Stronger-Than-Expected Earnings For Vodacom (VOD): Implications For Payout

Table of Contents

Vodacom's Q2 2024 Earnings: A Detailed Analysis

Revenue Growth and Key Performance Indicators (KPIs)

Vodacom's Q2 2024 financial results showcased robust growth across several key revenue streams. The company's stronger-than-expected earnings are attributable to a combination of factors, resulting in improved KPIs.

- Increased Data Usage: A significant rise in data consumption driven by increased smartphone penetration and growing demand for mobile internet services contributed substantially to revenue growth.

- Mobile Money Transactions: Vodacom's M-Pesa platform experienced a surge in transaction volumes, further boosting overall revenue. This reflects the increasing adoption of mobile financial services across its markets.

- Enterprise Services: Growth in enterprise solutions, including cloud services and connectivity solutions, demonstrated Vodacom's success in capturing a larger share of the business market.

Vodacom's key performance indicators also showed marked improvements:

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): Experienced a double-digit percentage increase compared to the same period last year.

- ARPU (Average Revenue Per User): Showed a significant rise, indicating increased customer engagement and higher spending per user.

- Customer Acquisition: Vodacom successfully added a substantial number of new subscribers, broadening its customer base and underpinning future revenue streams. This success contributed significantly to the stronger-than-expected earnings for Vodacom (VOD).

Factors Contributing to Exceeding Expectations

Several factors contributed to Vodacom's exceeding of market expectations:

- Successful Marketing Campaigns: Targeted marketing initiatives effectively reached new customer segments and boosted product adoption.

- Effective Cost Management: Vodacom implemented efficient cost-control measures, improving operational efficiency and profitability.

- Strategic Partnerships: Collaborations with other businesses expanded market reach and created new revenue opportunities.

Vodacom's competitive advantage in key markets, combined with its proactive strategic initiatives, played a crucial role in delivering these stronger-than-expected earnings. The company's strong market share also contributed to its overall success.

Implications for Vodacom's Dividend Payout

Increased Dividend Potential

The stronger-than-expected earnings for Vodacom (VOD) significantly increase the potential for a higher dividend payout to shareholders. Vodacom's historical dividend payout ratio suggests that a substantial portion of its profits are typically distributed as dividends. Given the exceptional Q2 2024 performance, a more generous dividend is highly likely.

Potential Impact on Share Price

The improved earnings and the anticipation of a potentially increased Vodacom dividend yield are likely to positively influence Vodacom's share price. Positive investor sentiment following the earnings announcement is expected to drive demand for Vodacom stock, leading to an increase in its market value. Improved Vodacom stock performance will be closely watched by investors.

Other Potential Uses of Excess Capital

Besides increasing the dividend payout, Vodacom has several options for utilizing its excess capital:

- Reinvestment in Network Infrastructure: Investing in upgrading its network infrastructure will enhance service quality and capacity, supporting future growth.

- Acquisitions: Strategic acquisitions of companies within the telecommunications or related sectors could further expand Vodacom's market reach and service offerings.

- Debt Reduction: Reducing its debt burden will strengthen Vodacom's financial position and improve its credit rating.

The strategic allocation of excess capital will be a key factor in shaping Vodacom's future growth trajectory. The choices made will impact Vodacom's capital expenditure and long-term financial health.

Conclusion: Stronger-Than-Expected Earnings for Vodacom (VOD): A Positive Outlook for Investors

Vodacom's stronger-than-expected earnings for Q2 2024 paint a positive picture for investors. The robust revenue growth, improved KPIs, and increased potential for a higher dividend payout all contribute to a positive outlook. The potential impact on Vodacom's share price is also significant, making it an attractive investment opportunity. The strong performance suggests that the company is well-positioned for continued growth and success.

Stay updated on Vodacom's financial performance and the implications for its dividend payout by regularly checking the company's investor relations section. Consider Vodacom (VOD) as a potential addition to your investment portfolio, given its stronger-than-expected earnings and the positive outlook for shareholder returns. Understanding Vodacom's financial strength and strategic direction is key for informed investment decisions.

