The €18 Million Question: Investigating A Deutsche Bank London Fixed Income Bonus

Table of Contents

The recent revelation of an €18 million bonus paid to a Deutsche Bank employee in its London fixed income division has sparked intense debate and scrutiny. This eye-watering sum raises questions about executive compensation, regulatory oversight, and the ethical considerations within the high-stakes world of investment banking. This article delves into the details surrounding this controversial bonus payment, exploring its implications and wider context within the financial industry. We will examine the context of the fixed income market, scrutinize the justification for the €18 million payment, explore the potential regulatory consequences, and discuss the wider implications for executive compensation and ethical considerations in banking.

<h2>The Context: Understanding the Fixed Income Market and Deutsche Bank's Position</h2>

The fixed income market encompasses a vast array of debt securities, including government bonds, corporate bonds, and other debt instruments. This market is characterized by its inherent risks and rewards. High-yield bonds, for example, offer potentially higher returns but carry greater default risk. Sophisticated trading strategies, often leveraging complex derivatives, are employed to manage risk and generate profits. The success or failure of these strategies can significantly impact profitability, leading to substantial bonuses in good years and potentially heavy losses in bad years.

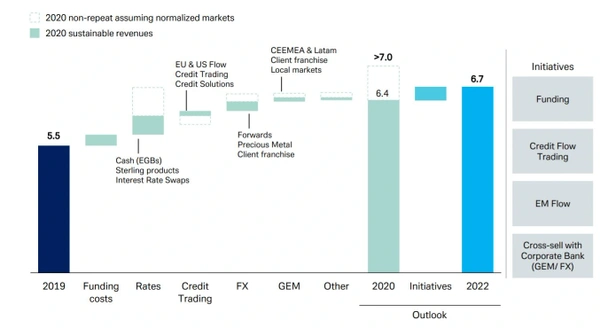

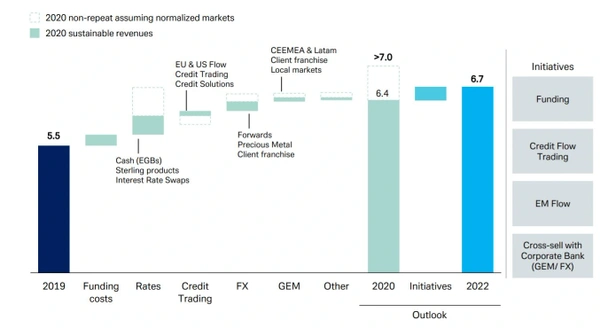

Deutsche Bank, a global banking giant, has a significant presence in the fixed income market. In recent years, the bank has undergone a period of restructuring, focusing on streamlining operations and reducing costs. This restructuring has involved shedding certain business lines and focusing on core strengths. The employee who received the €18 million bonus likely held a senior position within the fixed income division, potentially managing a large trading portfolio or overseeing a specific team. Their responsibilities would have involved significant risk management, strategic decision-making, and the generation of substantial revenue for the bank.

- High-risk, high-reward nature of fixed income trading: Profits can be substantial, but so can losses. Market volatility and unpredictable events can significantly impact results.

- Deutsche Bank's restructuring efforts and cost-cutting measures: These efforts may have influenced the decision-making process related to bonus allocation.

- Potential conflicts of interest related to bonus structures: Incentives to take on excessive risk need to be carefully balanced against the potential for losses.

- Market volatility and its impact on bonus calculations: A particularly volatile year might lead to significantly higher (or lower) bonuses depending on performance.

<h2>The €18 Million Bonus: Scrutinizing the Payment and its Justification</h2>

The circumstances surrounding the €18 million bonus payment remain largely undisclosed. However, it is likely that the payment was based on a combination of factors, including the employee's individual performance, the overall performance of their team, and the overall profitability of Deutsche Bank's fixed income division. The metrics used to justify such a large bonus are likely to be a significant point of contention. Did these metrics accurately reflect true risk-adjusted performance, or were other factors at play?

Several questions need to be addressed: Were specific, pre-defined performance targets actually met, or was the bonus awarded based on subjective assessments? How does this bonus compare to compensation packages at other major investment banks for similar roles? Were there any potential breaches of internal policies or regulatory guidelines regarding executive compensation?

