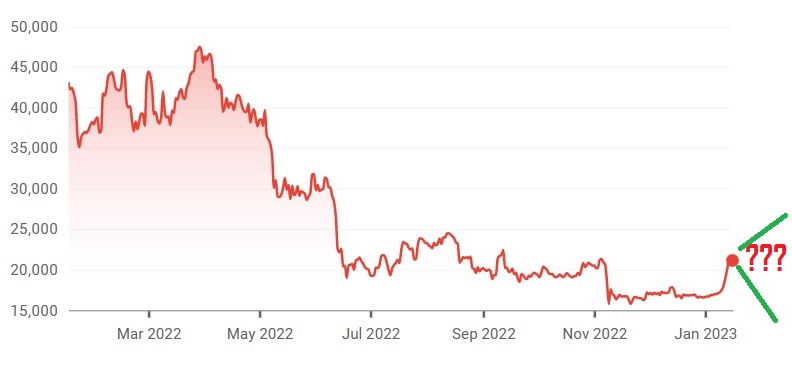

The Bitcoin Rebound: A Deeper Dive Into Market Dynamics

Table of Contents

Macroeconomic Factors Influencing the Bitcoin Rebound

High inflation and fluctuating interest rates significantly impact Bitcoin's price, creating a complex interplay of economic forces. Understanding these macroeconomic factors is crucial for interpreting the Bitcoin rebound and predicting future trends.

Inflation and its Impact on Bitcoin's Value

High inflation erodes the purchasing power of fiat currencies, prompting investors to seek alternative assets to preserve their wealth. Bitcoin, with its fixed supply of 21 million coins, is often viewed as a hedge against inflation. This "flight to safety" contributes to increased demand and, consequently, a Bitcoin rebound.

- Decreased confidence in fiat currencies: As inflation rises, trust in traditional currencies diminishes, pushing investors towards Bitcoin as a store of value.

- Bitcoin's scarcity as a deflationary asset: Unlike fiat currencies, Bitcoin's limited supply creates scarcity, potentially driving its value higher during inflationary periods.

- The flight to safety: Investors see Bitcoin as a safe haven asset during times of economic uncertainty, increasing its demand and contributing to price appreciation.

For instance, during periods of high inflation in 2021 and 2022, Bitcoin's price showed a positive correlation with inflation indices, reflecting investor behavior. Further research into specific inflation rates and their correlation with Bitcoin price movements is necessary for a more complete understanding.

Interest Rate Hikes and Bitcoin's Correlation

Central banks' decisions on interest rate hikes significantly influence market sentiment towards risk assets, including Bitcoin. Higher interest rates generally reduce risk appetite as investors shift towards safer, higher-yield investments. Conversely, lower rates can fuel a Bitcoin rebound.

- The relationship between risk appetite and Bitcoin's price: A risk-on environment often leads to increased investment in volatile assets like Bitcoin. Conversely, a risk-off environment may cause investors to sell Bitcoin to secure less volatile assets.

- Impact of monetary policy on Bitcoin investment: Monetary policy decisions directly impact the overall macroeconomic environment and investor confidence, impacting Bitcoin's price.

Analyzing historical data on interest rate changes and their subsequent effect on Bitcoin's price reveals a clear correlation between monetary policy and Bitcoin's market performance. This understanding is key to predicting future price movements in response to changes in interest rates.

Technological Advancements and Bitcoin's Future

Technological advancements are a major catalyst for Bitcoin's price. Improvements in scalability and increased institutional adoption have been key drivers in the recent Bitcoin rebound and underpin its future potential.

The Lightning Network and Scalability

The Lightning Network, a layer-2 scaling solution, significantly addresses Bitcoin's previous scalability limitations. By enabling faster and cheaper transactions, it makes Bitcoin more viable for everyday use and contributes to broader adoption.

- Improved scalability addresses previous criticisms: The Lightning Network solves the problem of slow transaction times and high fees, making Bitcoin a more attractive option for everyday payments.

- Increased transaction volume and adoption rates: As the Lightning Network gains traction, we can expect a significant increase in Bitcoin transaction volume, further bolstering its price.

Data on Lightning Network adoption rates and transaction volume demonstrates its growing impact on Bitcoin's usability and appeal, contributing to positive price action.

