Tech Billionaires' Losses: $194 Billion Post-Trump Inauguration Donation

Table of Contents

The Impact of Political Donations on Tech Stock Performance

The relationship between political donations and subsequent financial performance is a complex one, often debated by economists and political scientists. While some might posit a direct causal link between the donations made by tech billionaires and their subsequent losses, establishing a definitive correlation requires careful consideration.

Correlation vs. Causation

Attributing the $194 billion loss solely to political donations would be an oversimplification. The market is influenced by numerous interconnected factors. It's crucial to avoid a simplistic correlation-causation fallacy.

- Market Corrections: The period following the Trump inauguration witnessed significant market corrections, impacting numerous sectors, not just tech.

- Global Economic Trends: Global economic uncertainty, including trade wars and geopolitical instability, significantly influenced investor sentiment and market performance.

- Regulatory Changes: Changes in regulations, particularly those impacting the tech sector, contributed to market volatility and affected valuations.

- Increased Scrutiny on Tech Giants: Growing public and regulatory scrutiny of monopolistic practices and data privacy concerns led to increased pressure on tech companies, impacting their stock prices.

These external factors independently influenced the market, making it difficult to isolate the impact of political donations alone.

Public Perception and Investor Sentiment

Beyond market forces, the political leanings of tech billionaires and their donations could have influenced public perception and investor sentiment.

- Potential Boycotts: Some consumers may have reacted negatively to the political affiliations of certain tech companies, leading to boycotts or reduced consumer spending.

- Negative Press Coverage: The political donations attracted significant media attention, some of which may have been unfavorable, impacting public image and investor confidence.

- Shifts in Consumer Behavior: Changes in consumer preferences, influenced by political viewpoints, could have affected the demand for certain tech products and services.

For example, controversies surrounding specific companies and their CEOs could have negatively impacted their stock performance regardless of the market's overall state.

