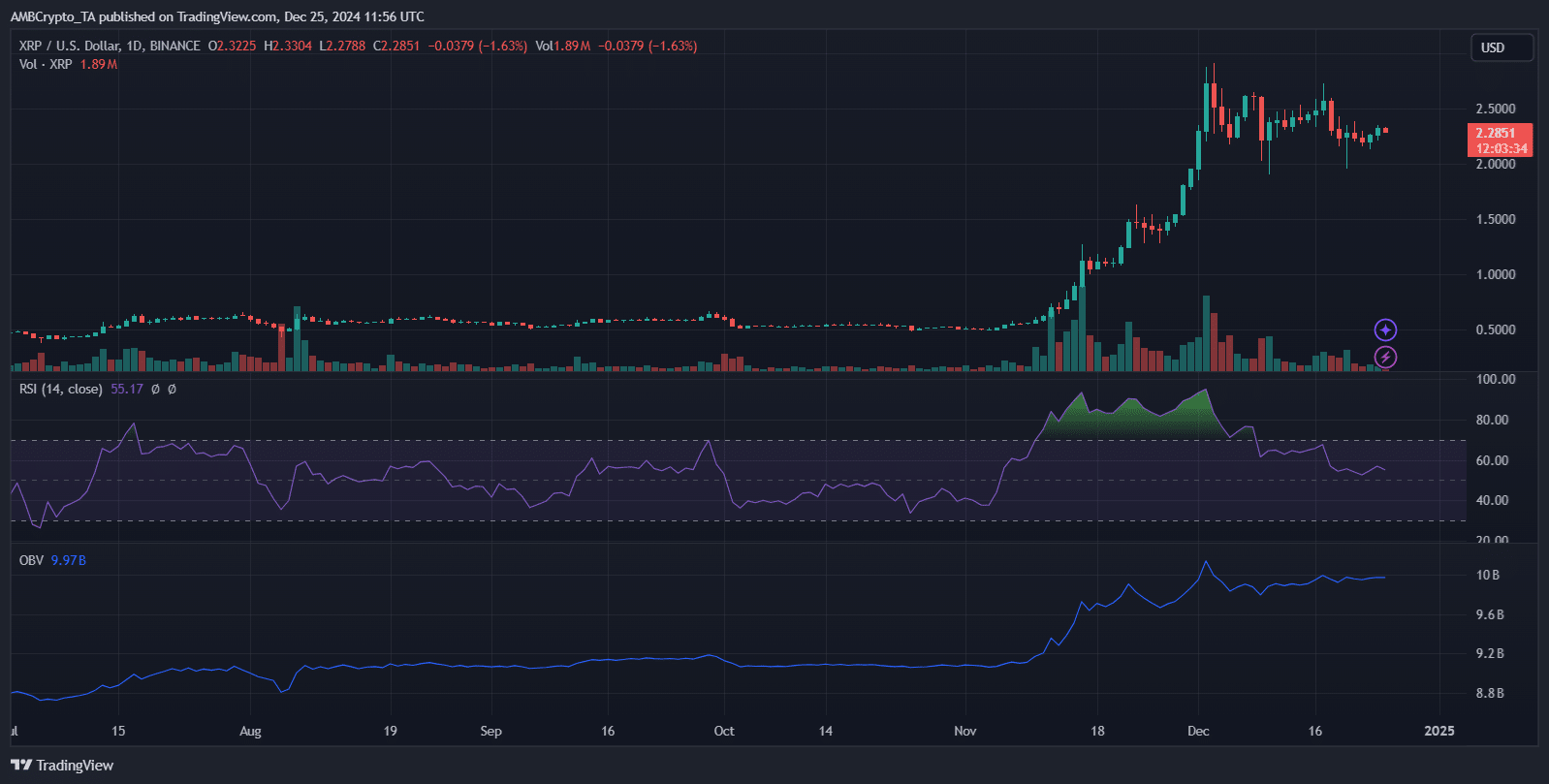

Analyzing the Future Price of XRP: Factors to Consider

Predicting the future price of XRP is inherently speculative, but several factors warrant consideration:

The Impact of Regulatory Clarity

Regulatory clarity, regardless of whether it is positive or negative, will significantly influence XRP's future price. A clear regulatory framework, even if unfavorable, provides predictability, which is crucial for investor confidence.

