The Angry Elon Effect: Analyzing Tesla's Performance

Table of Contents

Stock Market Volatility and the Angry Elon Effect

The correlation between Elon Musk's public pronouncements and Tesla's stock price is undeniable. His tweets, often impulsive and controversial, have sent shockwaves through the market, leading to significant and sometimes dramatic fluctuations in Tesla's valuation. This volatility directly embodies the "Angry Elon Effect."

- Examples of Market-Moving Events: Musk's April 2018 tweet about taking Tesla private, his subsequent SEC battle, and his more recent pronouncements on cryptocurrency have all resulted in significant stock price swings. For instance, his tweets about Dogecoin have been directly linked to considerable price increases and subsequent dips in the cryptocurrency's value, indirectly impacting Tesla’s image and investor sentiment.

- Short-Term vs. Long-Term Impact: While short-term volatility is undeniable, the long-term impact is more nuanced. While some events have led to temporary setbacks, Tesla's underlying growth and innovation have often overshadowed these short-term fluctuations. However, the cumulative effect of these events remains a concern for long-term investors.

- Media Amplification: The media plays a significant role in amplifying the "Angry Elon Effect." Every tweet, every controversial statement, is amplified, often out of proportion, leading to heightened investor anxiety and market reactions. This media cycle fuels the unpredictable nature of Tesla's stock performance.

- Data Points: Studies have shown a statistically significant correlation between negative news cycles surrounding Musk and subsequent dips in Tesla's stock price, highlighting the tangible impact of the "Angry Elon Effect" on investor confidence and market valuation.

Impact on Brand Reputation and Consumer Perception

Elon Musk's persona is intrinsically linked to the Tesla brand. This creates a double-edged sword. His visionary image and association with cutting-edge technology undoubtedly attract customers drawn to his innovative spirit. However, his erratic behavior also raises concerns about brand credibility and long-term stability.

- Positive Aspects: Musk's reputation as a disruptive innovator attracts customers who value bold innovation and technological advancement. This positive association has undoubtedly contributed to Tesla's success in building a strong and loyal customer base.

- Negative Aspects: Concerns about his impulsive decision-making and unpredictable behavior can create uncertainty among potential buyers and damage the brand's long-term reputation. Negative news cycles fueled by the "Angry Elon Effect" can erode consumer trust.

- Demographic Perceptions: Different demographics perceive Elon Musk and Tesla differently. Younger generations may be more forgiving of his eccentricities, while older, more conservative investors might be more concerned about the brand’s image and long-term stability.

- Social Media Sentiment: Social media sentiment analysis reveals a complex picture. While there is strong support for Tesla's products and technology, there's also significant concern about Musk's leadership style and its potential impact on the company's future.

The Role of SEC Regulations and Legal Battles

Legal battles and SEC scrutiny significantly impact Tesla's performance and shareholder confidence. These external pressures interact directly with the "Angry Elon Effect," creating a complex web of challenges for the company.

- Significant Legal Cases: Musk's past run-ins with the SEC, including the infamous "taking Tesla private" tweet, have resulted in significant fines and reputational damage. These legal battles directly impact investor confidence and Tesla's financial stability.

- Impact on Investor Trust: Legal uncertainties and regulatory challenges create a climate of uncertainty, impacting investor trust and making it more challenging for Tesla to attract and retain investment. This, in turn, can affect the company’s ability to fund future growth and innovation.

- Potential for Future Challenges: The potential for future regulatory challenges remains a significant risk, especially considering Musk's history and his continued outspokenness. This ongoing uncertainty is a key factor influencing the perception of the "Angry Elon Effect."

- Financial Costs: Legal battles incur significant costs, impacting Tesla's bottom line and diverting resources away from core business activities. This added financial burden further complicates the challenges posed by the "Angry Elon Effect."

Long-Term Sustainability of the Angry Elon Effect

The long-term sustainability of the "Angry Elon Effect" is a key question. Will Elon Musk's behavior continue to significantly impact Tesla's trajectory, or will other factors eventually overshadow this aspect of the company's narrative?

- Shift in Public Perception: Over time, public perception might evolve. As Tesla achieves greater market dominance and expands its product line, Musk's pronouncements might become less impactful.

- Tesla's Growth and Market Dominance: Tesla's continued success and market leadership could help to mitigate the negative effects of the "Angry Elon Effect." A strong track record of innovation and growth could overshadow concerns about Musk's public behavior.

- Changes in Communication Strategy: A potential shift in Musk's communication strategy could also lessen the impact of the "Angry Elon Effect." More carefully considered public pronouncements might reduce the volatility associated with his statements.

