Sustainability Funding Options For SMEs: A Comprehensive Guide

Table of Contents

Government Grants and Subsidies for Sustainable Practices

Identifying and securing government funding is a crucial first step for many SMEs looking to implement sustainable practices. Numerous national, regional, and local government programs offer financial incentives specifically designed for businesses adopting eco-friendly technologies and processes. These programs often prioritize initiatives focused on energy efficiency, waste reduction, renewable energy adoption, and sustainable supply chain management.

Identifying Relevant Programs

Finding the right government grant or subsidy requires diligent research. Many opportunities are often overlooked due to a lack of awareness. Here's how to effectively search for available funding:

- Research government websites: Begin by thoroughly exploring websites dedicated to small business support and environmental initiatives within your country, region, and local municipality. Look for keywords such as "green business grants," "sustainable business funding," "energy efficiency incentives," and "renewable energy subsidies."

- Utilize online grant search engines: Several specialized online platforms aggregate information on various government grants and subsidies. These tools allow you to filter search results based on your industry, location, and project type.

- Network with industry associations and chambers of commerce: These organizations often have strong relationships with government agencies and can provide valuable insights into available funding opportunities and application processes.

- Consider seeking professional grant writing assistance: Preparing a competitive grant application can be time-consuming and requires specific skills. If needed, consider enlisting the help of a professional grant writer.

Eligibility Criteria and Application Process

Successfully securing a government grant requires a thorough understanding of the eligibility criteria and a well-structured application. Each program has unique requirements, focusing on factors like:

-

Business size: Many programs target SMEs based on specific employee counts or revenue thresholds.

-

Industry: Certain grants might focus on specific sectors with significant environmental impact, such as manufacturing or agriculture.

-

Project scope: The nature and scale of your proposed sustainable project will directly impact eligibility.

-

Meticulous review: Before submitting an application, carefully review all eligibility criteria to ensure your business and project meet all requirements.

-

Compelling application: Your application needs to convincingly demonstrate the environmental impact and financial viability of your project. Highlight the positive contributions to sustainability and the potential return on investment.

-

Expert feedback: Seek feedback from experienced professionals or mentors on your application before submission. A fresh perspective can identify areas for improvement.

-

Diligent follow-up: After submitting your application, follow up regularly to check on its status and address any inquiries.

Green Loans and Financing Options

Beyond government grants, various financial institutions offer specialized financing options specifically designed for sustainability initiatives. These green loans and other financial products make it easier for SMEs to invest in environmentally friendly projects.

Banks and Financial Institutions Offering Green Loans

Many banks and credit unions now offer green loans with attractive features, recognizing the growing importance of sustainable business practices. These loans often come with:

-

Competitive interest rates: Incentivizing businesses to adopt sustainable practices.

-

Flexible repayment terms: Catering to the specific needs of SMEs.

-

Simplified application processes: Streamlining the borrowing process.

-

Inquire with your current bank: Start by contacting your existing bank or credit union to inquire about their green financing options. They may have dedicated programs for sustainable projects.

-

Research dedicated lenders: Explore banks and credit unions with a strong commitment to sustainable lending practices. Their expertise in this area can be invaluable.

-

Compare offers: Before committing to a loan, compare interest rates, repayment terms, fees, and other conditions from multiple lenders to secure the best deal.

Securing Green Bonds and Impact Investments

For larger-scale sustainability projects, green bonds and impact investments present powerful funding avenues.

-

Green bonds: These debt instruments specifically finance environmental projects, offering a targeted approach to raising capital for initiatives focused on renewable energy, energy efficiency, and pollution control.

-

Impact investing: This approach focuses on investments that generate both financial returns and positive social and environmental impact. Impact investors actively seek opportunities to support businesses with strong sustainability commitments.

-

Impact investor platforms: Explore online platforms that connect businesses with impact investors. These platforms facilitate the process of securing funding from investors who prioritize sustainability.

-

Strong investment proposal: Develop a detailed investment proposal that clearly outlines your project's environmental and financial benefits. Showcase its potential for positive impact and a strong return on investment.

-

Investor expectations: Understand the specific criteria and expectations of impact investors. Their due diligence process is often rigorous, requiring a comprehensive understanding of your sustainability strategy.

Crowdfunding and Community Investment

Leveraging community support can be a powerful way to secure funding for your SME's sustainability initiatives. Crowdfunding platforms and local community engagement can provide access to diverse funding sources.

Utilizing Crowdfunding Platforms for Sustainability Projects

Platforms like Kickstarter and Indiegogo allow you to present your project to a wider audience and raise funds based on community support. Successful crowdfunding campaigns for sustainability projects often emphasize:

- Compelling storytelling: Connect with potential backers by articulating the project’s purpose, impact, and benefits in a compelling way.

- Active engagement: Actively engage with potential backers through social media, email, and other channels to build excitement and support.

- Incentivized rewards: Offer attractive rewards to incentivize contributions, ranging from early access to products or services to exclusive experiences.

Seeking Investment from Local Communities and Social Enterprises

Connecting with local communities and social enterprises can unlock alternative funding streams. These groups often prioritize social and environmental impact, aligning with the goals of many sustainability projects.

