Tesla's Legal Maneuvers After Musk's Compensation Controversy

Table of Contents

Shareholder Lawsuits and Their Implications

The controversial compensation package has attracted a flurry of shareholder lawsuits, alleging various breaches of fiduciary duty and inadequate disclosures.

The Nature of Shareholder Claims

These lawsuits primarily contend that:

- Breach of Fiduciary Duty: Shareholders argue that the board of directors failed to act in their best interests by approving such a generous compensation package, potentially harming shareholder value. Specific allegations include claims of excessive compensation unrelated to performance and a lack of transparency in the compensation structure.

- Inadequate Disclosure: Plaintiffs argue that Tesla failed to adequately disclose the risks and potential conflicts of interest associated with the compensation plan, violating securities laws. They claim that this lack of transparency misled investors.

- Waste of Corporate Assets: Some lawsuits allege that the compensation plan constitutes a waste of corporate assets, arguing that the potential payout is excessive and disproportionate to Musk's actual contributions.

The potential financial ramifications for Tesla are significant, potentially including substantial payouts to shareholders, increased legal fees, and reputational damage.

Tesla's Defense Strategies

Tesla's defense team has employed various strategies, including:

- Board Approval: Tesla emphasizes that the compensation package was approved by a majority of independent directors, suggesting a degree of oversight and due diligence. They argue that this approval process shields the company from accusations of mismanagement.

- Market Performance: Tesla points to the company's substantial growth and market capitalization as evidence that the compensation package did not harm shareholder value. They assert that Musk's leadership is directly responsible for this success.

- Alignment of Interests: The defense team highlights the alignment of Musk's interests with those of shareholders, arguing that the performance-based nature of the package incentivizes him to maximize company value.

The legal precedents cited by both sides center around the standards for executive compensation and the responsibilities of corporate boards in overseeing such arrangements. The outcome of these lawsuits will set crucial precedents regarding executive compensation and corporate governance for publicly traded companies.

The Role of Independent Directors

The actions and involvement of Tesla's independent board members are central to the legal defense. Their approval of the compensation package, the degree of their oversight, and their subsequent actions (or inaction) in the face of criticism are all under intense scrutiny. The effectiveness of independent oversight in this case will significantly influence future corporate governance practices.

SEC Investigations and Their Fallout

The SEC's involvement extends beyond shareholder lawsuits. Musk's frequent and often controversial tweets regarding Tesla have drawn significant regulatory attention.

SEC Scrutiny of Musk's Tweets and Communications

The SEC has investigated instances where Musk's tweets appeared to manipulate Tesla's stock price, potentially violating securities laws. Specific examples include:

- "Funding Secured" Tweet: The infamous 2018 tweet about securing funding for taking Tesla private triggered an SEC investigation and a subsequent settlement.

- Production and Delivery Targets: Several instances of Musk's public pronouncements about production and delivery targets, which later proved inaccurate, are also under scrutiny.

These investigations expose Tesla to significant regulatory penalties, including substantial fines and potential restrictions on Musk's communications. This regulatory uncertainty can also severely impact investor confidence and the company's stock price.

Tesla's Compliance Efforts

In response to the SEC scrutiny, Tesla has implemented several compliance measures, including:

- Enhanced Internal Controls: Tesla has reportedly strengthened its internal review process for public statements, including those made by Musk.

- Improved Communication Protocols: New protocols are designed to ensure that public communications adhere to securities regulations.

- Legal Counsel Oversight: Greater involvement of legal counsel in reviewing communications before they are released publicly is also implemented.

The effectiveness of these measures remains to be seen, but they represent a significant effort by Tesla to improve its regulatory compliance.

Long-Term Effects on Corporate Governance

The SEC investigations and their outcomes will have long-lasting effects on Tesla's corporate governance. The company may face pressure to implement more robust oversight mechanisms, including strengthening its board's independence and enhancing its internal control systems to prevent future regulatory issues. This could influence corporate governance practices across the broader market.

Public Opinion and Brand Image

The compensation controversy and subsequent legal battles have taken a toll on Tesla's public image.

The Impact of Negative Publicity

Negative media coverage and public criticism have impacted Tesla's brand reputation. Examples include:

- Erosion of Consumer Trust: Some consumers express concern about Tesla's corporate governance practices, potentially impacting sales and customer loyalty.

- Negative Social Media Sentiment: Social media channels reflect a mixture of support and criticism regarding the compensation controversy.