Conclusion

The "Angry Elon Effect" represents a complex and multifaceted challenge for Tesla. While Elon Musk's visionary leadership has undoubtedly propelled the company to remarkable heights, his impulsive communication style and frequent controversies create significant volatility in the stock market and raise concerns about the brand's long-term reputation. The interplay between Musk's persona, legal battles, and regulatory pressures shapes Tesla's performance in ways that are both fascinating and concerning. The long-term consequences remain uncertain, but the "Angry Elon Effect" is undeniably a critical factor shaping Tesla's trajectory. We invite you to share your thoughts on the "Angry Elon Effect" and its long-term consequences for Tesla. How will this phenomenon continue to shape the future of the electric vehicle giant? Let's continue the discussion and analysis of the "Angry Elon Effect" and its future impact on Tesla's trajectory.

Featured Posts

-

Saint Ouen Le Demenagement De L Ecole Une Necessite Selon Le Maire

May 27, 2025

Saint Ouen Le Demenagement De L Ecole Une Necessite Selon Le Maire

May 27, 2025 -

Tramps Un Putins Ukrainas Miera Liguma Ultimats

May 27, 2025

Tramps Un Putins Ukrainas Miera Liguma Ultimats

May 27, 2025 -

Criminal Minds Evolution Season 18 Images Hint At A Violent Season

May 27, 2025

Criminal Minds Evolution Season 18 Images Hint At A Violent Season

May 27, 2025 -

Podderzhka Ukrainy Germaniya Obespechit Pvo Sredstva Reb I Svyazi

May 27, 2025

Podderzhka Ukrainy Germaniya Obespechit Pvo Sredstva Reb I Svyazi

May 27, 2025 -

The Impact Of Canada Posts Issues On The Alternative Delivery Landscape

May 27, 2025

The Impact Of Canada Posts Issues On The Alternative Delivery Landscape

May 27, 2025

Latest Posts

-

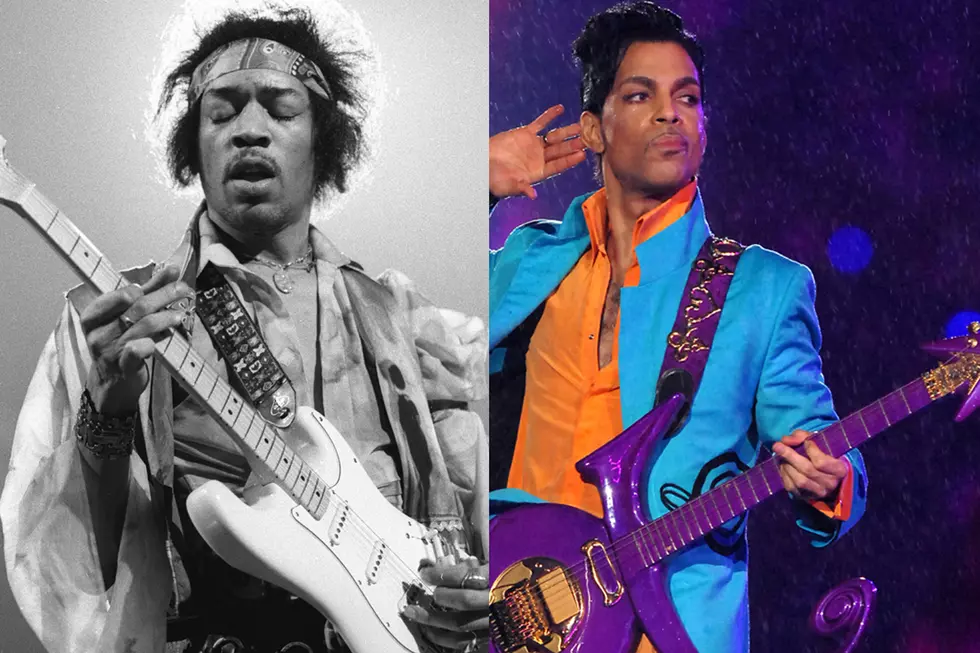

Today In History March 26 2016 The Death Of Prince

May 31, 2025

Today In History March 26 2016 The Death Of Prince

May 31, 2025 -

The Fentanyl Report Revisiting Princes Death On March 26

May 31, 2025

The Fentanyl Report Revisiting Princes Death On March 26

May 31, 2025 -

Fentanyl Toxicity In Princes Death A Look Back At March 26th

May 31, 2025

Fentanyl Toxicity In Princes Death A Look Back At March 26th

May 31, 2025 -

The Day Prince Died March 26th And The Fentanyl Report

May 31, 2025

The Day Prince Died March 26th And The Fentanyl Report

May 31, 2025 -

Fentanyl Levels In Princes Death March 26th Report

May 31, 2025

Fentanyl Levels In Princes Death March 26th Report

May 31, 2025