Sustainable Business Growth: Funding Opportunities For SMEs

Table of Contents

Main Points:

2.1 Government Grants and Subsidies for Sustainable Businesses

Governments worldwide recognize the vital role SMEs play in economic growth and are increasingly incentivizing sustainable business practices. Numerous government initiatives offer grants and subsidies specifically designed to support environmentally conscious and socially responsible SMEs. These programs often prioritize businesses focused on renewable energy, waste reduction, sustainable agriculture, and green technology.

- Examples of Government Grant Programs: While specific programs vary by location, many countries offer grants through agencies dedicated to environmental protection, economic development, or small business support. For example, [insert link to a relevant national or regional government grant program, if applicable]. Research your national and regional government websites for relevant programs.

- Eligibility Criteria: Eligibility typically involves meeting specific criteria related to business size, industry sector, sustainability initiatives, and financial projections. Detailed requirements are outlined in each program's application guidelines.

- Application Process and Funding Amounts: The application process usually involves submitting a detailed business plan, financial statements, and evidence of commitment to sustainable practices. Funding amounts vary considerably, depending on the program and the scale of the project.

Keywords: government grants, SME grants, sustainability grants, green grants, government funding for SMEs, subsidies for small businesses.

2.2 Green Loans and Sustainable Finance Initiatives

The rise of sustainable finance has opened up exciting new avenues for SMEs seeking funding for environmentally responsible projects. Green loans are specifically designed for businesses committed to sustainability and offer several advantages over traditional business loans.

- Benefits of Green Loans: These loans often come with lower interest rates, more favorable repayment terms, and increased access to capital compared to traditional loans. Lenders often prioritize ESG (Environmental, Social, and Governance) factors in their lending decisions.

- Key Players in Sustainable Finance: Many banks and investment funds are increasingly incorporating sustainable finance into their portfolios. Research institutions dedicated to sustainable development often maintain lists of banks and financial institutions offering green loans. [Insert links to relevant financial institutions or resources, if applicable].

- Securing Green Loans: To secure a green loan, SMEs need to demonstrate a clear commitment to sustainability through detailed business plans highlighting environmental and social impact metrics.

Keywords: green loans, sustainable finance, impact investing, ESG investing, ethical finance, green business loans.

2.3 Crowdfunding and Impact Investing for Sustainable Growth

Crowdfunding platforms offer an alternative route to secure seed funding, particularly for innovative sustainable projects. Impact investors actively seek out businesses with a strong positive social and environmental impact.

- Crowdfunding for SMEs: Platforms like Kickstarter and Indiegogo allow SMEs to raise capital directly from the public by showcasing their product or service and its positive impact. A compelling narrative and well-structured campaign are vital for success.

- Impact Investing: Impact investors are increasingly interested in backing SMEs with a demonstrable commitment to sustainability. They look beyond traditional financial returns, also considering environmental and social benefits. Presenting a robust business plan that showcases both financial viability and positive social/environmental impact is crucial.

Keywords: crowdfunding, impact investing, equity crowdfunding, crowdfunding for SMEs, social impact investing, sustainable crowdfunding.

2.4 Venture Capital and Angel Investors for Sustainable SMEs

Venture capitalists and angel investors are increasingly recognizing the potential of sustainable and scalable businesses. Securing funding from these sources can provide significant growth capital.

- Attracting Venture Capital and Angel Investors: A compelling pitch deck that showcases the business's potential for rapid growth, strong social/environmental impact, and a clear path to profitability is crucial. Thorough due diligence is a standard part of the process.

- Benefits and Drawbacks of Equity Investment: While securing equity investment can provide significant capital, it involves relinquishing a portion of ownership in the company. Carefully evaluate the terms and conditions before accepting equity financing.

Keywords: venture capital, angel investors, seed funding, series A funding, equity investment, sustainable venture capital.

Conclusion: Sustainable Business Growth Starts with the Right Funding

Achieving sustainable business growth for your SME requires a strategic approach to securing the right funding. This article has highlighted several key opportunities, including government grants, green loans, crowdfunding, and impact investing. Remember, careful planning and a robust business plan are critical elements in any funding application. Before applying, thoroughly research the specific requirements and eligibility criteria of each funding option.

Start your journey towards sustainable business growth today by researching the funding opportunities best suited to your SME. Don't hesitate to explore government grants, green loans, and impact investing options to fuel your sustainable future. Further explore options for sustainable SME finance, green business funding, and ethical investment to find the best fit for your business needs.

