Tech Firms Delay IPOs: Tariff Uncertainty Creates Headwinds

Table of Contents

The Impact of Tariffs on Tech Companies' Valuation

The imposition of tariffs has profoundly impacted the valuation of tech companies considering an IPO. Increased costs and supply chain disruptions directly affect a company's attractiveness to investors.

Increased Costs and Reduced Profit Margins

Tariffs directly increase the cost of imported components crucial for tech manufacturing, squeezing profit margins and impacting the bottom line.

- Higher costs for raw materials and manufacturing equipment: Many tech companies rely on imported components from countries affected by tariffs. These increased costs are passed down the supply chain, increasing the overall cost of production.

- Increased prices for finished goods, potentially reducing consumer demand: To maintain profitability, companies may raise prices for their products. However, this can lead to reduced consumer demand, impacting revenue projections.

- Pressure on profit margins impacting investor confidence and IPO valuation: Reduced profit margins make a company less attractive to investors. Lower projected profitability directly translates to a lower IPO valuation. Investors look for strong, stable margins in a tech IPO.

These factors directly influence a company's attractiveness to investors during an IPO. A company with squeezed margins and uncertain future earnings is a much riskier investment.

Supply Chain Disruptions and Uncertainties

Tariffs significantly disrupt established global supply chains, introducing delays and uncertainty that impact IPO readiness.

- Dependence on specific geographic regions for components: Many tech companies rely on specific regions for sourcing components. Tariffs disrupt these established relationships, forcing companies to find alternatives.

- Difficulty in finding alternative suppliers, leading to increased costs or delays: Finding new suppliers is time-consuming and often comes with higher costs or longer lead times. This adds to the uncertainty around production timelines.

- Uncertainty in forecasting future costs and production timelines: The unpredictability of tariff policies makes it nearly impossible to accurately forecast future costs and production timelines, making it difficult to present a stable and reliable financial outlook to potential investors. This uncertainty is a major deterrent for investors considering a tech IPO.

Investor Sentiment and Risk Aversion in the Current Climate

The current climate of tariff uncertainty contributes significantly to investor risk aversion, impacting the timing and success of tech IPOs.

Increased Volatility in the Stock Market

Tariff uncertainty contributes to overall market volatility, creating a risk-averse environment for investors.

- Fluctuations in stock prices make it difficult to accurately price an IPO: Volatile markets make it extremely difficult to determine a fair and accurate price for an IPO. In uncertain times, it is often better to postpone.

- Investors may postpone investment decisions until the market stabilizes: Investors are less likely to commit capital in an unpredictable market, preferring to wait for greater clarity and stability.

- Increased risk premium demanded by investors for tech IPOs: Investors will demand a higher return to compensate for the increased risk associated with investing in a volatile market. This further reduces the attractiveness of a tech IPO.

These market conditions make launching an IPO during times of high volatility a far more challenging endeavor.

Difficulty in Predicting Future Earnings

The unpredictability of tariff policies makes forecasting future earnings extremely challenging, impacting investor confidence.

- Uncertainty about future input costs and consumer demand: Companies struggle to accurately predict future costs due to the unpredictable nature of tariffs. Similarly, consumer demand is uncertain given the possibility of price increases.

- Difficulty in securing long-term contracts with clients and suppliers: The uncertain environment makes it difficult to secure long-term contracts, further hindering financial projections.

- Reduced investor confidence due to lack of clarity in financial projections: Uncertain and unreliable financial projections greatly reduce investor confidence, making a successful IPO less likely.

The inability to confidently predict future earnings is a major hurdle for any tech company contemplating an IPO in this volatile climate.

Strategic Considerations for Tech Companies

Facing these challenges, tech companies are adopting strategic approaches to navigate the complexities of tariff uncertainty.

Waiting for Clarity on Trade Policies

Many companies are strategically delaying their IPOs until there is more clarity and stability regarding trade policies and tariffs.

- Reduced risk of negative market reactions to unexpected tariff changes: Waiting reduces the risk of negative market reactions due to unexpected changes in tariff policies.

- Opportunity to achieve more favorable valuation after policy stabilization: Once the market stabilizes, companies can potentially achieve a more favorable valuation for their IPO.

- Ability to present more accurate and stable financial projections to investors: Waiting allows companies to present more reliable financial projections, increasing investor confidence.

Delaying the IPO until more favorable conditions exist can be a smart strategic move.

Exploring Alternative Funding Options

To avoid the pressures of an immediate IPO, many companies are pursuing alternative funding options.

- Provides additional capital without immediate need for IPO: Alternative funding methods, such as private equity, can provide the necessary capital without the immediate pressures of a public offering.

- Allows time to address concerns around tariffs and improve financial performance: This provides valuable time to address issues related to tariffs and improve overall financial performance before entering the public market.

- Potentially advantageous if the market outlook improves later: This strategy offers a strategic advantage if market conditions improve significantly in the future.

Alternative funding provides flexibility and time for tech companies to navigate these challenging times.

Conclusion

The current climate of tariff uncertainty significantly impacts the timing and success of tech IPOs. Increased costs, supply chain disruptions, and investor risk aversion are all contributing factors to tech IPO delays and tariff uncertainty. While some companies strategically delay their IPOs, others explore alternative funding options. Understanding the impact of tariff uncertainty is crucial for any tech firm considering an IPO. Careful planning and a strategic approach are essential to navigate this challenging landscape and successfully launch a successful IPO. Prospective IPO candidates need to carefully weigh the risks and benefits of delaying or proceeding given current market realities associated with tech IPO delays and tariff uncertainty.