Institutional Investment and Adoption

Growing institutional interest in Bitcoin signifies a shift in market perception, lending credibility and stability to the cryptocurrency. Large-scale institutional investment leads to increased price stability and market confidence, fueling further growth.

- The role of large corporations and investment firms: Major financial institutions actively purchasing and holding Bitcoin lend legitimacy and stability to the market, attracting more investors.

- Investment strategies and their impact: Diversification strategies adopted by institutional investors show Bitcoin's growing integration into mainstream finance, driving price increases.

Examples of institutional investors like MicroStrategy and Tesla adopting Bitcoin as part of their treasury holdings demonstrate the shift toward institutional adoption, impacting the Bitcoin rebound positively.

Regulatory Landscape and its Influence on the Bitcoin Rebound

The regulatory landscape significantly influences investor confidence and market stability. Clearer regulations or a lack thereof in different jurisdictions influence Bitcoin adoption and price.

Regulatory Clarity and its Impact

Clear and consistent regulatory frameworks create a more predictable and trustworthy environment for Bitcoin investors. This stability can lead to increased investment and a Bitcoin rebound. Conversely, uncertainty can discourage investment.

- Impact of positive regulatory developments: Countries with favorable Bitcoin regulations see increased adoption and market growth, often resulting in positive price movements.

- Comparison of different regulatory approaches globally: A comparison of regulatory frameworks across different countries sheds light on the impact of various approaches on Bitcoin's price and market dynamics.

Examples of countries implementing clear Bitcoin regulatory frameworks and their resulting positive market effects provide insights into the importance of regulatory clarity for the Bitcoin rebound and future growth.

Government Policies and Bitcoin’s Price

Government policies concerning cryptocurrencies directly influence market sentiment and trading activity. Supportive policies can drive a Bitcoin rebound while restrictive measures can trigger price drops.

- Potential government bans, restrictions, or endorsements: Governmental actions concerning Bitcoin directly impact investor confidence and market behavior.

- Real-world examples of government policies impacting Bitcoin prices: Analyzing historical examples of government policies and their subsequent impact on Bitcoin illustrates the direct relationship between governmental action and price fluctuations.

Understanding the influence of government policies on Bitcoin’s price is crucial for predicting market trends and navigating potential future regulatory changes.

Conclusion

The Bitcoin rebound is a complex phenomenon shaped by a multitude of interconnected factors. Understanding macroeconomic trends, technological advancements, and the regulatory landscape is vital for navigating this volatile market. The interplay between inflation, interest rates, institutional adoption, and regulatory clarity profoundly impacts Bitcoin’s price. By carefully considering these dynamics, investors can make more informed decisions. Stay informed about future developments and continue to research the intricacies of the Bitcoin market to capitalize on potential future Bitcoin rebounds and opportunities within the cryptocurrency space.

