Taiwan Financial Regulator Probes ETF Sales Pressure On Employees

Table of Contents

The Nature of the Allegations of ETF Sales Pressure

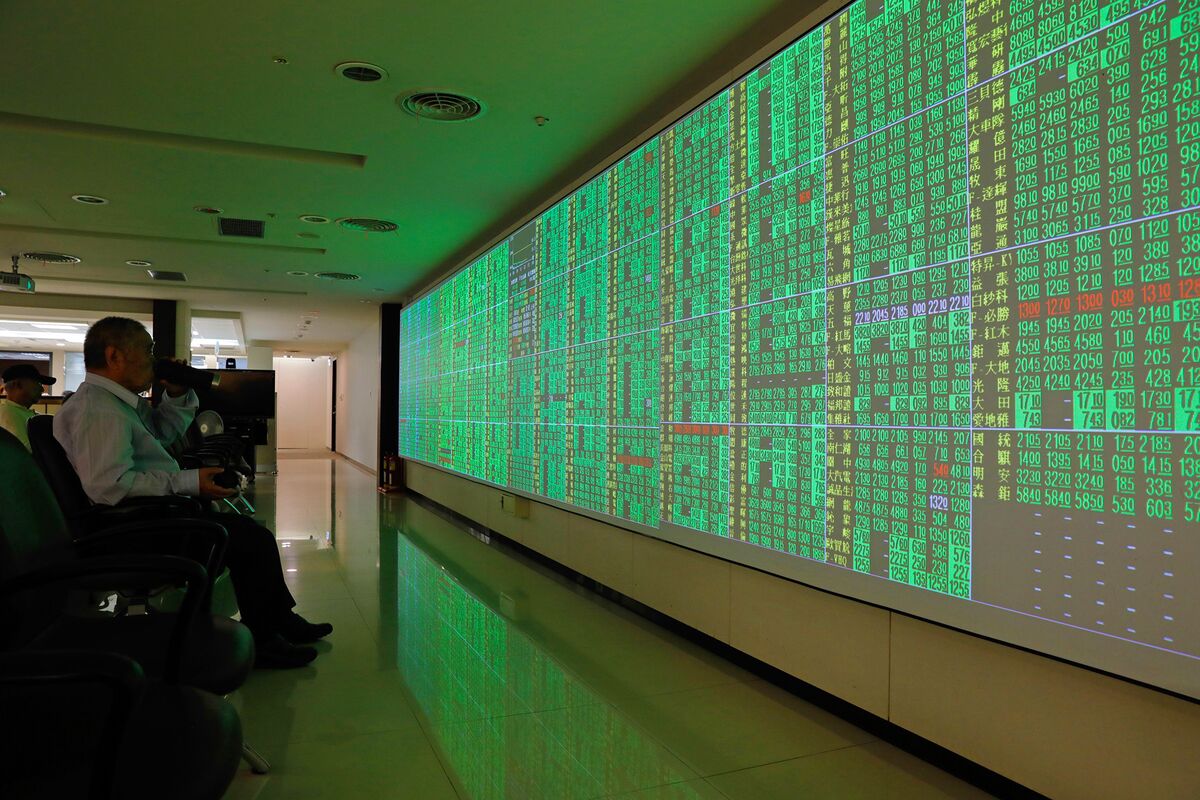

The allegations center around claims that financial institutions in Taiwan are employing aggressive and unethical tactics to push the sale of exchange-traded funds (ETFs), regardless of client suitability. Employees report feeling immense pressure to meet unrealistic sales targets, leading to concerns about potential financial misconduct and damage to investor trust.

-

Examples of alleged pressure tactics: Reports include threats of job loss or demotion for failing to meet quotas, excessively aggressive performance reviews focused solely on ETF sales volume, and a general culture of prioritizing sales above client needs. Some employees allege they were pressured to sell ETFs even when they believed the products were unsuitable for specific clients.

-

Evidence gathered by the regulator: The investigation is reportedly using a variety of evidence, including internal company memos detailing sales targets and incentive structures, employee testimonies providing firsthand accounts of pressure tactics, and sales data analysis revealing potentially manipulative sales patterns.

-

Types of ETFs involved: While the specific ETFs under scrutiny haven't been publicly named, the allegations appear to encompass a range of ETF types, potentially including those tracking various sectors and investment strategies. This suggests a widespread problem rather than an isolated incident involving a single product. The investigation is focusing on uncovering the systemic nature of the alleged unethical sales practices.

The Regulatory Response and Investigation

The Taiwan financial regulator, likely the Financial Supervisory Commission (FSC), has initiated a formal investigation into these allegations of financial misconduct in Taiwan. The regulator's response has been swift and decisive, signaling a commitment to addressing the issue and protecting investors.