Featured Posts

-

Adios A Joan Aguilera Leyenda Del Tenis Espanol Y Ganador De Un Masters 1000

May 19, 2025

Adios A Joan Aguilera Leyenda Del Tenis Espanol Y Ganador De Un Masters 1000

May 19, 2025 -

Fechas Eurovision 2025 Semifinales Y Gran Final

May 19, 2025

Fechas Eurovision 2025 Semifinales Y Gran Final

May 19, 2025 -

Johnny Mathis 89 Retires A Career Retrospective And Health Update

May 19, 2025

Johnny Mathis 89 Retires A Career Retrospective And Health Update

May 19, 2025 -

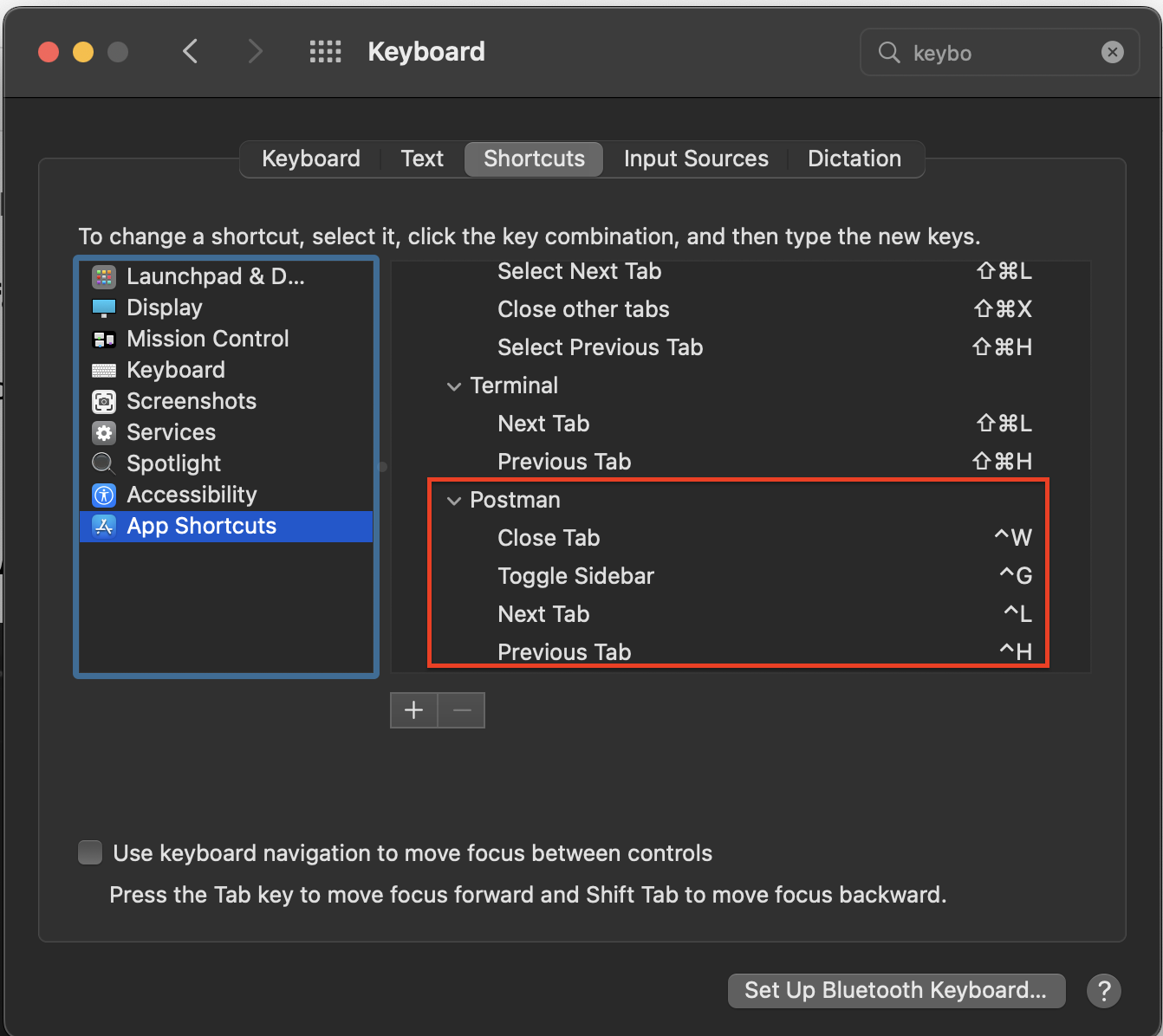

Postman Productivity Expert Tips And Shortcuts

May 19, 2025

Postman Productivity Expert Tips And Shortcuts

May 19, 2025 -

The Mets Hitting Problem Causes And Potential Solutions

May 19, 2025

The Mets Hitting Problem Causes And Potential Solutions

May 19, 2025