Featured Posts

-

Analysis Of Iron Ore Price Decline Amidst Chinas Steel Production Curbs

May 09, 2025

Analysis Of Iron Ore Price Decline Amidst Chinas Steel Production Curbs

May 09, 2025 -

Cham Dut Ngay Viec Giu Tre Thieu An Toan Tai Tien Giang

May 09, 2025

Cham Dut Ngay Viec Giu Tre Thieu An Toan Tai Tien Giang

May 09, 2025 -

Nepogoda V Yaroslavskoy Oblasti Prognoz Snegopadov

May 09, 2025

Nepogoda V Yaroslavskoy Oblasti Prognoz Snegopadov

May 09, 2025 -

Rising Rental Costs In La After Fires A Look At Price Gouging Claims

May 09, 2025

Rising Rental Costs In La After Fires A Look At Price Gouging Claims

May 09, 2025 -

Madeleine Mc Cann Case New Development Harassment Charges

May 09, 2025

Madeleine Mc Cann Case New Development Harassment Charges

May 09, 2025

Latest Posts

-

Us Attorney Generals Fox News Presence Beyond The Epstein Narrative

May 09, 2025

Us Attorney Generals Fox News Presence Beyond The Epstein Narrative

May 09, 2025 -

Is Daily Fox News Appearance By Us Attorney General A Distraction

May 09, 2025

Is Daily Fox News Appearance By Us Attorney General A Distraction

May 09, 2025 -

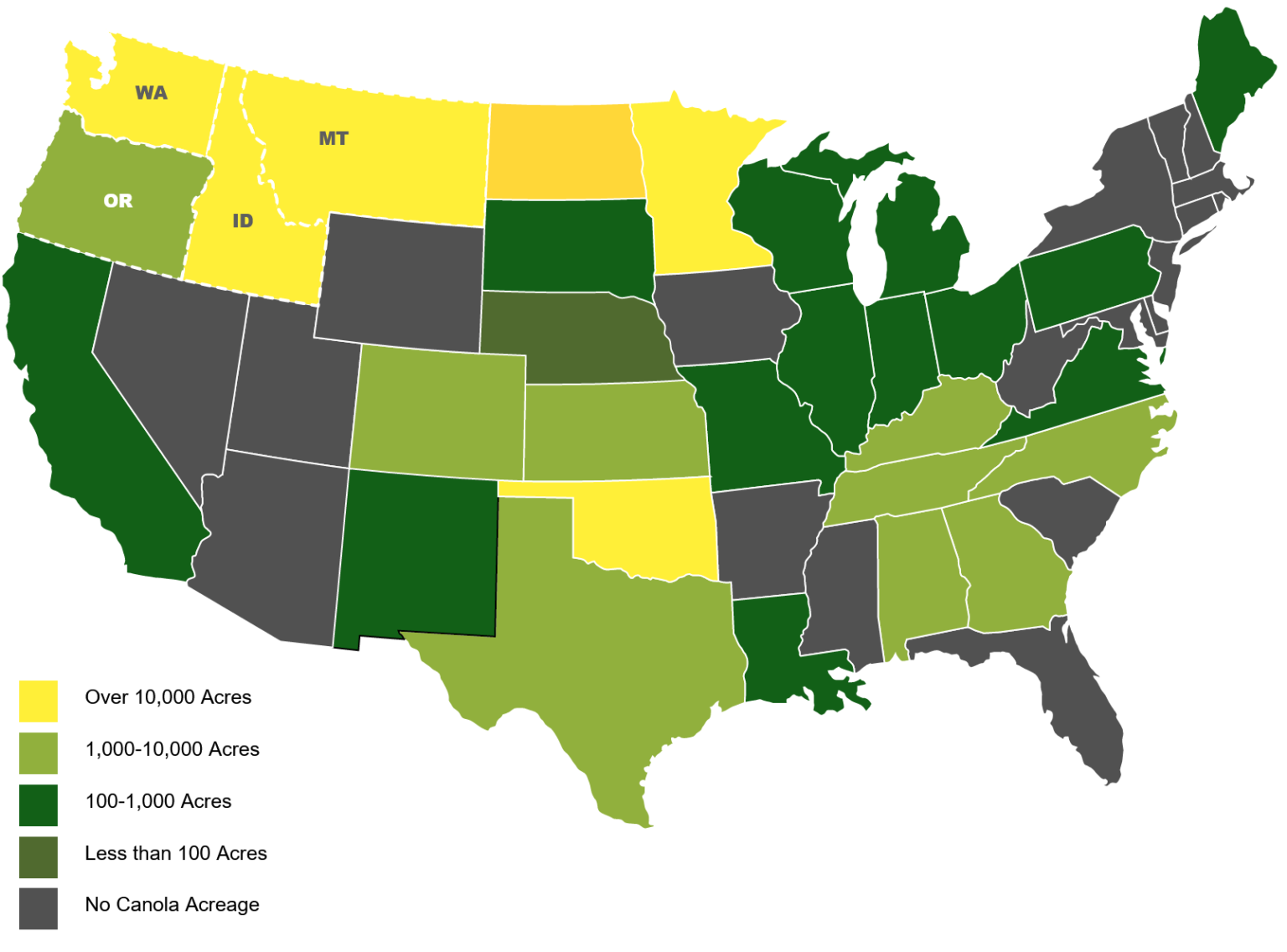

Chinas Canola Supply Chain Adapting To The Canada Fallout

May 09, 2025

Chinas Canola Supply Chain Adapting To The Canada Fallout

May 09, 2025 -

New Canola Suppliers For China The Impact Of The Canada Trade Dispute

May 09, 2025

New Canola Suppliers For China The Impact Of The Canada Trade Dispute

May 09, 2025 -

Canola Trade Shift Chinas Search For New Suppliers

May 09, 2025

Canola Trade Shift Chinas Search For New Suppliers

May 09, 2025