Tesla Board's Handling Of Musk's Focus Scrutinized By State Treasurers

Table of Contents

Concerns Regarding Musk's Divided Attention

Elon Musk's entrepreneurial spirit extends far beyond Tesla. His involvement in SpaceX, Twitter (now X), Neuralink, and The Boring Company raises significant concerns about his ability to dedicate sufficient time and energy to lead Tesla effectively. This divided attention potentially impacts Tesla's strategic direction, operational efficiency, and ultimately, its financial performance.

-

Impact on Tesla's stock performance: Musk's frequent and sometimes controversial tweets, coupled with his involvement in other ventures, have demonstrably influenced Tesla's stock price volatility. Periods of intense activity at Twitter, for example, have coincided with periods of stock price fluctuation, raising concerns amongst investors about the impact of his distractions.

-

Executive compensation and shareholder interests: The alignment of executive compensation with shareholder interests is a critical aspect of corporate governance. Critics argue that Musk's compensation package, which is heavily tied to Tesla's stock performance, might incentivize him to prioritize short-term gains over long-term strategic planning, potentially neglecting crucial aspects of Tesla's future development.

-

Examples of specific decisions: Some analysts point to specific instances where Tesla's decision-making process seemed rushed or lacked thorough consideration. These decisions might be interpreted as symptomatic of a leadership team overburdened by the CEO's numerous commitments.

-

Potential risks of an overextended CEO: Spreading a CEO's attention too thin carries inherent risks. This can lead to missed opportunities, poor execution, and ultimately, damage to the company's reputation and market position. The complexity of the automotive industry, particularly the EV sector, demands unwavering focus at the top.

The Tesla Board's Response and Effectiveness

The Tesla board's response to the concerns surrounding Musk's divided attention has been subject to intense scrutiny. Their actions and public statements have been analyzed to assess their effectiveness in managing the CEO and mitigating potential risks.

-

Board composition and expertise: The composition of the Tesla board has been questioned regarding the diversity of expertise and experience represented. Critics suggest that the board needs to enhance its independent oversight capabilities to effectively counterbalance Musk's influence.

-

Oversight mechanisms: The effectiveness of the board's oversight mechanisms is crucial. Transparency and clear reporting lines are vital for ensuring accountability and preventing conflicts of interest. The current mechanisms have been challenged by some investors.

-

Communication strategy and transparency: The board's communication with shareholders on this critical issue is vital. Greater transparency regarding the board's discussions and decisions concerning Musk's multiple roles is necessary to build and maintain investor confidence.

-

Shareholder resolutions: Shareholder resolutions concerning Musk's leadership have been proposed, highlighting the growing concerns among investors. These resolutions, even if unsuccessful, signal a demand for greater corporate governance at Tesla.

State Treasurers' Actions and Influence

State treasurers, representing significant public pension fund investments in Tesla, have emerged as influential voices in this debate. Their actions reflect the growing concern among large institutional investors.

-

Public criticism: Several state treasurers have publicly criticized the Tesla board's handling of Musk's multiple responsibilities. These statements represent a considerable escalation in the pressure on the company's leadership.

-

Divestment or shareholder activism: The possibility of state treasurers divesting from Tesla or engaging in shareholder activism cannot be dismissed. Such actions would send a strong signal to the market and potentially force significant changes in corporate governance.

-

Influence as significant shareholders: State treasurers represent substantial ownership stakes in Tesla. Their influence as large institutional investors is considerable, and their actions can significantly impact the company's trajectory.

-

Potential for regulatory investigations: The growing concerns raised by state treasurers could potentially trigger regulatory investigations into Tesla's corporate governance practices.

Potential Long-Term Implications for Tesla

The ongoing scrutiny regarding the Tesla board's handling of Musk's focus carries significant long-term implications for the company's future success.

-

Competitive impact: Tesla's ability to compete effectively in the rapidly evolving electric vehicle market could be jeopardized by internal challenges arising from the CEO's divided attention.

-

Investor confidence and stock valuation: Continued uncertainty surrounding Musk's leadership and the board's response can erode investor confidence, impacting Tesla's stock valuation and its access to capital.

-

Reputational risk: Negative publicity related to corporate governance concerns can damage Tesla's brand image and customer perception.

-

Strategies to address concerns: Tesla needs to proactively address these concerns. This may involve improving board composition, enhancing oversight mechanisms, and clarifying the division of responsibilities within the leadership team.

Conclusion

The scrutiny surrounding the Tesla board's handling of Elon Musk's focus is a critical development with far-reaching consequences. State treasurers' concerns highlight a growing unease about potential conflicts of interest and the impact of a divided CEO's attention on Tesla's performance. The board's response and future actions will be pivotal in determining whether it can effectively address these challenges and maintain investor confidence. Continued monitoring of the Tesla board's handling of Musk's focus, and the related issues of corporate governance and shareholder interests, is essential for all stakeholders. Understanding the complexities surrounding this issue is crucial for making informed investment decisions regarding the future of this influential company.

