Tesla's Board Under Fire From State Treasurers For Musk's Focus

Table of Contents

Concerns of State Treasurers Regarding Musk's Diversification

State treasurers are expressing serious apprehension about Elon Musk's widespread business interests and their potential detrimental effects on Tesla. Their primary concern centers on the impact of Musk's diversification on the company's performance and governance.

Impact of Musk's Multiple Ventures on Tesla's Performance

Musk's entrepreneurial endeavors extend far beyond Tesla, including significant involvement in SpaceX, the social media platform X (formerly Twitter), and other ventures. This extensive portfolio raises concerns about:

- Resource Diversion: The significant resources – both financial and human capital – allocated to SpaceX and X potentially detract from Tesla's operational needs, hindering innovation and growth.

- Management Attention: Musk's time and energy are spread thinly across multiple companies, potentially leading to insufficient attention to Tesla's strategic direction and day-to-day operations.

- Stock Price Fluctuations: There's a perceived negative correlation between significant events at Musk's other companies (e.g., Twitter's turbulent period) and fluctuations in Tesla's stock price, suggesting a direct impact on investor confidence.

- Conflicts of Interest: The potential for conflicts of interest between Tesla and Musk's other ventures remains a significant concern for state treasurers and investors alike. For instance, decisions benefiting one company might inadvertently harm another.

Lack of Oversight by Tesla's Board of Directors

Criticism is also directed at Tesla's board of directors for its perceived lack of oversight regarding Musk's divided focus. The board's composition and potential internal conflicts of interest are subject to considerable scrutiny. Questions are being raised about:

- Board Independence: Concerns exist about the independence of certain board members and their potential biases towards Musk.

- Effectiveness of Oversight: The board's apparent failure to adequately address and mitigate the risks associated with Musk's multiple ventures is a major point of contention.

- Public Statements: The lack of clear and decisive public statements from the board addressing these concerns has further fueled criticism and fueled calls for greater accountability.

Financial Implications for Tesla and its Investors

The concerns about Musk's divided attention translate directly into substantial financial implications for Tesla and its investors.

Potential for Decreased Stock Value

Musk's distracted leadership poses a significant threat to investor confidence, potentially leading to decreased stock value.

- Investor Sentiment: Negative news related to Musk's other companies directly impacts investor perception of Tesla, leading to sell-offs.

- Stock Performance Correlation: Statistical analysis may reveal a correlation between negative events at Musk's other ventures and a decline in Tesla's stock price.

- Shareholder Lawsuits: The potential for shareholder lawsuits alleging mismanagement and inadequate oversight further underlines the financial risk.

Risk to Long-Term Sustainability of Tesla

The lack of focused leadership poses a considerable threat to Tesla's long-term sustainability and competitive advantage.

- Innovation and Development: Resource constraints and managerial distractions could hinder Tesla's ability to innovate and develop new products and technologies.

- Market Share: Competitors in the rapidly evolving electric vehicle market could capitalize on Tesla's potential weaknesses.

- Future Growth: Overall, the long-term growth trajectory of Tesla is directly threatened by the current management structure and leadership focus.

Calls for Reform and Increased Accountability

The growing concerns have prompted calls for significant reforms and increased accountability within Tesla's governance structure.

Demands for Board Restructuring or Changes in Leadership

State treasurers and other stakeholders are demanding changes, including:

- Board Restructuring: Calls for the appointment of more independent and experienced directors to provide effective oversight.

- Leadership Changes: While less frequently suggested, some advocate for changes in leadership to ensure a greater focus on Tesla's core business.

- Shareholder Proposals: Shareholders might initiate proposals for changes in corporate governance to address these concerns.

Increased Transparency and Disclosure Requirements

Greater transparency surrounding Musk's involvement in other companies and their impact on Tesla is crucial. This includes:

- Enhanced Disclosure: More detailed public disclosures regarding the allocation of resources and management time across Musk's various ventures.

- Regulatory Scrutiny: Increased regulatory scrutiny could enforce greater transparency and accountability.

- Independent Audits: Independent audits could help verify the accuracy and completeness of financial disclosures.

Conclusion: The Future of Tesla's Board and Musk's Focus

The ongoing controversy surrounding Tesla's board and Elon Musk's divided focus highlights the critical importance of effective corporate governance. State treasurers' concerns regarding the potential negative impacts on Tesla's stock performance, long-term sustainability, and investor confidence are substantial. The key takeaway is that a lack of focused leadership and oversight poses significant risks. To ensure Tesla's future success, meaningful reforms are urgently needed, including board restructuring, increased transparency, and a more defined strategic focus. Stay informed about future developments to understand how this situation impacts the future of Tesla and the electric vehicle industry. The scrutiny of Tesla's board and Musk's focus will continue to shape the narrative around corporate governance and the leadership of innovative technology companies.

