Succeeding In The Private Credit Hiring Process: A 5-Point Guide

Table of Contents

Mastering the Fundamentals of Private Credit

Before you even begin applying for private credit jobs, a solid understanding of the core concepts is crucial. This isn't just about possessing basic finance knowledge; it’s about demonstrating a deep understanding of the intricacies of private credit investing. This includes a thorough grasp of different debt structures, sophisticated credit analysis techniques, and proficient financial modeling skills. Prospective employers in the private credit industry, whether it's a private credit fund or a large investment bank's private credit arm, expect a high level of expertise.

- Understand various debt instruments and their risk profiles: This involves a detailed knowledge of senior secured loans, mezzanine debt, subordinated debt, and other less common structures. Knowing the nuances of each instrument's seniority and risk profile is paramount.

- Master financial modeling techniques relevant to private credit deals: Proficiency in building and analyzing leveraged buyout (LBO) models, discounted cash flow (DCF) models, and other valuation techniques specific to private credit transactions is essential.

- Develop a strong understanding of credit metrics: You should be comfortable interpreting key credit metrics such as leverage ratios (debt-to-EBITDA, debt-to-equity), interest coverage ratios, and other relevant indicators of creditworthiness.

- Familiarize yourself with different types of private credit strategies: Gain a working understanding of direct lending strategies, fund-of-funds approaches, and other investment strategies within the private credit space. Understanding the nuances of various strategies demonstrates a comprehensive understanding of the market.

Tailoring Your Resume and Cover Letter for Private Credit Roles

Your resume and cover letter are your first impression – make it count. In the competitive private credit job market, a generic application won't cut it. You need to tailor your materials to specifically highlight skills and experiences relevant to the target private credit roles. Remember, recruiters scan resumes quickly, so make yours easy to read and packed with relevant keywords.

- Quantify your accomplishments using numbers and data: Instead of simply stating your responsibilities, quantify your achievements using concrete numbers and data to demonstrate your impact. For example, instead of saying "Improved financial reporting," say "Improved financial reporting efficiency by 15%, resulting in a $50,000 cost saving."

- Use keywords relevant to private credit job descriptions: Carefully review job descriptions for common keywords and incorporate them naturally into your resume and cover letter. This helps applicant tracking systems (ATS) identify your application as a good match.

- Highlight transferable skills from previous roles: Even if your previous roles weren't directly in private credit, highlight transferable skills such as financial analysis, modeling, teamwork, and problem-solving.

- Showcase your understanding of the private credit industry and its trends: Demonstrate your knowledge of current market trends and significant events in the private credit space to show you’re genuinely interested in the field.

