The Future Of Chinese Plastics Imports: The Impact Of US Sanctions On Iran

Table of Contents

The US sanctions on Iran have significantly disrupted global trade, particularly impacting the supply of petrochemicals – a crucial component in plastics manufacturing. This ripple effect has profoundly altered the landscape of Chinese plastics imports, creating both challenges and opportunities. This article examines how these sanctions are reshaping the future of Chinese plastics imports, exploring the complexities and potential outcomes of this geopolitical shift.

Disrupted Supply Chains: The Impact on Chinese Plastics Manufacturers

Reduced Access to Iranian Petrochemicals

Chinese plastics manufacturers have historically relied heavily on Iranian petrochemicals, such as naphtha and ethylene, for their production processes. These materials offered a cost-effective and readily available source of raw materials, fueling the growth of China's plastics industry. However, US sanctions on Iran have drastically reduced the volume of Iranian petrochemical exports, creating a significant supply chain disruption. This shortage has led to:

- Increased prices: The reduced supply has driven up prices for alternative petrochemical sources, increasing the cost of production for Chinese manufacturers.

- Sourcing difficulties: Finding reliable and consistent alternative suppliers has proven challenging, leading to production delays and uncertainty.

- Production slowdowns: Many factories have experienced production slowdowns or even temporary closures due to the lack of essential raw materials.

- Potential factory closures: The sustained high cost of raw materials could force some smaller or less-efficient plastics manufacturers to close their operations.

Search for Alternative Suppliers

Faced with the shortfall from Iran, Chinese companies are actively seeking alternative suppliers of plastic raw materials. This search has led them to explore options in various regions, including:

- Saudi Arabia: Saudi Arabia, with its substantial petrochemical industry, has emerged as a key alternative supplier.