Featured Posts

-

Bed Akhr Ankhfad Asear Aldhhb Alywm Fy Alsaght

Apr 23, 2025

Bed Akhr Ankhfad Asear Aldhhb Alywm Fy Alsaght

Apr 23, 2025 -

End Of Ryujinx Nintendo Contact Leads To Emulator Shutdown

Apr 23, 2025

End Of Ryujinx Nintendo Contact Leads To Emulator Shutdown

Apr 23, 2025 -

Brewers Vs Diamondbacks Naylors Key Rbi In Diamondbacks Win

Apr 23, 2025

Brewers Vs Diamondbacks Naylors Key Rbi In Diamondbacks Win

Apr 23, 2025 -

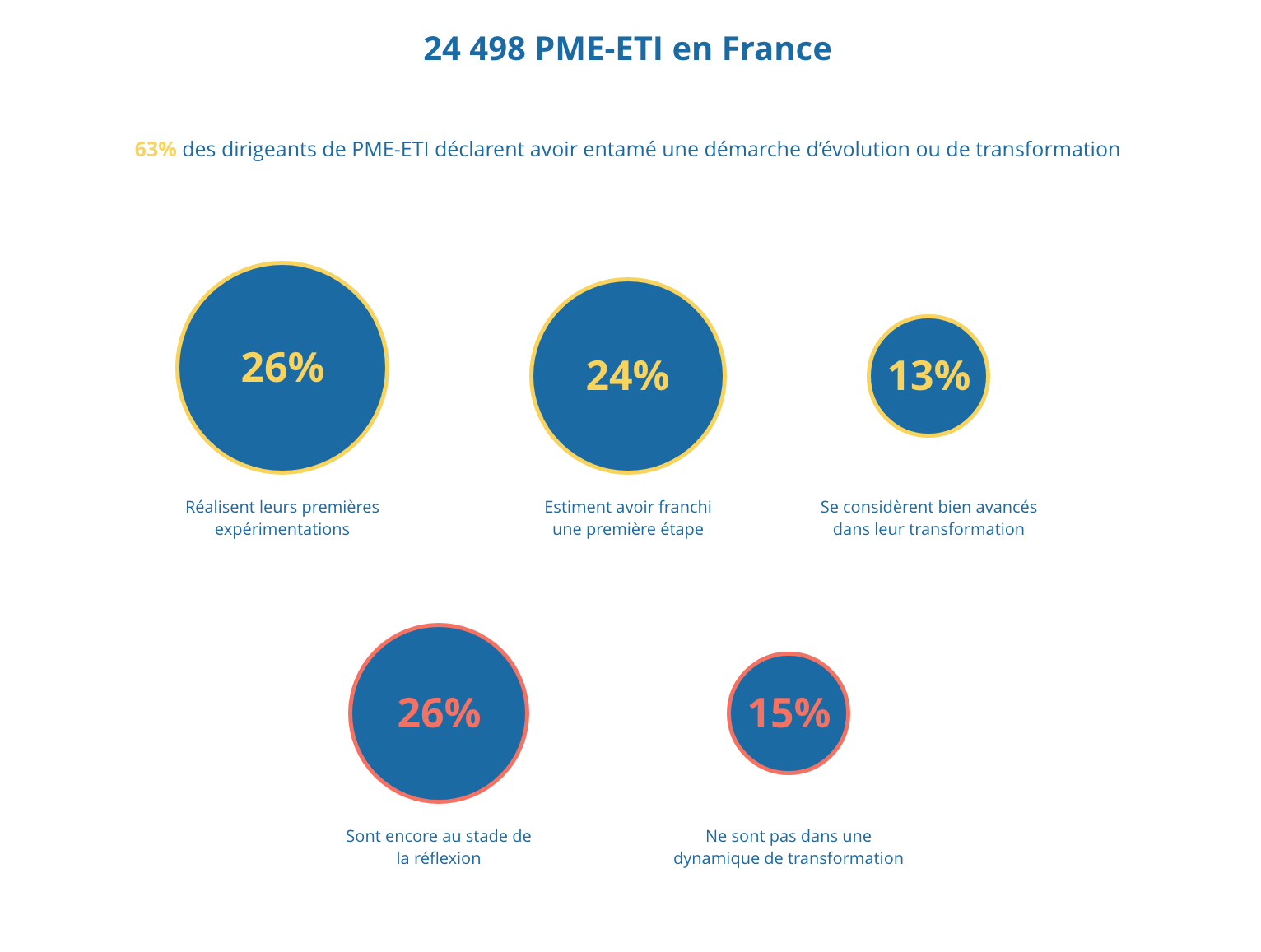

Actualites Economiques Du 18h Eco Lundi 14 Avril

Apr 23, 2025

Actualites Economiques Du 18h Eco Lundi 14 Avril

Apr 23, 2025 -

La Carte Blanche De Marc Fiorentino Analyse Et Decryptage

Apr 23, 2025

La Carte Blanche De Marc Fiorentino Analyse Et Decryptage

Apr 23, 2025