Telus Announces Q1 Earnings Growth And Dividend Boost

Table of Contents

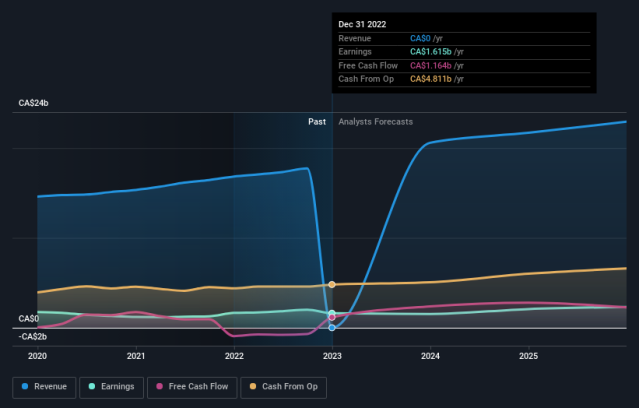

Q1 Earnings Growth Exceeds Expectations

Telus's Q1 2024 financial performance exceeded expectations across the board, demonstrating strong year-over-year (YoY) growth in key financial metrics. This robust performance reflects the company's operational efficiency and strategic initiatives.

-

Q1 Revenue: Telus reported Q1 revenue of [Insert Actual Revenue Figure], representing a [Insert Percentage]% YoY increase. This substantial growth is largely attributed to increased demand for its wireless and internet services.

-

Net Income: Net income for the quarter reached [Insert Actual Net Income Figure], a [Insert Percentage]% YoY surge. This reflects improved profitability and effective cost management.

-

Earnings Per Share (EPS): EPS increased to [Insert Actual EPS Figure], marking a [Insert Percentage]% YoY growth. This signifies increased earnings per share held by investors.

-

Key Drivers of Revenue Growth: The growth in revenue can be attributed to several key factors, including a significant increase in mobile subscribers, particularly in its high-value plans, and strong performance in its fiber optic internet services, driven by increasing demand for high-speed connectivity. The successful launch of [mention any new product or service] also contributed significantly to revenue growth.

Increased Dividend: A Sign of Confidence

Telus announced a significant increase to its quarterly dividend, further solidifying its commitment to shareholder returns. This move reflects the company's confidence in its future prospects and its ability to generate sustainable profits.

-

New Dividend Amount: The new quarterly dividend per share is [Insert Actual Dividend Amount].

-

Percentage Increase: This represents a [Insert Percentage]% increase compared to the previous quarter's dividend.

-

Ex-Dividend Date: The ex-dividend date is [Insert Actual Ex-Dividend Date].

-

Implications for Dividend Yield: The dividend increase results in a [Insert Actual Dividend Yield]% dividend yield, making Telus an attractive option for income-seeking investors.

-

Management Commentary: Telus management highlighted the dividend increase as a reflection of the company's strong financial position and commitment to delivering long-term value to shareholders. This increased dividend payout ratio signifies confidence in sustained future profitability.

Analysis of Key Business Segments

Telus operates across several key business segments, each contributing to the overall financial success of the company. Analyzing each segment's performance reveals areas of strength and potential for future growth.

-

Wireless: The wireless segment continued to demonstrate strong performance, with [Insert Specific Data, e.g., X% increase in subscribers] and an increase in average revenue per user (ARPU).

-

Internet: The internet segment saw robust growth driven by increased demand for high-speed internet services, particularly fiber optic connections. [Insert Specific Data, e.g., X% increase in subscribers].

-

Television: The television segment [Insert Performance Summary and relevant data]. Telus is actively adapting to the changing media landscape by investing in streaming services and enhancing its content offerings.

-

Competitive Landscape: Telus maintains a strong competitive position in the Canadian telecommunications market, leveraging its extensive network infrastructure and innovative service offerings. The company continues to focus on customer acquisition and retention strategies to maintain market share.

Future Outlook and Investor Implications

Telus's Q1 results provide a positive outlook for the remainder of the year. The company’s strong financial performance and strategic initiatives suggest continued growth.

-

Financial Guidance: Telus provided [Insert Summary of Telus' Financial Guidance for the Rest of the Year].

-

Potential Impact on Stock Price: The positive Q1 earnings and the dividend increase are likely to positively influence Telus's stock price, making it an attractive investment for growth and income-focused investors.

-

Key Risk Factors: While the outlook is positive, potential risk factors for investors include increasing competition, regulatory changes, and macroeconomic uncertainties.

-

Investment Recommendations: Given the strong Q1 performance and positive outlook, Telus stock could be considered a buy or hold for investors with a long-term perspective. Further research is recommended to assess individual investment suitability.

Conclusion

Telus's Q1 2024 earnings report showcases strong earnings growth, a significant dividend boost, and positive future prospects. The company's robust financial performance and strategic initiatives position it well for continued success. This makes Telus an attractive investment for those looking for strong dividend growth alongside capital appreciation. Learn more about Telus's Q1 2024 earnings and investment opportunities by visiting the official Telus investor relations website. Consider investing in Telus stock based on this robust performance and promising future.

Featured Posts

-

Indy Cars 2025 Changes Increased Danger For Drivers

May 12, 2025

Indy Cars 2025 Changes Increased Danger For Drivers

May 12, 2025 -

9 Potential Popes Examining The Leading Candidates For The Papacy

May 12, 2025

9 Potential Popes Examining The Leading Candidates For The Papacy

May 12, 2025 -

Transferrykten Thomas Mueller Lockas Av Tva Okaenda Klubbar

May 12, 2025

Transferrykten Thomas Mueller Lockas Av Tva Okaenda Klubbar

May 12, 2025 -

Eric Antoine Une Ancienne Miss Meteo Fait Sensation A La Premiere De Son Spectacle

May 12, 2025

Eric Antoine Une Ancienne Miss Meteo Fait Sensation A La Premiere De Son Spectacle

May 12, 2025 -

The Consistent Easter Egg Across Adam Sandlers Movie Filmography

May 12, 2025

The Consistent Easter Egg Across Adam Sandlers Movie Filmography

May 12, 2025

Latest Posts

-

Exposition D Art Sylvester Stallone Visiteur D Exception

May 12, 2025

Exposition D Art Sylvester Stallone Visiteur D Exception

May 12, 2025 -

Lofzang Op Instagram De Schoonheid Van Sylvester Stallones Dochter

May 12, 2025

Lofzang Op Instagram De Schoonheid Van Sylvester Stallones Dochter

May 12, 2025 -

Itv 4s Kojak Full Episode Listings And Air Times

May 12, 2025

Itv 4s Kojak Full Episode Listings And Air Times

May 12, 2025 -

Mon Atelier D Art Une Rencontre Inattendue Avec Sylvester Stallone

May 12, 2025

Mon Atelier D Art Une Rencontre Inattendue Avec Sylvester Stallone

May 12, 2025 -

Beelden Dochter Sylvester Stallone Bewijst Haar Schoonheid

May 12, 2025

Beelden Dochter Sylvester Stallone Bewijst Haar Schoonheid

May 12, 2025