The Changing Face Of X: A Deep Dive Into The Latest Financial Data From Musk's Debt Sale

Table of Contents

The Debt Sale: Terms, Conditions, and Key Players

The details of Musk's X debt sale are crucial to understanding its impact. Securing the necessary funds to acquire X required a complex financing strategy involving a mix of debt instruments.

Details of the Debt Financing:

The exact figures surrounding the debt sale remain partially opaque, but reports indicate a significant amount borrowed to finance the acquisition and subsequent operations. Understanding the terms is paramount to analyzing the overall financial health of X.

- Total debt amount secured: While the precise figure isn't publicly available, estimates place it in the billions of dollars.

- Interest rates and associated costs: High-interest rates likely accompany such a large loan, placing significant pressure on X's cash flow and profitability.

- Maturity dates and repayment schedule: The repayment schedule is another critical factor, with shorter-term debt exerting more immediate pressure than long-term loans.

- Key lenders and their involvement: A mix of banks, private equity firms, and potentially even high-net-worth individuals likely participated in the financing. Identifying these lenders helps assess the potential influence they might exert on X's future decisions.

- Potential risks associated with the debt structure: The high debt levels expose X to significant financial risks, including the possibility of default if revenue projections fail to materialize.

Analysis: The terms of Musk's X debt sale paint a picture of substantial financial leverage. The high debt levels coupled with interest payments create significant pressure on X's ability to achieve profitability and financial stability.

Impact on X's Financial Performance: A Data-Driven Analysis

The debt sale has profoundly affected X's financial performance, necessitating a close examination of its revenue streams, cost structure, and overall financial health.

Revenue Projections and Growth Strategies:

X's revenue streams rely heavily on advertising, subscriptions, and potentially other avenues like e-commerce integration. The debt burden necessitates aggressive revenue growth strategies to meet debt obligations.

- Pre- and post-debt sale revenue comparisons: Analyzing revenue figures before and after the acquisition provides a clear picture of the impact. Publicly available financial statements (if any) should be consulted for this information.

- Analysis of key financial metrics (e.g., EBITDA, net income): Key performance indicators like EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and net income show X's profitability and ability to service its debt.

- Projected growth trajectories under different scenarios: Modeling various scenarios (e.g., increased advertising revenue, successful subscription growth) allows for a clearer picture of X's financial outlook.

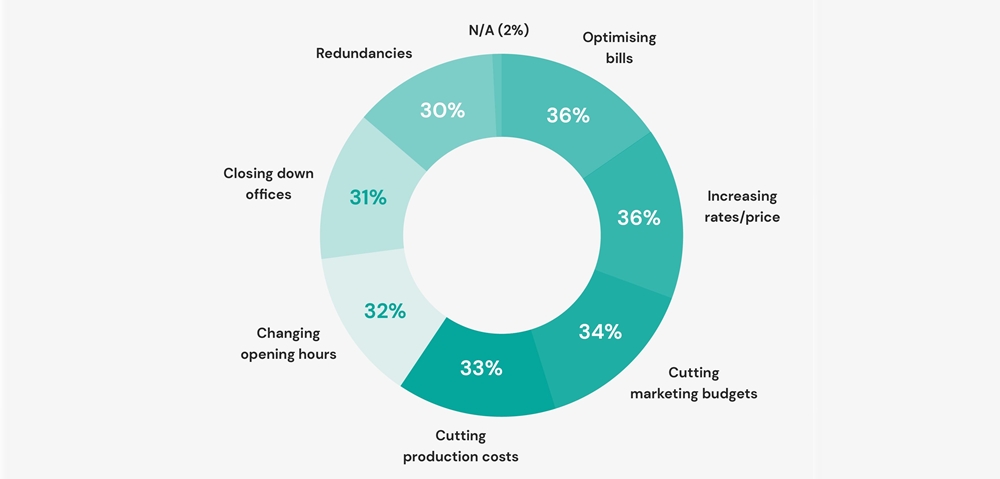

- Discussion of cost-cutting measures implemented: Musk's focus on efficiency and cost reduction is likely to play a significant role in X's ability to manage its debt burden.

Analysis: X needs to significantly increase its revenue streams to alleviate the pressure from its substantial debt. The success of its cost-cutting measures and growth strategies will be crucial in determining its long-term financial health.

Market Reaction and Investor Sentiment Following the Debt Sale

The market's reaction to Musk's X debt sale offers valuable insights into investor sentiment and the perceived risks associated with the platform's future.

Stock Market Performance (if applicable):

If X were a publicly traded company, analyzing its stock price fluctuations after the debt sale would be a critical indicator of investor confidence.

