Tesla Q1 Profits Plunge Amid Musk's Political Backlash

Table of Contents

The Steep Decline in Tesla Q1 Earnings

The Tesla Q1 earnings report revealed a far steeper decline than anticipated. This significant drop in profitability presents a serious challenge for the company, demanding a thorough analysis of the underlying causes.

Financial Figures and Analysis

Tesla's Q1 2023 profits fell by [Insert Exact Percentage]% compared to the previous quarter (Q4 2022) and missed analyst expectations by [Insert Percentage/Amount]. While precise figures will vary based on final reporting, early indications point to a substantial decrease. Beyond the political backlash, contributing factors likely include increased competition from established and emerging EV manufacturers, persistent supply chain issues impacting production, and the impact of recent price cuts implemented to boost sales volume. These factors, combined with the negative publicity, created a perfect storm impacting Tesla's bottom line.

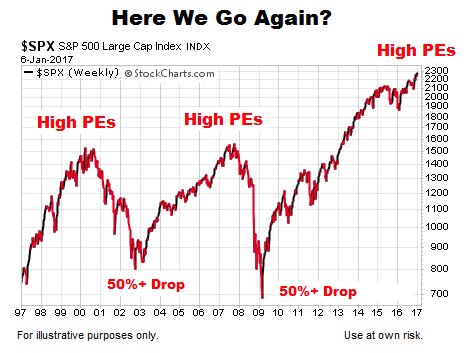

Impact on Tesla Stock Price

The announcement of the significantly lower-than-expected Tesla Q1 profits immediately impacted the stock price. [Insert Data on Stock Price Fluctuation – ideally with a chart or graph]. Investor sentiment turned overwhelmingly negative, leading to a considerable drop in Tesla's market capitalization. This sharp decline reflects the market's concern about the company's ability to maintain its growth trajectory amidst escalating challenges.

- Specific numbers for Q1 profit: [Insert Exact Figures]

- Comparison to Q4 2022 profits: [Insert Percentage/Amount Difference]

- Stock price fluctuation before and after the earnings announcement: [Insert Specific Data]

- Analyst predictions versus actual results: [Insert Comparison Data]

Elon Musk's Political Controversies and Their Impact

Elon Musk's recent highly publicized political actions and controversies have undoubtedly played a significant role in the Tesla Q1 profits plunge. The perception of risk associated with the company, fueled by these controversies, has undoubtedly affected investor confidence and consumer sentiment.

Specific Controversies

Several specific controversies have drawn considerable negative attention to Elon Musk and, by extension, Tesla. The tumultuous acquisition of Twitter, including significant financial investment and resulting operational disruptions, and Musk's outspoken political endorsements have generated considerable negative publicity. These actions have alienated segments of the consumer base and raised concerns among investors regarding potential reputational damage and negative long-term effects on the company's brand.

The Link Between Controversy and Profits

The causal link between Musk's actions and the decline in Tesla's Q1 profits is complex but undeniable. Negative media coverage surrounding the controversies has likely contributed to a decrease in consumer confidence, potentially leading to reduced demand for Tesla vehicles. Furthermore, the uncertainty surrounding Musk's leadership and the potential impact of his actions on Tesla's operations has undoubtedly shaken investor confidence, leading to sell-offs and a decline in the stock price.

- Summary of each major controversy: [Briefly describe each key controversy]

- Evidence of negative media coverage related to each controversy: [Cite relevant news sources]

- Potential impact on brand image and consumer sentiment: [Analyze the effects on brand perception]

- Analysis of investor responses: [Discuss sell-offs and market reactions]

Future Outlook for Tesla: Navigating the Storm

Despite the significant challenges, Tesla retains considerable strengths. The company's innovative technology, established brand recognition, and expanding global presence provide a solid foundation for future growth. However, navigating the current storm requires strategic action.

Strategies for Recovery

Tesla needs to implement a multifaceted strategy to recover from this setback. This may involve refocusing marketing efforts on product features and technological advancements, rather than the controversial actions of its CEO. New product launches, particularly in the more affordable vehicle segment, are crucial to maintain sales momentum. Cost-cutting measures may also be necessary to improve profit margins. Furthermore, a proactive public relations campaign aimed at rebuilding its brand image and regaining consumer trust is essential.

Analysis of Long-Term Viability

While the Tesla Q1 profits plunge is a significant blow, it doesn't necessarily signal the end of the company's dominance in the EV market. Tesla's long-term viability depends heavily on successfully navigating the current challenges, implementing effective recovery strategies, and effectively managing the impact of Elon Musk's public image on the company's brand.

- Potential new product announcements: [Discuss any anticipated product launches]

- Expected changes in marketing or PR strategies: [Analyze potential changes in communication approaches]

- Predictions for future quarters’ performance: [Offer cautious predictions for upcoming quarters]

- Expert opinions on Tesla's future: [Summarize opinions from industry analysts]

Conclusion: Tesla Q1 Profits Plunge: What's Next?

The Tesla Q1 profits plunge is a stark reminder of the interconnectedness between a company's financial performance and its leadership's public image. The significant drop in profits, directly linked to Elon Musk's political controversies and the resulting negative publicity, raises serious questions about the company's future trajectory. The impact of this political backlash on Tesla's financial health and its potential long-term consequences remain to be seen.

What are your predictions for Tesla's Q2 performance in light of these recent events? Share your thoughts on the Tesla Q1 profits plunge in the comments below!

Featured Posts

-

Why Investors Shouldnt Fear High Stock Market Valuations A Bof A Perspective

Apr 24, 2025

Why Investors Shouldnt Fear High Stock Market Valuations A Bof A Perspective

Apr 24, 2025 -

New Google Fi 35 Month Unlimited Plan A Comprehensive Guide

Apr 24, 2025

New Google Fi 35 Month Unlimited Plan A Comprehensive Guide

Apr 24, 2025 -

Teslas Reduced Q1 Profitability Analysis Of The Musk Factor

Apr 24, 2025

Teslas Reduced Q1 Profitability Analysis Of The Musk Factor

Apr 24, 2025 -

Landlord Rent Increases Following La Fires Spark Outrage

Apr 24, 2025

Landlord Rent Increases Following La Fires Spark Outrage

Apr 24, 2025 -

Tesla And Space X Under Epa Scrutiny The Rise Of Elon Musk And Dogecoin

Apr 24, 2025

Tesla And Space X Under Epa Scrutiny The Rise Of Elon Musk And Dogecoin

Apr 24, 2025