The 2025 Plunge Of D-Wave Quantum (QBTS): Factors And Implications

Table of Contents

Competitive Landscape and Technological Advancements

Emergence of Stronger Competitors

The quantum computing landscape is rapidly evolving, and D-Wave faces increasing competition from industry giants. Companies like IBM, Google, and IonQ are making significant strides in various quantum computing technologies, potentially overshadowing D-Wave's current market position.

- IBM's advancements: IBM continues to increase the qubit count in its superconducting quantum computers, improving coherence times and exploring advanced error correction techniques. Their extensive ecosystem and developer community provide a significant advantage.

- Google's progress: Google's focus on superconducting qubits and its pursuit of quantum supremacy have positioned them as a major player. Their research and development efforts are pushing the boundaries of qubit performance and scalability.

- IonQ's trapped ion approach: IonQ's trapped ion technology boasts high fidelity and long coherence times, making it a strong contender in the race for fault-tolerant quantum computers. Their focus on practical applications is also gaining traction.

These advancements threaten D-Wave's market share by offering potentially superior solutions for a wider range of quantum computing problems. D-Wave's current technology might struggle to compete with the scalability and versatility of gate-based approaches offered by these competitors. The impact on D-Wave's revenue projections and future funding rounds is a significant concern for investors considering QBTS stock.

Limitations of D-Wave's Annealing Approach

D-Wave's quantum annealing approach, while pioneering, has inherent limitations compared to gate-based quantum computing. This difference significantly impacts its applicability and competitiveness.

- Restricted problem types: Quantum annealing is primarily suited for solving specific optimization problems, limiting its versatility compared to the more general-purpose gate-based models.

- Scalability challenges: Scaling up the number of qubits in an annealing system while maintaining performance presents significant engineering challenges. Gate-based systems are generally considered to have a clearer path towards larger-scale systems.

- Error correction limitations: Error correction in annealing systems is considerably more challenging than in gate-based architectures. This impacts the accuracy and reliability of results, making them less suitable for certain applications.

Compared to gate-based methods like those employed by IBM and Google, which can perform a wider range of quantum algorithms, D-Wave's annealing approach appears less adaptable and scalable for future advancements in quantum computing.

Financial Performance and Investor Sentiment

Analyzing D-Wave's Financial Health

D-Wave's financial performance is a crucial factor affecting D-Wave Quantum (QBTS) stock valuation. Analyzing key financial metrics reveals concerns about its long-term viability.

- Revenue generation: D-Wave's revenue is largely dependent on sales of its quantum annealers and cloud access to its systems. The current revenue stream might not be sufficient to sustain its operations independently in the long run.

- Funding rounds and valuation: While D-Wave has secured significant funding through various investment rounds, the valuation of the company has yet to reach a level that definitively demonstrates strong market confidence.

- Operating expenses: Maintaining and scaling a quantum computing infrastructure requires substantial resources, leading to high operating expenses that impact profitability.

The sustainability of D-Wave's current business model, heavily reliant on external funding, raises questions about its long-term financial health and its ability to compete with better-funded rivals.

Shifting Investor Confidence

Investor sentiment towards D-Wave and the quantum computing market as a whole is highly volatile. This sentiment directly impacts the price of QBTS stock.

- Stock price fluctuations: The price of QBTS stock has experienced significant fluctuations, reflecting the uncertainty surrounding the company's future prospects and the overall quantum computing market.

- Analyst ratings: Analyst ratings for QBTS stock vary widely, demonstrating the lack of consensus on its investment potential. Some analysts express optimism, while others maintain a cautious or negative outlook.

- News coverage and market perception: News coverage and public perception of D-Wave's progress and the broader quantum computing sector heavily influence investor confidence and subsequent trading activity.

Macroeconomic factors and market volatility further contribute to the uncertainty surrounding QBTS stock, making it a high-risk investment.

Market Adoption and Practical Applications

Slow Pace of Quantum Computing Adoption

The widespread adoption of quantum computing technologies is facing considerable challenges, affecting the market outlook for all players, including D-Wave.

- High costs: The cost of developing, maintaining, and operating quantum computers is currently prohibitive for many potential users.

- Lack of skilled workforce: The lack of a sufficiently large and skilled workforce to develop and utilize quantum computing technologies hinders wider adoption.

- Limited real-world applications: While promising, the number of currently available real-world applications of quantum computing remains limited. Many potential applications are still in the research and development phase.

This slow adoption rate directly impacts D-Wave's potential market reach and revenue generation capabilities.

Limited Commercial Success of D-Wave's Technology

Despite D-Wave's pioneering efforts, the commercial success of its quantum annealers has been limited to date.

- Case studies: While some case studies demonstrate successful applications of D-Wave's technology in specific niches, the overall number of commercially successful deployments is still relatively small.

- Limitations of current applications: Current applications of D-Wave's technology primarily focus on optimization problems, which represent only a subset of potential quantum computing applications.

- Potential future applications: D-Wave is exploring new applications in areas like materials science and drug discovery, but the success of these efforts remains uncertain.

D-Wave needs to demonstrate significantly wider commercial success and expand its range of applications to realize its full market potential and attract substantial investment.

Conclusion

The projected 2025 downturn for D-Wave Quantum (QBTS) stock stems from a confluence of factors: intensifying competition, limitations of its core technology, financial challenges, and slow market adoption. While D-Wave's contributions to the quantum computing field are significant, investors need to carefully weigh these risks before investing in QBTS. Understanding the competitive landscape and the ongoing technological advancements is crucial for informed decision-making. Stay informed on D-Wave Quantum (QBTS) stock and the broader quantum computing sector for a comprehensive understanding of this evolving market. Thorough research into D-Wave Quantum (QBTS) stock is recommended before making any investment decisions.