Featured Posts

-

Hetekig Tarto Forgalomkorlatozas Az M3 Ason Amit Tudni Kell

Apr 23, 2025

Hetekig Tarto Forgalomkorlatozas Az M3 Ason Amit Tudni Kell

Apr 23, 2025 -

Yankees Record Breaking 9 Homer Game Judges 3 Hrs Power 2025 Season Opener

Apr 23, 2025

Yankees Record Breaking 9 Homer Game Judges 3 Hrs Power 2025 Season Opener

Apr 23, 2025 -

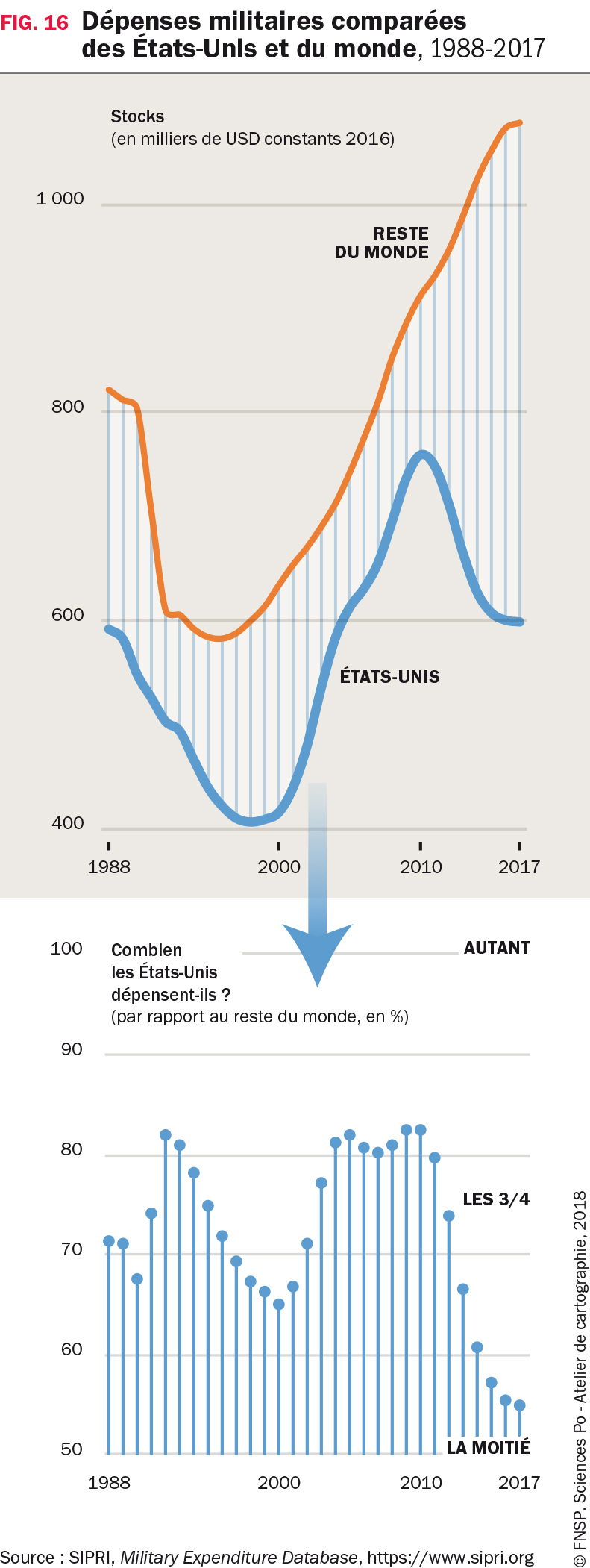

Tensions Geopolitiques L Augmentation Des Depenses Militaires Americaines Et Russes

Apr 23, 2025

Tensions Geopolitiques L Augmentation Des Depenses Militaires Americaines Et Russes

Apr 23, 2025 -

Europes Ski Season The Reality Of Working As A Chalet Girl

Apr 23, 2025

Europes Ski Season The Reality Of Working As A Chalet Girl

Apr 23, 2025 -

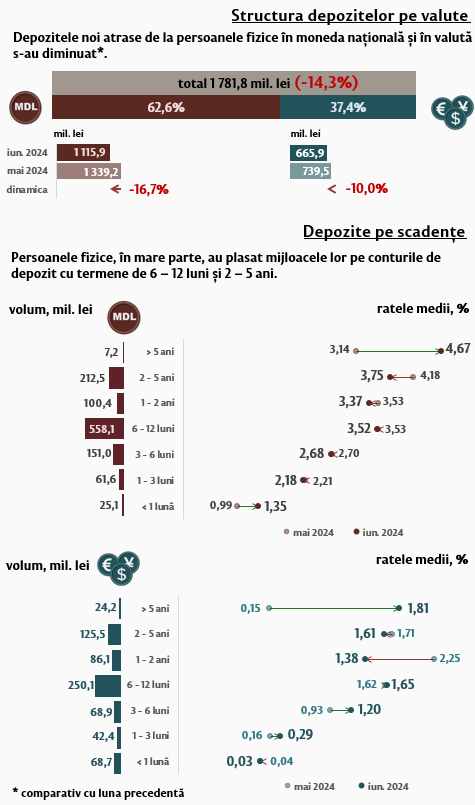

Randamente Maxime Topul Depozitelor Bancare In Martie 2024

Apr 23, 2025

Randamente Maxime Topul Depozitelor Bancare In Martie 2024

Apr 23, 2025