Suncor Energy: Record Production, But Lower Sales Due To Inventory

Table of Contents

Record Production in Upstream Operations

Suncor's recent success stems largely from its robust upstream operations, particularly its significant advancements in oil sands extraction.

Increased Oil Sands Production

Suncor's oil sands operations have experienced a substantial surge in production. For example, the Fort Hills oil sands project, a joint venture with TotalEnergies and Teck Resources, contributed significantly to this increase. Specific numbers and data (if available from recent reports) should be inserted here, illustrating the quantifiable increase in barrels produced.

- Specific Oil Sands Projects: [Insert names of projects and their contribution to the production increase]

- Technological Advancements: [Detail specific technological improvements, such as enhanced steam assisted gravity drainage (SAGD) techniques or improved extraction methods, that contributed to higher output]

- Production Increase: [Quantify the increase – e.g., "a 15% increase in oil sands production compared to Q2 2023"]

Enhanced Operational Efficiency

Beyond sheer scale, Suncor has also improved operational efficiency across its upstream operations. These improvements have significantly reduced production costs and boosted overall output.

- Automation and Technological Upgrades: [Describe automation efforts and other technological investments which have streamlined processes and reduced downtime.]

- Improved Maintenance Strategies: [Highlight any changes in maintenance procedures that minimized disruptions and maximized uptime.]

- Strategic Partnerships: [Mention any partnerships or collaborations that have contributed to enhanced efficiency and cost reduction.]

- Impact on Production Costs: [Quantify the cost savings achieved through these efficiency measures.]

Lower Sales Despite Record Production: The Inventory Factor

Despite record production, Suncor experienced lower sales. This discrepancy is largely attributed to a significant inventory buildup.

Inventory Buildup

An unexpected surplus of oil inventory played a crucial role in reducing sales. This surplus wasn't solely due to increased production; market factors also contributed significantly.

- Market Dynamics: [Explain factors like reduced global demand, pipeline capacity constraints impacting transportation, and unexpected shifts in market demand]

- Storage Costs: [Detail the financial implications of storing excess oil, including tank rental, maintenance, and insurance costs.]

- Impact on Cash Flow: [Explain how increased inventory negatively impacted Suncor's cash flow, tying up capital that could have been used elsewhere.]

Impact of Global Oil Prices

Fluctuations in global oil prices further exacerbated the situation. Suncor's inability to sell its inventory at optimal prices directly impacted revenue.

- Oil Price Volatility: [Discuss the recent trends in oil prices and how they affected Suncor's ability to price its products competitively.]

- Revenue Impact: [Quantify the impact of price volatility on Suncor's sales revenue.]

- Hedging Strategies: [Describe any hedging strategies employed by Suncor to mitigate price risk and their effectiveness.]

Refineries and Downstream Operations

Potential issues within Suncor's refining and downstream operations might have also contributed to reduced sales.

- Refinery Maintenance and Shutdowns: [Mention any planned or unplanned refinery maintenance or shutdowns that limited processing capacity.]

- Logistical Challenges: [Discuss any logistical issues, such as pipeline disruptions or transportation bottlenecks that affected the delivery of refined products to the market.]

- Downstream Capacity Constraints: [Analyze if capacity limitations within Suncor's downstream operations hindered the timely processing and sale of their products.]

Suncor Energy's Financial Performance and Outlook

The contrast between record production and lower sales significantly impacted Suncor's financial performance.

Financial Impact of the Discrepancy

The lower sales, despite increased production, had a noticeable effect on Suncor's financial reports.

- Revenue and Profit Margins: [Provide specific numbers from Suncor's financial statements illustrating the impact on revenue and profit margins.]

- Investor Sentiment: [Analyze the impact of the situation on investor confidence and the company's stock price.]

- Corrective Measures: [Discuss any actions taken by Suncor to mitigate the negative financial impact, such as cost-cutting measures or inventory management strategies.]

