Tech Sector Propels US Stocks Higher: Tesla's Impact

Table of Contents

H2: Tesla's Recent Financial Performance and Stock Price Surge:

H3: Q3 2023 Earnings Beat Expectations: Tesla's Q3 2023 earnings report exceeded analyst expectations, showcasing remarkable growth across key metrics.

- Revenue Growth: Tesla reported a significant year-over-year increase in revenue, surpassing projections by [Insert Percentage]%. This growth was driven by strong vehicle deliveries and increased energy storage deployments.

- Profitability: The company demonstrated robust profitability, with a net income exceeding [Insert Dollar Amount], indicating efficient operations and strong pricing power.

- EPS (Earnings Per Share): Tesla's EPS significantly outperformed forecasts, reaching [Insert Number]—a considerable improvement compared to the same quarter last year. This positive surprise led to immediate upgrades from multiple financial analysts.

- Analyst Reactions: Following the earnings release, several prominent investment firms raised their price targets for Tesla stock, reflecting a positive outlook on the company's future prospects.

H3: Positive Outlook Fuels Investor Confidence: Tesla's optimistic guidance for the remainder of 2023 and beyond has further solidified investor confidence.

- Production Increase: The company projects a substantial increase in vehicle production, driven by expansion of its manufacturing capacity in existing and new facilities.

- New Market Entries: Tesla plans to enter new geographic markets, expanding its global reach and customer base. This will contribute to future revenue streams and increase its market share in the EV industry.

- New Product Launches: Anticipated launches of new vehicles and energy products are expected to further fuel revenue growth and strengthen Tesla's position as a market leader. These new innovations continuously improve the Tesla stock performance.

- Analyst Predictions: Leading financial analysts predict continued strong growth for Tesla in the coming years, fueled by these factors. Many forecast significant increases in Tesla's stock price.

H2: The Broader Impact of Tesla on the Tech Sector:

H3: Innovation and Technological Leadership: Tesla's pioneering role in electric vehicle technology has spurred innovation throughout the automotive and technology sectors.

- Battery Technology: Tesla's advancements in battery technology have significantly improved the range and performance of electric vehicles, benefiting the entire EV industry. This leadership directly impacts Tesla stock performance.

- Autonomous Driving: Tesla's progress in autonomous driving technology is pushing the boundaries of what's possible, influencing research and development across the broader technology sector.

- Software Integration: Tesla's advanced software integration and over-the-air updates are setting a new standard for the automotive industry, impacting other manufacturers' strategies.

- Influence on Competitors: The success of Tesla has forced established automakers to accelerate their investments in electric vehicle technology, creating a more competitive and innovative market.

H3: Market Sentiment and Investor Confidence: Tesla's remarkable success has a ripple effect on the broader tech sector, boosting investor confidence.

- Correlation with Tech Indices: There's a strong correlation between Tesla's stock price and the performance of broader tech indices like the Nasdaq. Positive Tesla stock performance often signals overall positive investor sentiment towards the tech sector.

- Investor Psychology: Tesla's success is seen as a validation of the long-term growth potential of the tech sector, encouraging investors to allocate more capital to technology stocks.

- Spillover Effect: The positive sentiment surrounding Tesla frequently spills over to other innovative technology companies, lifting their stock valuations as well. This is closely related to the overall tech sector growth.

H2: Macroeconomic Factors Contributing to Tech Sector Growth:

H3: Government Policies and Incentives: Government policies and incentives are playing a significant role in driving growth within the tech sector, particularly in the EV industry.

- Tax Credits for EVs: Government tax credits and subsidies for electric vehicles are significantly boosting demand, benefitting companies like Tesla. These incentives are a significant factor behind Tesla stock performance.

- Investments in Renewable Energy: Government investments in renewable energy infrastructure are creating opportunities for growth within the energy storage sector, benefiting Tesla's energy business.

