The Fallout From The Trade War: A Canadian Aluminum Trader's Collapse

Table of Contents

The Impact of US Tariffs on Canadian Aluminum Exports

Increased Costs and Reduced Competitiveness

US tariffs on Canadian aluminum exports directly increased the cost of doing business for Canadian producers. These tariffs, implemented as part of broader trade disputes, acted as a significant barrier to entry in the US market, a crucial destination for Canadian aluminum. This led to several negative consequences:

- Increased Transportation Costs: To circumvent tariffs or find alternative markets, companies like North Star Aluminum were forced to utilize longer, more expensive shipping routes, significantly impacting their bottom line.

- Reduced Market Share: Facing higher prices compared to competitors from countries without tariffs imposed upon them, Canadian aluminum producers, including North Star, experienced a dramatic loss of market share in the US and other international markets.

- Impact on Pricing Strategies: The increased costs forced companies to either absorb the losses, impacting profitability, or raise prices, further hindering competitiveness in the global marketplace. This price squeeze made it difficult for Canadian companies to remain profitable.

Keywords: US tariffs, Canadian aluminum exports, global competitiveness, trade barriers, aluminum prices.

Disruption of Supply Chains

The imposition of US tariffs also caused significant disruption to established supply chains. The reliance on the US market meant that Canadian companies, particularly those specializing in aluminum, had to scramble to find alternative avenues for their product.

- Increased Lead Times: Finding new markets and establishing new logistical routes added significant lead times, delaying deliveries and frustrating customers.

- Higher Transportation Costs (reiterated): As mentioned, the shift in logistics increased transportation expenses, adding to the overall cost of production and delivery.

- Impact on Production Schedules: The uncertainty created by disrupted supply chains impacted production schedules and created significant challenges for businesses trying to maintain consistent operations.

Keywords: supply chain disruption, logistics, international trade, import/export, aluminum supply chain.

The Financial Strain on North Star Aluminum and Similar Businesses

Declining Revenue and Profitability

The combined effect of increased costs and reduced market access led to a dramatic decline in North Star Aluminum's revenue and profitability. While precise financial data may not be publicly available due to bankruptcy proceedings, it's evident that the company faced insurmountable challenges:

- Decreased Profits: The increased costs coupled with reduced sales volume inevitably led to significantly decreased profits, making it difficult to cover operational expenses.

- Debt Accumulation: To maintain operations, North Star Aluminum likely took on additional debt, further exacerbating the financial strain.

- Credit Rating Downgrades: The company's worsening financial situation almost certainly resulted in credit rating downgrades, making it even harder to secure financing and ultimately contributing to its collapse.

Keywords: financial instability, declining revenue, bankruptcy, profitability, aluminum market, financial distress.

Job Losses and Economic Ripple Effects

The collapse of North Star Aluminum had significant consequences for employment and the broader Canadian economy.

- Number of Job Losses: The closure resulted in the direct loss of numerous jobs at North Star and related businesses, impacting families and communities reliant on the company.

- Impact on Related Industries: The ripple effect extended to related industries, including transportation, logistics, and manufacturing, further magnifying the economic impact.

- Regional Economic Consequences: The closure of a major employer in any region causes significant regional economic consequences, potentially impacting local businesses, tax revenues, and community development.

Keywords: job losses, economic impact, regional development, unemployment, ripple effect, aluminum industry jobs.

Government Response and Future Implications for the Canadian Aluminum Industry

Government Aid and Support Measures

In response to the challenges faced by the Canadian aluminum industry, the government implemented various support measures. These initiatives aimed to mitigate the impact of trade wars and help businesses navigate the difficult economic climate.

- Types of Aid: These may have included subsidies, tax breaks, loan guarantees, and other financial assistance programs.

- Effectiveness of Measures: The effectiveness of these measures varies and remains subject to ongoing debate and economic analysis.

- Long-Term Sustainability: The long-term sustainability of the Canadian aluminum industry requires sustained government support and a proactive approach to diversifying markets and building resilient supply chains.

Keywords: government intervention, economic stimulus, trade policy, industry support, Canadian government aid.

Long-Term Strategies for Trade Diversification and Resilience

The North Star Aluminum collapse emphasizes the need for the Canadian aluminum industry to adapt and become more resilient to future trade shocks.

- Strategies for Market Diversification: Canadian businesses need to actively pursue new export markets, reducing reliance on any single trading partner.

- Investing in Infrastructure: Investments in modernizing infrastructure, including transportation and logistics, are crucial for maintaining competitiveness.

- Enhancing Competitiveness: Continuous investment in research and development, and efficiency improvements, is vital for maintaining a competitive edge in the global marketplace.

- Building Strategic Alliances: Forming strategic alliances with international partners can enhance market access and supply chain resilience.

Keywords: trade diversification, supply chain resilience, risk management, global trade strategy, aluminum industry future.

Conclusion: Lessons Learned from the Canadian Aluminum Trader's Collapse

The collapse of North Star Aluminum serves as a cautionary tale, illustrating the devastating effects of trade wars on Canadian businesses and the broader economy. The increased costs, disrupted supply chains, and subsequent job losses highlight the vulnerability of Canadian industries reliant on international trade. Understanding the fallout from the trade war, as exemplified by this Canadian aluminum trader's collapse, is crucial. Stay informed about the ongoing impact of trade policies on Canadian businesses and advocate for policies that foster a stable and prosperous aluminum industry. Support Canadian businesses and help build a more resilient and diversified Canadian economy. Learn more about the impact of trade wars and how to support Canadian aluminum producers by researching government initiatives and industry advocacy groups.

