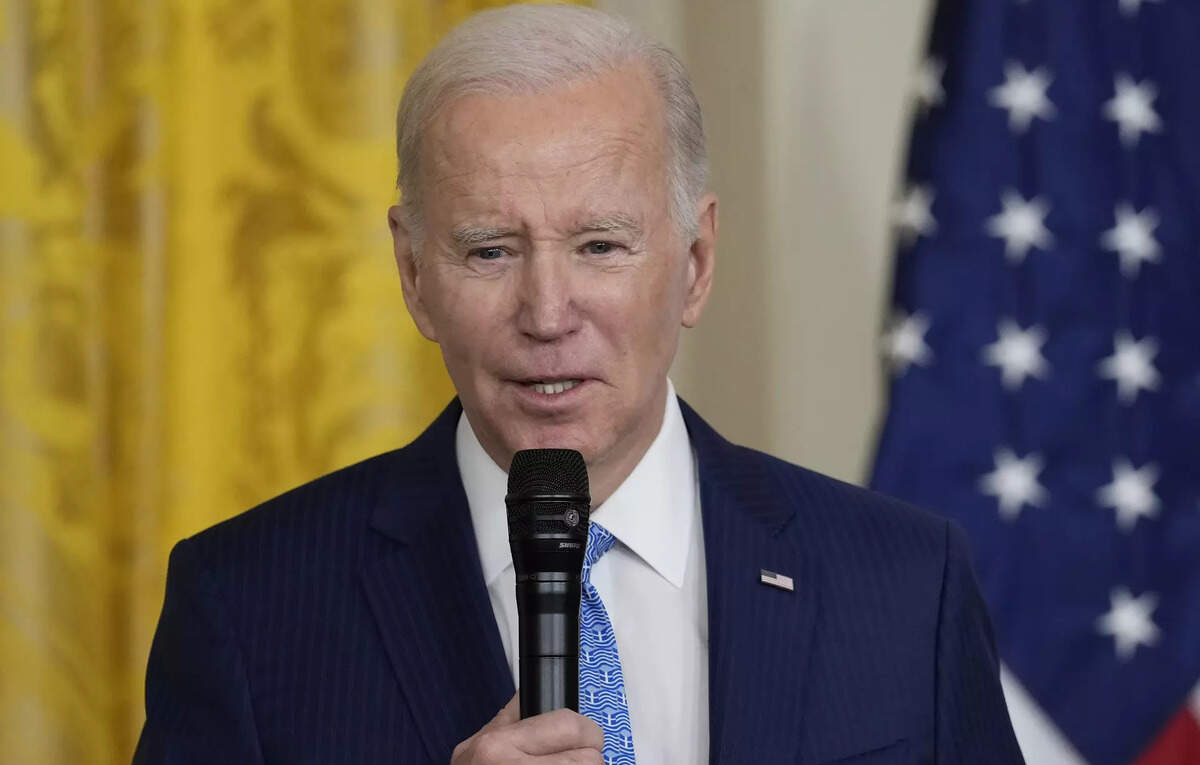

The Biden Presidency And Economic Slowdown: Causes And Consequences

Table of Contents

Inflationary Pressures and Supply Chain Disruptions

The current economic slowdown is significantly intertwined with persistent inflationary pressures and widespread supply chain disruptions. These two factors are closely related and have created a challenging environment for economic growth.

The Role of Supply Chain Bottlenecks

Global supply chains have been severely strained, leading to significant bottlenecks and increased costs. The COVID-19 pandemic initially exposed vulnerabilities in these systems, but pre-existing issues were exacerbated.

- Increased shipping costs: Container shipping rates surged dramatically, increasing the cost of imported goods and contributing to inflation.

- Microchip shortages: A global shortage of semiconductors impacted the production of automobiles, electronics, and other goods, leading to delays and higher prices.

- Port congestion: Major ports around the world experienced significant congestion, leading to delays in the delivery of goods and increased costs.

- Labor shortages: A shortage of workers in various sectors, including transportation and logistics, further exacerbated supply chain problems. These shortages contributed to increased wages in certain sectors, also feeding inflation.

These logistical challenges directly impact consumer prices, making everyday goods more expensive and reducing consumer purchasing power. The resulting supply chain crisis is a major factor in the ongoing inflationary pressures.

Fiscal Stimulus and Inflationary Concerns

The American Rescue Plan, a large fiscal stimulus package enacted early in the Biden administration, has been a subject of debate regarding its contribution to inflation. While proponents argued it was necessary to support the economy during the pandemic, critics raised concerns that the substantial government spending could fuel inflation.

- Increased demand: The stimulus package injected a significant amount of money into the economy, increasing aggregate demand and potentially outpacing the capacity of supply chains to meet that demand.

- Monetary policy response: The Federal Reserve responded to rising inflation by raising interest rates, attempting to cool down the economy and curb inflation. This policy, however, can also slow economic growth.