Featured Posts

-

The Evolution Of Agatha Christies Poirot

May 20, 2025

The Evolution Of Agatha Christies Poirot

May 20, 2025 -

Tadic In Fenerbahce Den Ayrilisi Resmiyete Dogru

May 20, 2025

Tadic In Fenerbahce Den Ayrilisi Resmiyete Dogru

May 20, 2025 -

Mild Temperatures And Little Rain Chance Perfect For Outdoor Activities

May 20, 2025

Mild Temperatures And Little Rain Chance Perfect For Outdoor Activities

May 20, 2025 -

Arsenal Transfer Target Key Details On 17 M Rated Premier League Players Release Clause

May 20, 2025

Arsenal Transfer Target Key Details On 17 M Rated Premier League Players Release Clause

May 20, 2025 -

Mickey 7 Robert Pattinsons Accent Elevates His Performance

May 20, 2025

Mickey 7 Robert Pattinsons Accent Elevates His Performance

May 20, 2025

Latest Posts

-

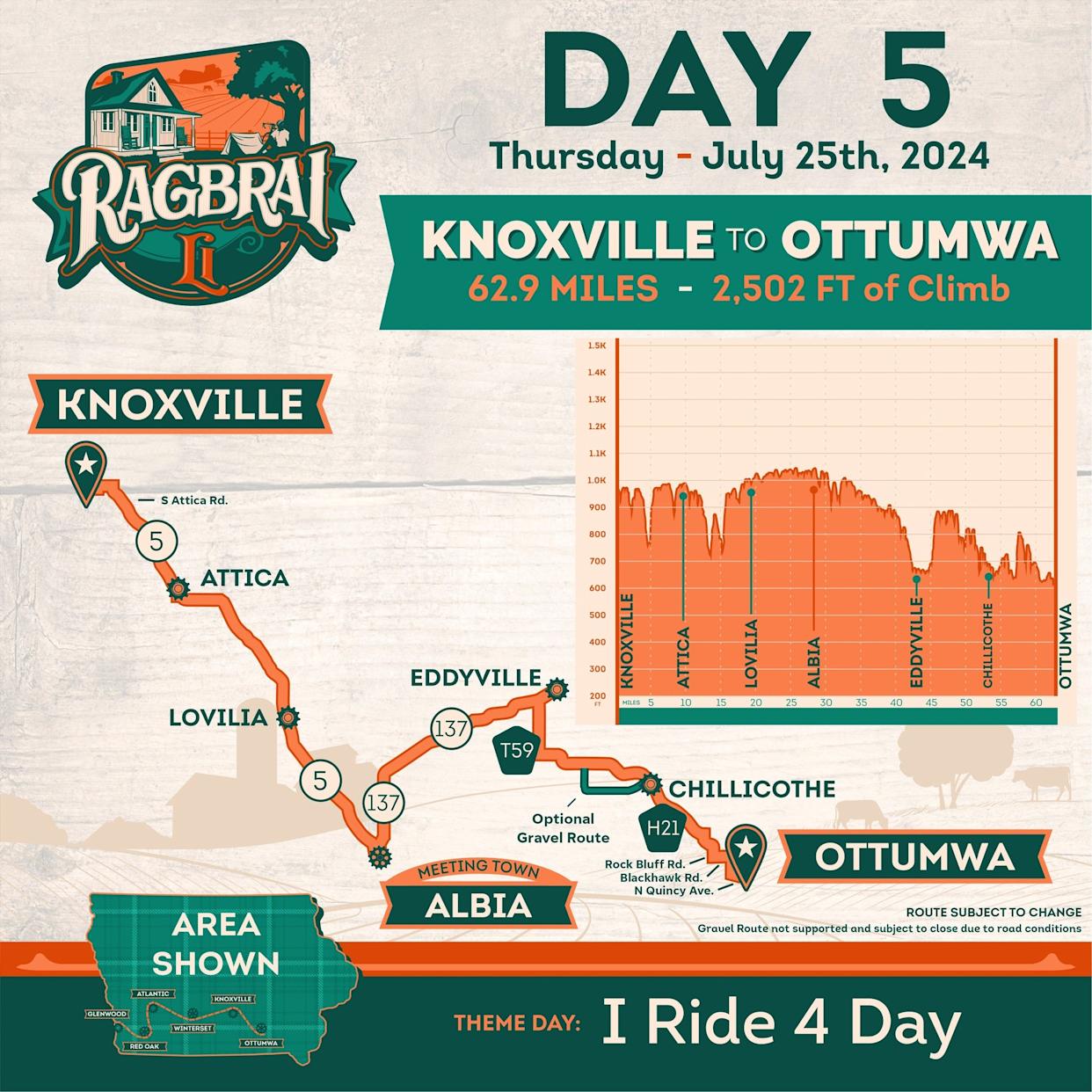

