The 2025 Decline Of BigBear.ai (BBAI): Factors Contributing To The Drop

Table of Contents

Competitive Landscape and Market Saturation

The AI and big data market is intensely competitive. Numerous established players and a constant influx of new entrants are vying for market share, creating a challenging environment for companies like BBAI. This hyper-competitive landscape directly contributed to the BigBear.ai downfall.

-

Increased competition from larger, more established tech firms: Giants like Google, Amazon, and Microsoft possess significantly greater resources and brand recognition, making it difficult for smaller companies like BBAI to compete effectively. This competitive pressure impacted BBAI's ability to secure contracts and maintain its market position.

-

Difficulty differentiating BBAI's offerings in a crowded market: In a saturated market, BBAI struggled to establish a unique selling proposition that clearly differentiated its services from competitors. This lack of clear differentiation hampered its ability to attract and retain customers.

-

Pressure on pricing and profit margins: The intense competition forced BBAI to lower prices to remain competitive, squeezing profit margins and impacting overall profitability. This directly affected the company's financial health and investor confidence in the BBAI stock price.

-

Emergence of innovative, disruptive technologies: The rapid pace of technological advancements in AI led to the emergence of newer, more efficient, and cost-effective solutions, rendering some of BBAI's offerings obsolete or less competitive. This constant evolution in the market requires companies to adapt quickly, a challenge that BBAI seemingly failed to overcome.

BBAI's failure to carve a unique niche and maintain a competitive edge contributed significantly to its market share erosion, directly impacting revenue and investor confidence, ultimately contributing to the overall BigBear.ai stock decline.

Financial Performance and Debt Burden

An analysis of BBAI's financial statements reveals a concerning pattern of recurring losses and escalating debt levels. These financial woes played a major role in the BBAI stock price drop.

-

Consistently high operating costs: BBAI struggled to control its operating expenses, leading to consistently high costs that outweighed revenue generation. This unsustainable cost structure negatively impacted profitability.

-

Failure to meet projected revenue targets: The company consistently missed its projected revenue targets, signaling a fundamental problem with its business model and market strategy. This failure eroded investor confidence in the long-term viability of the company.

-

High debt-to-equity ratio, impacting creditworthiness: BBAI's high debt levels significantly impacted its creditworthiness, making it difficult to secure additional funding and increasing the risk of default. This financial instability further undermined investor confidence.

-

Negative cash flow and reliance on external financing: The company experienced persistent negative cash flow, making it heavily reliant on external financing to stay afloat. This dependence on external funding is unsustainable in the long run and is a clear indicator of financial distress.

Poor financial performance significantly eroded investor trust and led to a decline in the BBAI stock price. The high debt burden further exacerbated the situation, contributing to the overall BigBear.ai downfall.

Management and Strategic Issues

Potential leadership challenges and questionable strategic decision-making within BBAI contributed significantly to its struggles and the subsequent BigBear.ai stock decline.

-

Lack of clear and consistent long-term strategic vision: The absence of a well-defined and consistently executed long-term strategic vision created uncertainty and hampered effective planning and execution.

-

High executive turnover and instability: Frequent changes in senior management created instability and disrupted operational efficiency. This lack of continuity hindered strategic planning and implementation.

-

Ineffective implementation of key strategies: Even when strategies were formulated, their implementation often lacked effectiveness, leading to missed opportunities and further eroding investor confidence in the BBAI stock price.

-

Poor communication with investors and stakeholders: Poor communication from management to investors and stakeholders led to a lack of transparency and fueled negative speculation, impacting the company's image and investor sentiment.

Internal issues within BBAI's management negatively impacted its operational efficiency and overall performance, ultimately contributing to the decline.

Technological Advancements and Disruption

The rapid pace of technological advancements in the AI sector rendered some of BBAI's technologies obsolete or less competitive. This technological disruption significantly contributed to the BigBear.ai downfall.

-

The rise of more advanced AI algorithms and models: The emergence of more sophisticated and efficient AI algorithms and models left BBAI's technology lagging behind its competitors.

-

Failure to adapt to emerging trends and technologies: BBAI's inability to adapt quickly to emerging trends and technologies hampered its innovation capabilities and competitiveness.

-

Inability to innovate and stay ahead of the competition: The company's failure to innovate and stay ahead of its competitors in the rapidly evolving AI landscape resulted in a loss of market share and competitiveness.

-

Dependence on older technologies: Reliance on older, less efficient technologies meant BBAI could not provide cost-effective or cutting-edge solutions, negatively impacting its market position.

The dynamic nature of the AI landscape required BBAI to continuously innovate; its failure to do so resulted in a significant loss of competitiveness and directly contributed to the BigBear.ai stock decline.