- Infrastructure Development: Government initiatives to improve charging infrastructure are also supporting the growth of the EV market, creating a positive feedback loop that boosts the Tesla stock performance and the broader tech sector.

H3: Increased Demand for Tech Products and Services: The demand for technology products and services is rising due to several factors.

- Digital Transformation: Businesses are increasingly embracing digital technologies, driving demand for software, cloud services, and related products. This digital transformation indirectly supports the Tesla stock performance by contributing to the overall tech sector growth.

- Remote Work Trends: The shift to remote work has increased demand for technology solutions that enable remote collaboration and productivity.

- Rise of the Metaverse: The growing interest in the metaverse is creating new opportunities for tech companies and fostering further innovation in the sector.

Conclusion: Tesla's outstanding performance has undeniably played a significant role in propelling the US stock market higher, particularly within the technology sector. Its strong financial results, innovative advancements, and influence on investor sentiment have contributed substantially to the positive market trends. Understanding the factors driving Tesla's success, along with the broader macroeconomic context, provides crucial insights for investors navigating the dynamic landscape of the tech sector. To stay updated on the latest developments in Tesla stock performance and its impact on the overall market, continue following reputable financial news sources and industry analysis. Keep a close watch on tech sector growth indicators and consider diversifying your portfolio to capitalize on opportunities presented by the US stock market.

