Successfully Applying For Private Credit Jobs: A 5-Point Guide

Table of Contents

Crafting a Winning Resume for Private Credit Jobs

Your resume is your first impression, and in the competitive world of private credit, it needs to be impeccable. A well-crafted resume highlights your skills and experience in a way that resonates with recruiters and hiring managers.

Highlighting Relevant Skills

Your resume should showcase the specific skills crucial for private credit roles. These include:

- Financial Modeling: Proficiency in building and utilizing financial models (DCF, LBO, etc.) is essential. Quantify your achievements. For example, instead of "Created financial models," write "Developed and implemented a discounted cash flow model that improved investment appraisal accuracy by 10%."

- Credit Analysis: Demonstrate your expertise in analyzing creditworthiness, assessing risk, and structuring debt transactions. Highlight your experience in performing credit due diligence and underwriting.

- Underwriting: Showcase your ability to evaluate loan applications, assess risk, and determine creditworthiness. Quantify your success: "Successfully underwrote $30M in commercial real estate loans with zero defaults."

- Due Diligence: Detail your experience conducting thorough investigations, analyzing financial statements, and identifying potential risks.

- Portfolio Management: If relevant, showcase your experience managing a portfolio of loans, monitoring performance, and managing risk.

You should also list specific software proficiency:

- Microsoft Excel (advanced skills are a must)

- Bloomberg Terminal

- Argus (for real estate)

- Other relevant financial software

Tailoring Your Resume to Each Application

Generic resumes rarely succeed. Each application requires a customized resume that speaks directly to the specific requirements and culture of the target company.

- Keyword Optimization: Carefully review the job description and identify key skills and requirements. Integrate these keywords naturally throughout your resume.

- Experience Adaptation: Tailor your experience descriptions to highlight the skills most relevant to the specific role. For example, if a job description emphasizes distressed debt experience, focus on that aspect of your background.

Mastering the Private Credit Job Interview

The interview stage is critical. Preparation is key to showcasing your skills and personality effectively.

Preparing for Behavioral Questions

Behavioral questions assess your past performance as an indicator of future success. Use the STAR method (Situation, Task, Action, Result) to structure your answers:

- Common Behavioral Questions: "Tell me about a time you failed," "Describe a challenging project and how you overcame it," "Give an example of a time you worked effectively under pressure," "How do you handle conflict?"

- STAR Method: Practice structuring your answers using the STAR method to provide clear, concise, and impactful responses. Focus on quantifiable results.

Demonstrating Technical Proficiency

Private credit roles demand strong technical skills. Be prepared for in-depth questions on:

- Common Technical Questions: "Explain your understanding of discounted cash flow analysis," "Walk me through your credit underwriting process for a leveraged buyout," "How do you assess the credit risk of a borrower?" "Discuss your experience with different types of loan structures."

- Demonstrating Expertise: Answer questions confidently and thoroughly, but avoid sounding arrogant. Show your passion for the field and your willingness to learn.

Networking Your Way to Private Credit Jobs

Networking is crucial for uncovering hidden job opportunities and making valuable connections.

Leveraging LinkedIn

LinkedIn is an invaluable tool for networking in the private credit industry:

- Profile Optimization: Optimize your LinkedIn profile with keywords relevant to private credit, a professional headshot, and a compelling summary highlighting your key skills and experience.

- Engaging with Professionals: Actively engage with professionals in the industry by commenting on posts, joining relevant groups, and participating in discussions.

Attending Industry Events

Networking events provide opportunities to meet potential employers and expand your network:

- Relevant Events: Research and attend industry conferences, workshops, and networking events focused on private credit, alternative investments, or finance.

- Maximizing Opportunities: Prepare talking points, practice your elevator pitch, and actively engage in conversations. Follow up with new contacts afterward.

Understanding the Private Credit Landscape

Demonstrating a solid understanding of the private credit industry is vital.

Researching Different Types of Private Credit Firms

Familiarize yourself with different types of private credit firms and their investment strategies:

- Types of Firms: Direct lenders, fund managers, investment banks, and other specialized firms all play unique roles in the private credit market. Research their investment mandates and target sectors.

