Student Loan Payment Problems: Protecting Your Credit Score

Table of Contents

Understanding the Impact of Missed Student Loan Payments on Your Credit Score

Late or missed student loan payments are seriously damaging to your credit score. When you miss a payment, your loan servicer reports this delinquency to the major credit bureaus (Equifax, Experian, and TransUnion). This negative information significantly impacts your FICO score and VantageScore, both widely used credit scoring models. The severity of the impact depends on the length and frequency of your delinquency.

- Specific examples of credit score drops: A single missed payment can result in a drop of 30-50 points, while repeated missed payments can lead to a significantly larger decrease, potentially impacting your ability to qualify for loans, rent an apartment, or even get a job.

- The length of time negative information remains: Negative information from missed payments typically remains on your credit report for seven years from the date of delinquency.

- Impact on future borrowing: A damaged credit score due to student loan payment problems translates to higher interest rates on future loans (auto loans, mortgages, etc.), making borrowing significantly more expensive. It may even make it impossible to secure credit altogether.

- Collection agencies: Persistent delinquency can lead to your loan being sent to collections, resulting in further damage to your credit score and potential legal action.

Strategies for Avoiding Student Loan Payment Problems

Proactive strategies are paramount to avoiding student loan payment problems. Thorough financial planning and budgeting are key to successful repayment. Understanding your loan terms is equally critical, paying attention to details such as repayment plans, interest rates, and any grace periods available.

- Budgeting and Financial Planning: Create a realistic budget that prioritizes your student loan payments. Track your income and expenses meticulously, ensuring that your loan payments are factored into your monthly spending plan.

- Budgeting Apps and Tools: Utilize budgeting apps or online tools to streamline your budget management and receive alerts for upcoming payments.

- Repayment Plans: Familiarize yourself with the different repayment plans available: Standard, Graduated, Extended, and Income-Driven Repayment (IDR). Choose the plan that best aligns with your current financial situation. IDR plans, for instance, adjust payments based on your income.

- Automatic Payments: Set up automatic payments from your bank account to ensure on-time payments and avoid late fees.

Dealing with Student Loan Payment Problems: Solutions and Resources

If you are already facing student loan payment difficulties, several options exist to help you regain control. Contacting your loan servicer immediately is crucial. They can explain options like forbearance, deferment, and income-driven repayment plans.

- Forbearance: Temporarily suspends your payments but accrues interest.

- Deferment: Postpones your payments, sometimes with interest accruing, sometimes without. Eligibility depends on specific circumstances.

- Income-Driven Repayment (IDR) Plans: Adjust your monthly payments based on your income and family size.

- Seeking Professional Help: Consider seeking professional financial advice from a certified financial planner or credit counselor. Organizations like the National Foundation for Credit Counseling (NFCC) offer free or low-cost financial guidance.

- Communicating with your Loan Servicer: Explain your situation clearly and honestly. Work collaboratively to find a solution that meets your needs.

Protecting Your Credit Score After a Student Loan Payment Problem

Rebuilding your credit score after a delinquency requires consistent effort and responsible financial behavior. Focus on consistently making on-time payments on all your debts and keeping your credit utilization low (the amount of credit you use compared to your total available credit).

- Improve Credit Scores: Pay down existing debt, maintain a good payment history, and avoid opening new accounts excessively.

- Credit Monitoring: Consider using a credit monitoring service to track your credit report regularly and identify any inaccuracies.

- Avoid Credit Repair Scams: Be wary of companies promising quick credit repair, as many are scams. Focus on responsible financial management instead.

Conclusion

Student loan payment problems can severely impact your credit score and overall financial health. By understanding the potential consequences, implementing proactive strategies, and utilizing available resources, you can effectively manage your student loan debt and protect your credit. Don't let student loan payment problems derail your financial future. Take control of your debt today by understanding your repayment options and implementing effective budgeting strategies to safeguard your credit score. Proactive management of your student loans is key to long-term financial well-being.

