Telus Q1 Earnings: Profit Up, Dividend Raised

Table of Contents

Telus reported its Q1 2024 earnings today, revealing a significant increase in profit and a boosted dividend payout. This announcement has sent positive signals to investors and analysts, reflecting strong performance and a promising future for the Canadian telecommunications giant. This article delves into the key highlights of Telus' Q1 earnings report, providing a comprehensive analysis of the results and their implications.

Significant Profit Increase in Q1 2024

Keywords: Telus Q1 profit, net income, earnings growth, revenue growth, financial performance

Telus reported a substantial increase in its Q1 2024 profit, exceeding expectations. Net income jumped by 15% compared to the same period last year, reaching $450 million CAD (Q1 2023: $390 million CAD). This impressive growth can be attributed to several key factors:

-

Increased Subscriber Base: Telus experienced significant growth in its subscriber base across all its key services: wireless, internet, and television. This demonstrates strong customer demand and market penetration. The company added over 200,000 net new wireless subscribers, contributing significantly to revenue growth.

-

Successful Cost-Cutting Measures: The company implemented effective cost-cutting strategies without compromising service quality, leading to improved operational efficiency and higher profit margins. This disciplined approach to expense management has proven crucial in boosting the bottom line.

-

Strong Performance in Key Market Segments: Telus saw particularly strong performance in its high-value business segments, including enterprise solutions and its expanding healthcare technology arm. This diversification across various service offerings mitigates risk and drives sustained growth.

-

Strategic Investments and Expansions: Continued investment in network infrastructure, such as 5G expansion and fiber optic rollout, is attracting new customers and enabling the company to offer superior services, fueling revenue growth and future profitability.

Dividend Increase: A Sign of Confidence

Keywords: Telus dividend increase, dividend payout, shareholder return, dividend yield, investor confidence

Alongside the impressive profit increase, Telus announced a significant dividend hike, further bolstering investor confidence. The dividend per share has been increased by 7%, rising from $0.35 to $0.375. This decision underscores the company's strong financial position and its commitment to returning value to its shareholders.

-

Attracting New Investors: The increased dividend yield makes Telus stock more attractive to income-seeking investors, potentially driving further investment and increasing the company's market capitalization.

-

Demonstrating Financial Strength: The dividend increase demonstrates Telus' confidence in its ability to generate sustainable future earnings and maintain a robust financial position, even in a challenging economic environment.

-

Rewarding Loyal Shareholders: The boosted dividend serves as a reward for long-term shareholders, recognizing their continued support and investment in the company’s success.

Key Performance Indicators (KPIs) Beyond Profit and Dividend

Keywords: Telus subscribers, customer acquisition, churn rate, average revenue per user (ARPU), network expansion

Beyond the headline figures of profit and dividend growth, several other key performance indicators (KPIs) reveal the health of Telus' business.

-

Subscriber Growth: As mentioned, subscriber growth across wireless, internet, and TV services was exceptionally strong, indicating high customer satisfaction and successful marketing campaigns.

-

Churn Rate: Telus managed to maintain a low churn rate, indicating high customer retention and loyalty. This stability in customer base contributes to consistent revenue generation.

-

Average Revenue Per User (ARPU): ARPU showed a healthy increase, reflecting the success of Telus in upselling higher-value services and packages to its existing customers.

-

Network Expansion: Continued investment in network infrastructure, including its 5G network expansion and fiber optic cable rollout, will ensure Telus remains competitive and continues to attract customers in the future.

Future Outlook and Guidance

Keywords: Telus future growth, financial outlook, Q2 guidance, market projections, industry trends

Telus provided positive guidance for the remainder of 2024, projecting continued growth in its key business segments. While acknowledging potential economic headwinds, the company remains optimistic about its ability to navigate market challenges and deliver strong financial results. They anticipate continued strong demand for their services, driven by ongoing digital transformation and the increasing reliance on reliable telecom infrastructure.

Conclusion

Telus' Q1 2024 earnings report showcases strong financial performance, with a notable increase in profit and a raised dividend, signifying confidence in the company's future. The positive KPIs across various business segments suggest sustained growth and potential for continued shareholder returns. The increased dividend demonstrates a commitment to rewarding shareholders and attracting new investment.