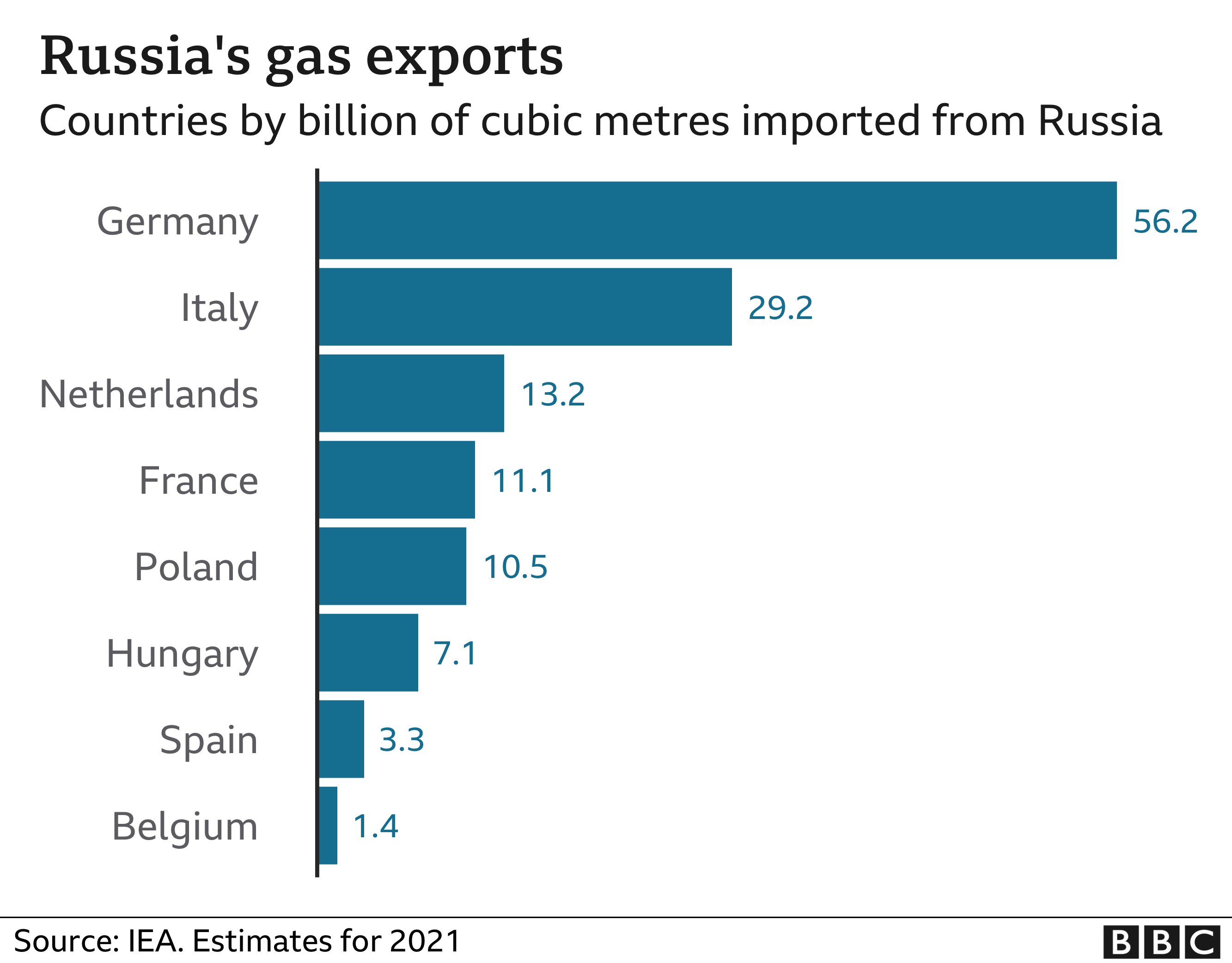

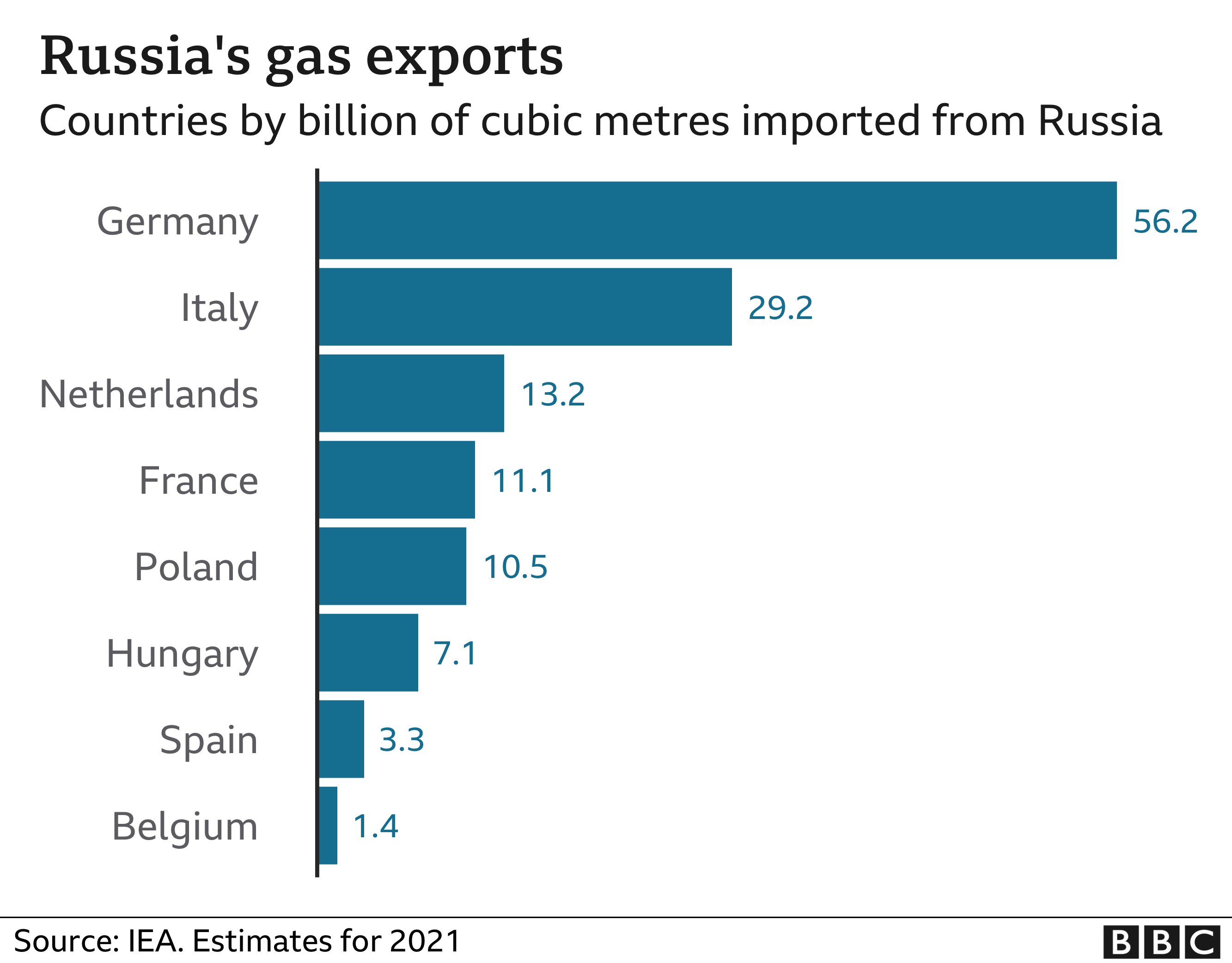

- Russia: Russia also offers a potential source, but logistical complexities and geopolitical considerations add layers of challenge.

- Southeast Asia: Countries in Southeast Asia are also attracting investment in petrochemical production, offering a more regionalized alternative.

However, shifting suppliers isn't without its challenges:

- Increased transportation costs: Sourcing from more distant locations significantly increases transportation costs, impacting overall production expenses.

- Potential for quality inconsistencies: The quality of petrochemicals can vary between suppliers, necessitating rigorous quality control measures.

- Negotiation complexities: Securing favorable contracts and negotiating prices with new suppliers requires significant effort and expertise.

- Longer lead times: Shipping from alternative locations can lead to considerably longer lead times, affecting production schedules and potentially delaying project deadlines.

Geopolitical Implications and Trade Diversification

The Strengthening of China-Iran Relations

Ironically, the US sanctions might inadvertently strengthen economic ties between China and Iran. Facing pressure from the West, China and Iran may deepen their economic cooperation in various sectors to offset the impact on plastics imports. This could manifest as:

- Increased bilateral trade in non-sanctioned goods: Increased trade in areas outside of petrochemicals could strengthen economic interdependence.

- Potential for joint ventures: Joint ventures in other industries could help both countries mitigate the economic impacts of sanctions.

- Investment in Iranian infrastructure: China might increase investment in Iranian infrastructure projects to further solidify its economic presence.

The Rise of Regional Petrochemical Hubs

The disruption caused by sanctions is accelerating the development of regional petrochemical hubs outside of Iran. Southeast Asia and the Middle East are likely to see significant investments in new petrochemical facilities, aiming to capitalize on the increased demand for plastic raw materials. This shift will:

- Increase investment in petrochemical facilities in alternative locations: Significant capital is flowing into the development of new facilities in these regions.

- Shift global supply dynamics: The global distribution of petrochemical production will become more geographically diversified.

- Competition for market share: The newly established hubs will compete with existing players, potentially leading to price fluctuations and increased competition.