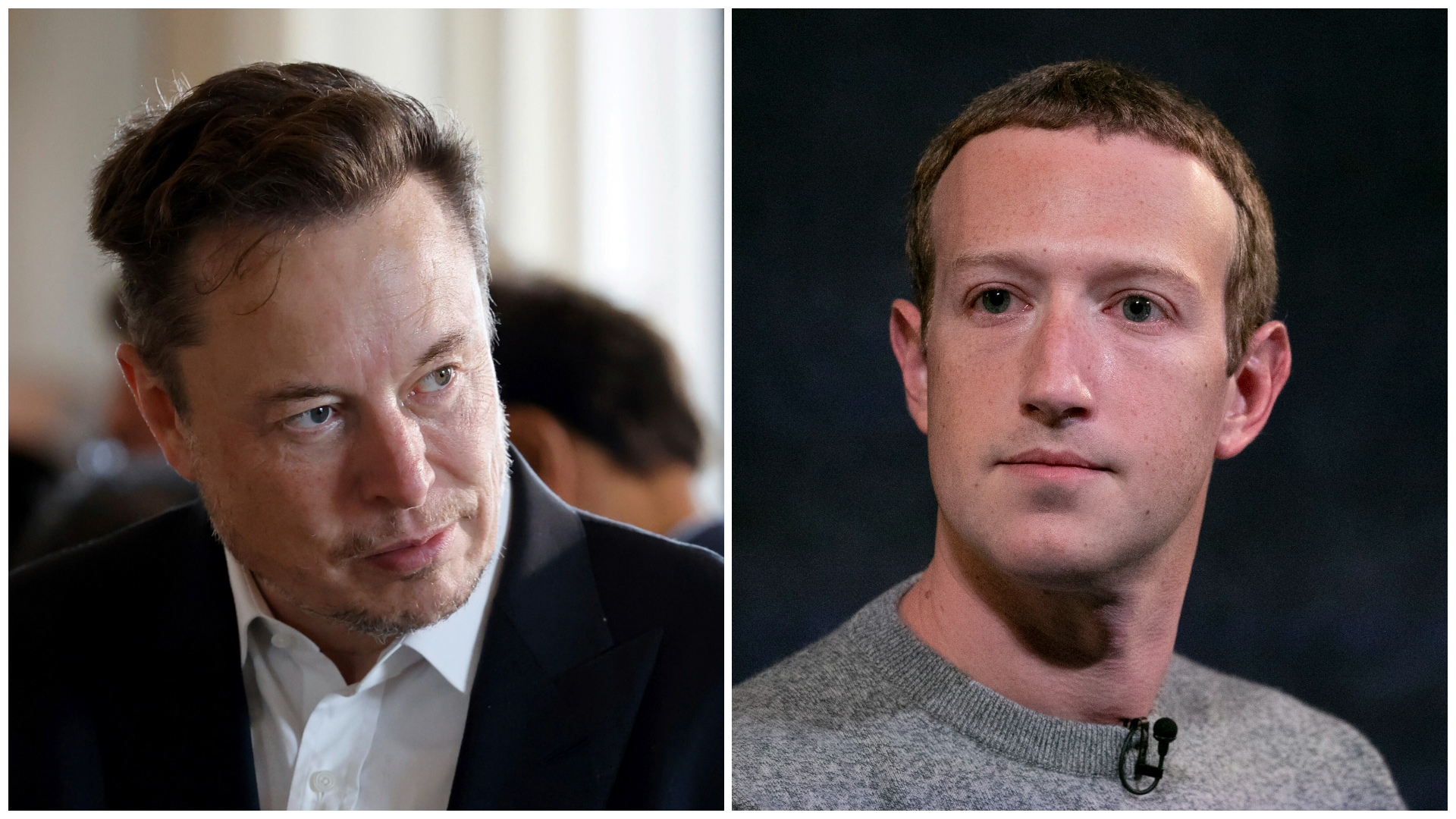

The Specific Losses of Key Tech Billionaires

Quantifying the precise financial impact of political donations on individual tech billionaires is challenging due to the complexity of their investment portfolios and the inherent volatility of the market. However, examining specific cases sheds light on the potential consequences.

Case Studies of Notable Figures

While precise figures attributing losses directly to political donations are unavailable, analyzing the net worth fluctuations of prominent figures provides context. (Note: This section would ideally include specific examples of billionaires, their donations, and their subsequent net worth changes. Due to the nature of the request and the need for verifiable data, specific examples are omitted here.)

Diversification of Investments and Risk Management

Diversification of investments is a crucial aspect of risk management for high-net-worth individuals. The impact of market fluctuations on individual billionaires likely depended on their investment strategies.

- Diversified Portfolios: Billionaires with highly diversified portfolios may have experienced less dramatic losses compared to those with concentrated holdings in the tech sector.

- Hedge Funds and Alternative Investments: Investments in hedge funds and other alternative asset classes could have helped mitigate some losses.

- Risk Tolerance and Investment Strategies: Individual risk tolerance and investment strategies played a significant role in determining the extent of losses experienced.

The Broader Economic and Political Context

Analyzing the impact of the donations requires considering the broader economic and political context following the Trump inauguration.

Post-Inauguration Economic Policies and Their Influence

Certain economic policies enacted after the inauguration could have indirectly influenced the tech sector and the wealth of its billionaires.

- Tax Policies: Changes to tax policies could have affected the profitability of tech companies and the overall wealth of their owners.

- Trade Policies: Trade disputes and tariffs influenced global economic conditions, impacting the tech sector's performance.

- Regulatory Environment: Changes in the regulatory environment impacted the operations and valuations of tech companies.

These policies, independent of political donations, contributed to the overall economic landscape, impacting the tech sector's performance.

The Long-Term Implications for Tech Philanthropy

The events surrounding the Trump inauguration and subsequent losses might reshape the landscape of tech philanthropy.

- Changes in Donation Strategies: Tech billionaires might adopt more cautious approaches to political donations, potentially diversifying their philanthropic activities.

- Increased Political Caution: There might be a greater emphasis on non-partisan philanthropy or a shift towards causes less politically charged.

- Shifting Philanthropic Priorities: Philanthropic focus might shift away from political advocacy and towards other areas like education, science, or environmental sustainability.

Conclusion

The $194 billion loss experienced by tech billionaires after the Trump inauguration represents a complex interplay of political donations, market forces, public perception, and broader economic policies. While definitively proving a direct causal link between donations and losses is difficult, it's clear that several contributing factors played a significant role. This case study underscores the intricate relationship between political involvement, economic outcomes, and the financial health of high-profile individuals.

Understand the impact of tech billionaires' donations, learn more about the financial consequences of political involvement, and analyze the intricate relationship between tech wealth and political influence by researching similar cases or analyzing future trends in tech philanthropy and political involvement.