Technological Advancements and Ripple's Ecosystem

Ripple's continued development of its technology and ecosystem will play a vital role. Ongoing innovations and partnerships can enhance XRP's utility and strengthen its position in the market, impacting XRP price prediction.

Market Sentiment and Investor Confidence

Market sentiment and investor confidence are powerful drivers of XRP's price.

- Influence of Bitcoin and other major cryptocurrencies: The overall cryptocurrency market's performance significantly influences XRP's price.

- The role of social media and news coverage: Media narratives and social media sentiment can heavily influence investor perception and price volatility.

- Impact of major partnerships and integrations: Strategic partnerships and integrations with established financial institutions can boost XRP's adoption and price.

Conclusion

The XRP future is inextricably linked to the outcome of the SEC lawsuit and the potential for XRP ETF approval. While significant uncertainties remain, the potential rewards are substantial. A favorable resolution to the lawsuit and subsequent ETF approval could propel XRP to new heights. However, an unfavorable outcome could lead to prolonged uncertainty and depressed prices. Stay informed about the XRP future and make informed investment decisions. Conduct thorough research, stay updated on the SEC lawsuit and Ripple’s developments, and carefully consider the potential implications for your XRP investments. Understanding these factors is crucial for navigating the complexities of the XRP market and making sound XRP investment decisions. The potential of XRP and its future in the evolving crypto landscape is significant, and staying informed is key to capitalizing on its opportunities.

Featured Posts

-

Smfg In Talks To Acquire Yes Bank Stake Sources

May 07, 2025

Smfg In Talks To Acquire Yes Bank Stake Sources

May 07, 2025 -

The Anthony Edwards Baby Mama Saga Internet Explodes With Reactions

May 07, 2025

The Anthony Edwards Baby Mama Saga Internet Explodes With Reactions

May 07, 2025 -

Dina In The Last Of Us Season 2 Isabela Merceds Character Explained

May 07, 2025

Dina In The Last Of Us Season 2 Isabela Merceds Character Explained

May 07, 2025 -

Is George Pickens Being Traded Schultz Weighs In

May 07, 2025

Is George Pickens Being Traded Schultz Weighs In

May 07, 2025 -

Significant Xrp Purchase Whale Transaction Sparks Market Speculation

May 07, 2025

Significant Xrp Purchase Whale Transaction Sparks Market Speculation

May 07, 2025

Latest Posts

-

Superman Faces Darkseids Legion July 2025 Dc Comic Solicitations

May 08, 2025

Superman Faces Darkseids Legion July 2025 Dc Comic Solicitations

May 08, 2025 -

Celebrating 85 Years Of Jimmy Olsen James Gunns Cryptic Daily Planet Photo And Potential Easter Egg

May 08, 2025

Celebrating 85 Years Of Jimmy Olsen James Gunns Cryptic Daily Planet Photo And Potential Easter Egg

May 08, 2025 -

Supermans Summer Special Kryptos Appearance Next Week

May 08, 2025

Supermans Summer Special Kryptos Appearance Next Week

May 08, 2025 -

Summer Of Superman Exclusive Preview Superman And Krypto

May 08, 2025

Summer Of Superman Exclusive Preview Superman And Krypto

May 08, 2025 -

Dont Miss It Superman Whistles To Krypto In Next Weeks Summer Of Superman Special

May 08, 2025

Dont Miss It Superman Whistles To Krypto In Next Weeks Summer Of Superman Special

May 08, 2025