The Dark Side Of Prediction Markets: Analyzing The Los Angeles Wildfires Example

Table of Contents

Information Asymmetry and the Los Angeles Wildfires

Information asymmetry, a fundamental market imperfection, significantly impacts the accuracy and fairness of prediction markets. In the context of the Los Angeles wildfires, this becomes particularly problematic.

Unequal Access to Information

Not all participants have equal access to crucial data about wildfire risk factors. This imbalance creates skewed predictions favoring those with privileged information.

- Insider information: Information from fire departments or insurance companies regarding specific high-risk zones or the severity of potential wildfires could significantly influence market prices, giving certain players an unfair advantage.

- Lack of public data: The absence of readily available, comprehensive public data on specific at-risk areas in Los Angeles creates an uneven playing field. This lack of transparency benefits those with access to specialized data sources.

- Biased predictions: This asymmetry inevitably leads to inaccurate predictions that reflect the biases and superior knowledge of the better-informed participants, distorting the market's overall predictive power.

The Role of Expert Opinion

While expert opinions are valuable, their integration into prediction markets doesn't guarantee accuracy. Experts, too, can be subject to biases and manipulation.

- Conflicting interests: Experts might possess personal interests influencing their predictions, such as financial incentives tied to specific outcomes or reputational concerns. This could lead to them providing skewed information.

- Weighting of opinions: The market's weighting of expert opinions might not accurately reflect their actual predictive accuracy, leading to mispricing and inaccurate forecasts.

- Expert disagreement: Disagreement among experts, a common occurrence in complex scenarios like wildfire prediction, introduces market volatility and uncertainty, hindering accurate forecasting.

Manipulation and Speculation in Prediction Markets

The potential for profit in prediction markets incentivizes manipulation and speculation, particularly in high-stakes events like wildfires.

Market Manipulation and the Wildfire Context

Individuals or groups can manipulate the market by spreading misinformation or engaging in coordinated trading to artificially inflate or deflate prices. This can lead to significant consequences.

- Spreading false rumors: False rumors about the timing or severity of impending wildfires could drive up prices on related assets, such as insurance policies or evacuation-related services, allowing manipulators to profit from the ensuing panic.

- Exploiting market vulnerabilities: The potential for significant profit incentivizes malicious actors to identify and exploit market vulnerabilities, potentially causing substantial financial harm to others.

- Regulatory necessity: Robust regulatory oversight is crucial to deter such market manipulation and ensure the integrity of prediction markets.

The Ethical Concerns of "Disaster Betting"

The very act of predicting and profiting from disasters raises ethical concerns regarding the commodification of human suffering.

- Moral objections: Many find it morally objectionable to profit from the misfortune of others, especially when dealing with events like wildfires that cause widespread devastation and human suffering.

- Social responsibility: This raises concerns about the social responsibility of prediction market participants and the designers of these markets. A careful consideration of the ethical implications is vital.

- Ethical guidelines and regulations: Discussions about establishing comprehensive ethical guidelines and regulations for prediction markets are essential to mitigate these concerns.

Limitations of Prediction Markets in Complex Events

Prediction markets are not equally effective in forecasting all types of events. The complexity of wildfires presents significant challenges.

Unpredictability of Natural Disasters

Wildfires are inherently complex events influenced by numerous intertwined factors, making accurate prediction incredibly difficult, even with advanced models.

- Inherent uncertainty: Prediction markets might struggle to accurately reflect the inherent uncertainty and complexity of wildfires, leading to inaccurate forecasts.

- Complacency and resource allocation: Overreliance on prediction markets for disaster preparedness could lead to complacency or inadequate resource allocation, potentially worsening the impact of an actual wildfire.

- Complementary forecasting methods: Other forecasting methods, such as statistical modeling and expert judgment, should be used alongside prediction markets to create a more robust and reliable forecasting system.

The Problem of Cascading Effects

Prediction markets often fail to capture the cascading effects of events. A wildfire can trigger power outages, road closures, and widespread economic disruption – consequences difficult to fully predict within a market.

- Interconnectedness of factors: The complex interconnection of various factors makes accurate forecasting exceptionally challenging.

- Underestimation of severity: The market might significantly underestimate the potential severity and scope of the consequences of a wildfire, leading to inadequate preparedness.

- Limited risk assessment: This limitation reduces the usefulness of prediction markets for comprehensive risk assessment and effective disaster management.