Featured Posts

-

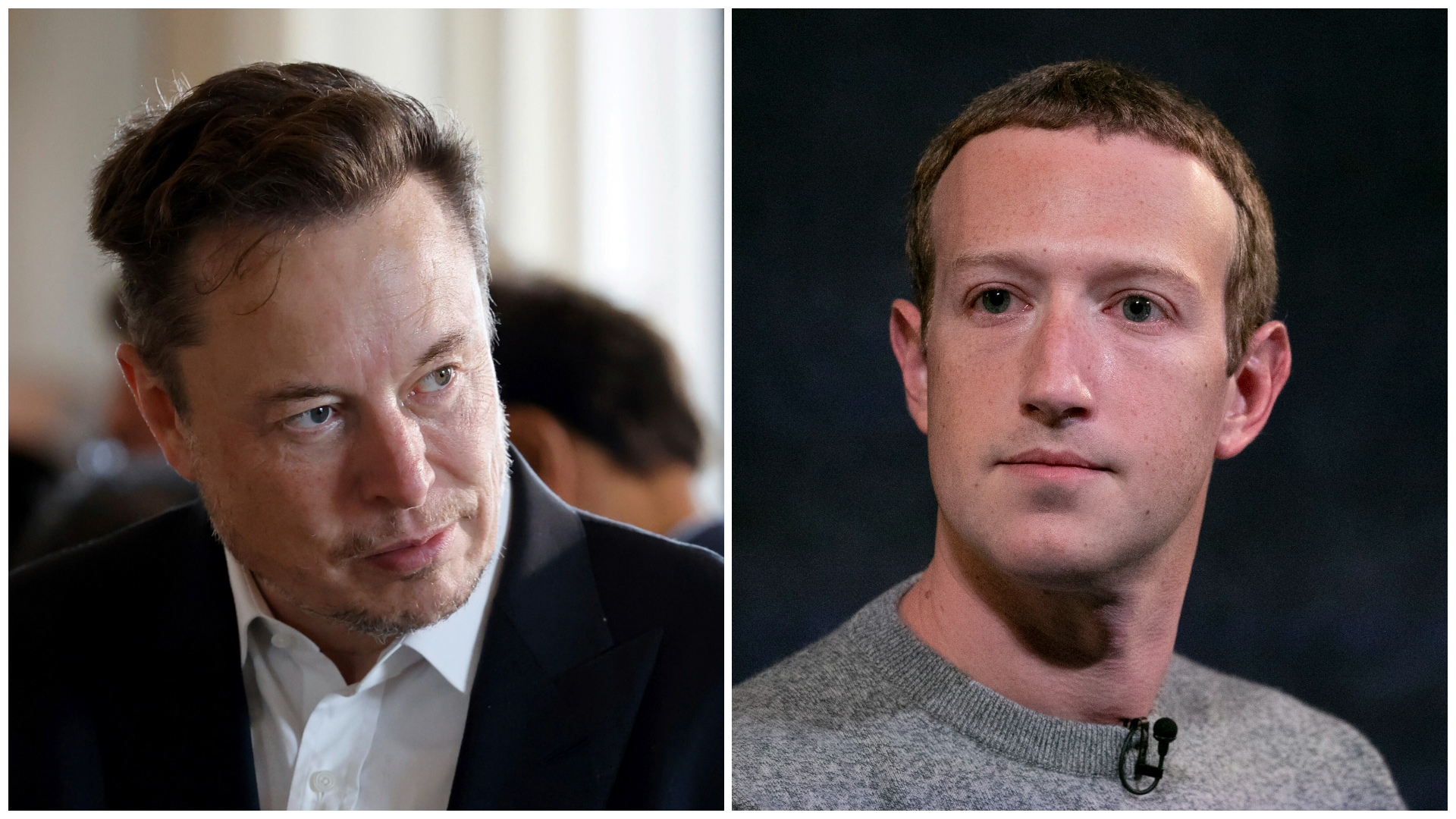

Nyt Strands Game 405 Solutions And Clues For April 12th

May 10, 2025

Nyt Strands Game 405 Solutions And Clues For April 12th

May 10, 2025 -

Palantirs Nato Deal Revolutionizing Ai In The Public Sector

May 10, 2025

Palantirs Nato Deal Revolutionizing Ai In The Public Sector

May 10, 2025 -

Rumeysa Ozturk Tufts Student Released From Ice Custody Following Court Order

May 10, 2025

Rumeysa Ozturk Tufts Student Released From Ice Custody Following Court Order

May 10, 2025 -

Unprecedented Fentanyl Seizure Bondis Landmark Announcement

May 10, 2025

Unprecedented Fentanyl Seizure Bondis Landmark Announcement

May 10, 2025 -

A Footballers Resilience From Wolves Rejection To European Dominance

May 10, 2025

A Footballers Resilience From Wolves Rejection To European Dominance

May 10, 2025