Tesla Q1 2024 Financial Results: Significant Impact Of Political Factors

Table of Contents

Geopolitical Instability and its Effect on Tesla's Supply Chain

Geopolitical instability significantly impacted Tesla's supply chain in Q1 2024, creating challenges in procuring raw materials and managing logistics. Fluctuations in the global political landscape directly translated into increased costs and operational disruptions.

Raw Material Price Fluctuations

The price volatility of crucial battery materials like lithium, nickel, and cobalt was heavily influenced by international relations and political instability in key mining regions.

- Political instability in the Democratic Republic of Congo: Ongoing conflict and political uncertainty disrupted cobalt mining operations, leading to supply shortages and price increases. This directly impacted Tesla's battery production costs.

- Lithium price spikes due to sanctions and trade disputes: Sanctions imposed on certain countries and trade disputes between major lithium-producing nations led to supply chain bottlenecks and dramatic price increases for this critical battery component.

- Government interventions aimed at market stabilization: While some governments attempted to intervene and stabilize raw material markets through subsidies and strategic reserves, their impact on Tesla's Q1 performance was limited due to the speed and scale of the price fluctuations. This highlights the vulnerability of Tesla's supply chain to global political events.

Disruptions in Manufacturing and Logistics

Political tensions and unexpected global events created significant disruptions in Tesla's manufacturing and logistics operations.

- Port closures and logistical delays: Geopolitical tensions and port congestion in key regions resulted in significant delays in the shipment of components and finished vehicles, impacting production schedules and delivery times.

- Trade wars and tariffs: Ongoing trade disputes resulted in increased tariffs on imported components, significantly adding to Tesla's production costs. This affected profitability and forced adjustments in pricing strategies.

- Tesla's mitigation strategies: Tesla actively sought to mitigate these risks through diversification of its supply chains, exploration of alternative sourcing options, and investment in enhanced logistics capabilities. However, the speed and severity of the geopolitical events limited the effectiveness of these strategies in Q1 2024.

Impact of Government Regulations and Policies on Tesla's Sales and Operations

Government regulations and policies played a significant role in shaping Tesla's sales and operations during Q1 2024, influencing consumer demand and operational costs.

Changes in EV Subsidies and Incentives

Changes in government subsidies and incentives for electric vehicles (EVs) significantly impacted market demand in various regions.

- Reduction of EV subsidies in certain countries: Some countries reduced or eliminated their EV subsidies, impacting consumer demand for Tesla vehicles. This led to a noticeable decrease in sales in those specific markets.

- Increased competition due to shifting subsidies: The changes in government support for EVs created a more competitive landscape, requiring Tesla to adjust its pricing and marketing strategies.

- Tesla's market share response: Tesla experienced fluctuations in its market share as a direct result of changes in government support for EVs in various regions.

Navigating Trade Wars and Tariffs

Trade wars and tariffs imposed by different governments created hurdles for Tesla's global operations and significantly increased costs.

- Tariffs on imported parts and materials: The imposition of tariffs on imported parts and materials increased Tesla's production costs and reduced its competitiveness in certain markets.

- Impact on export strategies: Tesla was forced to adjust its export strategies and pricing to mitigate the impact of tariffs, reducing profitability in some regions.

- Strategies to counteract negative impacts: Tesla employed various strategies to counter the negative effects of tariffs, including exploring alternative sourcing options and lobbying efforts to reduce or eliminate trade barriers.

Political Risks and Investment Decisions

The political landscape significantly influenced investor sentiment and Tesla's investment decisions in Q1 2024.

Investor Sentiment and Stock Market Reactions

Political uncertainty created volatility in investor sentiment and impacted Tesla's stock performance.

- Correlation between political events and stock price: Tesla's stock price showed a clear correlation with major political events and announcements, reflecting investor concerns about political risks.

- Analyst reports and investor statements: Many analyst reports highlighted the impact of political factors on Tesla's performance, reflecting a cautious investor sentiment.

- Impact on market capitalization: Fluctuations in investor sentiment resulted in significant changes in Tesla's market capitalization throughout the quarter.

Future Outlook and Mitigation Strategies

Tesla is taking proactive steps to mitigate political risks and maintain financial stability in the long term.

- Supply chain diversification: Tesla is actively diversifying its supply chains to reduce its reliance on politically unstable regions.

- Investment in R&D: Investing in R&D to enhance production efficiency and reduce reliance on specific materials vulnerable to political instability.