- Community networking: Network with local community organizations, social enterprises, and businesses with a shared commitment to sustainability.

- Project presentation: Present your project’s sustainability goals and the potential benefits to the community and the environment.

- Community benefit: Highlight the positive community impact of your project, demonstrating how it contributes to local economic development, job creation, or environmental improvement.

Conclusion

Securing funding for sustainability initiatives is crucial for SMEs aiming to reduce their environmental footprint and enhance their competitiveness. This guide highlights diverse funding options, from government grants and green loans to crowdfunding and impact investing. By thoroughly researching available programs, preparing compelling proposals, and actively engaging with potential investors, SMEs can successfully access the necessary capital to implement sustainable practices. Start exploring your sustainability funding options today and pave the way for a greener and more profitable future for your SME!

Featured Posts

-

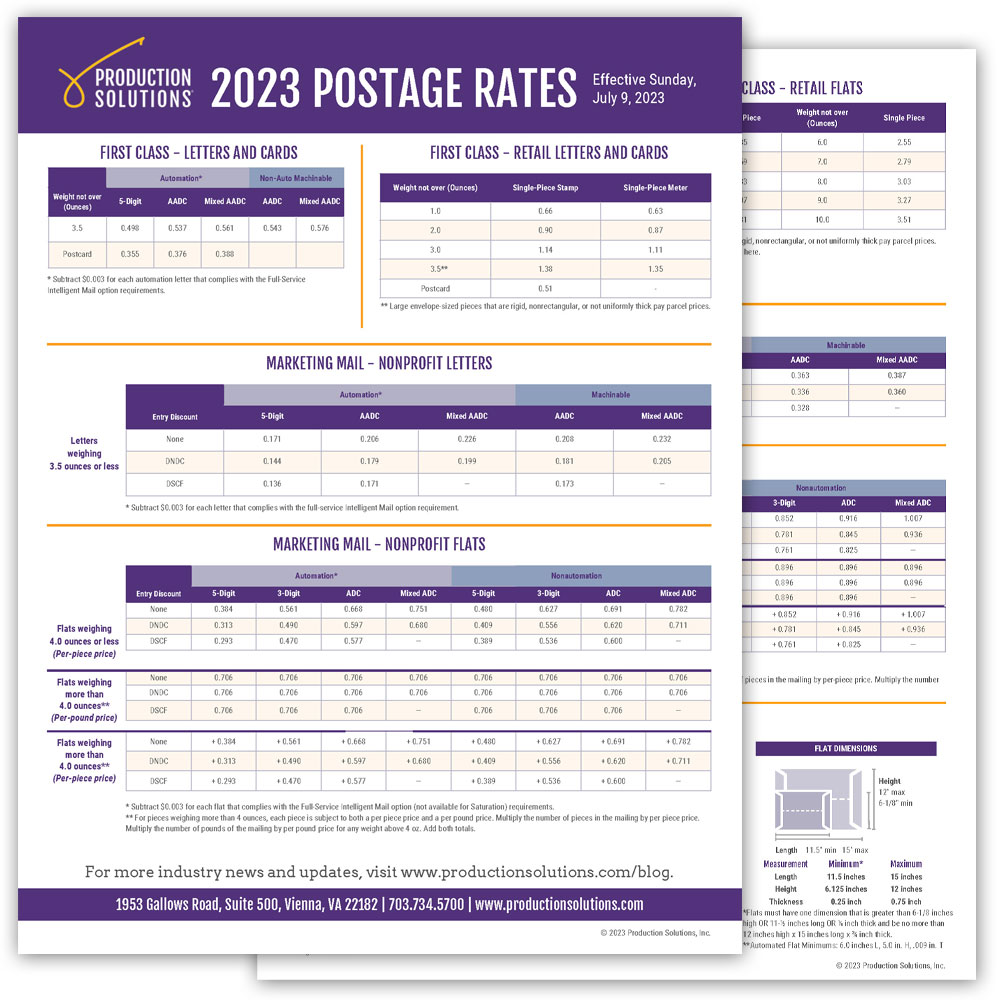

First Class Stamp Price Increase Impact On Consumers

May 19, 2025

First Class Stamp Price Increase Impact On Consumers

May 19, 2025 -

Paige Bueckers U Conn Huskies Of Honor Induction On Senior Day

May 19, 2025

Paige Bueckers U Conn Huskies Of Honor Induction On Senior Day

May 19, 2025 -

La Muerte De Juan Aguilera Un Hito En El Tenis Espanol

May 19, 2025

La Muerte De Juan Aguilera Un Hito En El Tenis Espanol

May 19, 2025 -

Blue Origin Rocket Launch Cancelled Subsystem Malfunction Investigation Underway

May 19, 2025

Blue Origin Rocket Launch Cancelled Subsystem Malfunction Investigation Underway

May 19, 2025 -

East Hampton Officer Luis Morales Faces Dwi Charges Southampton Police Investigation

May 19, 2025

East Hampton Officer Luis Morales Faces Dwi Charges Southampton Police Investigation

May 19, 2025