- Investment Thesis: Understand each firm’s investment thesis, target returns, and risk tolerance.

Staying Updated on Industry Trends

Keeping abreast of industry news and trends demonstrates your commitment and passion:

- Reliable Sources: Follow reputable financial news sources, industry publications, and research reports to stay informed on market trends, regulatory changes, and emerging opportunities.

- Demonstrating Knowledge: During interviews, subtly incorporate your knowledge of current events and trends to showcase your expertise and engagement with the industry.

Following Up After Applying for Private Credit Jobs

Following up professionally demonstrates your persistence and genuine interest.

Sending Thank-You Notes

Send personalized thank-you notes after each interview:

- Thank-You Note Templates: Craft individual notes reiterating your interest, highlighting key discussion points, and expressing gratitude for the interviewer's time.

- Making Notes Stand Out: Add a specific detail from the conversation to personalize your note and make it memorable.

Following Up on Your Application

If you haven't received a response within a reasonable timeframe, politely follow up:

- Appropriate Timelines: Allow a week or two after the interview before following up.

- Professional Follow-Up Emails: Keep your email brief, professional, and reiterate your interest in the position.

Conclusion

Securing a private credit job demands a multifaceted strategy. By diligently following this 5-point guide – crafting a compelling resume, mastering the interview, networking effectively, understanding the industry landscape, and following up professionally – you’ll significantly enhance your prospects. Don't delay; begin your journey to securing your ideal private credit job today!

Featured Posts

-

E Bay And Section 230 Court Ruling On Listings For Illegal Chemicals

May 31, 2025

E Bay And Section 230 Court Ruling On Listings For Illegal Chemicals

May 31, 2025 -

Chase Lees Scoreless Inning Marks Successful Mlb Return May 12 2025

May 31, 2025

Chase Lees Scoreless Inning Marks Successful Mlb Return May 12 2025

May 31, 2025 -

Duncan Bannatyne And Nigora Whitehorn Witness Life Changing Operations At Casablanca Childrens Hospital

May 31, 2025

Duncan Bannatyne And Nigora Whitehorn Witness Life Changing Operations At Casablanca Childrens Hospital

May 31, 2025 -

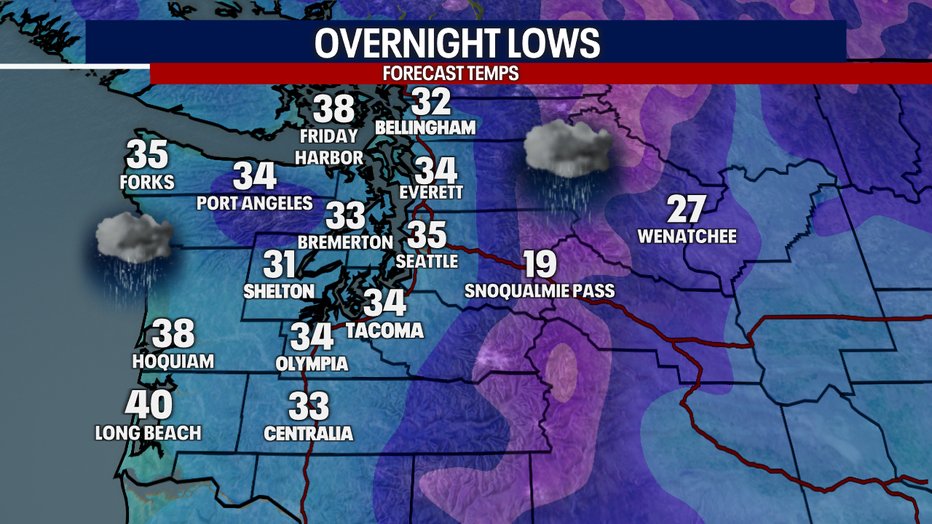

Seattle Weather Soggy Skies Continue Into The Weekend

May 31, 2025

Seattle Weather Soggy Skies Continue Into The Weekend

May 31, 2025 -

The 30 Day Minimalist Lifestyle Experiment How To Simplify Your Life

May 31, 2025

The 30 Day Minimalist Lifestyle Experiment How To Simplify Your Life

May 31, 2025