- Government relations and lobbying: Tesla is engaging in active lobbying efforts and government relations to advocate for favorable policies.

Conclusion

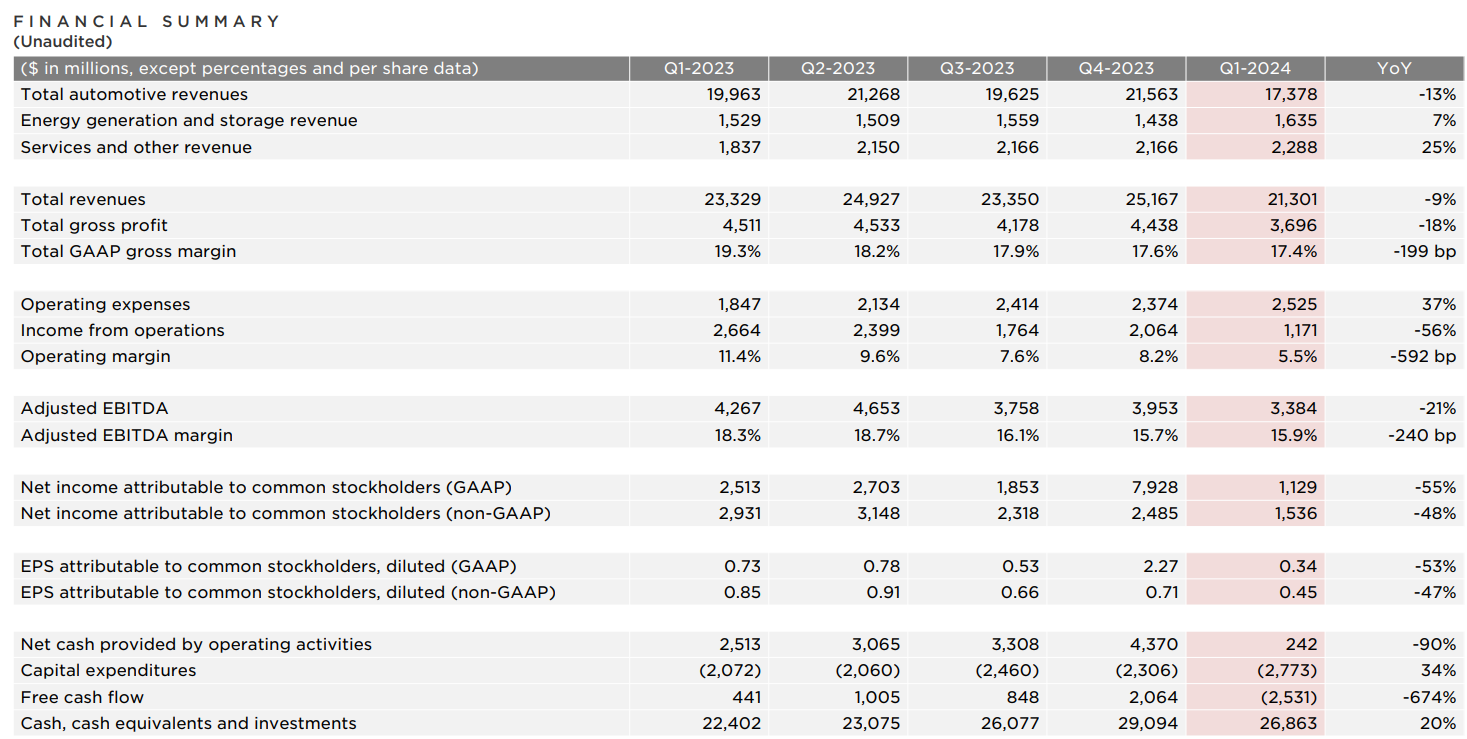

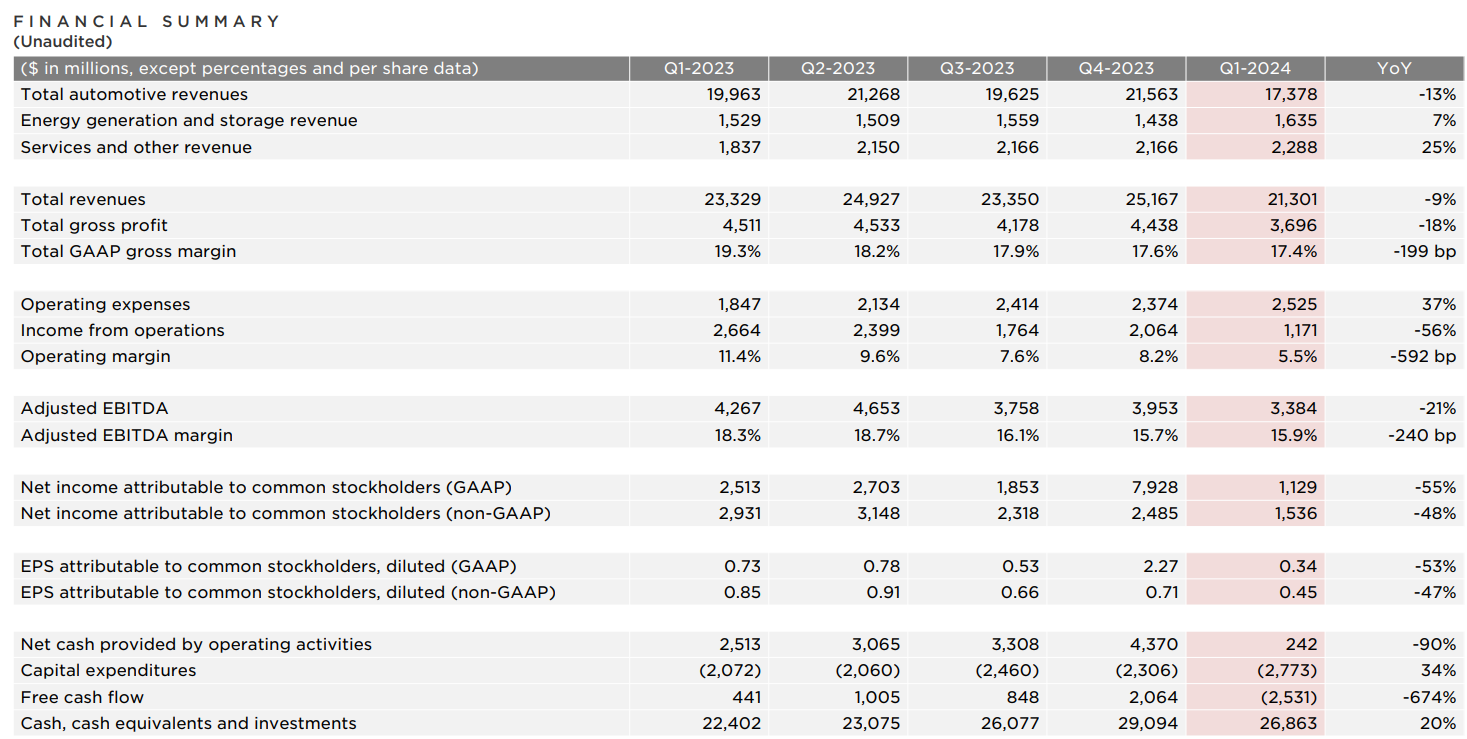

Tesla's Q1 2024 financial results demonstrate the significant influence of political factors on its performance. Geopolitical instability disrupted supply chains, impacting raw material costs and logistics. Changes in government policies regarding EV subsidies and trade wars further affected sales and operational costs. These political risks influenced investor sentiment and stock performance. Understanding the intricate interplay between politics and business is crucial for interpreting Tesla's Q1 2024 financial results and predicting its future performance. Staying informed about the political landscape impacting the electric vehicle industry is essential for investors and industry stakeholders alike. Continue to follow our analysis for further insights into Tesla's financial trajectory and the ongoing impact of political factors on the EV sector.

Featured Posts

-

Why Middle Managers Are Essential For Company Success And Employee Growth

Apr 24, 2025

Why Middle Managers Are Essential For Company Success And Employee Growth

Apr 24, 2025 -

Actors And Writers Strike Hollywood Faces Unprecedented Production Halt

Apr 24, 2025

Actors And Writers Strike Hollywood Faces Unprecedented Production Halt

Apr 24, 2025 -

Bethesdas Oblivion Remastered Everything You Need To Know

Apr 24, 2025

Bethesdas Oblivion Remastered Everything You Need To Know

Apr 24, 2025 -

Alcons 417 5 Million Acquisition Of Village Roadshow Approved

Apr 24, 2025

Alcons 417 5 Million Acquisition Of Village Roadshow Approved

Apr 24, 2025 -

Strong Interest In 65 Hudsons Bay Company Leases

Apr 24, 2025

Strong Interest In 65 Hudsons Bay Company Leases

Apr 24, 2025