- Impact on Investor Sentiment: The uncertainty created by the legal challenges could affect investor perception and Tesla's stock valuation.

Tesla's Public Relations Strategy

Tesla has employed various public relations strategies, including:

- Press Releases: Tesla has issued press releases to address shareholder concerns and provide its perspective on the ongoing legal battles.

- Social Media Engagement: Musk's continued active presence on social media, while controversial, is part of Tesla's communication strategy.

- Emphasis on Innovation and Future Growth: Tesla attempts to redirect public attention toward its technological advancements and future plans.

The effectiveness of Tesla's PR efforts remains debatable, as the controversy continues to generate significant media attention. A long-term strategy to repair the brand image will be crucial.

Conclusion: The Ongoing Legal Landscape and Future Implications of Tesla's Legal Maneuvers

Tesla faces a multifaceted legal landscape stemming from the Musk compensation controversy. The outcomes of the shareholder lawsuits and SEC investigations remain uncertain, but they carry significant implications for the company's financial stability, corporate governance, and brand reputation. The long-term effects on investor confidence and Tesla's market position will depend heavily on the resolution of these ongoing legal battles. To stay abreast of the evolving situation and its impact on Tesla's future, keep following developments surrounding Tesla's legal battles, Musk's compensation, and Tesla's legal strategy. The company's ability to navigate this complex legal minefield will be crucial to its long-term success.

Featured Posts

-

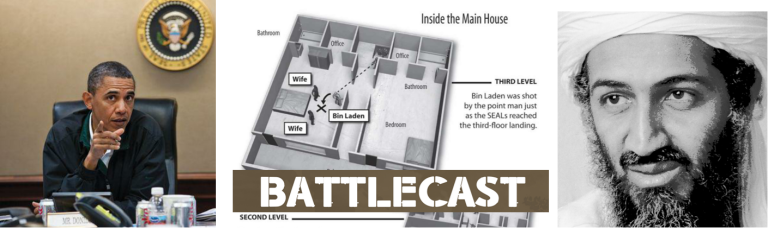

American Manhunt Osama Bin Laden Documentary Delayed Netflix Premiere Date

May 18, 2025

American Manhunt Osama Bin Laden Documentary Delayed Netflix Premiere Date

May 18, 2025 -

Analiz Axios Stiven Miller Kak Potentsialniy Sovetnik Trampa Po Natsionalnoy Bezopasnosti

May 18, 2025

Analiz Axios Stiven Miller Kak Potentsialniy Sovetnik Trampa Po Natsionalnoy Bezopasnosti

May 18, 2025 -

Teslas Strategy To Counter Shareholder Lawsuits Over Musks Compensation

May 18, 2025

Teslas Strategy To Counter Shareholder Lawsuits Over Musks Compensation

May 18, 2025 -

Asamh Bn Ladn Alka Yagnk Ke Mdahwn Ky Fhrst Myn Sb Se Awpr

May 18, 2025

Asamh Bn Ladn Alka Yagnk Ke Mdahwn Ky Fhrst Myn Sb Se Awpr

May 18, 2025 -

Netflixs Bin Laden Docuseries Manhunt Delays And Premiere Update

May 18, 2025

Netflixs Bin Laden Docuseries Manhunt Delays And Premiere Update

May 18, 2025

Latest Posts

-

Subskrybuj Podcast Stan Wyjatkowy Onetu I Newsweeka Dwa Raz W Tygodniu

May 18, 2025

Subskrybuj Podcast Stan Wyjatkowy Onetu I Newsweeka Dwa Raz W Tygodniu

May 18, 2025 -

Planifier Votre Sejour A Onet Le Chateau Le Lioran Vous Attend

May 18, 2025

Planifier Votre Sejour A Onet Le Chateau Le Lioran Vous Attend

May 18, 2025 -

Onetu I Newsweek Podcast Stan Wyjatkowy Regularne Aktualizacje

May 18, 2025

Onetu I Newsweek Podcast Stan Wyjatkowy Regularne Aktualizacje

May 18, 2025 -

Un Sejour Reussi A Onet Le Chateau Pres Du Lioran

May 18, 2025

Un Sejour Reussi A Onet Le Chateau Pres Du Lioran

May 18, 2025 -

Nowy Podcast Onetu I Newsweeka Stan Wyjatkowy Aktualnosci Dwa Raz W Tygodniu

May 18, 2025

Nowy Podcast Onetu I Newsweeka Stan Wyjatkowy Aktualnosci Dwa Raz W Tygodniu

May 18, 2025