Featured Posts

-

Post Roe America How Otc Birth Control Impacts Womens Health

Apr 28, 2025

Post Roe America How Otc Birth Control Impacts Womens Health

Apr 28, 2025 -

Hollywood Shutdown Double Strike Cripples Film And Television Production

Apr 28, 2025

Hollywood Shutdown Double Strike Cripples Film And Television Production

Apr 28, 2025 -

Nfl Draft 2024 Shedeur Sanders To The Cleveland Browns

Apr 28, 2025

Nfl Draft 2024 Shedeur Sanders To The Cleveland Browns

Apr 28, 2025 -

Unionized Starbucks Employees Turn Down Companys Guaranteed Raise Offer

Apr 28, 2025

Unionized Starbucks Employees Turn Down Companys Guaranteed Raise Offer

Apr 28, 2025 -

Microsoft Activision Deal Ftcs Appeal And Future Implications

Apr 28, 2025

Microsoft Activision Deal Ftcs Appeal And Future Implications

Apr 28, 2025

Latest Posts

-

This Red Sox Outfielder Poised For A Duran Like Breakout

Apr 28, 2025

This Red Sox Outfielder Poised For A Duran Like Breakout

Apr 28, 2025 -

The End Of An Era Orioles Hit Streak Ends At 160 Games

Apr 28, 2025

The End Of An Era Orioles Hit Streak Ends At 160 Games

Apr 28, 2025 -

Orioles Broadcasters Jinx Broken 160 Game Hit Streak Ends

Apr 28, 2025

Orioles Broadcasters Jinx Broken 160 Game Hit Streak Ends

Apr 28, 2025 -

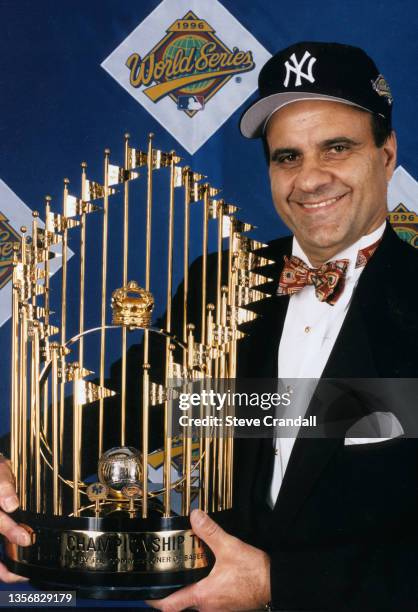

2000 Yankees Joe Torres Strategic Moves And Pettittes Shutout Against Minnesota

Apr 28, 2025

2000 Yankees Joe Torres Strategic Moves And Pettittes Shutout Against Minnesota

Apr 28, 2025 -

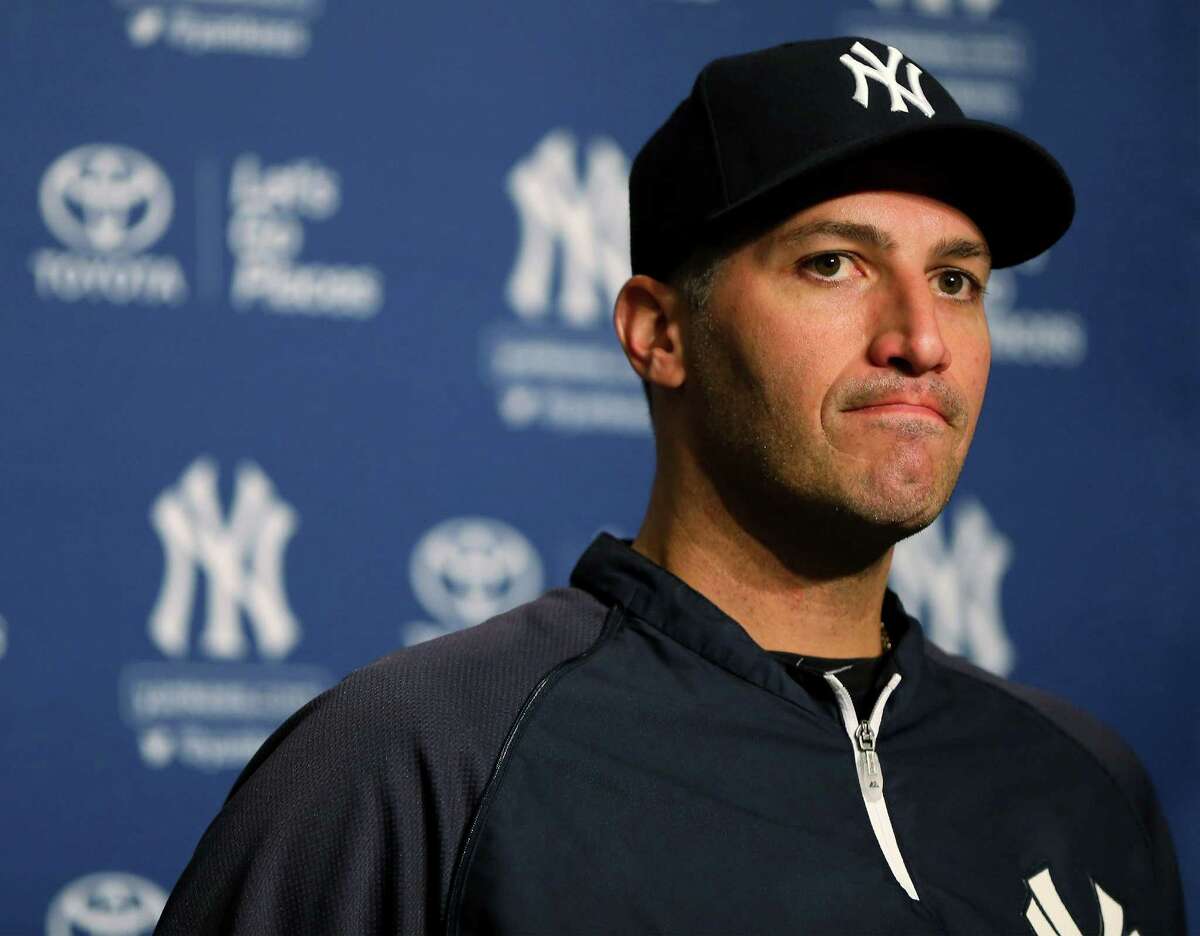

Andy Pettittes Gem Recalling The 2000 Yankees Victory Over The Twins

Apr 28, 2025

Andy Pettittes Gem Recalling The 2000 Yankees Victory Over The Twins

Apr 28, 2025