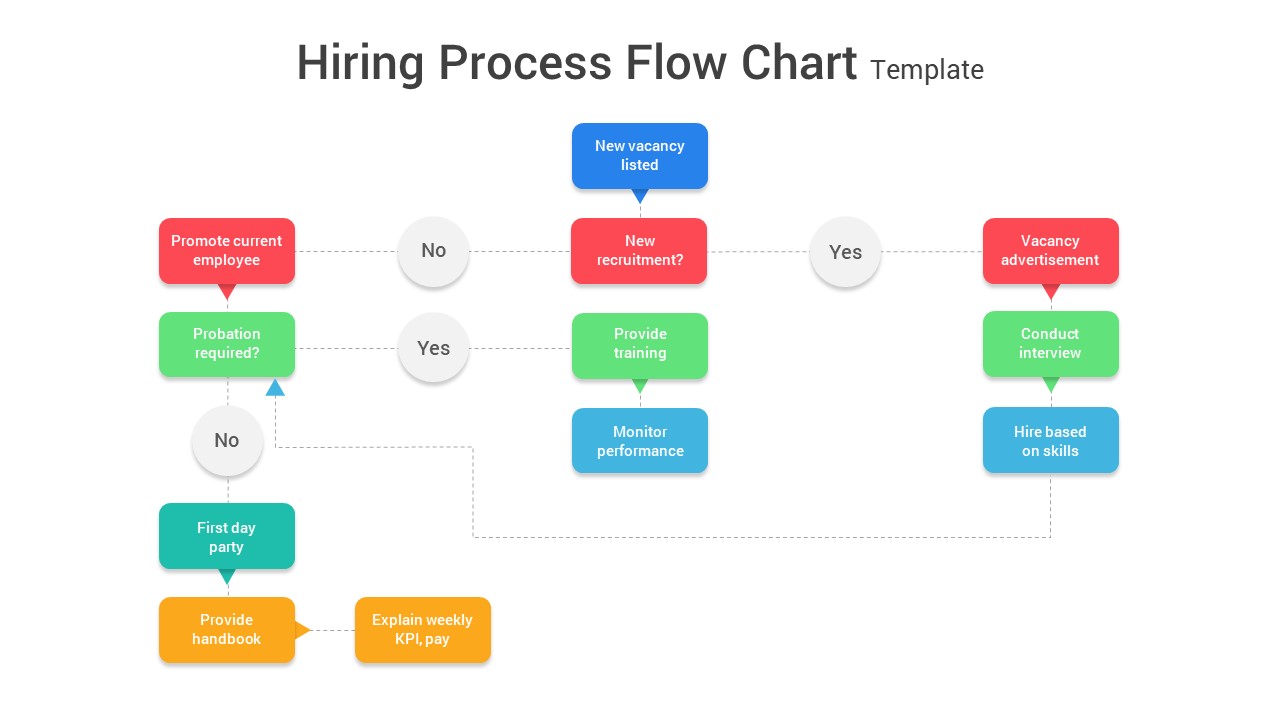

Preparing for the Private Credit Interview

The private credit interview process is typically rigorous, encompassing behavioral, technical, and often case study interviews. Thorough preparation is key to success. Practice answering common questions, brush up on your technical skills, and prepare for in-depth case studies.

- Prepare answers to common behavioral interview questions: Practice answering questions like "Tell me about a time you failed," "Describe a challenging project," and "How do you handle pressure?" Use the STAR method (Situation, Task, Action, Result) to structure your responses effectively.

- Practice technical questions related to financial modeling and credit analysis: Be prepared to discuss your modeling skills, explain your understanding of credit metrics, and analyze hypothetical scenarios related to debt structures and credit risk.

- Prepare for case study interviews by practicing similar examples: Case studies are often used to assess your problem-solving abilities and analytical skills. Practice analyzing case studies from various sources and develop a structured approach to answering them.

- Research the firm and the interviewer beforehand: Demonstrate your genuine interest in the firm by researching their investment strategy, recent transactions, and the interviewer's background.

Networking in the Private Credit Industry

Networking is invaluable in securing a private credit role. Building relationships with professionals in the field can lead to valuable insights, job opportunities, and mentorship. Take advantage of various networking opportunities to expand your professional circle.

- Attend industry conferences and workshops: Networking events provide excellent opportunities to meet professionals in private credit and learn about current industry trends.

- Actively network on LinkedIn: Connect with professionals in the private credit space, engage in relevant discussions, and follow industry leaders.

- Connect with professionals on informational interviews: Reach out to professionals for informational interviews to learn about their experiences and gain valuable career advice.

- Join relevant industry associations: Joining associations like the Alternative Credit Council (ACC) can provide networking opportunities and access to industry resources.

Negotiating Your Private Credit Offer

Once you receive a job offer, don't be afraid to negotiate. Knowing your worth and effectively communicating your expectations is crucial. Research salary benchmarks and consider the entire compensation package.

- Research average salaries for similar roles: Use online resources and networking contacts to research the average salary range for private credit roles with similar responsibilities and experience levels.

- Consider the entire compensation package: Don't just focus on the base salary; consider the total compensation package, including bonuses, benefits, and other perks.

- Prepare your desired salary range before negotiations: Have a clear idea of your desired salary range based on your research and experience.

- Negotiate confidently and professionally: Communicate your expectations clearly and professionally, highlighting the value you bring to the firm.

Conclusion

Securing a successful private credit career requires a multi-faceted approach. By mastering the fundamentals of private credit, crafting compelling application materials, preparing thoroughly for interviews, actively networking, and confidently negotiating your offer, you significantly increase your chances of success. Don't miss out on your dream private credit job – use this guide to ace the hiring process! Start your journey towards a successful private credit career today by implementing these five key steps!

Featured Posts

-

Canada Posts Future Commission Report Urges End To Daily Door To Door Service

May 19, 2025

Canada Posts Future Commission Report Urges End To Daily Door To Door Service

May 19, 2025 -

Visit Orlando 2025 A Photo Recap Of The Travel And Tourism Event

May 19, 2025

Visit Orlando 2025 A Photo Recap Of The Travel And Tourism Event

May 19, 2025 -

I Anastasi Toy Lazaroy Istoriko T Hriskeytiki Simasia Kai Klironomia Sta Ierosolyma

May 19, 2025

I Anastasi Toy Lazaroy Istoriko T Hriskeytiki Simasia Kai Klironomia Sta Ierosolyma

May 19, 2025 -

Everything You Need To Know About Balmains Fall Winter 2025 2026 Collection

May 19, 2025

Everything You Need To Know About Balmains Fall Winter 2025 2026 Collection

May 19, 2025 -

Mets Vs Blue Jays Queens Series Preview

May 19, 2025

Mets Vs Blue Jays Queens Series Preview

May 19, 2025