-

Timeline of the investigation: While the exact start date may not be publicly available, the investigation is likely ongoing, with the regulator collecting evidence, interviewing employees, and reviewing internal documents from implicated institutions.

-

Specific institutions under investigation: The names of the financial institutions involved haven't been publicly released to avoid prejudicing the investigation; however, it is anticipated that several major players in the Taiwanese financial market could be facing scrutiny.

-

Types of penalties the regulator can impose: The FSC holds significant authority to impose various penalties, including substantial fines, suspension of licenses, and even criminal charges depending on the severity of the findings. They may also order compensation for affected investors.

-

Steps taken to protect investors: The regulator is likely focusing on measures to identify and compensate any investors who may have suffered losses due to unsuitable ETF sales resulting from these alleged pressure tactics. This could involve reviewing transactions and providing redress where appropriate. Protecting investor rights remains a paramount concern in this FSC investigation.

Impact on the ETF Market in Taiwan

The allegations of ETF sales pressure and the subsequent regulatory investigation carry significant potential implications for the Taiwanese ETF market.

-

Potential decline in ETF sales: The negative publicity surrounding the investigation could erode investor confidence, leading to a short-term decline in ETF sales as investors become hesitant to participate in the market.

-

Impact on the growth of the Taiwanese ETF market: Long-term consequences depend on the regulator's actions and the industry's response. If the investigation reveals systemic problems and leads to significant reforms, it could ultimately improve investor trust and promote sustainable long-term growth. However, a failure to address the underlying issues could stifle the market's development.

-

Changes in investor behavior: Investors may become more discerning, demanding greater transparency and seeking independent advice before investing in ETFs. This shift could drive demand for more ethical and responsible investment options.

-

Potential for increased regulatory scrutiny of the ETF industry in Taiwan: The investigation is likely to result in increased scrutiny of the ETF industry, including stricter oversight of sales practices and stricter enforcement of regulations designed to protect investors. This could lead to more robust rules and regulations in the future.

Ethical Considerations and Best Practices

The core issue highlighted by the investigation is the need for ethical sales practices within the financial industry. Prioritizing client suitability over sales targets is not merely a matter of compliance; it is crucial for maintaining trust and ensuring long-term sustainability.

-

Importance of prioritizing client suitability over sales targets: Financial institutions must adopt a client-centric approach, ensuring that any investment product recommended aligns with the individual's financial goals, risk tolerance, and investment horizon.

-

Best practices for managing sales teams and setting realistic targets: Sales targets should be realistic and attainable without resorting to manipulative or coercive tactics. A focus on building long-term client relationships should replace short-term sales gains.

-

Importance of transparent and ethical compensation structures: Compensation structures should not incentivize aggressive sales tactics that prioritize volume over client needs. Instead, rewards should be tied to long-term client satisfaction and ethical conduct.

-

Role of compliance departments in preventing misconduct: Effective compliance programs are essential for identifying and preventing unethical behavior, providing training to staff, and ensuring adherence to regulations. A robust compliance department is crucial in preventing future incidents of unethical investing practices.

Conclusion

The investigation into alleged ETF sales pressure in Taiwan serves as a stark reminder of the crucial need for ethical conduct within the financial sector. The regulator's response is essential for protecting investors and safeguarding the integrity of the Taiwanese ETF market. The long-term impact remains uncertain, but this situation underscores the paramount importance of responsible sales practices and robust regulatory oversight. For investors, it is crucial to remain vigilant and to select financial institutions that unequivocally prioritize ethical conduct and client well-being. Further developments in this ongoing investigation of ETF sales pressure in Taiwan will undoubtedly be closely monitored.

Featured Posts

-

King Of Davos Exploring The Events Leading To His Demise

May 15, 2025

King Of Davos Exploring The Events Leading To His Demise

May 15, 2025 -

Years After Embryo Dispute Are Elon Musk And Amber Heards Twins Related

May 15, 2025

Years After Embryo Dispute Are Elon Musk And Amber Heards Twins Related

May 15, 2025 -

Georgia Southwestern State University Lifts Lockdown After Campus Incident

May 15, 2025

Georgia Southwestern State University Lifts Lockdown After Campus Incident

May 15, 2025 -

Thoi Gian Xong Hoi Meo Giup Ban Xong Hoi Hieu Qua Va An Toan

May 15, 2025

Thoi Gian Xong Hoi Meo Giup Ban Xong Hoi Hieu Qua Va An Toan

May 15, 2025 -

The Nhl Draft Lottery A Breakdown Of The Rules And The Fan Reaction

May 15, 2025

The Nhl Draft Lottery A Breakdown Of The Rules And The Fan Reaction

May 15, 2025