Analyst Ratings and Predictions:

Financial analysts' assessments of the debt sale's implications provide further insights into market expectations and potential future performance.

- Stock price changes before, during, and after the announcement: Charting stock price movements illustrates the market's response to the news.

- Summary of key analyst ratings and reports: Collecting and summarizing analyst ratings provides a consensus view on X's prospects.

- Investor confidence levels and market sentiment: Gauging investor sentiment helps understand the market's perception of the risks and opportunities associated with the debt.

- Comparison to industry benchmarks: Comparing X's performance to competitors provides context and identifies areas of strength and weakness.

Analysis: The market reaction reflects the collective judgment of investors regarding the risks and rewards associated with X's financial position after the debt sale.

Strategic Implications and Future Outlook for X

Musk's long-term vision for X, coupled with the realities of its significant debt burden, will shape its strategic direction and future outlook.

Musk's Long-Term Vision for X:

Musk's ambitious plans for X will influence its strategic priorities and growth trajectory.

Potential Acquisitions and Partnerships:

The debt sale might influence X's pursuit of acquisitions or partnerships to expand its reach and revenue streams.

- Musk's stated goals for X's future: Understanding Musk's vision helps interpret X's strategic choices and investment priorities.

- Potential areas for expansion or diversification: Identifying potential growth areas highlights the opportunities available to X.

- Opportunities and challenges presented by the debt: The debt presents both challenges and opportunities – strategic choices must address both.

- Long-term financial sustainability and profitability: The ultimate success depends on X's ability to achieve long-term financial stability.

Analysis: The future of X hinges on Musk's ability to successfully execute his vision while navigating the challenges posed by the massive debt he took on.

Conclusion: The Future of X After the Debt Sale: A Summary and Call to Action

Musk's X debt sale has fundamentally reshaped X's financial landscape. The high debt levels, the market's reaction, and the ongoing need for aggressive growth strategies all point towards a period of significant change and uncertainty. The analysis of X financial data reveals a company under considerable pressure to deliver on ambitious revenue projections while managing a substantial debt burden.

The long-term success of X, and the fulfillment of Musk's vision, depends critically on managing this debt effectively and achieving robust revenue growth. This hinges on strategic decision-making and a successful execution of growth strategies.

We encourage you to share your thoughts on the implications of Musk's X debt sale and stay tuned for further updates as more financial data becomes available. Subscribe to our newsletter to receive future analyses of Musk's X debt sale and its consequences for the changing face of X.

Featured Posts

-

Alterya Joins Chainalysis Boosting Blockchain Security With Ai

Apr 29, 2025

Alterya Joins Chainalysis Boosting Blockchain Security With Ai

Apr 29, 2025 -

Willie Nelson New Album Release Overshadowed By Family Drama

Apr 29, 2025

Willie Nelson New Album Release Overshadowed By Family Drama

Apr 29, 2025 -

Yukon Mining Dispute Politicians Threaten Contempt Action

Apr 29, 2025

Yukon Mining Dispute Politicians Threaten Contempt Action

Apr 29, 2025 -

Severe Weather Cleanup Louisville Accepting Debris Removal Requests

Apr 29, 2025

Severe Weather Cleanup Louisville Accepting Debris Removal Requests

Apr 29, 2025 -

Cost Cutting Measures Rise As U S Companies Face Tariff Uncertainty

Apr 29, 2025

Cost Cutting Measures Rise As U S Companies Face Tariff Uncertainty

Apr 29, 2025

Latest Posts

-

Fussball Oesterreich Pacult Raus Jancker Rein In Klagenfurt

Apr 29, 2025

Fussball Oesterreich Pacult Raus Jancker Rein In Klagenfurt

Apr 29, 2025 -

Austria Wien Jancker Folgt Auf Pacult

Apr 29, 2025

Austria Wien Jancker Folgt Auf Pacult

Apr 29, 2025 -

Tgi Ag Kitzbuehel Jubilaeumsfeier Und Ausblick

Apr 29, 2025

Tgi Ag Kitzbuehel Jubilaeumsfeier Und Ausblick

Apr 29, 2025 -

Klagenfurt Trainer Pacult Entlassen Jancker Folgt

Apr 29, 2025

Klagenfurt Trainer Pacult Entlassen Jancker Folgt

Apr 29, 2025 -

Tgi Ag Feiert In Kitzbuehel Blick In Die Zukunft

Apr 29, 2025

Tgi Ag Feiert In Kitzbuehel Blick In Die Zukunft

Apr 29, 2025