Featured Posts

-

Teenagers Arrested For Attack On 16 Year Old In Hate Crime

May 29, 2025

Teenagers Arrested For Attack On 16 Year Old In Hate Crime

May 29, 2025 -

Stranger Things Season 5 Fans Demand A Release Date Announcement

May 29, 2025

Stranger Things Season 5 Fans Demand A Release Date Announcement

May 29, 2025 -

Frances New Crackdown Confiscation Of Phones From Drug Users And Dealers

May 29, 2025

Frances New Crackdown Confiscation Of Phones From Drug Users And Dealers

May 29, 2025 -

Analisis Del Presente De Victor Fernandez

May 29, 2025

Analisis Del Presente De Victor Fernandez

May 29, 2025 -

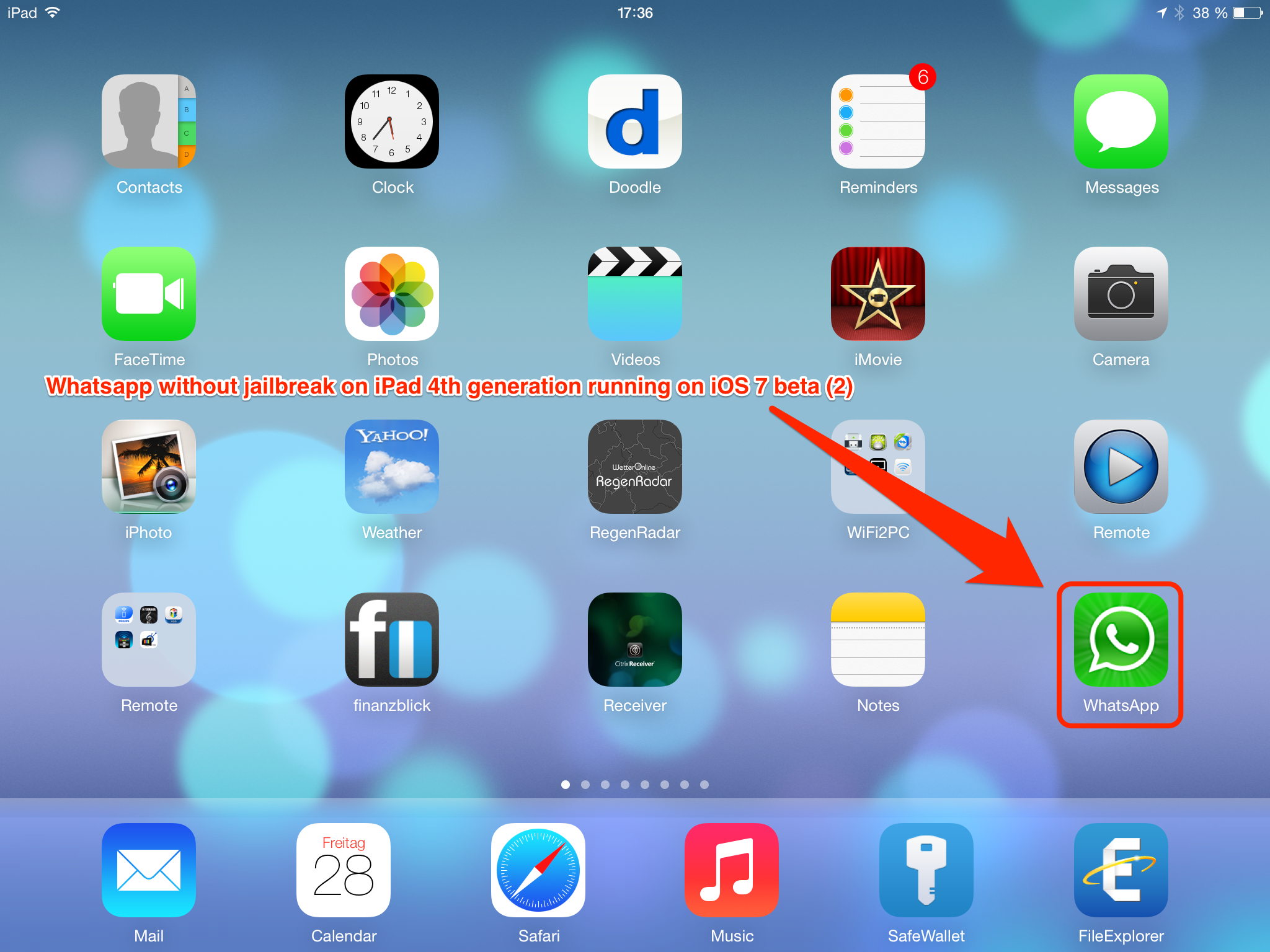

Whats App I Pad App 15 Years In The Making

May 29, 2025

Whats App I Pad App 15 Years In The Making

May 29, 2025

Latest Posts

-

World News Banksy Artwork Unveiled In Dubai For The First Time

May 31, 2025

World News Banksy Artwork Unveiled In Dubai For The First Time

May 31, 2025 -

World News Banksy Artwork Makes Its Dubai Premiere

May 31, 2025

World News Banksy Artwork Makes Its Dubai Premiere

May 31, 2025 -

One Year Of Banksy Print Sales A 22 777 000 Analysis

May 31, 2025

One Year Of Banksy Print Sales A 22 777 000 Analysis

May 31, 2025 -

Banksy In Dubai First Ever Showcase Of Artworks

May 31, 2025

Banksy In Dubai First Ever Showcase Of Artworks

May 31, 2025 -

The Banksy Effect 22 777 000 Generated From Print Sales In 12 Months

May 31, 2025

The Banksy Effect 22 777 000 Generated From Print Sales In 12 Months

May 31, 2025