The Fed And Interest Rates: A Look At Current Economic Conditions

Table of Contents

Current Inflationary Pressures and the Fed's Response

Inflation Data and Trends

Recent data from the Consumer Price Index (CPI) and Producer Price Index (PPI) paint a complex picture of inflation in the United States. Headline inflation, which includes all goods and services, has shown signs of cooling, but core inflation (excluding volatile food and energy prices) remains stubbornly high.

- Core inflation: Persistently elevated, indicating underlying inflationary pressures.

- Energy prices: Fluctuations in energy prices significantly impact headline inflation, creating volatility in the data.

- Food prices: Supply chain disruptions and geopolitical factors continue to drive food price increases.

- Future predictions: While some economists predict a continued slowdown in inflation, others warn of potential lingering inflationary pressures. The Federal Reserve's own predictions are subject to constant review and revision based on new economic data.

The Fed's Tools for Combating Inflation

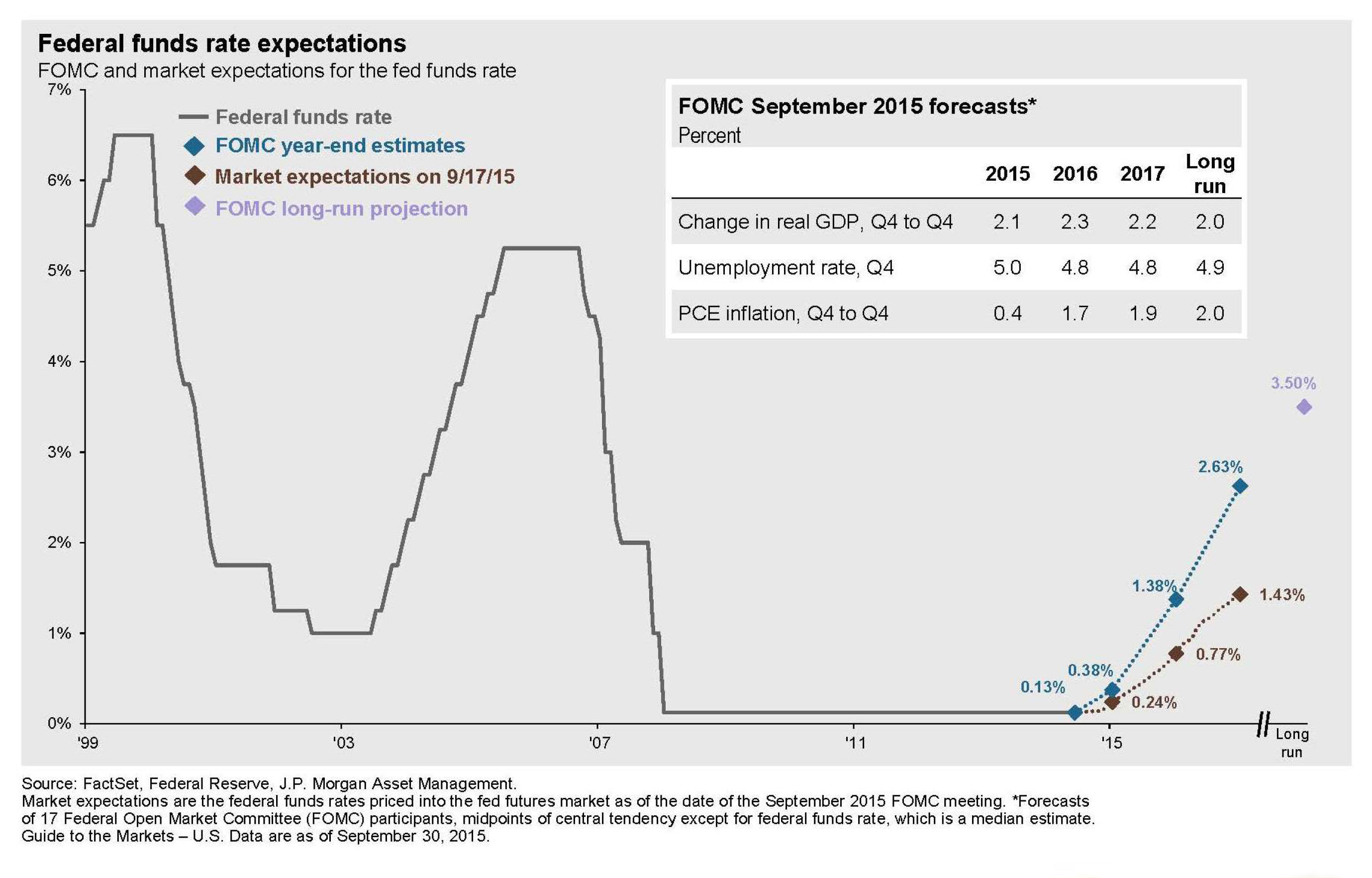

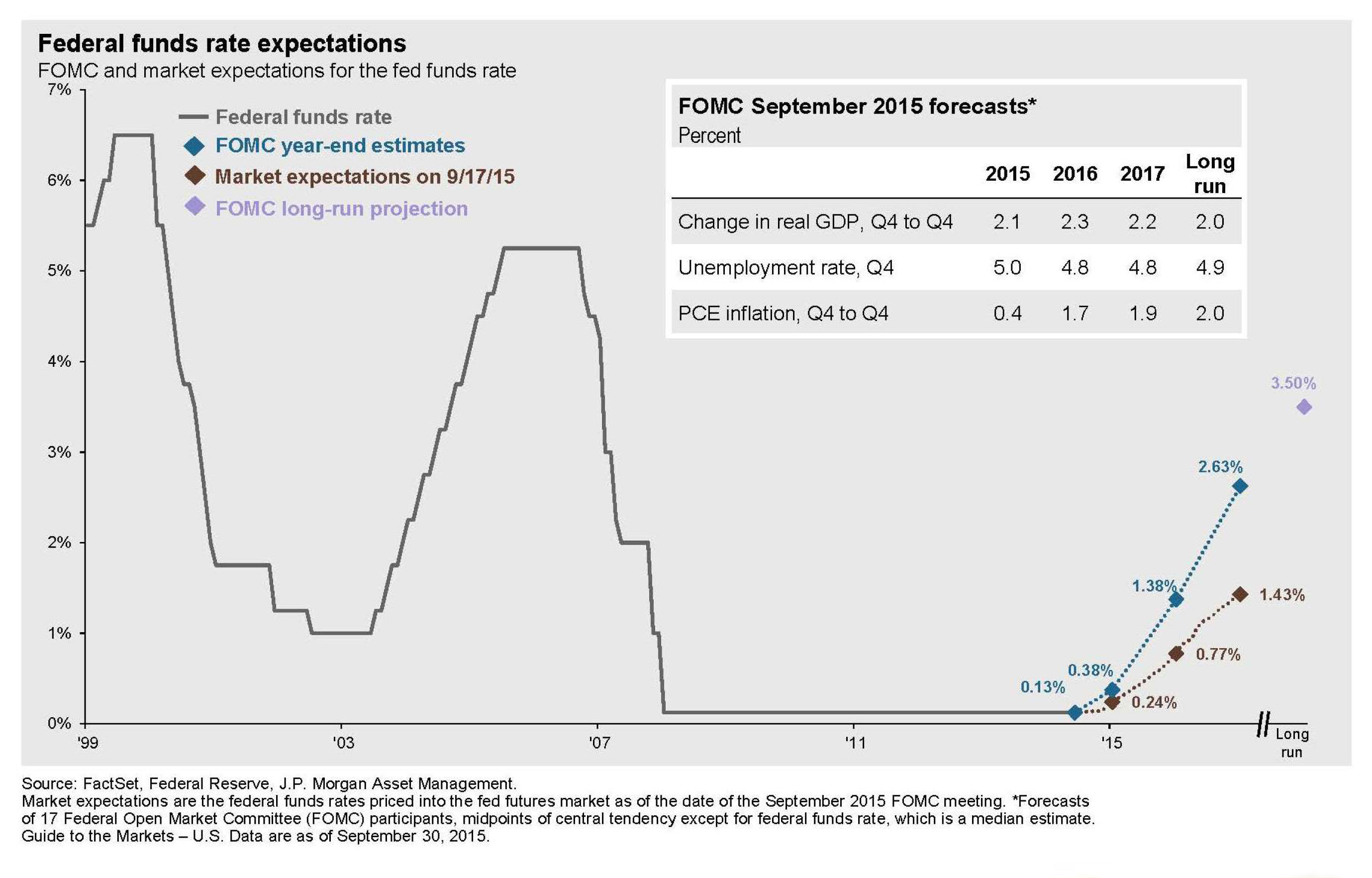

The Fed employs several tools to influence interest rates and combat inflation. The primary tool is adjusting the federal funds rate, the target rate banks charge each other for overnight loans. Other methods include quantitative tightening (QT), where the Fed reduces its holdings of Treasury securities and agency mortgage-backed securities.

- Federal Funds Rate: Increases in the federal funds rate directly increase borrowing costs for banks, which in turn pass these costs on to consumers and businesses through higher interest rates on loans and mortgages.

- Quantitative Tightening (QT): By reducing its balance sheet, the Fed aims to decrease the money supply, curbing inflationary pressures.

- Impact on borrowing costs: Higher interest rates increase the cost of borrowing for businesses, potentially slowing investment and economic growth. Consumers face higher interest rates on mortgages, auto loans, and credit cards.