Conclusion

The decline of BigBear.ai (BBAI) in 2025 can be attributed to a confluence of factors, including intense competition, weak financial performance, internal management issues, and the rapid pace of technological change in the AI sector. Understanding these challenges is crucial for investors considering investments in the AI and big data markets. While BBAI’s decline serves as a cautionary tale, it also highlights the importance of rigorous due diligence, a clear understanding of market dynamics, and the ability to adapt to rapid technological advancements when investing in the volatile world of BigBear.ai stock and similar high-growth tech companies. Thoroughly researching the BigBear.ai stock decline and similar case studies is vital for informed decision-making. Investors need to carefully consider the BBAI investment risks before making any investment decisions.

Featured Posts

-

New Attempt To Break The Trans Australia Run World Record

May 21, 2025

New Attempt To Break The Trans Australia Run World Record

May 21, 2025 -

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 21, 2025

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 21, 2025 -

The Truth About David Walliams Exit From Britains Got Talent

May 21, 2025

The Truth About David Walliams Exit From Britains Got Talent

May 21, 2025 -

Nyt Crossword Solutions April 25 2025

May 21, 2025

Nyt Crossword Solutions April 25 2025

May 21, 2025 -

D Wave Quantum Qbts Analyzing The 2025 Stock Price Decrease

May 21, 2025

D Wave Quantum Qbts Analyzing The 2025 Stock Price Decrease

May 21, 2025

Latest Posts

-

Manchester City Eyeing Arsenal Great To Replace Pep Guardiola A Detailed Look

May 22, 2025

Manchester City Eyeing Arsenal Great To Replace Pep Guardiola A Detailed Look

May 22, 2025 -

Report Manchester City Targets Arsenal Legend As Potential Guardiola Replacement

May 22, 2025

Report Manchester City Targets Arsenal Legend As Potential Guardiola Replacement

May 22, 2025 -

Pep Guardiolas Successor Is A Former Arsenal Star The Top Candidate For Manchester City

May 22, 2025

Pep Guardiolas Successor Is A Former Arsenal Star The Top Candidate For Manchester City

May 22, 2025 -

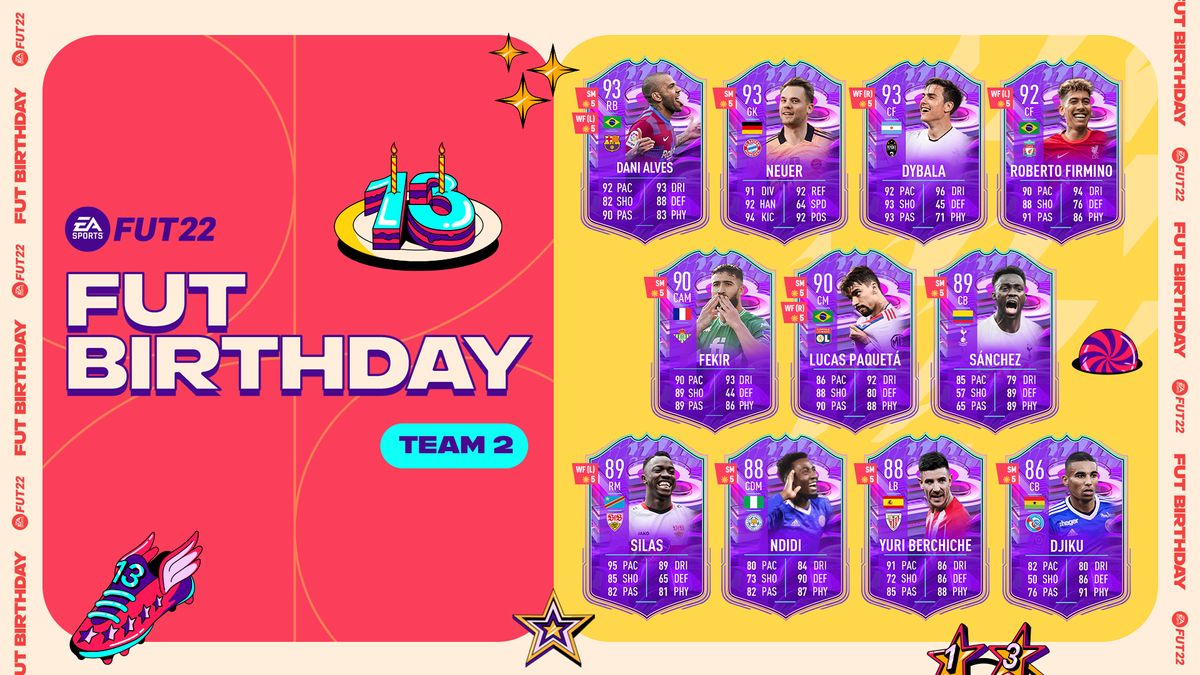

Ea Fc 24 Fut Birthday Tier List Of The Best Players For Your Squad

May 22, 2025

Ea Fc 24 Fut Birthday Tier List Of The Best Players For Your Squad

May 22, 2025 -

Best Ea Fc 24 Fut Birthday Cards A Complete Tier List Guide

May 22, 2025

Best Ea Fc 24 Fut Birthday Cards A Complete Tier List Guide

May 22, 2025