Tariff Hikes And Their Consequences For Bond Investors

Table of Contents

Impact of Tariffs on Inflation

Tariffs, essentially taxes on imported goods, directly impact inflation. This is a key consideration for bond investors as inflation significantly affects bond prices and yields.

Increased Prices for Consumers

Tariffs increase the cost of imported goods, leading to higher consumer prices. This is a fundamental principle of economics: increased supply costs translate to increased prices for the end consumer.

- Examples: Tariffs on steel have increased the cost of automobiles and construction materials. Tariffs on textiles have raised clothing prices.

- Case Studies: Analyzing specific tariff implementations and their subsequent impact on the prices of affected goods provides compelling evidence of this relationship. For example, research into the impact of past steel tariffs can illustrate the magnitude of price increases.

- The relationship between increased prices and inflation is direct; higher prices across a range of goods contribute to a rise in the overall price level, resulting in higher inflation.

Inflation's Effect on Bond Yields

Inflation and bond yields share an inverse relationship. Higher inflation erodes the purchasing power of future bond payments, making bonds less attractive to investors. To compensate for this erosion, investors demand higher yields, pushing bond prices down.

- Central Bank Reaction: Central banks often respond to rising inflation by increasing interest rates. This makes borrowing more expensive, cooling down economic activity and curbing inflation. The Federal Reserve's actions in response to inflationary pressures are a prime example.

- Yield Curve Impact: Changes in interest rates influence the yield curve, affecting the yields of various bonds with different maturities. Longer-term bonds are typically more sensitive to inflation expectations and interest rate changes than short-term bonds.

- Impact on Different Bond Types: Short-term bonds are generally less sensitive to inflation changes than long-term bonds. However, even short-term bonds can experience reduced returns if inflation rises unexpectedly.

The Influence of Tariffs on Interest Rates

Tariffs exert their influence on interest rates primarily through their impact on inflation. Central bank reactions to rising inflation further amplify the effect on interest rates.

Central Bank Response to Inflation

Central banks monitor inflation closely. Tariff-induced inflation often prompts central banks to take action to maintain price stability. This usually involves raising interest rates.

- Historical Responses: Examining historical instances where inflation was spurred by trade policies, and observing central bank responses (e.g., raising the federal funds rate), provides a valuable case study.

- Unexpected Interest Rate Changes: The timing and magnitude of interest rate adjustments can be unpredictable, creating uncertainty in the bond market and impacting bond yields and investor returns. This unpredictability highlights the importance of proactive risk management.

Impact on Bond Yields and Investment Returns

Changes in interest rates directly influence bond yields. Rising interest rates generally lead to lower bond prices and consequently, lower returns for bondholders.

- Bond Yield Calculation: Understanding how bond yields are calculated is essential for assessing the impact of interest rate changes. A rise in interest rates will reduce the present value of future coupon payments.

- Impact Scenarios: Different scenarios illustrating the impact of varying interest rate changes on bond returns can be modeled to highlight the risks and potential losses.

- Potential for Capital Losses: Rising interest rates can lead to significant capital losses for investors holding long-term bonds, especially those with fixed coupon payments.

Strategic Adjustments for Bond Investors

Effective strategies can help bond investors navigate the challenges presented by tariff hikes and their consequences.

Diversification Strategies

Diversification is a cornerstone of effective risk management in any investment portfolio. In the context of tariff hikes, diversification across different bond types, maturities, and geographies becomes crucial.

- Diversification Examples: Including a mix of government bonds, corporate bonds, municipal bonds, and international bonds in a portfolio can reduce the impact of any single sector or country's economic performance affected by tariffs.

- Maturity Diversification: Spreading investments across bonds with different maturities (short-term, intermediate-term, long-term) helps manage interest rate risk.

- Geographic Diversification: Investing in bonds issued by countries less affected by the tariff increases reduces the overall exposure to tariff-related risks.

Risk Management and Hedging Techniques

Employing risk management techniques protects bond portfolios from tariff-related volatility.

- Hedging Strategies: Using options or inflation-protected securities (TIPS) can help mitigate the risks associated with rising inflation and interest rates.

- Risk Tolerance Assessment: Investors should assess their risk tolerance to determine the appropriate level of risk exposure and choose suitable investment strategies accordingly. This is paramount before selecting bonds and implementing hedging strategies.

