Tesla's Q1 2024 Earnings Report: A 71% Drop In Net Income

Table of Contents

Analysis of Tesla's Q1 2024 Financial Performance

Significant Drop in Net Income

Tesla's Q1 2024 net income plummeted to [Insert Exact Figure], a 71% decrease compared to the [Insert Exact Figure] reported in Q1 2023. This represents a substantial blow to the company's profitability and signifies a significant shift in its financial landscape. Several factors contributed to this dramatic decline:

- Aggressive Price Cuts: Tesla implemented significant price reductions across its vehicle lineup to maintain market share in an increasingly competitive environment. These cuts, while boosting sales volume, severely impacted profit margins.

- Increased Competition: The EV market is becoming increasingly crowded with established automakers launching their own competitive EV models and new EV startups emerging with innovative technologies.

- Rising Production Costs: Escalating raw material prices, supply chain disruptions, and increased labor costs have put pressure on Tesla's production expenses.

- Increased Operating Expenses: Growth in research & development (R&D) and general & administrative (G&A) expenses also impacted the bottom line.

Further financial data reveals [Insert Revenue Figures], resulting in an earnings per share (EPS) of [Insert EPS Figure]. Gross margin also experienced a significant contraction, falling to [Insert Gross Margin Percentage] compared to [Insert Previous Quarter's Percentage]. (Source: [Insert Source of Financial Data – e.g., Tesla's official Q1 2024 earnings release]).

Vehicle Deliveries and Production

Tesla delivered [Insert Number] vehicles in Q1 2024, a [Insert Percentage Change] compared to Q1 2023. While this represents a [increase/decrease], it fell short of analyst expectations of [Insert Analyst Expectations]. Production challenges, including [mention any specific production challenges reported, e.g., supply chain issues, factory shutdowns], likely contributed to this shortfall. Geographic sales variations showed [mention any significant regional differences in sales]. [Include a chart or graph visualizing vehicle deliveries and production data, if possible].

Impact of Price Cuts on Profitability

Tesla's aggressive price cuts, while boosting sales volume, significantly squeezed profit margins. The company's strategy appears to prioritize market share over immediate profitability, aiming for a larger long-term return through economies of scale and increased brand dominance. Compared to competitors like [mention key competitors, e.g., Ford, GM, BYD], Tesla's pricing strategy is [compare pricing strategies and their impact on market share]. The long-term implications of this strategy remain uncertain, and its success will depend on several factors including maintaining production efficiency and continuing to drive down costs.

Rising Competition in the EV Market

The EV market is experiencing a surge in competition. Established automakers like [mention key competitors] are rapidly expanding their EV offerings, while new EV startups are disrupting the market with innovative technologies and business models. This intensified competition is putting pressure on Tesla's market share and forcing the company to adapt its strategies. The potential threat to Tesla's future growth includes [mention potential threats, e.g., loss of market share, pricing wars, technological disruption].

Investor Reaction and Future Outlook for Tesla

Stock Market Response

The immediate market reaction to the Q1 2024 earnings report was [Describe the immediate market reaction, e.g., a sharp drop in Tesla's stock price]. Investor sentiment reflects [Describe investor sentiment, e.g., concerns over profitability, uncertainty about the future]. The long-term effects on Tesla's stock valuation will depend on the company's ability to address the challenges it faces and restore investor confidence.

Tesla's Response and Future Plans

Tesla's official response to the earnings report included [Summarize Tesla's official statement and any actions taken]. The company is likely to [predict Tesla's likely future actions, e.g., adjust its pricing strategy, focus on cost reduction, invest in new technologies]. [Mention any new product announcements or development updates]. [Include quotes from Tesla executives if available].

Expert Opinions and Market Predictions

Industry analysts and financial experts offer varied opinions on Tesla's future performance. Some analysts express [Summarize positive opinions], while others highlight [Summarize negative opinions]. The potential for a recovery in Tesla's profitability hinges on [mention key factors affecting recovery].

Conclusion: Understanding Tesla's Q1 2024 Earnings Report - What's Next?

Tesla's Q1 2024 earnings report revealed a significant drop in net income, driven by aggressive price cuts, increased competition, and rising production costs. This has created uncertainty among investors and raised questions about the company's long-term strategy. The impact on the broader EV market remains to be seen, but the report underscores the intensifying competition and challenges faced by even the most established players in the sector. To stay informed about Tesla's financial performance and the evolving EV landscape, subscribe to our newsletter and follow us on social media for future updates and analysis of Tesla's Q2 earnings outlook and beyond. Understanding Tesla's financial performance is crucial for navigating the complexities of the EV market.

Featured Posts

-

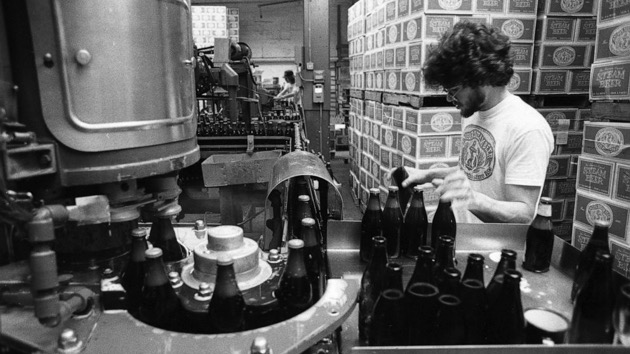

Anchor Brewing Company To Close After 127 Years The End Of An Era

Apr 24, 2025

Anchor Brewing Company To Close After 127 Years The End Of An Era

Apr 24, 2025 -

Teslas Reduced Q1 Profitability Analysis Of The Musk Factor

Apr 24, 2025

Teslas Reduced Q1 Profitability Analysis Of The Musk Factor

Apr 24, 2025 -

Sk Hynixs Ai Fueled Dominance In The Dram Industry

Apr 24, 2025

Sk Hynixs Ai Fueled Dominance In The Dram Industry

Apr 24, 2025 -

Zaboravljeni Film Tarantino I Travolta Neprijatna Saradnja

Apr 24, 2025

Zaboravljeni Film Tarantino I Travolta Neprijatna Saradnja

Apr 24, 2025 -

The Bold And The Beautiful Liams Collapse Spoilers And Survival Chances

Apr 24, 2025

The Bold And The Beautiful Liams Collapse Spoilers And Survival Chances

Apr 24, 2025