Featured Posts

-

Abn Amro Waarschuwt Te Grote Afhankelijkheid Van Goedkope Arbeidsmigranten In De Voedingsindustrie

May 21, 2025

Abn Amro Waarschuwt Te Grote Afhankelijkheid Van Goedkope Arbeidsmigranten In De Voedingsindustrie

May 21, 2025 -

Expecting Mild Temperatures Low Rain Probability This Week

May 21, 2025

Expecting Mild Temperatures Low Rain Probability This Week

May 21, 2025 -

Flavio Cobolli Wins First Atp Title At Bucharest Tournament

May 21, 2025

Flavio Cobolli Wins First Atp Title At Bucharest Tournament

May 21, 2025 -

Bbc Breakfast Guest Interrupts Live Broadcast Are You Still There

May 21, 2025

Bbc Breakfast Guest Interrupts Live Broadcast Are You Still There

May 21, 2025 -

Nyt Mini Crossword Solutions March 13 Complete Guide With Tips

May 21, 2025

Nyt Mini Crossword Solutions March 13 Complete Guide With Tips

May 21, 2025

Latest Posts

-

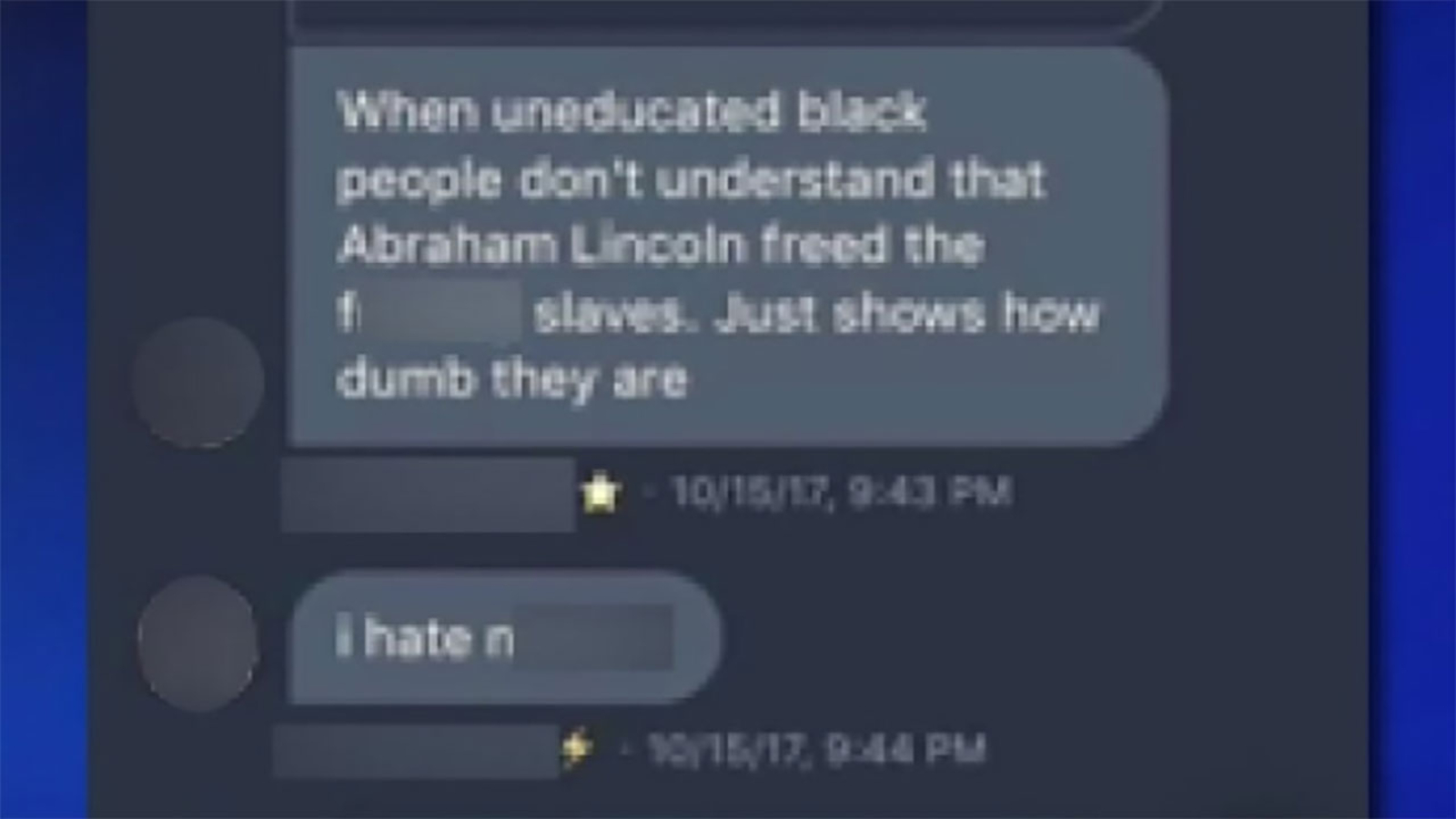

Tory Wifes Jail Sentence Stands After Anti Migrant Remarks In Southport

May 22, 2025

Tory Wifes Jail Sentence Stands After Anti Migrant Remarks In Southport

May 22, 2025 -

Lawsuit Update Appeal In Case Of Ex Tory Councillors Wifes Racist Tweet

May 22, 2025

Lawsuit Update Appeal In Case Of Ex Tory Councillors Wifes Racist Tweet

May 22, 2025 -

Lucy Connolly Appeal Fails In Racial Hatred Case

May 22, 2025

Lucy Connolly Appeal Fails In Racial Hatred Case

May 22, 2025 -

Court Delays Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025

Court Delays Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025 -

Sentence Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025

Sentence Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025