- Specific performance targets achieved (or not achieved): Transparency is key in understanding the justification for this substantial bonus.

- Comparison with bonuses paid to similar roles in competing banks: Market benchmarks are necessary to determine whether this bonus is truly exceptional or simply excessive.

- Potential breaches of internal policies or regulatory guidelines: Internal regulations and compliance with external laws must be carefully examined.

- Public and media reaction to the news: The overwhelmingly negative public response suggests a failure in communication and potentially ethical considerations.

<h3>Regulatory Scrutiny and Potential Consequences</h3>

Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK, play a crucial role in overseeing executive compensation in the financial industry. They aim to prevent excessive risk-taking and ensure that bonus structures align with responsible risk management. The €18 million bonus payment is likely to face intense regulatory scrutiny. Investigations may focus on whether the bonus payment complied with all applicable laws and regulations and whether it encouraged excessive risk-taking within the bank.

- Investigations by the Financial Conduct Authority (FCA) or other relevant bodies: A formal investigation might lead to penalties for both Deutsche Bank and the employee.

- Potential fines or penalties for Deutsche Bank: Non-compliance with regulations can result in hefty fines.

- Reputational damage to the bank and its employees: Such controversies negatively impact public trust and can hurt the bank’s brand.

- Impact on future compensation strategies: This incident may prompt a review of Deutsche Bank's bonus structure and possibly more stringent regulatory oversight.

<h2>Wider Implications: Executive Compensation and Ethical Considerations in Banking</h2>

The €18 million bonus exemplifies a broader debate surrounding excessive executive compensation in the financial industry. This debate often centers around the question of whether such large payouts are justified given the inherent risks involved in investment banking and the potential for systemic crises. Critics argue that these excessive bonuses incentivize short-term gains over long-term stability and responsible risk management. The ethical implications are significant, especially in the wake of previous financial crises where excessive risk-taking played a key role.

- The role of shareholder activism in influencing executive compensation: Shareholders have an increasing role in holding banks accountable for compensation practices.

- Calls for greater transparency and accountability in bonus structures: More transparent methods for determining bonuses are needed to prevent controversy.

- The potential for misaligned incentives leading to risky behavior: Bonuses must be aligned with long-term value creation and sustainable business practices.

- The need for stronger ethical guidelines within the banking sector: A robust ethical framework is vital to restore and maintain public trust.

<h2>Conclusion</h2>

The €18 million bonus paid to a Deutsche Bank employee highlights the ongoing debate surrounding executive compensation in the financial industry. This case raises critical questions about transparency, accountability, and the ethical considerations inherent in high-stakes fixed income trading. While the full implications remain to be seen, the scrutiny surrounding this incident underscores the need for stricter regulations and a greater focus on aligning executive incentives with long-term shareholder value and responsible risk management. Understanding the complexities surrounding this €18 million Deutsche Bank London fixed income bonus is crucial to fostering a more ethical and sustainable financial landscape. Further investigation and analysis are needed to fully understand the context and implications of this significant payment, ensuring such controversies are avoided in the future. The issue of excessive executive compensation, particularly within the context of high-risk fixed income trading, demands continued attention and reform to prevent future scandals involving large bonus payouts at institutions like Deutsche Bank.

Featured Posts

-

Des Moines School District Halts Central Campus Agriscience Program

May 30, 2025

Des Moines School District Halts Central Campus Agriscience Program

May 30, 2025 -

Copper Box Arena Hosts House Of Kong The Gorillaz Exhibition This Summer

May 30, 2025

Copper Box Arena Hosts House Of Kong The Gorillaz Exhibition This Summer

May 30, 2025 -

Nieuwe Trainer Gezocht Augsburg Na Ontslag Thorup

May 30, 2025

Nieuwe Trainer Gezocht Augsburg Na Ontslag Thorup

May 30, 2025 -

The Trump Administration And The Future Of Russia Sanctions

May 30, 2025

The Trump Administration And The Future Of Russia Sanctions

May 30, 2025 -

Jacob Alon Fairy In A Bottle The Latest Popular Song

May 30, 2025

Jacob Alon Fairy In A Bottle The Latest Popular Song

May 30, 2025