Student Loan Default: A Growing Threat To The National Economy

Table of Contents

The Rising Tide of Student Loan Debt

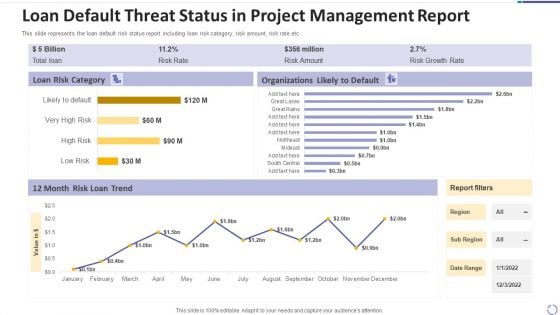

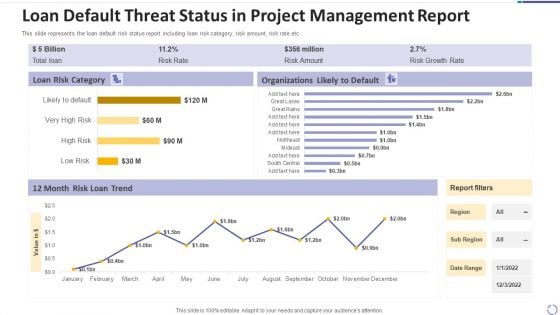

The exponential growth of student loan debt in recent years is alarming. The average student loan debt for borrowers is now exceeding $37,000, a figure that has been steadily increasing for decades. This escalating debt burden is fueled by several key factors:

- Skyrocketing Tuition Costs: College tuition and fees have risen far faster than inflation for years, making higher education increasingly inaccessible for many.

- Limited Financial Aid: The availability of grants and scholarships hasn't kept pace with rising tuition costs, forcing students to rely more heavily on loans.

- Stagnant Wages and Increased Cost of Living: Graduates are often faced with stagnant wages and an increasing cost of living, making it difficult to repay their loans promptly.

This combination of factors creates a perfect storm, leaving many graduates drowning in debt, unable to achieve financial stability and contribute fully to the economy. The impact of this debt extends far beyond individual borrowers, creating a significant drag on the national economy as a whole.

The Consequences of Student Loan Default

Defaulting on student loans has severe and long-lasting consequences for individuals. These consequences extend far beyond simply damaging a credit report:

- Damaged Credit Score: A default severely impacts credit scores, making it difficult to secure loans, rent an apartment, or even get a job in certain industries.

- Wage Garnishment: The government can garnish wages to recover defaulted loans, significantly reducing borrowers' disposable income.

- Difficulty Securing Future Loans and Employment: A history of student loan default can make it extremely challenging to obtain future loans for mortgages, cars, or other major purchases. Some employers conduct credit checks, and a poor credit score can negatively impact job prospects.

- Bankruptcy: In some extreme cases, the overwhelming burden of student loan debt can lead to bankruptcy. However, student loan debt is notoriously difficult to discharge through bankruptcy.

The Broader Economic Implications of Student Loan Defaults

The widespread impact of student loan defaults extends far beyond individual borrowers. The consequences ripple through the entire national economy:

- Reduced Consumer Spending: Individuals burdened with significant student loan debt have less disposable income to spend on goods and services, dampening economic growth.

- Decreased Tax Revenue: Lower consumer spending and reduced wages due to wage garnishment lead to a decrease in tax revenue for the government.

- Strain on Government Resources: The government spends significant resources on loan recovery efforts, diverting funds from other essential programs and services.

- Impact on GDP Growth: The combined effects of reduced consumer spending, lower tax revenue, and increased government spending on debt collection negatively impact overall GDP growth.

Potential Solutions and Policy Interventions

Addressing the student loan default crisis requires a multifaceted approach involving both policy interventions and individual financial planning. Several potential solutions are worth exploring:

- Income-Driven Repayment (IDR) Plans: IDR plans tie loan payments to borrowers' income, making repayments more manageable for those with lower earnings.

- Student Loan Forgiveness Programs: Targeted student loan forgiveness programs can provide relief to borrowers struggling with overwhelming debt. However, the economic and social implications of such programs require careful consideration.

- Policy Changes to Increase College Affordability: Policies aimed at controlling tuition costs, increasing financial aid, and promoting affordable alternatives to four-year colleges are crucial for long-term solutions.

- Improved Financial Literacy Programs: Educating students and families about responsible borrowing and effective financial planning can help prevent future defaults.

Conclusion

The student loan default crisis poses a serious and growing threat to the US national economy. The consequences of inaction are far-reaching, impacting individual borrowers, government budgets, and overall economic growth. Addressing this issue requires immediate and decisive action through a combination of effective policy interventions and proactive financial planning. Understanding and addressing the issue of student loan default is crucial for the future of the national economy. Take action today – explore available repayment options, improve your financial literacy, or contact your elected officials to advocate for comprehensive student loan debt reform.

Featured Posts

-

Giannis Head Grab Sparks Controversy Pacers Game Aftermath

May 28, 2025

Giannis Head Grab Sparks Controversy Pacers Game Aftermath

May 28, 2025 -

Saudia Airlines Penerbangan Langsung Bali Jeddah Resmi Dibuka

May 28, 2025

Saudia Airlines Penerbangan Langsung Bali Jeddah Resmi Dibuka

May 28, 2025 -

Understanding The Publics Reaction To Bianca Censoris Style

May 28, 2025

Understanding The Publics Reaction To Bianca Censoris Style

May 28, 2025 -

Nadals Last Roland Garros A Tearful Farewell And Sabalenkas Rise

May 28, 2025

Nadals Last Roland Garros A Tearful Farewell And Sabalenkas Rise

May 28, 2025 -

Confronting The Newark Airport Crisis Challenges And Solutions

May 28, 2025

Confronting The Newark Airport Crisis Challenges And Solutions

May 28, 2025