Conclusion

While prediction markets can offer valuable insights, the Los Angeles wildfires example highlights their limitations and potential downsides. Information asymmetry, manipulation, the ethical implications of "disaster betting," and the inherent unpredictability of complex events like wildfires pose significant challenges. Therefore, developing robust regulatory frameworks and ethical guidelines is vital to mitigate these risks and ensure the responsible development and application of prediction markets. Further research and discussion are essential for minimizing the "dark side" of these tools and ensuring their responsible use in forecasting natural disasters.

Featured Posts

-

Benny Blanco Cheating Scandal 10 Photos And What They Reveal

May 12, 2025

Benny Blanco Cheating Scandal 10 Photos And What They Reveal

May 12, 2025 -

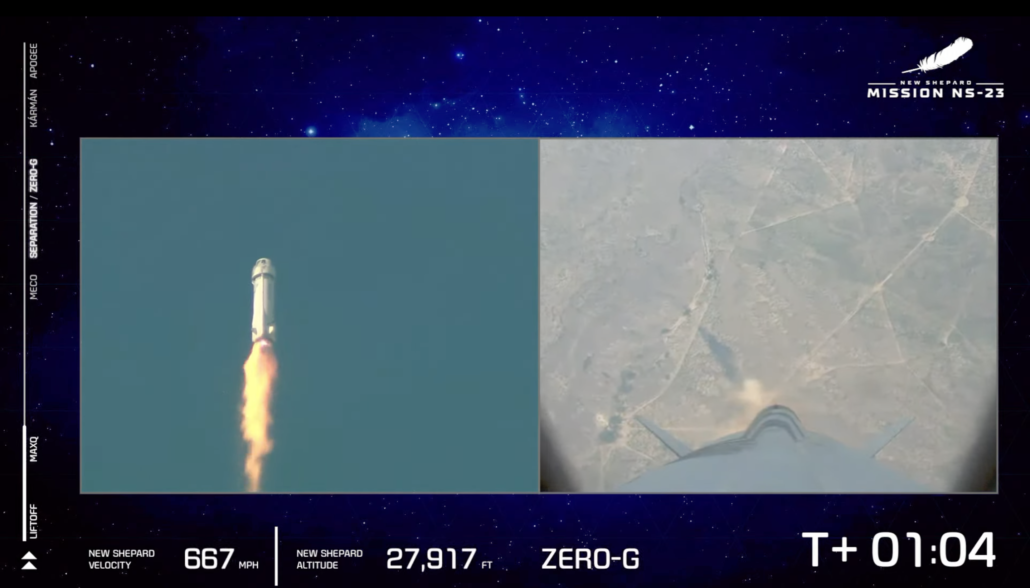

Blue Origins Rocket Launch Abruptly Halted By Technical Issue

May 12, 2025

Blue Origins Rocket Launch Abruptly Halted By Technical Issue

May 12, 2025 -

Figmas Ceo On The Future Of Ai A New Approach

May 12, 2025

Figmas Ceo On The Future Of Ai A New Approach

May 12, 2025 -

Manon Fiorot A Fighters Ascent

May 12, 2025

Manon Fiorot A Fighters Ascent

May 12, 2025 -

Dzhonson Proti Trampa Rizni Strategiyi Dosyagnennya Miru V Ukrayini

May 12, 2025

Dzhonson Proti Trampa Rizni Strategiyi Dosyagnennya Miru V Ukrayini

May 12, 2025

Latest Posts

-

Dodgers Vs Cubs Game Prediction Analyzing The La Unbeaten Streak

May 13, 2025

Dodgers Vs Cubs Game Prediction Analyzing The La Unbeaten Streak

May 13, 2025 -

Dodgers Pursuit Of Next Mlb Luxury Free Agent What We Know

May 13, 2025

Dodgers Pursuit Of Next Mlb Luxury Free Agent What We Know

May 13, 2025 -

Cubs At Dodgers Prediction Can The Cubs Upset The Home Team

May 13, 2025

Cubs At Dodgers Prediction Can The Cubs Upset The Home Team

May 13, 2025 -

Dodgers Vs Cubs Prediction Home Field Advantage For Los Angeles

May 13, 2025

Dodgers Vs Cubs Prediction Home Field Advantage For Los Angeles

May 13, 2025 -

Dodgers Reportedly Planning Bid For Top Mlb Free Agent

May 13, 2025

Dodgers Reportedly Planning Bid For Top Mlb Free Agent

May 13, 2025