Tariff Hopes Boost Stock Market: Dow, S&P 500, And Nasdaq Gains

Table of Contents

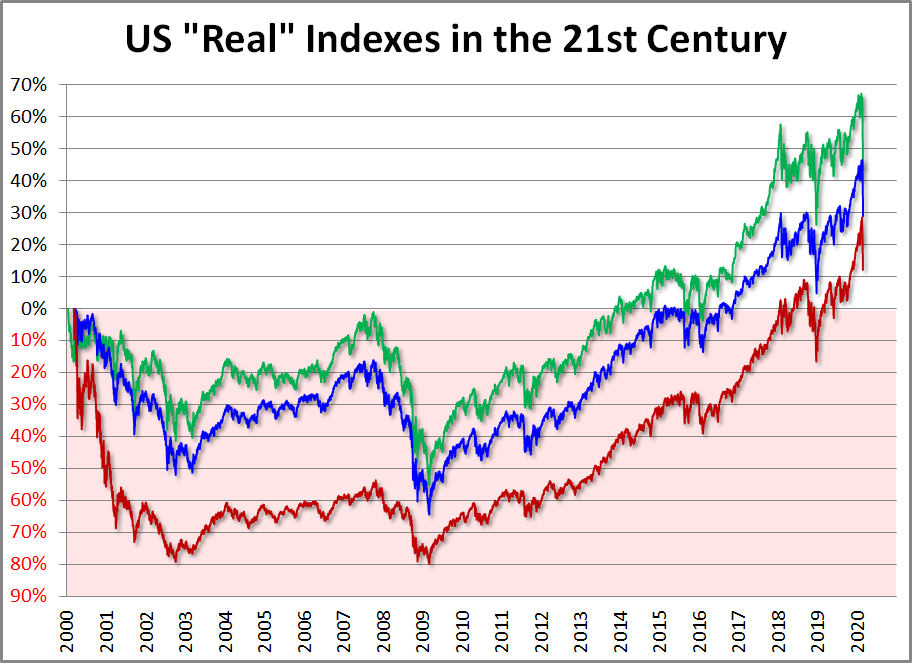

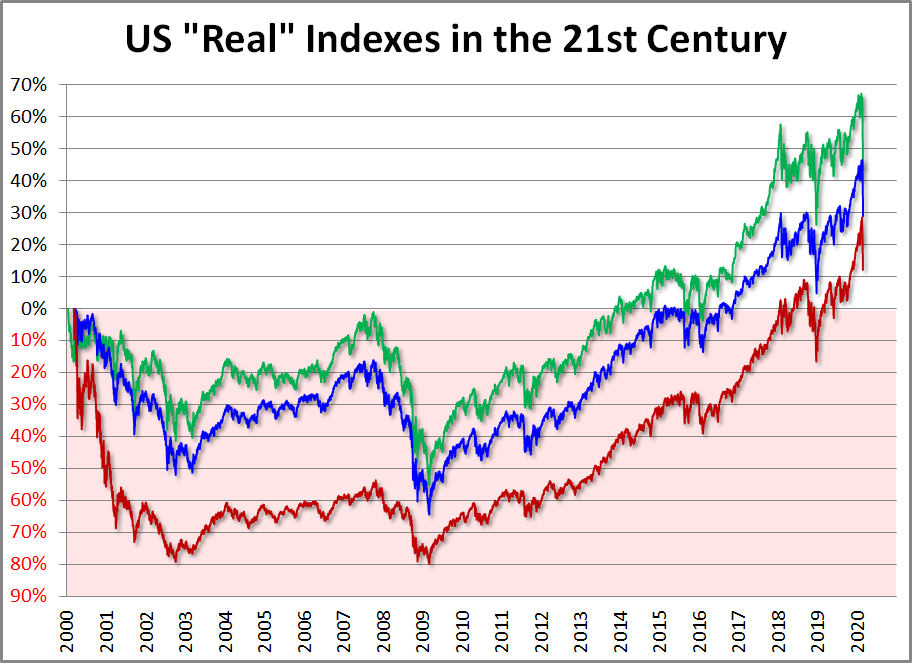

Easing Trade Tensions Drive Market Growth

Decreased uncertainty surrounding tariffs is a primary driver of this market upswing. Reduced trade tensions significantly impact business decisions and consumer confidence.

Reduced Tariff Uncertainty

The lessening of trade disputes and the implementation of specific tariff reductions have created a more predictable and stable economic environment. This newfound clarity empowers businesses to invest more confidently, knowing they face less risk from sudden tariff hikes. Consumers, too, feel more secure, leading to increased spending and overall economic growth.

- Examples of tariff reductions: The recent agreement between the US and [Country] to reduce tariffs on [Specific goods] is a prime example of the positive impact of de-escalation. Another example is the [Mention specific event/agreement].

- Data points: Studies show a strong positive correlation between tariff reduction announcements and immediate increases in stock market indices. For instance, [cite a study or statistic showing this correlation].

Improved Corporate Earnings Outlook

Lower tariffs directly translate to improved profit margins for many companies. This is particularly evident in sectors heavily impacted by import/export tariffs. Increased profitability naturally leads to higher stock prices, fueling the market rally.