Future Strategies and Expectations

Suncor is likely to implement strategies to address inventory challenges and improve future performance.

- Inventory Management Improvements: [Describe strategies for better forecasting and inventory control to avoid future surpluses.]

- Infrastructure Investments: [Mention plans for investments in pipeline infrastructure or other improvements to enhance transportation efficiency.]

- Strategic Partnerships and Diversification: [Discuss any plans to expand into new markets or diversify their product offerings.]

- Future Production and Sales Projections: [If available, include projected future production and sales figures.]

Conclusion

Suncor Energy's recent experience demonstrates the complex interplay of factors affecting the oil and gas sector. While achieving record production is commendable, the simultaneous decline in sales highlights the critical need for efficient inventory management and a deep understanding of market dynamics. Suncor's future success hinges on its ability to adapt to market fluctuations, optimize its operations, and refine its strategies to better align production with market demand. To stay informed about Suncor Energy's performance and the evolving landscape of the Canadian oil industry, continue to follow our updates on Suncor Energy and other key players in the energy sector.

Featured Posts

-

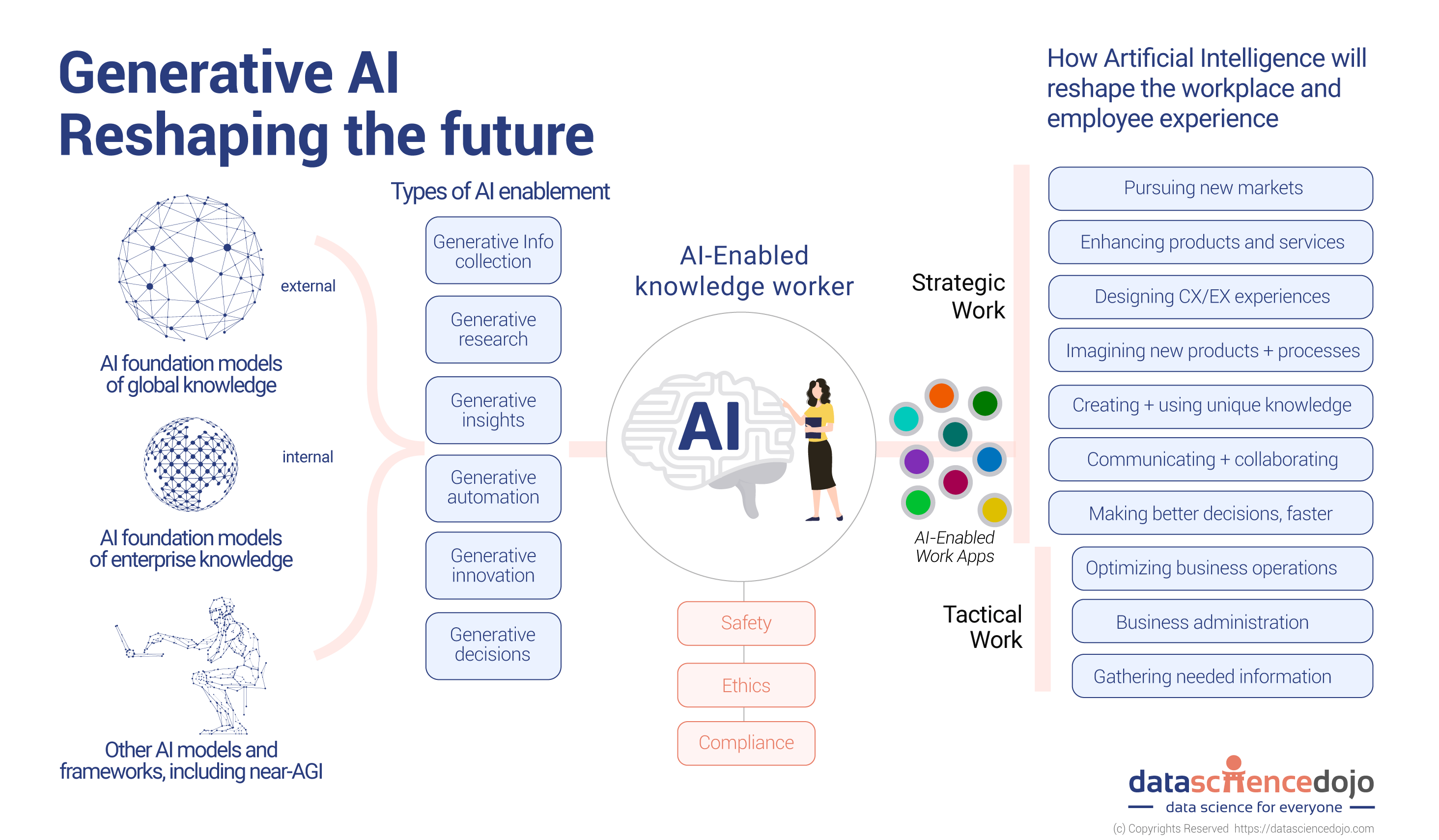

Apples Ai Future Leading The Pack Or Falling Behind

May 10, 2025

Apples Ai Future Leading The Pack Or Falling Behind

May 10, 2025 -

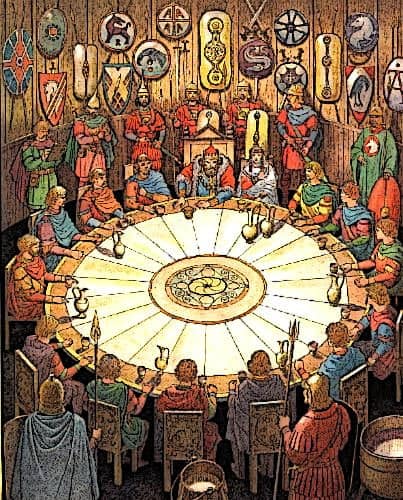

Uncovering A Medieval Mystery Merlin Arthur And The Intrigue On A Book Cover

May 10, 2025

Uncovering A Medieval Mystery Merlin Arthur And The Intrigue On A Book Cover

May 10, 2025 -

Stock Market Prediction Two Companies To Outpace Palantir Within 36 Months

May 10, 2025

Stock Market Prediction Two Companies To Outpace Palantir Within 36 Months

May 10, 2025 -

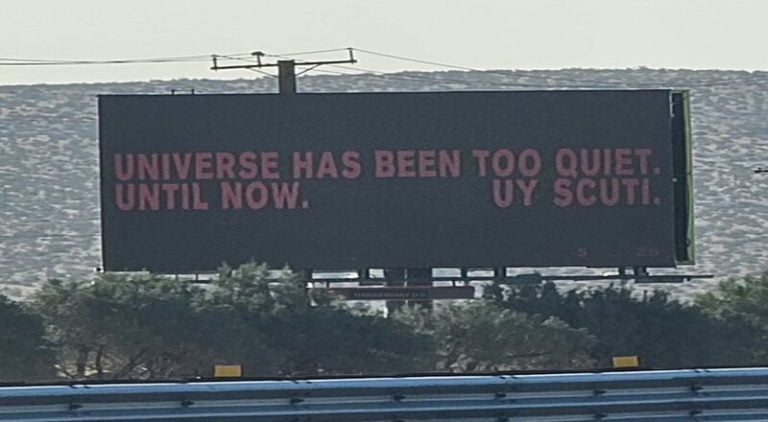

Uy Scuti Release Date Young Thug Offers Clues On Upcoming Album

May 10, 2025

Uy Scuti Release Date Young Thug Offers Clues On Upcoming Album

May 10, 2025 -

Perus Emergency Mining Ban And Its 200 Million Gold Price Tag

May 10, 2025

Perus Emergency Mining Ban And Its 200 Million Gold Price Tag

May 10, 2025