Featured Posts

-

Jobe Bellingham Transfer Fee What Chelsea And Tottenham Must Pay

May 14, 2025

Jobe Bellingham Transfer Fee What Chelsea And Tottenham Must Pay

May 14, 2025 -

Early Portuguese Elections May Date Possible Amidst Government Instability

May 14, 2025

Early Portuguese Elections May Date Possible Amidst Government Instability

May 14, 2025 -

Jobe Bellingham To Borussia Dortmund Transfer Speculation And Odds

May 14, 2025

Jobe Bellingham To Borussia Dortmund Transfer Speculation And Odds

May 14, 2025 -

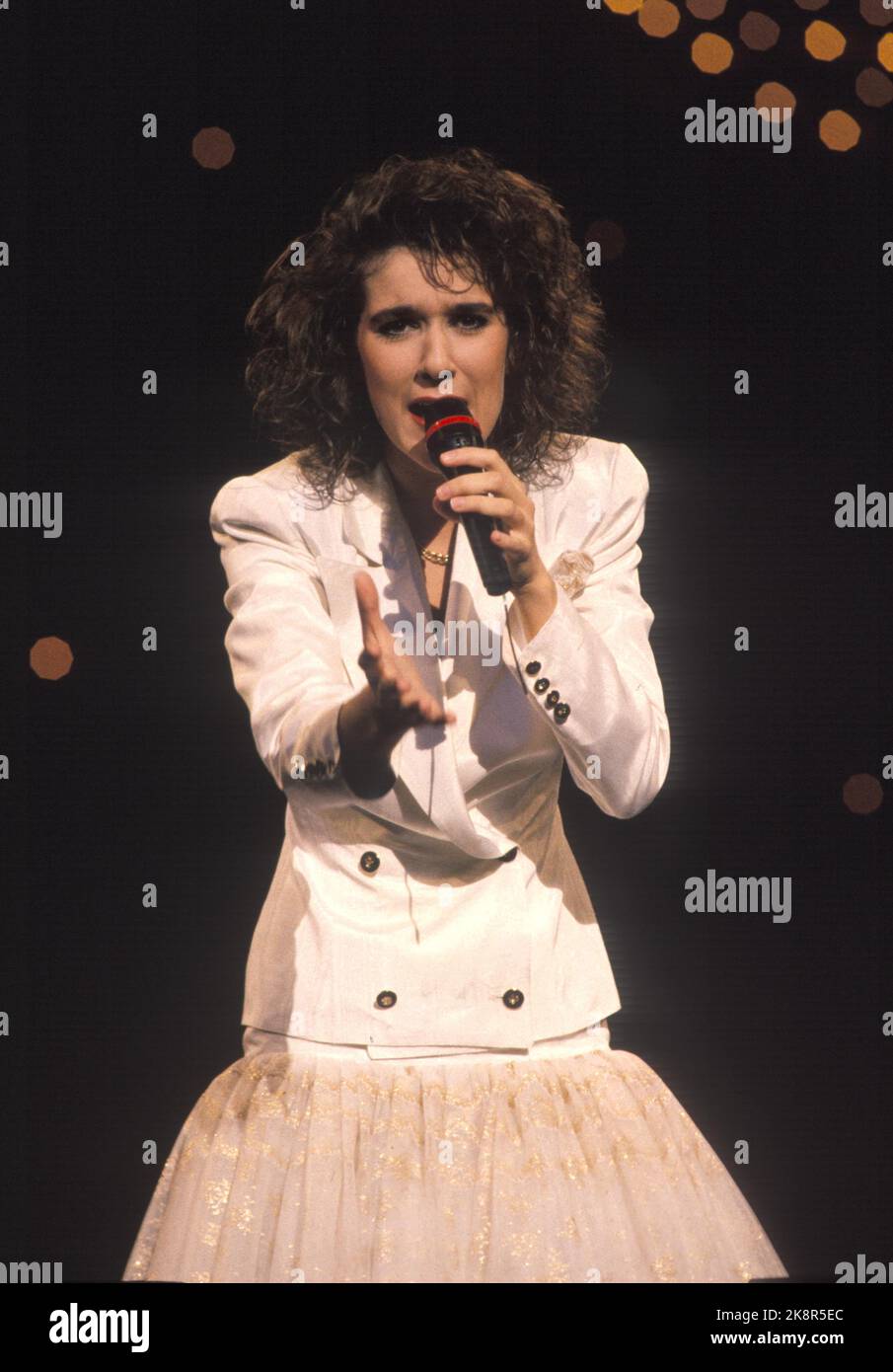

Celine Dion And Eurovision News And Updates Days Before The Final

May 14, 2025

Celine Dion And Eurovision News And Updates Days Before The Final

May 14, 2025 -

Hohburkersdorf Aktuell Entwarnung Nach Lagebeurteilung In Der Saechsischen Schweiz Osterzgebirge

May 14, 2025

Hohburkersdorf Aktuell Entwarnung Nach Lagebeurteilung In Der Saechsischen Schweiz Osterzgebirge

May 14, 2025