Featured Posts

-

Facing A Salary Gap How To Adjust Your Expectations And Land Your Next Role

May 17, 2025

Facing A Salary Gap How To Adjust Your Expectations And Land Your Next Role

May 17, 2025 -

Reta Nba Situacija Teisejas Pripazino Klaida Pakeitusia Pistons Ir Knicks Rungtyniu Rezultata

May 17, 2025

Reta Nba Situacija Teisejas Pripazino Klaida Pakeitusia Pistons Ir Knicks Rungtyniu Rezultata

May 17, 2025 -

How Josh Cavallo Is Changing Football With His Honesty

May 17, 2025

How Josh Cavallo Is Changing Football With His Honesty

May 17, 2025 -

7 Bit Casino A Leading Online Casino Choice In Canada

May 17, 2025

7 Bit Casino A Leading Online Casino Choice In Canada

May 17, 2025 -

Game 4 Pistons Anger Over Questionable Referee Decision

May 17, 2025

Game 4 Pistons Anger Over Questionable Referee Decision

May 17, 2025

Latest Posts

-

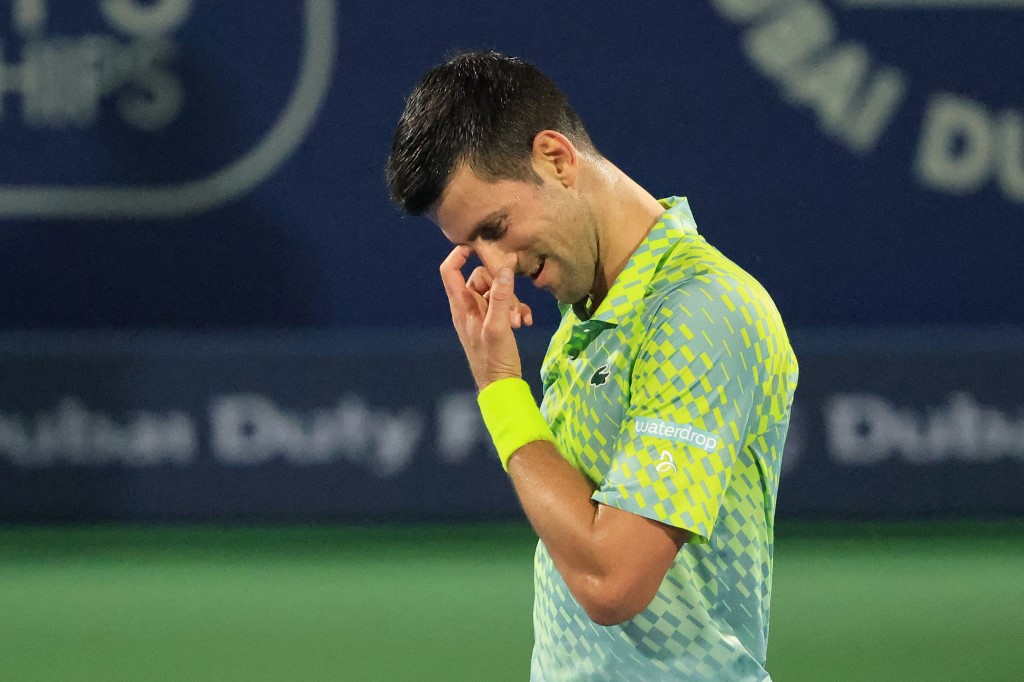

Novak Djokovic Miami Acik Finalinde Yerini Aldi

May 17, 2025

Novak Djokovic Miami Acik Finalinde Yerini Aldi

May 17, 2025 -

Miami Acik Novak Djokovic Finalde

May 17, 2025

Miami Acik Novak Djokovic Finalde

May 17, 2025 -

Novak Djokovic Miami Acik Ta Finalde

May 17, 2025

Novak Djokovic Miami Acik Ta Finalde

May 17, 2025 -

Djokovic Miami Acik Ta Finale Yuekseldi

May 17, 2025

Djokovic Miami Acik Ta Finale Yuekseldi

May 17, 2025 -

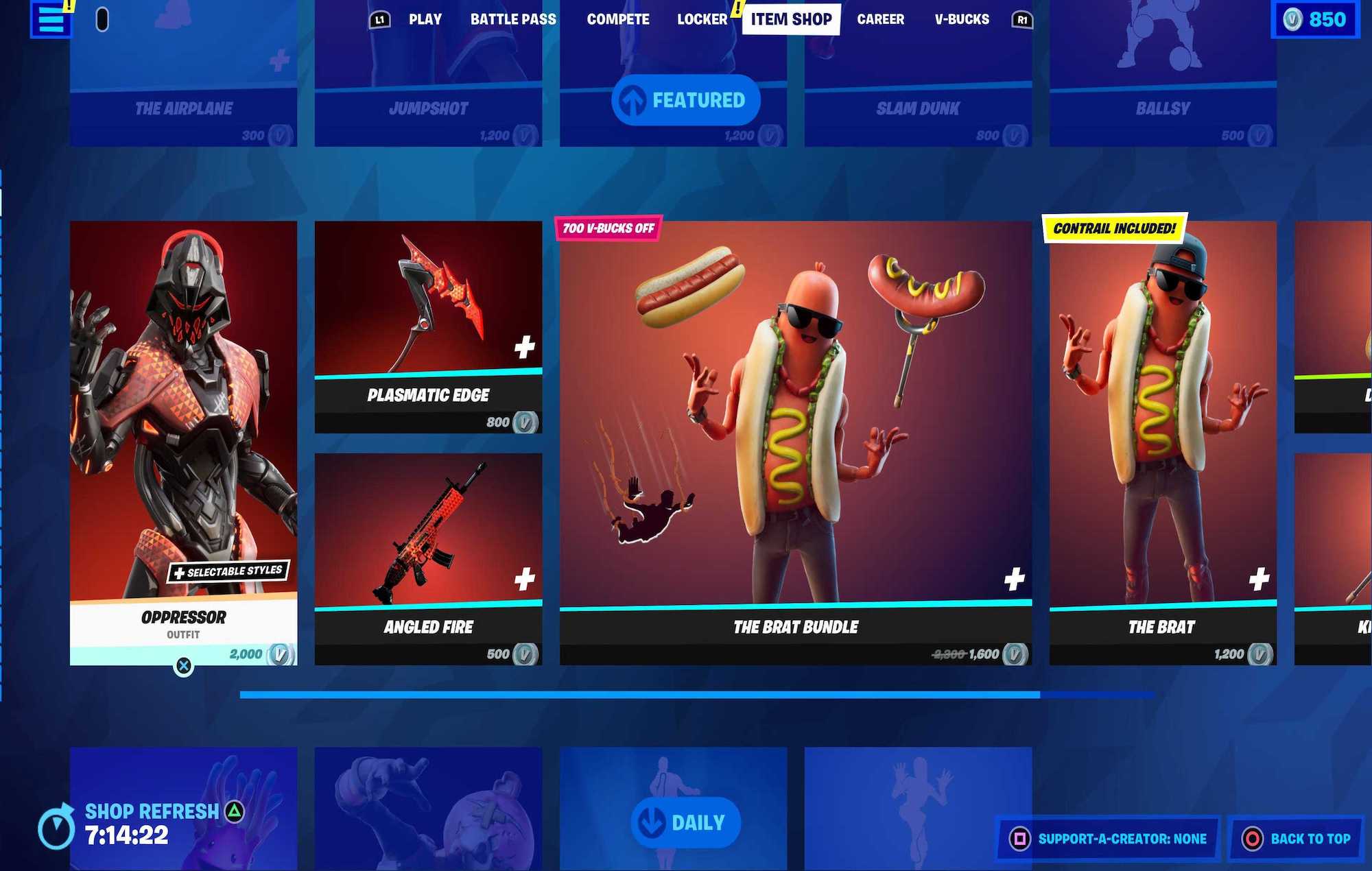

Lost Fortnite Skins Will They Return To The Item Shop

May 17, 2025

Lost Fortnite Skins Will They Return To The Item Shop

May 17, 2025