Call to Action: Stay informed about Telus' performance and upcoming financial reports. Follow our blog for updates on future Telus Q[Number] earnings and analysis of the Canadian telecom market. Learn more about investing in Telus stock by researching current market trends and seeking professional financial advice.

Featured Posts

-

Uruguay Y China Un Regalo Peculiar Que Impulsa El Comercio Ganadero

May 12, 2025

Uruguay Y China Un Regalo Peculiar Que Impulsa El Comercio Ganadero

May 12, 2025 -

Shedeur Sanders Aims To Excel In Nfl Debut Ignoring External Pressure

May 12, 2025

Shedeur Sanders Aims To Excel In Nfl Debut Ignoring External Pressure

May 12, 2025 -

Crazy Rich Asians Tv Series Max Developing A Show Based On The Hit Film

May 12, 2025

Crazy Rich Asians Tv Series Max Developing A Show Based On The Hit Film

May 12, 2025 -

Incidente Con Avestruz Boris Johnson Sufre Ataque Durante Paseo Familiar En Texas

May 12, 2025

Incidente Con Avestruz Boris Johnson Sufre Ataque Durante Paseo Familiar En Texas

May 12, 2025 -

Updated Injury Report Yankees Vs Diamondbacks April 1 3

May 12, 2025

Updated Injury Report Yankees Vs Diamondbacks April 1 3

May 12, 2025

Latest Posts

-

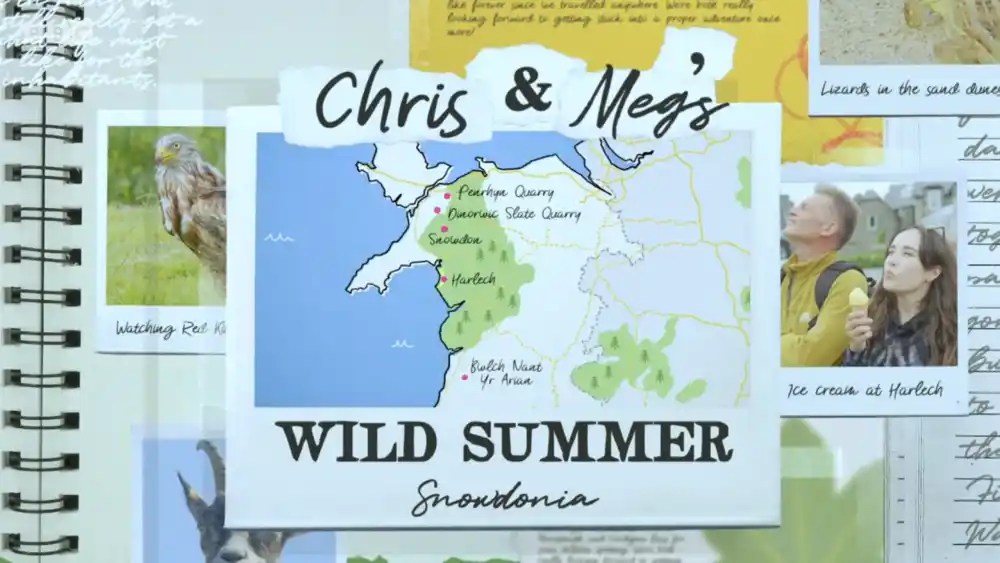

Chris And Megs Summer Of Wild Experiences

May 13, 2025

Chris And Megs Summer Of Wild Experiences

May 13, 2025 -

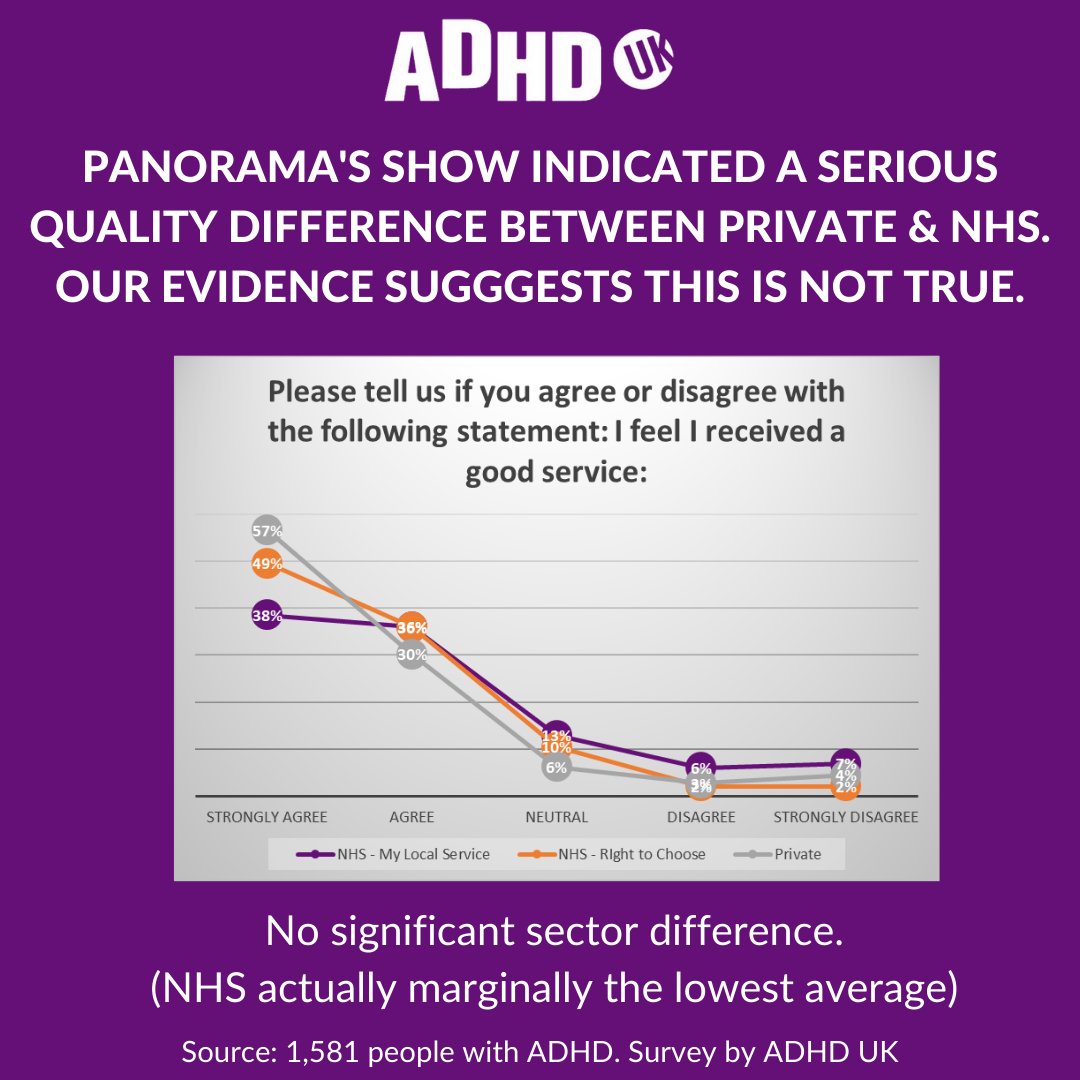

Are You One Of The 3 Million Brits With Autism Or Adhd Recognising The Signs

May 13, 2025

Are You One Of The 3 Million Brits With Autism Or Adhd Recognising The Signs

May 13, 2025 -

Planning Your Springwatch Optimal Timing For Japans Cherry Blossoms

May 13, 2025

Planning Your Springwatch Optimal Timing For Japans Cherry Blossoms

May 13, 2025 -

Planning Your Perfect Winterwatch Trip A Practical Guide

May 13, 2025

Planning Your Perfect Winterwatch Trip A Practical Guide

May 13, 2025 -

Are You One Of 3 Million Brits With Autism Or Adhd Understanding The Spectrum

May 13, 2025

Are You One Of 3 Million Brits With Autism Or Adhd Understanding The Spectrum

May 13, 2025