Economic and Environmental Consequences

Price Volatility and Inflationary Pressures

The disruption in the supply chain is already causing price volatility in the Chinese plastics market. The increased cost of raw materials is directly affecting the prices of finished plastic products, leading to:

- Increased costs for consumers: Higher production costs are passed onto consumers in the form of higher prices for plastic goods.

- Potential for price hikes: The price of various consumer goods incorporating plastics will likely increase.

- Inflationary pressures on the Chinese economy: Widespread price increases can contribute to broader inflationary pressures within the Chinese economy.

Environmental Implications of Shifting Supply Chains

The search for alternative suppliers also raises significant environmental concerns. Sourcing materials from more distant locations will inevitably increase transportation distances, leading to:

- Increased carbon footprint from transportation: Longer shipping routes contribute to a larger carbon footprint associated with plastic production.

- Potential for lower environmental standards in alternative sourcing countries: Some alternative suppliers may have less stringent environmental regulations, potentially increasing pollution.

- Impact on waste management: The increased production and consumption of plastics could exacerbate waste management challenges in both China and the alternative sourcing countries.

Conclusion:

The US sanctions on Iran have undeniably created significant challenges for the future of Chinese plastics imports. The disruption of established supply chains, coupled with the need to find reliable alternative sources, presents a complex situation. While China is actively exploring new avenues and strengthening relationships with alternative suppliers, the long-term implications remain uncertain. The resulting price volatility, geopolitical shifts, and environmental considerations necessitate a cautious and strategic approach to securing a stable and sustainable supply of plastic raw materials. Understanding the evolving dynamics of the global plastic supply chain is paramount for navigating this intricate landscape. Staying informed about the complexities of Chinese plastics imports and the effects of US sanctions on Iran is crucial for all stakeholders involved.

Featured Posts

-

Warriors Pursuit Of Kevon Looney Nba Free Agency Update

May 07, 2025

Warriors Pursuit Of Kevon Looney Nba Free Agency Update

May 07, 2025 -

The Lotto Results For Wednesday 16th April 2025

May 07, 2025

The Lotto Results For Wednesday 16th April 2025

May 07, 2025 -

Xrp Price Poised For Record High As Grayscale Etf Awaits Sec Decision

May 07, 2025

Xrp Price Poised For Record High As Grayscale Etf Awaits Sec Decision

May 07, 2025 -

Can Germanys New Chancellor Reassert European Leadership

May 07, 2025

Can Germanys New Chancellor Reassert European Leadership

May 07, 2025 -

All 2025 Game Release Dates Ps 5 Ps 4 Xbox Pc And Nintendo Switch

May 07, 2025

All 2025 Game Release Dates Ps 5 Ps 4 Xbox Pc And Nintendo Switch

May 07, 2025

Latest Posts

-

Analisis Del Instituto De Cordoba Sobre La Salud Economica Del Central En El Gigante De Arroyito

May 08, 2025

Analisis Del Instituto De Cordoba Sobre La Salud Economica Del Central En El Gigante De Arroyito

May 08, 2025 -

Informe Sobre La Situacion Del Club Atletico Central Cordoba Perspectivas Desde El Gigante De Arroyito

May 08, 2025

Informe Sobre La Situacion Del Club Atletico Central Cordoba Perspectivas Desde El Gigante De Arroyito

May 08, 2025 -

Central Cordoba Analisis Del Estado De Salud Del Club En El Gigante De Arroyito

May 08, 2025

Central Cordoba Analisis Del Estado De Salud Del Club En El Gigante De Arroyito

May 08, 2025 -

El Estado De Salud Del Central En El Gigante De Arroyito Informe Del Instituto De Cordoba

May 08, 2025

El Estado De Salud Del Central En El Gigante De Arroyito Informe Del Instituto De Cordoba

May 08, 2025 -

Rogue One Star Reveals Thoughts On Beloved Character

May 08, 2025

Rogue One Star Reveals Thoughts On Beloved Character

May 08, 2025