- Examples of benefiting sectors: The technology sector, heavily reliant on global supply chains, has seen significant gains due to reduced tariff burdens. Similarly, the manufacturing sector is also benefiting from decreased input costs.

- Data points: Following positive tariff-related news, several financial analysts revised their earnings estimates upward for numerous companies, reflecting the improved outlook. [Cite examples of such revisions with data].

Dow, S&P 500, and Nasdaq Respond Positively

The positive sentiment surrounding reduced tariffs is clearly reflected in the performance of major market indices.

Dow Jones Industrial Average Gains

The Dow Jones Industrial Average experienced a substantial percentage increase ([Specific percentage]% increase). This significant gain reflects the broad-based optimism in the market.

- Specific company performance: Companies like [Company A] and [Company B], both heavily involved in international trade, saw particularly significant gains.

- Data points: The Dow closed at [Specific number] on [Date], marking a [Specific number] point increase from the previous [Time period].

S&P 500 Index Surge

The S&P 500, a broader market indicator, also experienced a notable surge ([Specific percentage]% increase), demonstrating the widespread positive impact of easing trade tensions.

- Sector-specific gains: The [Specific sector] and [Specific sector] sectors within the S&P 500 showed particularly strong performance.

- Data points: The S&P 500 closed at [Specific number] on [Date], representing a [Specific number] point increase.

Nasdaq Composite's Strong Performance

The tech-heavy Nasdaq Composite also reacted positively to the tariff news, recording a significant increase ([Specific percentage]% increase). This reflects the positive outlook for technology companies reliant on global supply chains.

- Benefiting tech companies: Companies like [Specific tech company A] and [Specific tech company B] experienced notable gains.

- Data points: The Nasdaq closed at [Specific number] on [Date], marking a [Specific number] point increase.

Investor Sentiment and Market Volatility

The reduction in tariff-related uncertainty has profoundly impacted investor sentiment and market volatility.

Increased Investor Confidence

Easing trade tensions have boosted investor confidence significantly. Investors are more willing to take on risk, leading to increased investment activity.

- Indicators of investor sentiment: The VIX volatility index, a key measure of market fear, has decreased, reflecting reduced uncertainty.

- Data points: The VIX index dropped from [Specific number] to [Specific number] following the tariff-related news, indicating a calmer market.

Market Volatility Reduction

The decreased uncertainty surrounding tariffs has contributed to lower market volatility. This stability benefits investors, particularly those employing long-term investment strategies.

- Implications for long-term investment: Lower volatility makes long-term planning and investment decisions easier and less risky.

- Data points: [Cite data showing a decrease in market volatility, perhaps using a specific volatility measure].

Conclusion: Tariff Hopes Continue to Drive Market Growth – What's Next?

Easing tariff concerns have demonstrably fueled a significant rally in the Dow, S&P 500, and Nasdaq. The positive correlation between tariff hopes and stock market gains is undeniable. Reduced uncertainty, improved corporate earnings outlooks, and increased investor confidence are key drivers of this market upswing.

To capitalize on these positive trends, stay informed about further developments in trade policy and their potential impact on your investment strategy. Keep track of ongoing negotiations and announcements related to tariffs. Learn more about how tariff reductions impact your portfolio by consulting financial news sources and investment professionals. Stay tuned for further updates on how tariff hopes continue to shape stock market performance.

Featured Posts

-

Canadian Auto Dealers Propose Five Point Plan To Combat Us Trade War

Apr 24, 2025

Canadian Auto Dealers Propose Five Point Plan To Combat Us Trade War

Apr 24, 2025 -

B And B Recap Steffy Bill Finn And Liams Tensions On April 9th

Apr 24, 2025

B And B Recap Steffy Bill Finn And Liams Tensions On April 9th

Apr 24, 2025 -

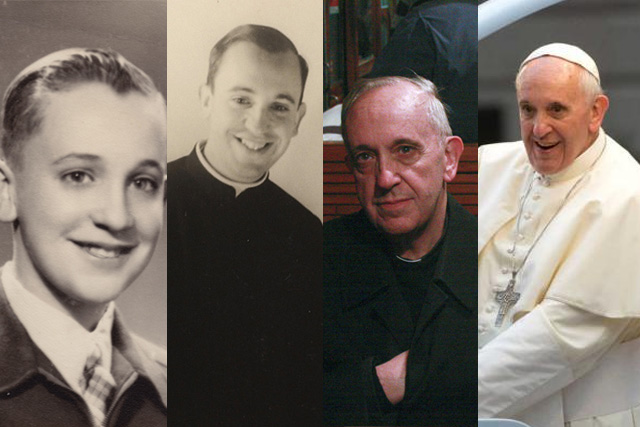

A More Global More Divided Church Pope Francis Papacy

Apr 24, 2025

A More Global More Divided Church Pope Francis Papacy

Apr 24, 2025 -

Ice Deportation Case Prevents Columbia Student Mahmoud Khalil From Seeing Sons Birth

Apr 24, 2025

Ice Deportation Case Prevents Columbia Student Mahmoud Khalil From Seeing Sons Birth

Apr 24, 2025 -

Bitcoin Climbs Amidst Trumps Trade And Fed Policy Moves

Apr 24, 2025

Bitcoin Climbs Amidst Trumps Trade And Fed Policy Moves

Apr 24, 2025