- Lagged effects: Monetary policy changes have lagged effects; it often takes several months for the full impact of interest rate adjustments to be felt throughout the economy.

Unemployment and its Relationship to Interest Rate Decisions

Current Unemployment Rates and Trends

The unemployment rate currently sits at [Insert Current Unemployment Rate and Source], a [Describe the trend - e.g., relatively low level/increase/decrease] compared to previous years. Jobless claims, a measure of newly filed unemployment insurance claims, provide a real-time indication of labor market dynamics. Labor force participation rates are also important indicators of the overall health of the employment sector.

- Phillips Curve: The relationship between inflation and unemployment, often depicted by the Phillips Curve, suggests a trade-off between the two – lower unemployment often coincides with higher inflation and vice-versa.

- Interest rate hikes and employment: Aggressive interest rate hikes can lead to job losses as businesses reduce investment and hiring in response to higher borrowing costs.

- Unemployment metrics: Different metrics, such as U-3 (official unemployment rate), U-6 (includes discouraged workers and part-time workers who want full-time employment), provide a more comprehensive view of the labor market.

The Fed's Balancing Act

The Fed faces the challenge of balancing inflation control with the goal of full employment. Raising interest rates too aggressively risks triggering a recession and increasing unemployment, while failing to adequately control inflation can lead to long-term economic instability.

- Recession risk: Aggressive interest rate hikes increase the risk of a recession, as businesses cut back on investments and hiring.

- Impact on the job market: Different interest rate scenarios have varied impacts on job creation and unemployment rates. The Fed aims for a "soft landing," where inflation is brought under control without causing a significant economic downturn.

- Soft landing: This ideal scenario is difficult to achieve, as it requires precise calibration of monetary policy.

Economic Growth and the Outlook for Interest Rates

GDP Growth and its Determinants

Recent GDP growth figures [Insert Recent GDP Growth Data and Source] reveal [Describe the trend - e.g., a slowdown/strong growth/contraction] in economic activity. Several factors influence GDP growth, including consumer spending, business investment, and government spending.

- Consumer spending: Consumer confidence and spending play a significant role in driving economic growth.

- Business investment: Investment in new equipment, technology, and expansion is crucial for long-term economic growth.

- Government spending: Government policies and spending can stimulate or dampen economic activity.

- Geopolitical instability and supply chain disruptions: These factors pose significant risks to sustained economic growth.

Predicting Future Interest Rate Movements

Predicting future interest rate movements is inherently challenging, as it depends on various economic indicators and the Fed's assessment of the economic outlook. Several scenarios are possible, including further interest rate hikes, rate cuts, or a pause in rate adjustments.

- Further rate hikes: If inflation remains stubbornly high, the Fed may continue raising interest rates.

- Rate cuts: If economic growth slows significantly or inflation falls substantially, the Fed may consider cutting interest rates to stimulate economic activity.

- Uncertainty and risks: Unforeseen events, such as geopolitical instability or unexpected economic shocks, can significantly alter the economic outlook and influence the Fed's decisions.

- Economic indicators: Key indicators such as inflation data, unemployment figures, and GDP growth will provide insights into the future trajectory of interest rates.

Conclusion

This article explored the intricate relationship between The Fed and Interest Rates, highlighting their impact on inflation, unemployment, and economic growth. The Fed's decisions regarding interest rates represent a delicate balancing act, aiming for price stability while fostering sustainable economic expansion. Understanding this interplay is critical for informed personal financial decisions and investment strategies. The future direction of interest rates remains uncertain, contingent upon evolving economic conditions and the Fed's continuous evaluation of the situation.

Call to Action: Stay informed about the latest developments concerning The Fed and Interest Rates to make sound financial decisions. Continue to follow our analysis for updates and insights into how these crucial factors are shaping the current economic climate and influencing the markets. Regularly check our site for further analysis on The Fed and Interest Rates and related economic topics.

Featured Posts

-

Investigating Us Funding For Transgender Animal Research Studies

May 10, 2025

Investigating Us Funding For Transgender Animal Research Studies

May 10, 2025 -

Understanding Abcs Decision To Air High Potential Repeats In March 2025

May 10, 2025

Understanding Abcs Decision To Air High Potential Repeats In March 2025

May 10, 2025 -

The Mystery Of The Epstein Client List Pam Bondis Role

May 10, 2025

The Mystery Of The Epstein Client List Pam Bondis Role

May 10, 2025 -

Celebrity Stylist Elizabeth Stewart Designs Exclusive Line With Lilysilk

May 10, 2025

Celebrity Stylist Elizabeth Stewart Designs Exclusive Line With Lilysilk

May 10, 2025 -

Lake Charles Easter Weekend A Lineup Of Live Music And Events

May 10, 2025

Lake Charles Easter Weekend A Lineup Of Live Music And Events

May 10, 2025