From Ragbrai To Daily Rides Scott Savilles Passion For Biking

May 20, 2025

From Ragbrai To Daily Rides Scott Savilles Passion For Biking

May 20, 2025 -

Scott Savilles Cycling Journey From Ragbrai To Daily Commutes

May 20, 2025

Scott Savilles Cycling Journey From Ragbrai To Daily Commutes

May 20, 2025 -

Mild Temperatures And Little Rain Chance Perfect For Outdoor Activities

May 20, 2025

Mild Temperatures And Little Rain Chance Perfect For Outdoor Activities

May 20, 2025 -

Washington County Breeder Faces Action After 49 Dogs Removed

May 20, 2025

Washington County Breeder Faces Action After 49 Dogs Removed

May 20, 2025 -

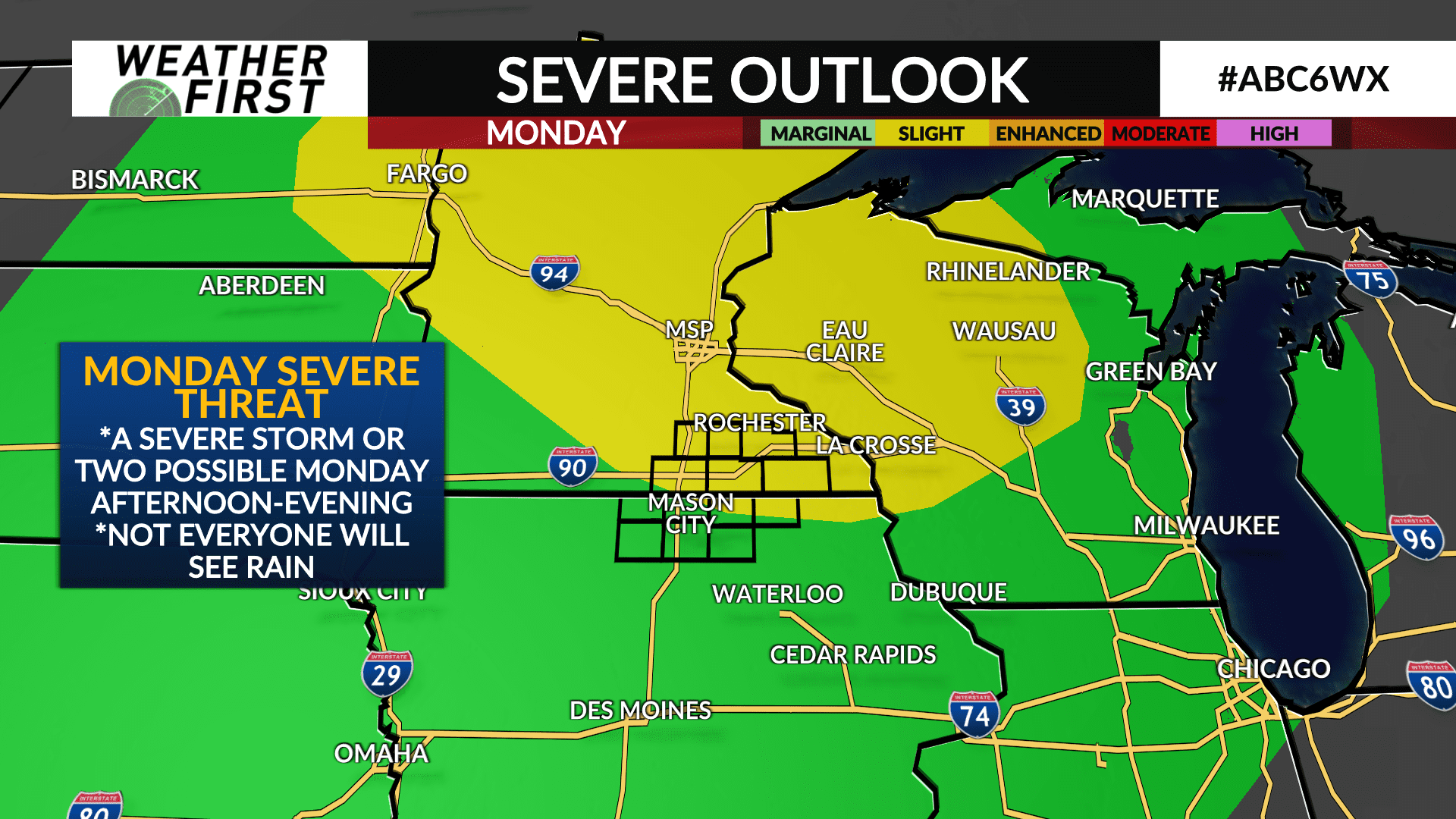

Increased Storm Chance Overnight Severe Weather Possible Monday

May 20, 2025

Increased Storm Chance Overnight Severe Weather Possible Monday

May 20, 2025