- Debate on the stimulus's impact: Economists continue to debate the extent to which the stimulus contributed to inflation, with differing views on the relative contributions of supply-side constraints versus demand-side pressures.

Understanding the interplay between fiscal policy, monetary policy, and the resulting inflation rate is crucial to analyzing the economic slowdown.

Geopolitical Factors and Economic Uncertainty

Geopolitical events have significantly impacted the global economy and added to the economic uncertainty facing the United States.

The War in Ukraine and Energy Prices

The Russian invasion of Ukraine has had a profound impact on global energy markets. Russia is a major exporter of oil and natural gas, and the war disrupted these supplies, leading to a sharp increase in energy prices worldwide.

- Increased oil and gas prices: The price of oil and natural gas soared, impacting transportation costs, energy bills for consumers and businesses, and overall inflation.

- Energy security concerns: The war highlighted the vulnerabilities of relying on specific countries for energy supplies, leading to increased focus on energy independence and diversification.

- Sanctions and their economic impact: International sanctions imposed on Russia have further disrupted global energy markets and contributed to economic uncertainty.

These energy price increases are a major driver of inflation and contribute significantly to the economic slowdown.

Global Economic Slowdown and its Ripple Effects

The war in Ukraine, coupled with persistent inflation and supply chain issues, has increased the risk of a global recession. A global slowdown would have significant ripple effects on the US economy given its high degree of integration with global markets.

- International trade disruptions: Reduced international trade would negatively impact US businesses that rely on exports and imports.

- Investor sentiment: Economic uncertainty can lead to decreased investor confidence, potentially leading to reduced investment and slower economic growth.

- Interconnectedness of global markets: The US economy is highly interconnected with the global economy, making it vulnerable to shocks originating in other parts of the world.

Consequences of the Economic Slowdown

The combined effects of inflation, supply chain disruptions, and geopolitical instability have resulted in several negative consequences for the US economy.

Impact on Employment and Wages

The economic slowdown has had a mixed impact on employment and wages. While the unemployment rate has remained relatively low, wage growth has not kept pace with inflation, resulting in a decline in real wages for many workers.

- Unemployment statistics: While unemployment remains low, certain sectors have experienced job losses due to economic uncertainty and reduced consumer demand.

- Wage stagnation: Wage growth has lagged behind inflation, meaning that many workers' purchasing power has decreased.

- Potential for job losses: Continued economic slowdown could lead to further job losses in vulnerable sectors.

Impact on Consumer Spending and Consumer Confidence

Economic uncertainty and high inflation have dampened consumer spending and eroded consumer confidence. Consumers are becoming more cautious about their spending habits, leading to slower economic growth.

- Consumer confidence index: The consumer confidence index has declined, reflecting consumers' pessimism about the economy.

- Retail sales data: Retail sales figures have shown signs of slowing, indicating a decrease in consumer spending.

- Changes in consumer spending patterns: Consumers are prioritizing essential goods and services, reducing spending on discretionary items.

Conclusion:

The economic slowdown during the Biden presidency is a complex issue with multiple contributing factors. Inflationary pressures stemming from supply chain disruptions and fiscal stimulus, coupled with geopolitical instability and the war in Ukraine, have created a challenging economic environment. These factors have resulted in decreased consumer confidence, slower economic growth, and a mixed impact on employment and wages. The interconnectedness of these issues highlights the complexity of navigating economic challenges during periods of global uncertainty. To stay informed on the ongoing developments related to The Biden Presidency and Economic Slowdown, continue to monitor economic indicators and engage with reliable sources of economic news and analysis.

Featured Posts

-

Rwyt Aljbht Alwtnyt Llastthmar Thlyl Wrqt Alsyasat Alaqtsadyt

May 03, 2025

Rwyt Aljbht Alwtnyt Llastthmar Thlyl Wrqt Alsyasat Alaqtsadyt

May 03, 2025 -

Political Fallout Rupert Lowes Commitment To Great Yarmouth

May 03, 2025

Political Fallout Rupert Lowes Commitment To Great Yarmouth

May 03, 2025 -

The Selena Gomez Effect High Waisted Suits And 80s Office Style

May 03, 2025

The Selena Gomez Effect High Waisted Suits And 80s Office Style

May 03, 2025 -

Todays Lotto Results Lotto Plus 1 And Lotto Plus 2 Winning Numbers

May 03, 2025

Todays Lotto Results Lotto Plus 1 And Lotto Plus 2 Winning Numbers

May 03, 2025 -

Tuerkiye Ile Endonezya Nin Ekonomik Ve Siyasi Is Birligi Anlasmalari

May 03, 2025

Tuerkiye Ile Endonezya Nin Ekonomik Ve Siyasi Is Birligi Anlasmalari

May 03, 2025