Conclusion

Tariff hikes significantly impact inflation, interest rates, and subsequently, bond yields and investment returns for bond investors. Understanding these complex relationships is crucial for successful risk management. Navigating the complexities of tariff hikes and their effect on bond investment requires a proactive approach. Learn more about effective strategies for mitigating risk and maximizing returns in this changing market environment. Consult with a financial advisor to develop a robust investment plan that addresses the potential consequences of future tariff increases. Don't let tariff hikes impact your bond investments negatively – take control of your portfolio today.

Featured Posts

-

Lower Box Office Revenue Cineplex Reports First Quarter Loss

May 12, 2025

Lower Box Office Revenue Cineplex Reports First Quarter Loss

May 12, 2025 -

Lowry And Mc Ilroy Friendship And The Masters Tournament

May 12, 2025

Lowry And Mc Ilroy Friendship And The Masters Tournament

May 12, 2025 -

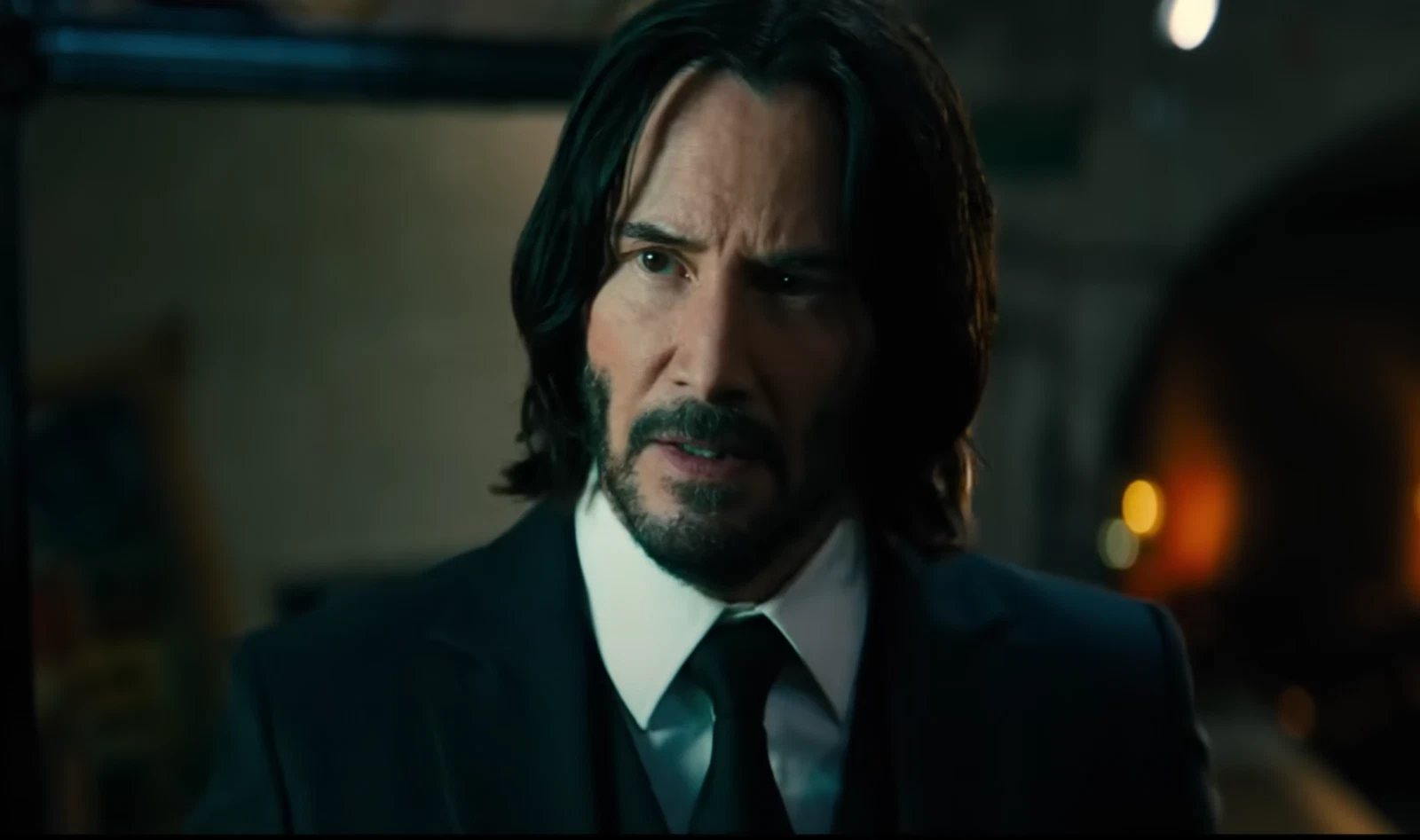

The John Wick 5 Question What Does Keanu Reeves Update Mean

May 12, 2025

The John Wick 5 Question What Does Keanu Reeves Update Mean

May 12, 2025 -

A Private Item A Public Oops Selena Gomez And Benny Blanco

May 12, 2025

A Private Item A Public Oops Selena Gomez And Benny Blanco

May 12, 2025 -

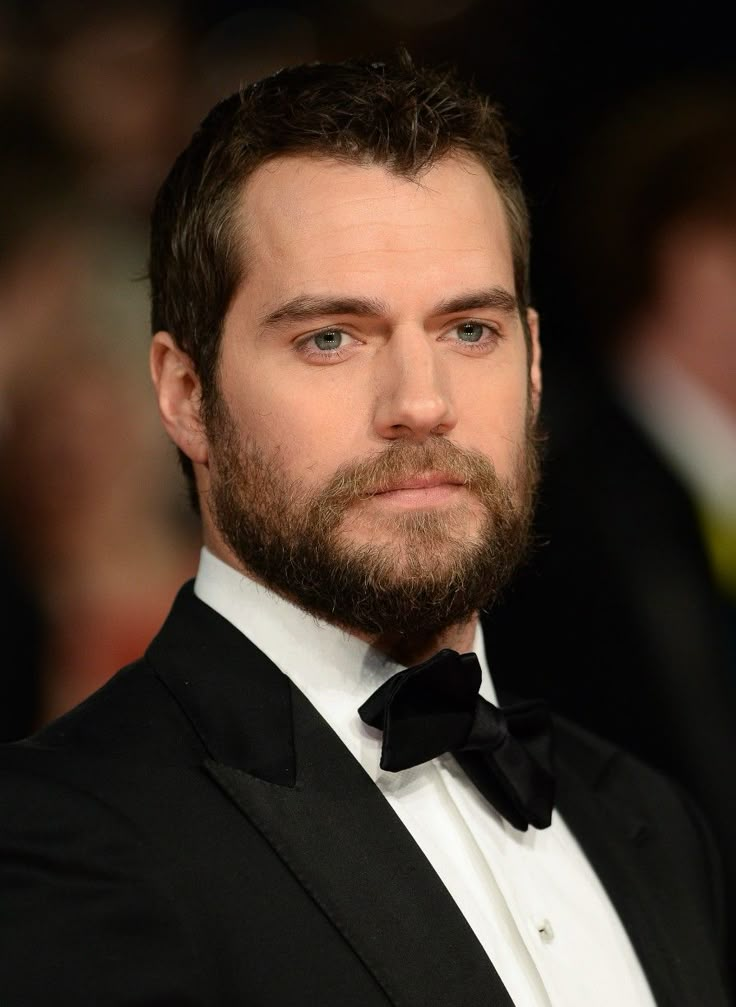

Tom Cruise Explains Henry Cavills Mid Scene Beard Change In Fallout

May 12, 2025

Tom Cruise Explains Henry Cavills Mid Scene Beard Change In Fallout

May 12, 2025

Latest Posts

-

Sabalenkas Miami Open Win A Dominant Performance Against Pegula

May 13, 2025

Sabalenkas Miami Open Win A Dominant Performance Against Pegula

May 13, 2025 -

Senior Citizens Guide Calendar Of Trips Activities And Events

May 13, 2025

Senior Citizens Guide Calendar Of Trips Activities And Events

May 13, 2025 -

Pegula Falls To Sabalenka In Miami Open Championship Match

May 13, 2025

Pegula Falls To Sabalenka In Miami Open Championship Match

May 13, 2025 -

Planning Your Senior Year A Calendar Of Trips And Events

May 13, 2025

Planning Your Senior Year A Calendar Of Trips And Events

May 13, 2025 -

Miami Open 2024 Sabalenka Beats Pegula In Final

May 13, 2025

Miami Open 2024 Sabalenka Beats Pegula In Final

May 13, 2025